Click here: to donate by Credit Card

Or here: to donate by PayPal

Or by mail to: Free Republic, LLC - PO Box 9771 - Fresno, CA 93794

Thank you very much and God bless you.

Posted on 08/14/2025 9:30:23 AM PDT by Heartlander

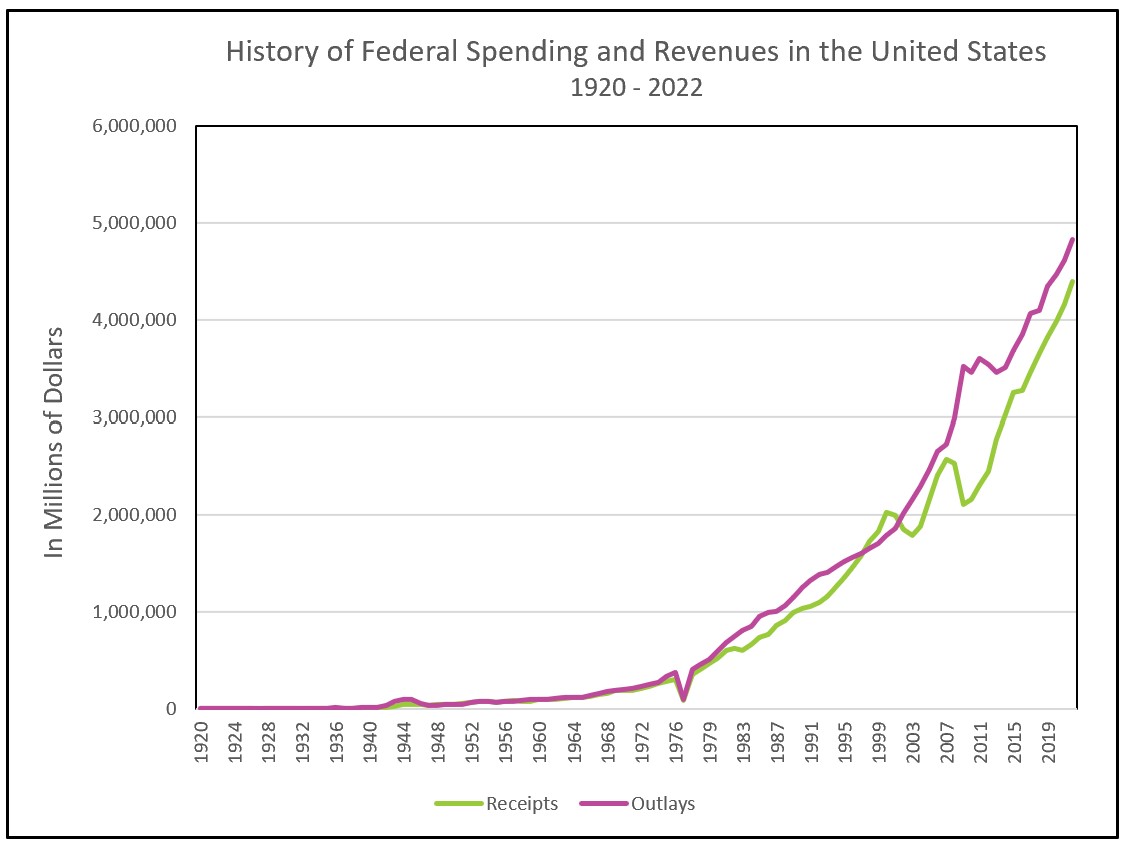

I saw this chart making the rounds on Twitter this week, and it stopped me cold. While the specific figures combine data from multiple sources, the trend is undeniable: in 1950, over half of 30-year-olds were married homeowners. By 2025, some analysts project that number as low as 13%.

That’s not a societal transformation. It’s not an economic fluke. It’s the visible outcome of an invisible strategy—one that extracted everything it could from a three-generation arc and left only illusions in its place.

They’ll tell you people just choose differently now—that marriage rates fell because of changing values. But people can’t choose what they can’t afford. When the economic foundation for family formation disappears, cultural changes follow inevitably. That chart doesn’t show us changing values or new priorities. It shows systemic breakdown, disguised for decades as freedom.

It maps the slow evaporation of the social contract. For one generation, adulthood was a starting point. For the next, a struggle. For the latest, an abstraction—marketed endlessly but almost never attained. What began as a rite of passage has become a paywalled simulation.

