Skip to comments.

Job Cuts Surge 19%; Energy Sector 38% Of Total: Falling Oil Hasn't Resulted In Higher Spending

Zero Hedge ^

| 03/05/2015

| Tyler Durden

Posted on 03/05/2015 8:56:07 AM PST by SeekAndFind

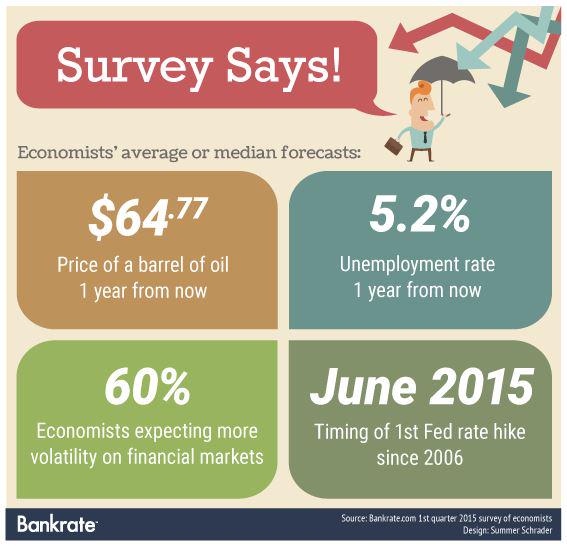

A month ago we asked if, perchance, the BLS had simply forgotten to add any of the job losses in the energy sector in January, when it reported a drop of just 1900 jobs in the entire Oil and Gas Extraction space, compared to 18K actual announcements, and 21,300 job cuts in the sector as reported by Challenger. Moments ago, the latest Challenger data is out, and we really hope the BLS finally reads it because things in the energy sector are getting worse by the day, if only for its well-paid workers.

According to Challenger, the February total planned job cut were over 50,000 for the second month in a row, or a total of 103,620 in the first two months of 2015, up 19% from the same period last year, with a 38% of the total, or 39,621 of these job cuts, due to plunging oil prices and about to take place in the highest paid oil extraction space.

From the press release:

Employers announced 103,620 planned layoffs through the first two months of 2015, which is up 19 percent from the 86,942 job cuts recorded during the same period in 2014.

Once again, the energy sector saw the heaviest job cutting in February, with these firms announcing 16,339 job cuts, due primarily to oil prices.

Falling oil prices have been responsible for 39,621 job cuts, to date. That represents 38 percent of all recorded workforce reductions announced in the first two months of 2015. In February, 36 percent of all job cuts (18,299) were blamed on oil prices.

Here is the one chart that the BLS, if it ignored everything else, should look at:

To paraphrase John Challenger, it is unambiguously ungood.

“Oil exploration and extraction companies, as well as the companies that supply them, are definitely feeling the impact of the lowest oil prices since 2009. These companies, while reluctant to completely shutter operations, are being forced to trim payrolls to contain costs,” said John A. Challenger, chief executive officer of Challenger, Gray & Christmas.

“While oil-related companies will see profits slide, the net impact of falling oil prices will likely be positive for the economy, as a whole. Some economists are estimating that GDP could see a 0.5 percentage point boost from low oil prices, due mostly to the extra spending power among consumers. Meanwhile, companies that are big users of oil, such as transportation firms, airlines, and manufacturers of plastic and paint products will see higher profits thanks to cheap oil,” noted Challenger.

Yes, in theory, plunging oil is great. In practice however...

Cheap oil does not yet appear to be helping stem the tide of job cuts in the retail sector, which saw the second highest number of job cuts in February with 9,163. Employers in the sector have announced 15,862 job cuts, so far this year. That is little changed from the 15,242 retail job cuts announced in the first two months of 2014.

The punchline: “So far, falling oil prices have not resulted in higher retail spending.” said Challenger. But, but, they promised.

And finally, here is how the YTD job cuts look when compared between the BLS and Challenger:

TOPICS: Business/Economy; Society

KEYWORDS: energy; energysector; jobcuts; jobs; oil; unemployment

To: SeekAndFind

I know in my case, lower gas prices helps me divert money to pay other bills but that’s about it.

