Posted on 07/23/2010 10:39:49 AM PDT by ChrisBoundsTX

Senator Kerry, do you hate the poor in Massachusetts?

You may not have earned your incredible wealth from your own personal works, but you have proudly voted to raise taxes in Congress every time the opportunity presents itself. I thought surely a man of honorable military integrity would live by his word and pay his fair share in taxes when selling his 76 foot luxury yacht. However, I was distraught to read on the Boston Herald that you skipped town to avoid paying a six-figure state “sails tax”:

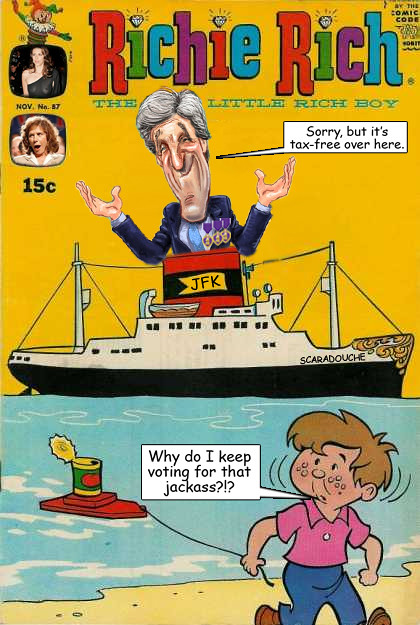

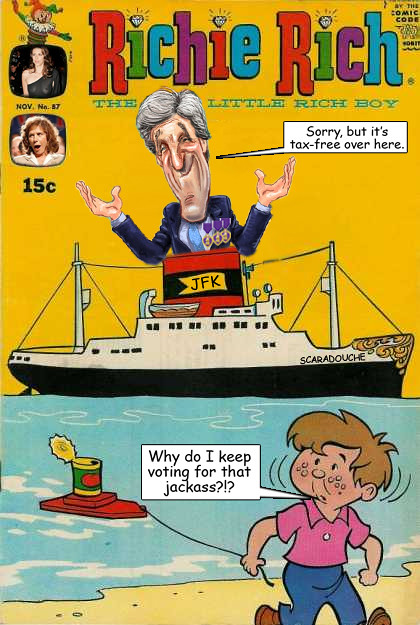

"Sen. John Kerry, who has repeatedly voted to raise taxes while in Congress, dodged a whopping six-figure state tax bill on his new multimillion-dollar yacht by mooring her in Newport, R.I.

Isabel – Kerry’s luxe, 76-foot New Zealand-built Friendship sloop with an Edwardian-style, glossy varnished teak interior, two VIP main cabins and a pilothouse fitted with a wet bar and cold wine storage – was designed by Rhode Island boat designer Ted Fontaine.

But instead of berthing the vessel in Nantucket, where the senator summers with the missus, Teresa Heinz, Isabel’s hailing port is listed as “Newport” on her stern.

Could the reason be that the Ocean State repealed its Boat Sales and Use Tax back in 1993, making the tiny state to the south a haven – like the Cayman Islands, Bermuda and Nassau – for tax-skirting luxury yacht owners?

Cash-strapped Massachusetts still collects a 6.25 percent sales tax and an annual excise tax on yachts. Sources say Isabel sold for something in the neighborhood of $7 million, meaning Kerry saved approximately $437,500 in sales tax and an annual excise tax of about $70,000."

Michelle Malkin reminded me of a comment you said in 2009:

"If you put a tax cut into the hands of a business or family, there’s no guarantee that they’re going to invest that or invest it in America."

Senator Kerry, your home state is starving for cash which no doubt negatively affects its welfare programs. Did you skip town to avoid paying your fair share of taxes that would help support those programs. Do you hate the poor? Tell me it isn’t so Senator Kerry!

This traitor, who so lavishly spends the inheritance of Senator Heinz children on his toys, thinks nothing of stiffing the people he represents.

Many of his constituents see him in person only when he is cutting them in line - at an airport, a clam shack or the Registry of Motor Vehicles. One talk-show caller a few weeks back recalled standing behind a police barricade in 2002 as the Rolling Stones played the Orpheum Theater, a short limousine ride from Kerry’s Louisburg Square mansion.

The caller, Jay, said he began heckling Kerry and his wife as they attempted to enter the theater. Finally, he said, the senator turned to him and asked him the eternal question.

“Do you know who I am?”

“Yeah,” said Jay. “You’re a gold-digger.”

Mr. Kerry doesn’t like anyone - other than himself and his wife’s do-re-mi.

Beyond that, it’s a roll of the dice.

WTF?????

Are we talking about the same John Kerry here??

Taxes for thee, but not for me.

Halp Us Jon Carry—We R Stuck Hear N Massa- Mass- Ma- Choud Nashun.

sarcasm

Gaming the system - typical limo liberal

Kerry lives in a mansion on Beacon Hill on which he has borrowed $6 million to finance his campaign. A fire hydrant that prevented him and his wife from parking their SUV in front of their tony digs was removed by the city of Boston at his behest.

The Kerrys ski at a spa the widow Heinz owns in Aspen, and they summer on Nantucket in a sprawling seaside “cottage” on Hurlbert Avenue, which is so well-appointed that at a recent fund-raiser, they imported porta-toilets onto the front lawn so the donors wouldn’t use the inside bathrooms. (They later claimed the decision was made on septic, not social, considerations).

It’s a wonderful life these days for John Kerry. He sails Nantucket Sound in “the Scaramouche,” a 42-foot Hinckley powerboat. Martha Stewart has a similar boat; the no-frills model reportedly starts at $695,000. Sen. Kerry bought it new, for cash.

Every Tuesday night, the local politicians here that Kerry elbowed out of his way on his march to the top watch, fascinated, as he claims victory in more primaries and denounces the special interests, the “millionaires” and “the overprivileged.”

“His initials are JFK,” longtime state Senate President William M. Bulger used to muse on St. Patrick’s Day, “Just for Kerry. He’s only Irish every sixth year.” And now it turns out that he’s not Irish at all.

But in the parochial world of Bay State politics, he was never really seen as Irish, even when he was claiming to be (although now, of course, he says that any references to his alleged Hibernian heritage were mistakenly put into the Congressional Record by an aide who apparently didn’t know that on his paternal side he is, in fact, part-Jewish).

That’s right on the button, Col.

Yeh, you're a treasonous coward who went to Vietnam to get his ticket punched and then came back to the comfort of the US to slander the troops that you fought with. You aren't worth the air you breathe...

You know... politics... if you make the most of it, you work hard, you use some common sense, and you make an effort to be patriotic, you can do well. If you don’t... you get stuck as the ski-bum-boy-toy of a gin-soaked ketchup dowager.

Massachusetts has a general sales tax of 5 percent, with exemptions for food and clothing purchases under $175. The sales tax is the second-largest source of tax revenue for the state, and is projected to generate just over $4 billion in the coming fiscal year. Of the 45 states that have a general sales tax, Massachusetts ranks last in terms of the revenue the sales tax raises as a percentage of personal income.

What Would be the Revenue Effect of a Sales Tax Change?

If the state were to increase the sales tax from 5 percent to 6 percent, it would increase state revenue by approximately $800 million a year. However, because the sales tax has not kept up with changes in the economy, the revenue raised by such an increase would likely decline over time as a share of the economy. As more people shop online, where it is difficult to collect the sales tax, and as more economic activity shifts to the service sector, which is not subject to the sales tax, Massachusetts loses revenue that it had been collecting through this tax.

Is the Sales Tax Regressive or Progressive?

As the chart below demonstrates, the general sales tax is very regressive – that is, poor and middle class people pay a much higher percentage of their income towards it than wealthy people do. The chart below shows that those at the 80th percentile of income and above contribute less than half as much to the sales tax, as a percentage of their income, than the lowest income earners in the state. Similarly, those earning between $34,000 and $58,000 contribute twice as much to the sales tax, again as a percentage of their income, as do income earners in the top 5 percent. An increase in the sales tax would therefore hit low and middle-income people harder than high-income people.

LOL!

I would hate to be John Kerry.

He lies to himself, and he lies to his constituents.

He must wear a blindfold when he shaves.

Does this clown still have his Man Servant bringing him his peanut butter and grape jelly sandwiches?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.