Posted on 02/04/2019 9:05:23 AM PST by SeekAndFind

We Baby Boomers timed it perfectly. We came of age during in an era of plentiful jobs and relatively high wages. Public pensions were generous. Stock, bond and home prices were low, and have since risen strongly, enriching anyone who managed to save regularly. College was (by current standards) insanely cheap, allowing us to upgrade our skills with minimal sacrifice.

The result was a generation with high average net worth and, at first glance, a great shot at a comfortable retirement.

But that’s an illusion, for several reasons.

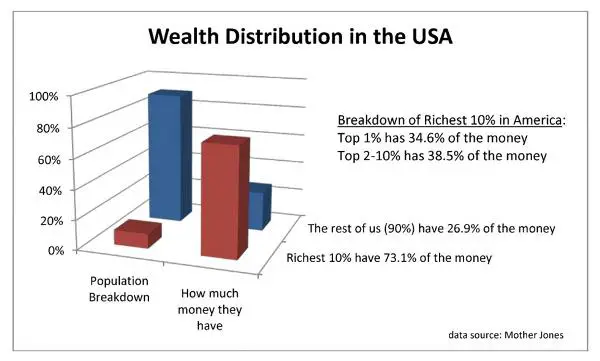

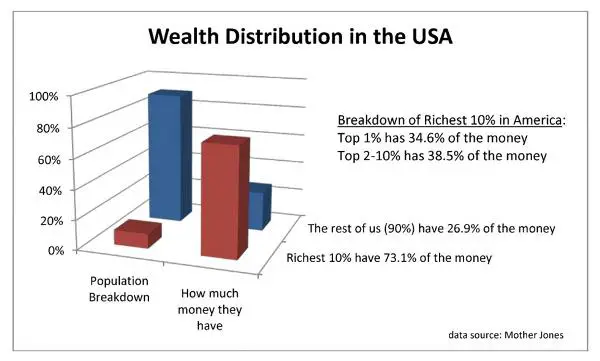

First, the “average net worth” stat masks the fact that many Boomers didn’t actually do much saving. All those outrageous wealth inequality charts include retirees, which by definition means that most Boomers have been harvested by the 1% along with their kids and grandkids.

Second, public sector pensions (as just about everyone knows by now) don’t have anything like the resources needed to actually pay current and future retirees what they’ve been promised. When those plans start imploding in the next recession, benefits will be cut dramatically. See here, here and here for the grisly details.

And this morning the Wall Street Journal added to the list with a feature on how (of all things) Boomer student loan balances are exploding:

Over 60, and Crushed by Student Loan Debt

One generation of Americans owed $86 billion in student loan debt at last count. Its members are all 60 years old or more.

Many of these seniors took out loans to help pay for their children’s college tuition and are still paying them off. Others took out student loans for themselves in the wake of the last recession, as they went back to school to boost their own employment prospects.

On average, student loan borrowers in their 60s owed $33,800 in 2017, up 44% from 2010, according to data compiled for The Wall Street Journal by credit-reporting firm TransUnion. Total student loan debt rose 161% for people aged 60 and older from 2010 to 2017—the biggest increase for any age group, according to the latest data available from TransUnion.

Some are having funds garnished from their Social Security checks. The federal government, which is the largest student loan lender in the country, garnished the Social Security benefits, tax refunds or other federal payments of more than 40,000 people aged 65 and older in fiscal year 2015 because they defaulted on student or parent loan debt. That’s up 362% from a decade prior, according to the latest data from the Government Accountability Office.

Student debt is one of the biggest contributors to the overall increasing debt burden held by seniors. U.S. consumers who are 60 or older owed around $615 billion in credit cards, auto loans, personal loans and student loans as of 2017. That is up 84% since 2010—the biggest increase of any age group, according to the TransUnion data.

The borrowing buildup has upended the traditional arc of adult life for many Americans. Average debt levels traditionally peak for families headed by people aged 45 to 54 years old, according to the Employee Benefit Research Institute based on data from the Federal Reserve’s Survey of Consumer Finances. But between 2010 and 2017 people in their 60s, like most other age groups, accelerated their borrowing in nearly every category, according to the TransUnion data.

Seniors are finding they have to work longer, holding onto positions younger adults might otherwise receive. They’re relying on credit cards and personal loans to pay for basic expenses. People 65 and older account for a growing share of U.S. bankruptcy filers, according to the Consumer Bankruptcy Project; unlike most consumer loans, student debt is rarely dischargeable in bankruptcy.

Perhaps the most surprising element of this surge is the rapid run-up in student loans, an issue that used to be mostly concentrated among young adults. Changes made in the wake of the last recession help explain the shift.

In the years after 2008 banks and other private student lenders began tightening underwriting standards for their loans, requiring more parents to sign on to student loans along with the student borrower. Cosigning makes the parents equally responsible for paying back the loan, resulting in a lower credit score and crimping their ability to borrow if they or their child miss a payment.

In recent years, private lenders including SLM Corp., better known as Sallie Mae, and Citizens Financial Group Inc., have increased their focus on parents. They’ve rolled out student loans that are just for parents who want to pay for their kids’ college education. The loans’ main pitch includes the possibility of a lower interest rate for parents who have high credit scores than what the federal government charges on its own parent loans; it also allows parents to spare their children the burden of debt by taking it on themselves.

Another problem: The federal government caps the dollar amount of loans that undergraduate students can borrow for college, but no caps exist for the aggregate amount that parents can take on. That has contributed to parents increasingly borrowing to cover the gap between tuition costs and the amount of free aid and loans their children receive.