The post–World War II boom was never sustainable. In hindsight, this was obvious. It relied on conditions that were always time-limited: cheap energy from newly tapped oil fields, industrial monopolies before globalization kicked in, dollar hegemony that exported inflation globally, and a demographic pyramid with more workers than retirees. It was a golden window, not a golden age. And when the window closed, the illusion had to be maintained—through leverage, narrative, and ever-increasing sacrifice from the generations that followed.

The math quietly stopped working. Boomers bought homes for two or three times their annual income during an era when interest rates would fall for the next four decades—turning their mortgages into wealth-building machines as rates dropped from 15% to near-zero. Today’s buyers face five to six times their income—or more in major cities—while rates can only go up from historic lows. Where Boomers rode a 40-year tailwind of falling borrowing costs that inflated their assets while deflated their debt, current generations face headwinds at every turn. The Federal Reserve data confirms this unprecedented decline, showing rates falling from over 18% in the early 1980s to near 2.6% by 2021.

The housing market itself tells the story: recent data shows over 500,000 more sellers than buyers – not because homes are affordable, but because an entire generation has been systematically priced out.

The institutions that promised stability—education, government, media, finance—mutated into extraction machines. Still speaking the old language, they now served a different purpose: to keep people compliant inside a system that no longer offered a way out.

This wasn’t merely economic. It was existential. The foundations of meaning—family, ownership, stability—were quietly downgraded to lifestyle preferences, and then systematically priced out. People without homes are easier to relocate. People without families are easier to isolate. People without rootedness are easier to govern.

The Boomers didn’t design the con, but they lived in its payout phase. They received land, pensions, and a functional society. Many still believe they earned it, unable to recognize how thoroughly their reality was engineered from the start. Their children were left trying to replicate a model that no longer existed. Their grandchildren have grown up in the wreckage, wondering why their competence and effort never translate into traction.

This didn’t happen by accident. As I’ve documented in “The Technocratic Blueprint,” we’re witnessing the culmination of a century-long plan—a sophisticated pump-and-dump scheme where the bill is finally coming due. The architecture for this extraction has deep historical roots, dating back to systematic changes in how America was governed and how citizens were legally classified. What followed was a long, slow harvest of the population—one that disguised control as progress, debt as opportunity, and collapse as evolution. The postwar boom didn’t contradict that system—it lubricated it.

Now, the mirage is gone. What was once promised can no longer be afforded. The institutions that upheld the illusion are spent. They extract, but no longer inspire. They preach equity while enforcing dependence. They sell empowerment while removing agency.

And still, they insist the dream is alive.

But here’s where the extraction becomes truly sophisticated. As the traditional American Dream died, a new form of participation emerged: digital membership in what amounts to a global dollar club. As KFrecently explained in his analysis of the GENIUS Act, stablecoins—digital bank accounts disguised as innovation—have exploded to serve 400 million users globally while generating massive profits for their issuers.

The trade-off is stark. Boomers got real assets with relative transactional privacy. The next generation gets digital “assets”—stablecoin wallets, app-based banking, algorithmic financial services—in exchange for comprehensive surveillance. What looks like financial inclusion is actually the infrastructure for total economic monitoring.

This represents the systematic replacement of real value with declared value across every domain. America has become a “club promoter” for the global dollar system, offering relaxed entry requirements that have drawn hundreds of billions into US Treasury-backed stablecoins. Users get access to “dollar-denominated wealth” through stablecoins that pay them no interest while the issuers pocket billions from the Treasury yields. It’s the same extraction model that’s been systematically engineered through culture and media for decades, just scaled globally and digitized.

Experts in these systems, like Aaron Day, warn that this represents a “backdoor CBDC”—applying existing financial surveillance laws to what was previously private money.

The surveillance trade-off is particularly insidious. In the short term, these systems offer less monitoring than traditional banks—no extensive paperwork, minimal identity verification. But once everyone is locked into the digital infrastructure, America can impose far stricter controls than ever before. Every transaction becomes trackable, every account becomes freezable, every economic participant becomes manageable.

We’re witnessing the replacement of physical ownership with digital access—and calling it progress. Where Boomers built equity in homes, the next generation builds balances in accounts that can be monitored, modified, or eliminated with keystrokes.