2

posted on

03/05/2015 9:01:07 AM PST

by

Nowhere Man

(Barring a reformation, Islam Delenda Est.)

To: SeekAndFind

Nobody working in the energy industry make minimum wage.

Probably one of the highest wage industries, that’s a lot less disposable income.

3

posted on

03/05/2015 9:19:06 AM PST

by

RS_Rider

(I hate Illinois Nazis)

To: SeekAndFind

Of course it has not resulted in higher spending, falling oil prices arrived too late, the average American was already out of money, already in survival mode, those who have a job are paid less and there are no new jobs on the horizon, obamanomics is working as planned.

4

posted on

03/05/2015 9:32:08 AM PST

by

PoloSec

( Believe the Gospel: how that Christ died for our sins, was buried and rose again)

To: Nowhere Man

EXACTLY! That is where any savings from fuel prices are going.

5

posted on

03/05/2015 9:47:41 AM PST

by

CapnJack

To: PoloSec

All of our disposable income went to Saudi Sheiks so they could buy more golden toilets. 4 years is a long time to pay 4 bucks a gallon.

6

posted on

03/05/2015 9:56:56 AM PST

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: central_va

Well said!

Expensive oil bankrolls Islamic terror.

7

posted on

03/05/2015 9:58:10 AM PST

by

nascarnation

(Impeach, convict, deport)

To: SeekAndFind

Oil bust threatens mortgage-backed securities in Wall Street-funded shale towns

http://fuelfix.com/blog/2015/03/05/oil-bust-threatens-mortgage-backed-securities-in-wall-street-funded-shale-towns/

March 5, 2015

The oil glut is threatening to expose cracks in the commercial-mortgage bond market.

Nomura Holdings Inc. estimates that $16 billion in property debt that has been sold to investors as securities is vulnerable to default after crude prices plunged, posing risks for the economies of U.S. cities and towns built around the boom.

Wall Street analysts are poring over commercial-mortgage backed securities for signs of distress as the oil crash weighs on demand for real estate in energy hubs.....

8

posted on

03/05/2015 10:03:00 AM PST

by

thackney

(life is fragile, handle with prayer)

To: central_va

4 years is a long time to pay 4 bucks a gallon. Where did you pay that?

9

posted on

03/05/2015 10:06:02 AM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

My car uses premium, so does my SUV.

10

posted on

03/05/2015 10:08:12 AM PST

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: central_va

High compression is a good thing for efficiency and power.

11

posted on

03/05/2015 10:09:39 AM PST

by

nascarnation

(Impeach, convict, deport)

To: central_va

Okay, thanks.

Have you ever calculated what the cost adder is of driving a vehicle that uses premium?

12

posted on

03/05/2015 10:12:04 AM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

13

posted on

03/05/2015 10:55:25 AM PST

by

SeekAndFind

(If at first you don't succeed, put it out for beta test.)

To: SeekAndFind

Gas prices have gone up 20 cents in Fairbanks over the last 2 weeks. Why?

14

posted on

03/05/2015 1:48:14 PM PST

by

vpintheak

(Call them what they are - regressive control-freaks)

To: Nowhere Man

I was watching the documentary called the Flaw. They claim, and I have seen it elsewhere, that since 1975 wages have not risen on a real basis. The asset bubble of the housing market was the only way Americans could spend more money.

15

posted on

03/05/2015 3:25:53 PM PST

by

Sam Gamgee

(May God have mercy upon my enemies, because I won't. - Patton)

To: CapnJack

I know, I'm thankful gas is down now and I hope it does not go too much where it is now since I'm struggling. I thank God since Mom passed, my father helps me a little, usually he gives me 10 gallons in cans when I see him. Usually I'm "Mr. Lucky that I can keep a quarter tank" in my car. I'm looking for better work closer to me since I drive 92 miles round trip to work.

My standard of living really went down since Barky Obongo took office. I know the passing of my mother in 2013 took a gouge out of me too but even if Mom was still alive, we were on a downward spiral, albeit more slowly. Plus I have to drain the swamp, too many debt alligators bitin' my butt.

