Skip to comments.

Android’s Pursuit of the Biggest Losers

Asymco ^

| August 17, 2010

Posted on 08/18/2010 11:15:27 AM PDT by Swordmaker

The mobile phone market is intertwined with the telecommunications industry which is vast and there are numerous competitors which are much more dynamic and better capitalized than the moribund PC or music player vendors. It’s also a regulated and fragmented global market with 1.2 billion units and 5 billion consumers—far greater than any of the markets Apple played in for its first 30 years.

Nevertheless, the iPhone has had a huge impact on the industry. To show just how much of an impact, I dove in and pulled over 500 data points on three years’ financial performance of seven competitors responsible for 80 percent of units being shipped today. The time frame covers the iPhone’s participation in the market so it allows for “before-and-after” comparisons.

I divided the findings into five articles:

- Unit Volumes. The evolution of market share.

- Revenues. The shift in where dollars are spent.

- Selling prices. The tale of ASP erosion.

- Operating margin. Profitability ratios over time.

Now I turn my attention to draw a bottom line from all the data above, namely the operating earnings (EBIT or Earnings before Interest and Taxation).

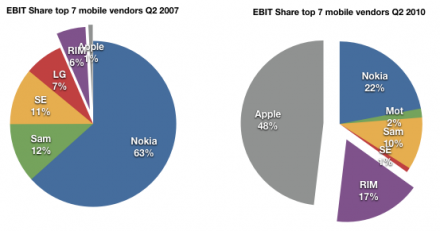

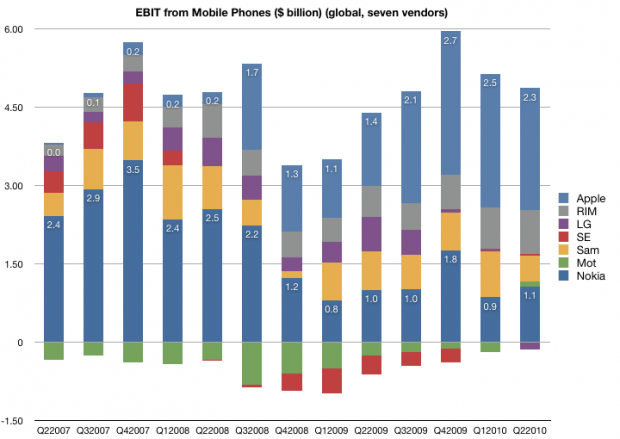

The first chart shows the EBIT from the top seven vendors of mobile phones since the quarter when the iPhone launched. I annotated Nokia and Apple’s bars to give perspective.

The total available profits in the industry dipped to a bit under $4 billion at the trough of the recession, and have recovered to nearly $6 billion in the holiday quarter last year. However, not all vendors are profitable. As you might expect from looking at the operating margins, Motorola and Sony Ericsson have been generating losses for most of this time period. They have both reached profitability in the last quarter, though at very low levels and after having lost a large part of their sales. LG has turned negative this past quarter after being a modest earner for some time. Samsung has maintained a fairly even consistency in its profit capture, though with its expanding market share, it seems to have come at the cost of pricing.

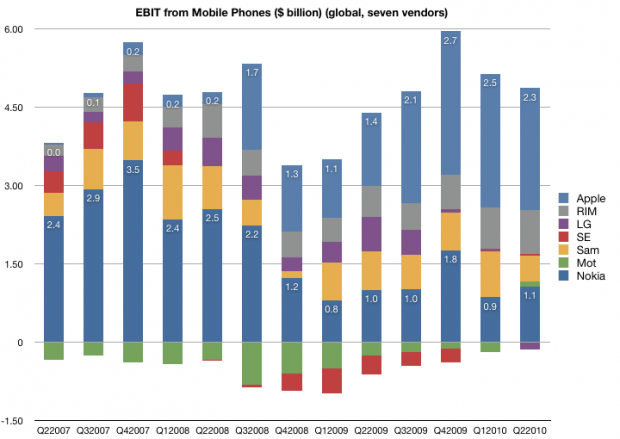

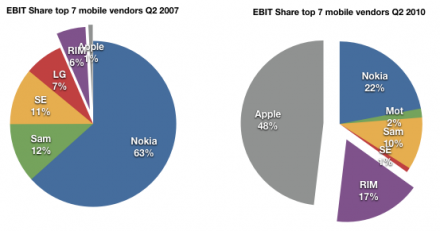

Finally, looking at the pure smartphone vendors RIM and Apple, the picture is nothing short of astonishing. This before-and-after share-of-available-profit chart shows that the two entrants went from about 7% profit share to 65% in three years.

Apple in particular is capturing about half of the available profits with three percent of the units. It dwarfs all the other vendors, more than double the nearest (Nokia). All that in three years and with the added burdens of only three models, a recession and limited distribution.

What does it all mean?

Here are my conclusions, enumerated:

- The lack of a real response. The recurring theme in this series of articles has been that giant multinational incumbents in a vast and rapidly growing industry, enjoying all the advantages that size and incumbency, have had their profits taken from them. And they don’t seem to have put up much of a fight.

- It’s all wealth transfer. Note the total amount of profit available has not increased markedly; this is not about incumbents growing the pie. Two thirds of what should have rightly been theirs moved from the incumbent shareholders to the entrant shareholders.

- Speed. This shift of profit occurred over an unprecedentedly short period of time. Three years is no more than two product cycles in the industry and it’s an order of magnitude faster than what happened historically to other industries.

- Disruption is the diagnosis here. The incumbents were caught in the headlights. Disruptive innovation leads to asymmetric competition and this is what we just witnessed. History has shown that the shift of profits is usually the last stage of disruption and is usually irreversible because the change in business models cannot happen at the rate of change of profit transfer.

Which leads me to one final point.

When analyzing the potential for challengers to the new winners, the most cited is Android. Can Android affect this redistribution of profit once again? And to whom?

If Android is to become the dominant platform, does it depend on the success of its licensees? Who are these licensees and what are the chances that they will be able to align their businesses to what Android offers (a new revenue model based on services and advertising).

One problem I see is that Google is making a bet on those same vendors who are now squeezed in the middle of that last pie chart: Samsung, LG, Motorola and Sony Ericsson. Nokia, Apple and RIM will certainly not take the OS over what they already have as it dilutes their differentiation and margins. That means Android is aligned with the biggest losers in the industry.

So how likely are these disrupted ex-giants to recover and take Android forward? My bet: slim to none. Android does not offer more than a lifeline. It is not a foundation for long-term profitability as it presumes the profits accrue to the network and possibly to Google. Profit evaporation out of devices to Google may be a possibility at some time in the future, but only if the devices don’t need too much attention to remain competitive. But because they’re still not good enough (and they won’t be for years to come), it’s certain that attention to detail is what will be most important to stay abreast of Apple.[1]

So here we have the real challenge to Android: partnership with defeated incumbents whose ability to build profitable and differentiated products is hamstrung by the licensing model and whose incentives to move up the steep trajectory of necessary improvements are limited.

In other words, Android’s licensees won’t have the profits or the motivation to spend on R&D so as to make exceptionally competitive products at a time when being competitive is what matters most.

[1]: I would argue the same lack of symmetry with licensed software vendor Microsoft is what led the the failure of the same incumbents to make a dent in the industry with Windows Mobile [2003 to 2010].

TOPICS: Business/Economy; Computers/Internet

KEYWORDS:

Navigation: use the links below to view more comments.

first previous 1-20, 21-33 last

To: The Unknown Republican

By the way, you seem to have taken my comments personally. No, I didn't. I don't know you, don't care and speak only to the facts. Any emotion you think you read into this is your own projection. This is my only comment about you. Now and ever. Do you work for Apple or have some emotional connection to them? This? Again? WTF? OK, Yes, I am Steve Jobs.... uh, uhm... Sister. Yeah, that's it. I am Steve Jobs' sister. Make any difference?

Oh, emotions again... uhm... "hi". That's about the level I can muster on this tangent. Apple has shown a distinct preference for closed systems since its inception.

Apple? Closed? Man bites dog. That is hardly news or post worthy. And who cares? I prefer it that way. I guess others prefer viruses and spyware in their unregulated wild apps. That's the only thing that IS closed. What Apps they allow on the App store. The core OS is no more closed than any other and is based on FreeBSD.

So what other closed could you mean?

Remember how they killed their own clone market?

What is this? "johhny this is your life"??

They didn't KILL their "own" clone market they SUED THE FRAK out of pirates and thieves and WON. THEN and now again with PissStar.

Apple sells hardware...the future is software.

Oh this isn't even funny. Apple is NOT a hardware vendor. Apple is a PRODUCT creator. They make wholistic complete and integrated solutions which WORK without the problems of the rest of the world who makes junk FOR others or is stuck with trying to make some generic software run on the stuff they make.

This is why they can, do and will MAKE MORE MONEY. Which is all anyone who invests in them should care about and all anyone who wants a seemlessly working product should know.

If you get your software in every ecosystem and dominate...you win.

Then, I guess that's why you made this a "10 year" thing.

Well, if any of us are around in 10 years and still care, I'll see ya then.

21

posted on

08/18/2010 2:46:19 PM PDT

by

RachelFaith

(2010 is going to be a 100 seat Tsunami - Unless the GOP Senate ruins it all...)

To: RachelFaith

Yet you chose to insist that Apple will dominate? Your logic leaves my assertions just as valid as yours. And yes, if Apple refuses to open its closed system I will stand by my prediction.

Every time Apple has succeeded it has been by opening up a closed system. The iPod was a closed system and nearly a failure until iTunes for Windows. The Mac has found new life since switching to a Unix-based open-source OS and using Intel CPUs. Apple does usually recognize, albeit late in the game, that they have shot themselves in the foot with their closed systems. At some juncture Steve Jobs will miss the boat on opening such a system...he can’t help himself.