But charts don’t lie. That one chart—the brutal slope from 52% to 13%—says what no institution will admit: the old system is dead. It wasn’t lost. It was liquidated—and we were the product.

What gets built in its place remains an open question. The GENIUS Act’s full-reserve model could enable either unprecedented control—or the first real challenge to fractional-reserve banking in a century. But as Catherine Austin Fitts has pointed out, the Act contains no protections against programmable money, potentially creating private CBDCs with even less oversight than government-issued digital currency.

As she explains, ‘the issuing is not centralized, it’s dispersed. But if you look at the control mechanism of a social credit system and we know the federal government is doing remarkable things to pull together all the data they need to do a social credit system controlled by private corporations, tech companies, essentially.’ The outcome isn’t predetermined—it’s being decided right now.

The good news is that once the spell breaks, you stop trying to win the rigged game. You stop competing for scraps and start building something real. Not a nostalgic replica of a world that’s gone—but a new structure, grounded in truth, agency, and actual sovereignty. The chart that documents the death of the old dream becomes the blueprint for something better—if we’re honest enough to read what it’s really telling us.

Republished from the author’s Substack

|

Click here: to donate by Credit Card Or here: to donate by PayPal Or by mail to: Free Republic, LLC - PO Box 9771 - Fresno, CA 93794 Thank you very much and God bless you. |

The corrupt in Government and Communist government schools are directly to blame.

Open violent borders, 37 trillion in debt, wars costing many trillions where we win nothing but debt and death, people can't afford a home with two incomes, trade deals only our enemies love, wide spread government corruption in D.C., down through the local levels, and then government sponsored inflation where millions are taking a huge hit, food jumping 40 percent in 4 years, on and on.

They've screwed this country over bad.

In essence, during the ongoing industrial/digital revolution, all conditions are time-limited.

The author is correct in his claim the past 60 years has been living in an illusion. This was the time of the Mediacracy, when the old dominant media created a series of narrative lies to control the political process and power of the United States.

Those lies are being exposed because of the creation and growth of alternative media. We now live in an age of fractured, partisan media, where, with some effort, you can discover considerable truth.

I wonder what that rate was for the “generations” before the boomers came on the scene. And 1950 home owners were NOT boomers. They were barely 5 years old at the time.

In ten years there will be a housing glut. Probably sooner.

Yep started with the inflation, and financialization and monetization of everything starting in about 1973-75. Nixon inflation, and price controls, watergate, Vietnam windown and debt, and then Ford and Jimmy. In 1974 no one know what a money market was. By 1980 folks were getting 20% in money market funds. Oh - yeah, and don’t foget Nixon and petrodollars - which kept us from going bankrupt while we started trying to pay for the great society and the debt from Vietnam all at the same time, the Vietnam debt needed for Kissinger to negotiate an honorable peace.

When this started you got your mortgage from a S&L in your community. When it ended it was a piece of paper slipped into a derivative sliced and diced and sold on the financial markets.

They were veterans. VA home loans. GI Bill.

They were also children of the Depression, not of recent decades.

Yep...And who kicked off the great society? LBJ, another president from Texas, and he was certainly NO boomer.

Globalism didn’t “kick in”. It was a planned rape of the US economy,.

I am a Baby Boomer and I don’t have a lot of respect for my generation as a whole. A lot of Baby Boomers seem to not realize that they were born at a really perfect time. Economic prosperity would never be easier to attain. Societal changes made everything fun — sexual revolution! Yee haa! Hippies! Disco! Yuppies! Lots of good times. Just about everyone gets a house! Lots of people get pensions!!

Yes, people worked hard. Yes, not everyone achieved a life of prosperity. Not everyone partied. But the Baby Boom was the luckiest time in human history.

I think the least that older people can do is at least acknowledge that they were born at a fortunate time. Younger people today are growing up in a very different world. They aren’t lazy — they’re screwed. They will own nothing and they will be happy(?). The game is rigged against them and they know it. The American Dream isn’t there for most of them and they don’t see why they ought to be wage slaves for a system that still favors people born in 1950.

1) The article mentions buying a house while young adults. My grown kids (late 20's to early 30's) are having trouble buying a house. That is, until they realized that their first home can't realistically be expected to be as big as the one they grew up. My first home sure wasn't. Once my kids came to that understanding it was fairly easy for them to find one.

