Posted on 02/20/2022 9:21:50 AM PST by blam

US headline inflation exceeded 7% in 2021. But rent increases put the Consumer Price Index to shame, soaring an average of 13.5%. And within that already-brutally-high average, there were some absolutely astounding outliers. Phoenix rents soared 25.3%, followed by Tampa, Miami, Orlando, Las Vegas, and Austin, all of which exceeded 20%.

That means an Austin barista could receive a 10% salary bump and have most of it wiped out just by an increase in their rent. Add in the soaring costs of food and gasoline, and our hypothetical worker is actually losing ground despite their double-digit pay raise.

A confluence of things

Rents do tend to rise a bit each year, with 3%-4% being typical. So how did 3% become 20%+ in so many markets? A confluence of factors, including:

Rent forbearance. State and federal programs designed to prevent evictions during the worst of the pandemic lockdowns hit landlords – who have loans of their own to pay off and can’t do so without rental income – especially hard. Many are now raising rents where they can to offset where, for over a year, they couldn’t.

General inflation. Pretty much everything required to manage rental properties – including construction materials, labor, and electricity – is up, in some cases dramatically. To stay solvent, landlords have to pass on at least some of these costs to tenants. So 7% headline inflation equals (at least) a comparable increase in rents.

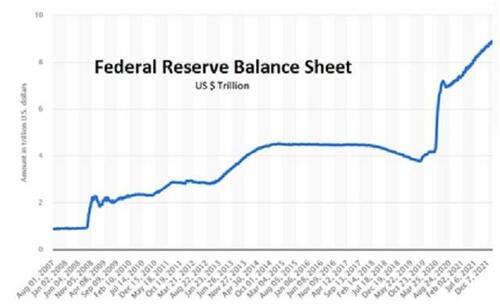

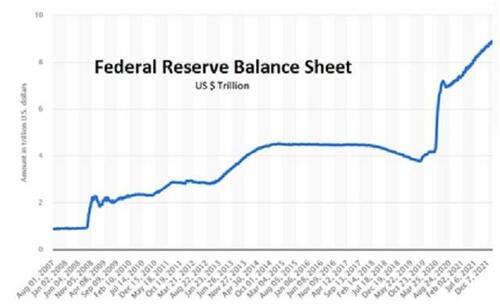

Soaring home prices. As the world tipped into pandemic-induced recession in 2020, governments responded with an epic money-printing binge. The Federal Reserve’s balance sheet – a proxy for the number of newly created dollars the central bank has created and dumped into the economy – has more than doubled since 2019. Expressed another way, 40% of all the dollars ever created came into being in the first two years of the pandemic.

Combine this tsunami of new money with artificially low mortgage rates – another side effect of QE – and the result is soaring home prices. This impacts the rental market in two ways: First, more expensive houses price ever more would-be buyers out of the market, thus increasing the pool of renters competing for a limited supply of available units. Second, a rental house bought at today’s higher price requires more monthly income to cover its costs, which ratchets up rents.

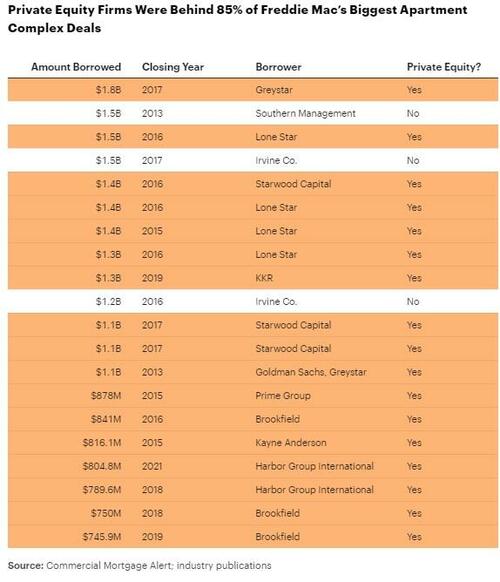

Wall Street. Private equity firms and investment banks developed a taste for rental property during the Great Recession, and now they’re back for the main course. The vast majority of apartments sold in recent years have been gobbled up by Wall Street:

From ProPublica’s When private equity becomes your landlord:

Private equity firms often act like a corporate version of a house flipper: They seek deals on apartment buildings, slash costs or hike rents to boost income, then unload the buildings at a higher price.

The companies’ size allows them to influence market rates and lobby against reforms that could dilute their power. And their goals — quickly hiking a building’s profits so they can sell it at a premium — are often at odds with those of the tenants who need to live in them. In contrast, so-called mom-and-pop landlords usually look for steady streams of rental income over time while their buildings grow in value.

And the sharks are still hungry:

America’s Largest Landlord Just Got Even Bigger: Blackstone Buys 12,000 Sunbelt Apartments For $5.8 Billion

The deal includes more than 40 rental apartment properties including 12,000 units in states including Florida, Tennessee and Georgia. Preferred Apartment also owns 54 grocery-anchored shopping centers anchored by grocery stores. About 70% of the deal’s value is in its rental apartments.