My grade school buddy, we've been hanging since 4th grade (1976/77) and his wife is sick so there are times I helped him buy meds for her and also it has been bad for him with gas that he took paid time off work when he didn't have a busy day to save gas.

16

posted on

03/05/2015 9:06:49 PM PST

by

Nowhere Man

(Barring a reformation, Islam Delenda Est.)

To: Sam Gamgee

I was watching the documentary called the Flaw. They claim, and I have seen it elsewhere, that since 1975 wages have not risen on a real basis. The asset bubble of the housing market was the only way Americans could spend more money.

I'd like to see that documentary. I think in all honesty, we should have experienced a collapse in the 1980;s or 1990's but I think what saved us is a combination of Ronald Reagan's economic policies along with the economy getting a boost from the computer sector with the coming of the PC's and later, internet. Also, later on, as you eluded to, easy credit. I had a few customers from Germany and they told me that getting credit in Germany is a lot harder than it is here in the U.S.

1975? That's about right. My father and Chuck Harder (I miss his show), when he hosted "For the People," said 1973 so it really started to rot from that time on.

17

posted on

03/05/2015 9:17:27 PM PST

by

Nowhere Man

(Barring a reformation, Islam Delenda Est.)

To: Nowhere Man

I have heard various years picked from the 1970s. I guess it depends how you measure things. Libertarian types like to point out how our standard of living has risen or how cheap it is to feed ourselves. That is true UNTIL the 1970s. If you take a look at the cost of various groceries from then to now as a percentage of income it really hasn't changed and has gotten in some cases slightly worse.

18

posted on

03/09/2015 3:28:48 PM PDT

by

Sam Gamgee

(May God have mercy upon my enemies, because I won't. - Patton)

To: Sam Gamgee

I have heard various years picked from the 1970s. I guess it depends how you measure things. Libertarian types like to point out how our standard of living has risen or how cheap it is to feed ourselves. That is true UNTIL the 1970s. If you take a look at the cost of various groceries from then to now as a percentage of income it really hasn't changed and has gotten in some cases slightly worse.

Good points. I remember my grandmother saying that "if I didn't have to eat, I'd be rich." Everytime we took her shopping, she'd say that and when Mom was still alive I often quoted grandma so much, Mom's eyes would roll. B-)

I think is some cases, as Pogo Possum would say," we have met the enemy, he is us." Most of us are used to the high life, computers every few years, smartphones up the wazoo, and other high tech toys that become expensive, doubly so if you add them all up.

With me working and Mom's income from Social Security, we lived a very basic lifestyle although since Obongo was elected, we were slowly losing ground like most people. Still, at least we have cable, phone and internet although it was nip and tuck at times. Since Mom passed, my standard of living went down the commode, in many ways, I've been thrown to a 1960's or 1970's era type of living with just hints of internet. I still watch a 1982 Zenith TV.

I'm on my friend's plan for a smartphone so I have that as my only phone which I pay him. I use that for an internet hotspot for my laptop (made in 2007) but have to watch my data useage. I had to cut back on food too. I can't blame it all on Obongo, Mom's passing hurt me more, but I think the way things are going, we would be at this point albeit a bit slower.

I listen to Glenn Beck, but I think he goes into BS territory when he talks of "The Singularity" with technology. It's like what Mom said, "it may sound good, but with the lack of good jobs and so forth, who can afford all of this 'Flash Gordon, Buck Rogers' stuff?"

19

posted on

03/10/2015 8:52:22 AM PDT

by

Nowhere Man

(Barring a reformation, Islam Delenda Est.)

To: Nowhere Man

I agree that obviously from a technological point of view, and entertainment in general, we are well better off. But with a family of six, cheap smart phones mean very little. Groceries are by far, excepting the mortgage of course, the largest budget I have to contend with. I make a good living considering my limited skills but we still struggle as a family to get by when it comes to eating. Of course I’m in Canada, so I think food is much pricier here.

20

posted on

03/11/2015 10:19:32 AM PDT

by

Sam Gamgee

(May God have mercy upon my enemies, because I won't. - Patton)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson