Posted on 05/18/2022 1:50:44 PM PDT by blam

Yep, we went there and unleashed the ‘deer in headlights’ image…

While most blinkered investors ignored last week’s record surge in revolving consumer credit (i.e. credit card spending), this week’s Walmart and Target earnings brought it home to the rest of the country that the “American consumer is strong” or “consumer has best balance sheet ever” narrative imploded, crashing on the shores of a gigantically lopsided and divided national aggregate that hides the reality that most of America is unable to pay the ‘cost of living’ under Bidenomics 40-year-high inflation without resorting to the plastic. Additionally, we are hearing more investors coming around to the idea that Powell’s comments were anything but ‘less hawkish’ – he unequivocally put 75bps back on the table with his ‘if things do not go as planned, we will do more’ comments… it just seems like nobody wanted to hear that yesterday!?

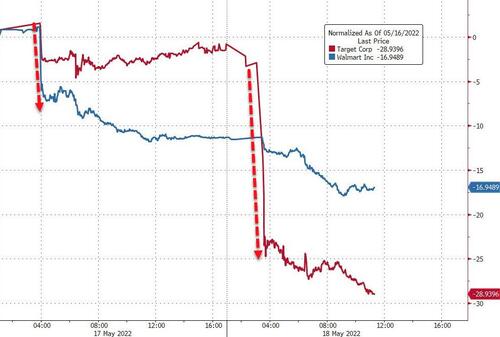

TGT and WMT are a bloodbath this week (-29% and -17% respectively in the last two days – worst drops since 1987)…and to pile on the ‘recession’ trade, Disney’s CFO warned that “growth in per capita parks spending will slow”..

Source: Bloomberg

NOTE – these are not widely held hedge fund names – they are, however, extremely widely-held ETF and passive investor names… when do the passive hand-sitters, reach for the mouse and end the pain?

That ugly realization appeared to finally hit home today as Housing data confirmed the signals from the retailers, sending stocks and bond yields plunging lower (and the yield curve dramatically flatter) as stagflationary themes are becoming base case for many.

Nasdaq was the biggest loser today but chatting with some more ‘seasoned’ traders, almost everyone said a similar thing – this is the calmest major selloff they have ever seen, no panic puke, just slow and steady derisking (again perhaps signaling a VWAP seller and more passive investor unwinds)

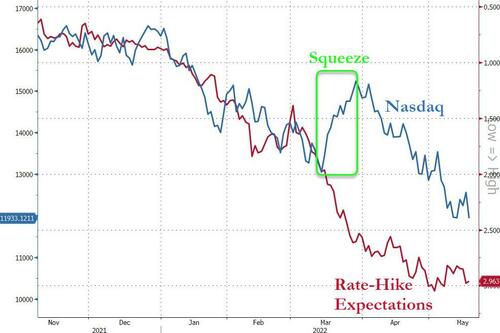

Stocks have almost unwound all of the dead-cat bounce from last week (remember that bounce was triggered when the S&P 500 hit a drawdown of 19.99% – just shy of the bear market trigger)…

The S&P lost its 4,000 pin once again…

Stocks still not ‘pricing in’ The Fed…

Source: Bloomberg

Staples & Discretionary were (unusually both) monkeyhammered today…

Source: Bloomberg

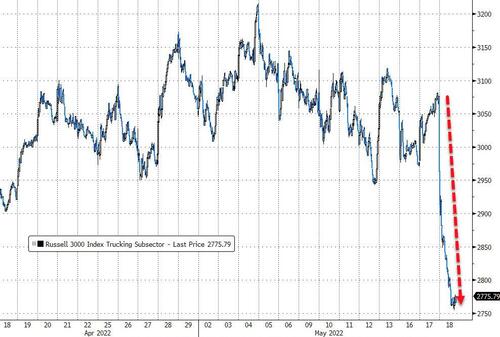

Trucking stocks were clubbed like a baby seal (to their lowest since Feb 2021) after the Target comments on Transportation costs…

Source: Bloomberg

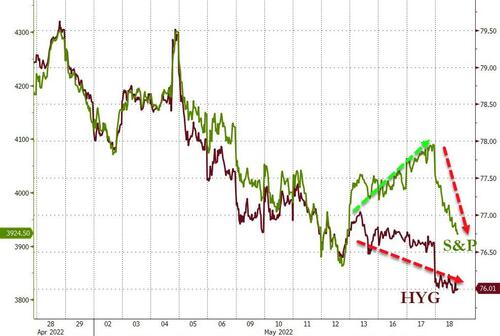

Equity markets caught down to credit’s ongoing weakness today…

Source: Bloomberg

VIX rose modestly today but equity risk remains massively under-priced relative to credit risk…

Source: Bloomberg

As stocks puked, bond yields crashed with the long-end outperforming (30Y -11bps, 2Y -3bps)…

Source: Bloomberg

…signaling “growth scare” fears are rising (and thus stagflation… globally)

Source: Bloomberg

10Y tested 3.00% again and plunged…

Source: Bloomberg

And the yield curve flattened dramatically…

Source: Bloomberg

TINA is dead… there is an alternative…

Source: Bloomberg

The dollar managed a small rebound today after 3 down days…

,/A>

,/A>

Source: Bloomberg

Bitcoin broke back below $30k again today – remaining in the $29-$31k range…

Source: Bloomberg

Despite a sizable crude and gasoline inventory draw, oil prices tumbled along with the rest of the risk assets…

Gold managed gains today, holding above $1800…

Finally, as we noted earlier, don’t be fooled by (nominal) retail sales spending data…

After adjusting for inflation, the US consumer has hit the wall.

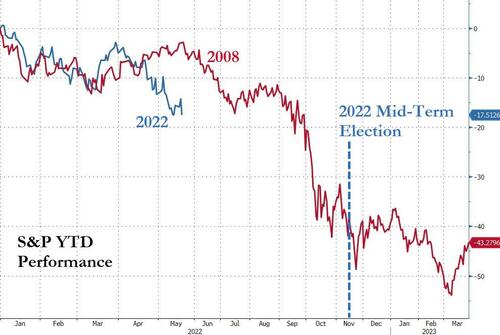

Still, things could get a lot worse yet…

Source: Bloomberg

Will Powell allow that? Will Biden allow Powell to allow that?

Yup—DC is acting like the Emperor and his Court in ancient Rome—following their own agenda, lining their own pockets with massive corruption and not giving a flying f*&^ about the opinions of the peons in the periphery of the Empire.

“Don’t be too sure they are feeling the pain at the capital.”

If the GOP wins the House and Senate the first budget passed should cut the size of the non-military federal workforce by at least 10% and end “bonuses” for federal employees. In addition, royalty payments by industry to government scientists (like Fauci) for patents received from federal government financed research must also be ended.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.