The federal government disbursed $12.7 billion in new “Parent Plus” loans during the 2017-18 academic year, up from $7.7 billion a decade prior and $3.3 billion in 1999-2000, according to an analysis of Education Department data by Mark Kantrowitz, publisher of Savingforcollege.com. Its underwriting standards are generally looser than banks and other private lenders, making it easier for more applicants to qualify. Parents on average owed an estimated $35,600 in these loans at the time of their children’s college graduation last spring, according to Mr. Kantrowitz. They owed nearly $6,400 on average (not adjusted for inflation) in the spring of 1993.

There’s so much to hate about this situation: The fact that the government and private sector lenders are “targeting” seniors for student loans; the fact that soaring senior debt has “upended the traditional arc of adult life” for so many; and last but definitely not least, the fact that this is happening during a long economic expansion. In the coming recession, retiree borrowing will soar, along with the attendant stress and anger. We Boomers might find ourselves back where we started during the Vietnam War, in the streets protesting an outrageously predatory government.

>>> those who do have liquid assets like stocks, bonds, and mutual funds are eventually going to find that they might ultimately do worse off <<<<

Hm... and here I am wishing I had liquid assets ... never really had a job working for someone else. Became an entrepreneur at a young age, started several small businesses and worked for a unsympathetic slave driver, myself.

I bought commercial and residential properties, mostly paid for. But now, I’m a slave to those properties and an aging man. Tenants are more sketchy by the year and the market doesn’t seem to want commercial and industrial property much anymore unless you’re in a thriving urban area. I’m not.

I was planning for endless cash flow, enough so someone else carried the keys around .... sell off a property here and there but I’ve lost confidence in that plan too.

I have several retired Gov worker friends ... some of them

have the life! Many Already retired for years

Where I had planned for cash flow to be king, seems atrophy is instead.

My “friends” ragged on my ass as I took advantage of IRAs and 401Ks as long as then existed while I was of working age. They also ragged on my ass about staying in the Guard/Reserve, “wasting evenings, weekends and two weeks each summer, while they lived paycheck-to-paycheck, buying/blowing all of their money.

They also ragged on me for being a “good company drone”, and not job hop.

Today, I am about to turn 72, I have my company pension, military pension, social security, and an IRA financed by my 401ks, and living comfortably.

Of course, Nancy Pelosi believes that I cannot be trusted with my retirement income, and believes that it is in my best interest for the government to absorb my IRA and provide me with an appropriate, means-tested annuity.

Congrats! I too always put in the max in ira and 401k. My friends were spending it on bars, fancy cars and cruises. It wasn’t all rosy. We had tough times too with layoffs and job losses. I don’t need the govt telling me how to save.

You don’t know me. We are not crappy parents.I just paid one of their student loans even though the loan is in their name not mine.

It’s a generational thing. Living for the moment. Won’t look for work.

Maybe they had bad parents?

I love how the Boomers complain about their kids, but you guys never take time to look in the mirror and engage in some introspection. It’s always someone else’s fault — the Boomer mindset.

Why dont you share why you think you are such a great parent. Did your parents raise you to be rude and insulting to people you know nothing about. I doubt it but you do act that way.

They also ragged on my ass about staying in the Guard/Reserve, “wasting evenings, weekends and two weeks each summer, while they lived paycheck-to-paycheck, buying/blowing all of their money” ................... LOL, he who laughs last laughs best. Tri Care for life alone was worth it! I was once told the reason I wasn’t “moving up” was my dedication to my other job (the USAR) and they feared I could be called up at any time. I became self employed shortly after.

Is it a generational thing? Do you think millennials have it as easy as you did? Do you ever take time to think the burden you Boomers are on our society? We have to fund your socialist medicare and social security so you guys can go to the Dr five times a week. We have to compete in a workforce that is flooded with third world scum that will work for a fraction of what we need to just pay rent.

And this is all possible because you Boomers elected politicians that sold our country out. And you did not care, because you just cared about making money and “muh Constitution.” You guys get what you deserve.

It’s only when those who took out loans have to start repaying them that they suddenly ‘discover’ how utterly selfish are their own children.

By then it is way too late for anything to be done.

Their children fully expect mom and dad to pay the loans for them because they’ve always covered for their children.

Selfish children. Blindly loving parents.

Bad combination.

“We have to fund your socialist medicare and social security so you guys can go to the Dr five times a week. “

.

Truth hurts.

Selfish parents for not saving for college. Most states have 529s and if you start saving a minimum amounts when the child is born by 18, there should be plenty of money.

But hey, did you see Eddie bought a new Harley? WOW, I am going to go down tomorrow and check one out. Just refinanced the house and got a nice chunk of change. May check out that Bayliner too.

“We have to fund your socialist medicare and social security so you guys can go to the Dr five times a week. “

Exaggerate much????????????

Go to your local doctors office at 10 am on a weekday and look at the worthless Boomers sitting around.

You sound angry and troubled. I went to a clinic for bronchitis once in the past year. I got a flu shot. I pay more in medical coverage than I took. Boomers are children of the greatest generation. They taught me about god,family country work ethic savings.Not communicating with you again.

So what you're saying is my wife and I deserve our $10k per month public sector pension?

Please forgive the language, but this sums it up.

John Goodman in The Gambler on

“The position of F@#$ You”.

https://www.youtube.com/watch?reload=9&v=xdfeXqHFmPI

The Boomers get everything they deserve.

So what you’re saying is my wife and I deserve our $10k per month public sector pension?

But you love the “free market” and “capitalism” huh? You prove my point, this site is full of Boomer hypocrites: socialism and govt pensions for me, not for thee.

Learn to read. Paid for kids private school college, thru 529, savings, bonds taken out of payroll and cash. Each kid took out the max allowed subsidized and unsubsidized loans around 29k so they would be part of the investment in college. You must hate your parents and grandparents. Sad.

“Go to your local doctors office at 10 am on a weekday and look at the worthless Boomers sitting around.”

.

‘.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.