2) Young adults not marrying. Well, that goes hand-in-hand with item #1 above. Two incomes can afford a home easier than one income. I hear from some young adults that they don't want to marry because their parents modeled marriage horribly. I don't blame those. But at the same time don't think a single income can get what a double income can.

3) This article and others like it always use some caveat like this one's "or more in major cities". Of course a young couple can't buy a starter home in the most expensive areas. That's not a generational change argument. As long as I've been alive you had to pay more for a home with a shorter commute, regardless of which generation is having to buy it.

4) Not mentioned in the article is the effect of massive immigration. More people = more demand for housing = higher prices. Especially with Section 8 housing now paying for families to rent a house within subdivisions of home owners and non-welfare renters. In other words, lower middle class families are now competing with welfare housing (govt money), where as in prior generations the welfare housing was only in the projects.

Churn. In 1950, many if not most adults worked at one job and lived nearby in that town for their entire career. Now people jump from job to job, change careers, have their jobs outsourced or employer goes bankrupt / sells off to another corporation. People now have to be more flexible in their living arrangements to go where the work is, so renting makes sense for them.

*** And 1950 home owners were NOT boomers. ***

Thank you for pointing this out. My parents were part of the Greatest Generation. The men went off to war, fought for their country, and if they came back alive, they picked back up where they left off. The women did their best to support their country by raising their kids while dad was gone.

That generation gave rise to the Baby Boomers.

I get tired of hearing that Boomers are the ones who ruined everything. Maybe some, those in high places, but the everyday lower or middle class Boomer had to play by the rules others made, just the same as the younger generations are doing now.

It’s not the generation that caused problems. It’s the people in high places. Especially Democrats. They ruin everything they touch. They don’t solve problems; they create them.

The men went off to war, fought for their country, and if they came back alive, they picked back up where they left off.

Many of those men went to Korea.

The USA babies being born in 2025 are about 50% white and will grow up to be at least 60% Democrat.

For reasons unknown, the Republican Party has supported massive LEGAL immigration for the last 50 years.

I’m a Boomer, on the late side, but still one. I totally acknowledge that I have lived, especially in adulthood, a charmed life. (My childhood was not a pleasant one, but no need to go into that).

Younger people are growing up in a different world. True.

However, I never once took a vacation that I couldn’t afford, that I hadn’t saved up for. I didn’t go to the spa for massages or treatments. We lived on one income in our marriage. It was our agreement. There were a few years when the kids were older that I worked outside the home. Before that time, I volunteered my time to our church, my kids’ school, and the community as a scout leader.

I purchased two new outfits for my kids every season, but other than that, everything was second hand. That was ALL we could afford.

We didn’t try to keep up with the Joneses.

The younger kids today who complain so much about the housing spend their money on frivolities. They rack up credit card debt like you wouldn’t believe. However, they take lavish vacations, eat out FREQUENTLY, throw ridiculous birthday party celebrations for their kids, and seriously, indulge themselves at nearly every turn.

My own kids do some of these things. Amazingly, the one with the lowest income is in the best financial shape, because he doesn’t live lavishly. He pays his bills and saves his money.

Our oldest is the one who is up to his eyeballs in debt, though his undergrad schooling was completely paid off within a year of graduation. He lives in a place where he can’t afford to live, but somehow doesn’t put 2 and 2 together.

The middle child is a cross between the older and the younger. Completely paid off her college several years ago. Has a lot in savings, owns a home, but still lives a very comfortable lifestyle.

The one that bellyaches about Boomers the most is our oldest, who is trying so hard to keep up with the Joneses that I think he and his wife ARE the Joneses. One day, if they don’t start to get a handle on it now, they will really be hurting. What do they say? The more you make, the more you spend? That’s him (and his wife) to a T.

My Dad served in WWII and Korea.

Korea is the “forgotten war”.

...the ponzi scheme will crash once THIS gen. of crooks have lived the good-life off their corrupt bounty...and they know it...the "policy-makers" borrowed and stole...knowing full well the house built on a foundation of monopoly money will fall...so long as it didn't fall while they were enjoying the fruits of their fraud...they didn't/don't give 2-fx. Yeah, they threw a few peanuts to the serfs, but only so the (otherwise) angered/rioting masses wouldn't ruin their party...

The cradle will fall and this (latest) version of empire will crash.

...so it was written, so it shall be done.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.