To: RachelFaith

Hmmm...sounds pretty emotional to me. Bye.

To: Swordmaker

My wife and I both own droids. Mine is Motorola , hers is HTC. The only reason we have them is that we are on Verizon.

The day Verizon has the I-phone, we will switch to the I-Phone.

24

posted on

08/18/2010 5:24:17 PM PDT

by

hecht

(TAKE BACK OUR NATION AND OUR NATIONAL ANTHEM)

To: ConservativeMind

Uh, this idiot of a researcher left out HTC. Uh, no, he didn't. He specified which phone vendors where included and why:

"The first chart shows the EBIT from the top seven vendors of mobile phones since the quarter when the iPhone launched. I annotated Nokia and Apple’s bars to give perspective."

HTC was not in the top seven. US figures were not considered... this was WORLD WIDE Vendors... the statistics are correct.

25

posted on

08/19/2010 12:33:13 AM PDT

by

Swordmaker

(This tag line is a Microsoft product "insult" free zone!)

To: Erik Latranyi

PS: You left HTC off (since they just broke into the top 10 device manufacturers). Watch them. HTC was left out of the TOP SEVEN because the TOP SEVEN does not include the TOP TEN... At least not in any TOP SEVEN list I've ever seen...

26

posted on

08/19/2010 12:35:11 AM PDT

by

Swordmaker

(This tag line is a Microsoft product "insult" free zone!)

To: The Unknown Republican

Apple had the major share of the business market with their hardware, but Microsoft won with their OS. Excuse me, that is revisionist history. Apple NEVER had the major share of the business market with their hardware. NEVER. Business was on Mainframes... and MINI computers... made by IBM and DEC and Honeywell and SPERRY... and other companies not Apple. They went with what they knew. And IBM came out with a desktop microcomputer and buyers bought what they knew. IBM. Which happened to have a Disk Operating System bought essentially off the shelf from a little known company called Microsoft.

27

posted on

08/19/2010 12:39:26 AM PDT

by

Swordmaker

(This tag line is a Microsoft product "insult" free zone!)

To: Mr. Blonde

Seems like Motorola’s gains would be attributable to Android. Look at the chart for Q22010... and you'll see the Android effect on Motorola... it's no longer in the below zero profit margin area.

28

posted on

08/19/2010 12:42:53 AM PDT

by

Swordmaker

(This tag line is a Microsoft product "insult" free zone!)

To: smokingfrog

HTC hits top 10, Android Surges That is an event that takes place ONLY in the last quarter of the multi-quarter study this article reports on... and HTC does not rise INTO the TOP SEVEN that are being studied. It only makes it to EIGHTH. As a result, it is not even a blip on this study... yet.

Both LG (#3) and Samsung (#2) have some of their phones running Android. But not all.

29

posted on

08/19/2010 12:48:24 AM PDT

by

Swordmaker

(This tag line is a Microsoft product "insult" free zone!)

To: The Unknown Republican

I believe Apple is making the same mistake in the mobile space that they made in the desktop space. Their cost premium and proprietary OS will be their ultimate undoing. What cost premium? The iPhone 3Gs is currently available from Apple and AT&T for $99 on contract. The iPhone4 is currently available from Apple and AT&T for $199 on contract for $199. You will find the fancy Android smartphones are available for prices that are at the same price points with contracts. Where are the cost premiums you are claiming?

30

posted on

08/19/2010 1:54:39 AM PDT

by

Swordmaker

(This tag line is a Microsoft product "insult" free zone!)

To: The Unknown Republican; RachelFaith

I believe Apple is making the same mistake in the mobile space that they made in the desktop space. Their cost premium and proprietary OS will be their ultimate undoing. That thinking prevailed briefly awhile back and Jobs was ousted. Your thinking is what almost DID put Apple out of business. I am continuously amazed by backbenchers who post here about how Apple is doing everything wrong while Apple continues to grow and amaze the naysayers.

31

posted on

08/19/2010 4:46:28 AM PDT

by

Mind-numbed Robot

(Not all that needs to be done needs to be done by the government)

To: The Unknown Republican

Is Apple in a far better position now or when they licensed their OS? I really don’t think the data backs up the position that Apple should license their software. It takes a lot of OS X license to equal one MBP.

32

posted on

08/19/2010 4:46:39 AM PDT

by

Mr. Blonde

(You ever thought about being weird for a living?)

To: The Unknown Republican

f Apple refuses to open its closed system I will stand by my prediction.It will be just as valid 10 years from now as it was 20 years ago. A straw man argument that leads nowhere.

Apple makes money, not commodity junk, there is plenty of that available for you to purchase, so enjoy.

33

posted on

08/19/2010 11:41:53 AM PDT

by

itsahoot

(Republican leadership got us here, only God can get us out.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-33 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson