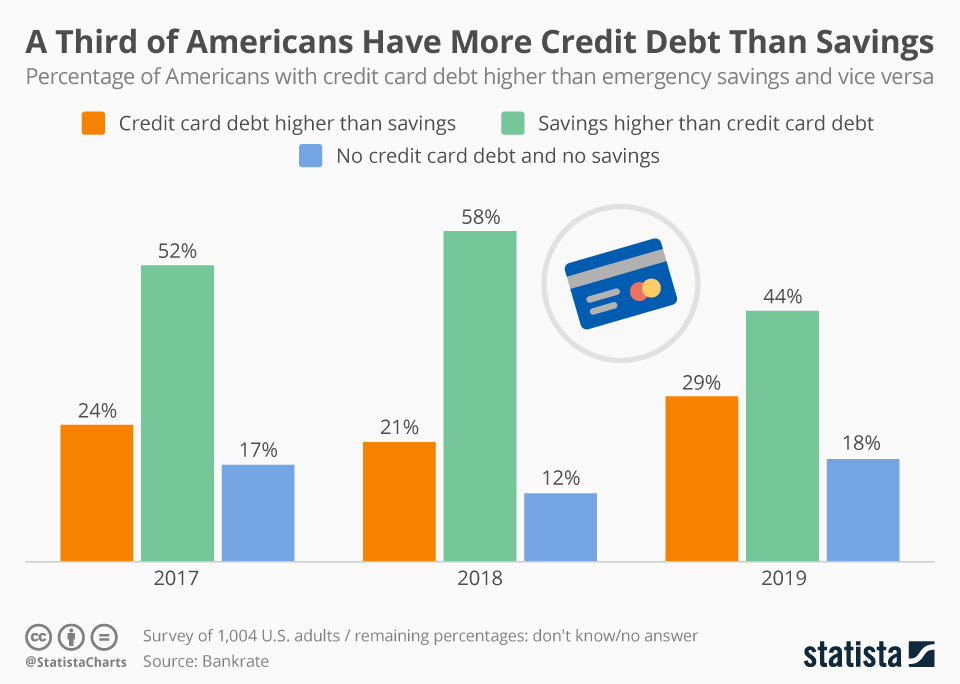

One in three Americans now have more credit card debt than emergency savings, according to the latest survey by financial services company Bankrate.

As Statista's Anna Flecks shows in the chart below, this is up ten percentage points from 2011, when the company first started polling the question.

Meanwhile, around 53 percent of respondents said that their savings were currently exceeding their credit card debt.

This is down two percentage points from the same time last year, but slightly up from 2011.

Around one in ten Americans are living paycheck-to-paycheck in 2025, not making any debt or saving up money.

You will find more infographics at Statista

Millennials were the most likely to say that they had tapped into their emergency savings over the past 12 months.

The most common uses for emergency savings among all groups were unplanned emergency expenses, such as car repairs or medical bills, followed by monthly bills, including rent and mortgages, followed by day-to-day expenses such as food.