Blackstone has been aggressively ramping up its bet on U.S. rental housing. The firm has agreed to buy two other companies that own apartments in the past two months, building up its presence in states including Colorado, Texas, Arizona and Georgia.

Multifamily properties particularly in high-growth Sunbelt states have been one of the hottest commercial property types in recent years because businesses have been relocating to those regions. Owners have been able to raise rents well above the inflation rate throughout the Covid-19 pandemic.

Blackstone, the world’s largest commercial property owner and until recently America’s largest landlord after scooping up tens of thousands of single-family homes in the aftermath of the 2009 subprime mortgage crisis, has been feverishly working to regain the title by bidding up rental apartments for years. The firm is purchasing Preferred Apartment through its largest fund, Blackstone Real Estate Income Trust, which has raised more than $50 billion since it started five years ago and mostly targets individual investors

It’s a similar story in rental houses, where private equity firms have taken to swooping in and buying entire neighborhoods at above-market prices, then converting the houses to rentals at inflated rates.

The implication? With market power firmly on the side of our new corporate landlords, rents aren’t coming down anytime soon. Just the opposite.

Uh, it ain’t just rent......

Wall Street. Private equity firms and investment banks developed a taste for rental property during the Great Recession, and now they’re back for the main course. The vast majority of apartments sold in recent years have been gobbled up by Wall Street:

…and, during election time, I hope the remember it’s their own darn fault!

How about gas and food? New cars? Used cars?

They got us by the short hairs my friends. Rent control leads to this stuff. Flop houses gone. Atlas will shrug. The only thing left to do is shave.

“And within that already-brutally-high average, there were some absolutely astounding outliers. Phoenix rents soared 25.3%, followed by Tampa, Miami, Orlando, Las Vegas, and Austin”

Those are all places people are fleeing to, to get away from their Rats infested cities and states. Could that have something to do with it?

Rent forbearance: this is the check in a lot of us knew was going to come home to roost once this pandemic thing was over. And here we are...

Check in = chickens come home to roost

The rent’s too damn high!

No, the people are too damn low-skilled.

Yes, one must be high skilled to rent an apartment. yuk yuk..

“Yes, one must be high skilled to rent an apartment. yuk yuk..”

No, they just need to be reasonably skilled and able to work with others.

One man’s floor is another mans ceiling! Ya want an apartment? Ya better be highly skilled and highly paid!

Looken sharp America!@

good one!

Totally Agree, Thank you.

It has been a huge concern of mine how people have celebrated the ‘value’ of their homes skyrocketing. Putting home and apartments out of the reach of anyone who isn’t financially well-off.

Middle class and lower working classes need affordable homes and apartments too.

Think of George Bailey in ‘It’s a Wonderful Life”.

George Bailey still rings true about the working man::::

” Just a minute... just a minute. Now, hold on, Mr. Potter. You’re right when you say my father was no businessman. I know that. Why he ever started this cheap, penny-ante Building and Loan, I’ll never know. But neither you nor anyone else can say anything against his character, because his whole life was... why, in the 25 years since he and his brother, Uncle Billy, started this thing, he never once thought of himself. Isn’t that right, Uncle Billy? He didn’t save enough money to send Harry away to college, let alone me. But he did help a few people get out of your slums, Mr. Potter, and what’s wrong with that? Why... here, you’re all businessmen here. Doesn’t it make them better citizens? Doesn’t it make them better customers? You... you said... what’d you say a minute ago? They had to wait and save their money before they even ought to think of a decent home. Wait? Wait for what? Until their children grow up and leave them? Until they’re so old and broken down that they... Do you know how long it takes a working man to save $5,000? Just remember this, Mr. Potter, that this rabble you’re talking about... they do most of the working and paying and living and dying in this community. Well, is it too much to have them work and pay and live and die in a couple of decent rooms and a bath? Anyway, my father didn’t think so. People were human beings to him. But to you, a warped, frustrated old man, they’re cattle. Well in my book, my father died a much richer man than you’ll ever be.”

You bet...Our first home in CA we literally had to beg, borrow and steal and that was with TWO INCOMES, for the bloated insane down payment. And what kind of home was it? A 58 year old fixer upper. And the monthly mortgage was nearly unbearable.

Spit*

One of the best movies.

Very relevant. Thanks for posting.

Jimmy Stewart was an American hero of a breed that is now totally extinct.

Yes. And that movie still brings tears to my eyes everytime I see it.

I noticed Amazon Prime is raising their fees by ~ 17% this year.

That is closer to the true inflation rate than the 6-7% bs the government is saying.

Keep an eye on other rate increases (utilities, etc) and you will see the true rate.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.