Skip to comments.

CPI inflation report will be released by Labor Department, while other data is delayed by shutdown

CNBC (Business Website) ^

| 10 October 2025

| Alex Harring

Posted on 10/10/2025 12:35:51 PM PDT by zeestephen

The Labor Department will bring back staff to work on the consumer price index...The report will come out at 8:30 AM ET on 24-OCT, nine days after it was originally scheduled.

(Excerpt) Read more at cnbc.com ...

TOPICS: News/Current Events

KEYWORDS: economy

Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

My first instinct...

Labor Department employees will do every thing they can think of to create bad inflation news for Trump.

If bad news is not possible, they will deliberately create suspicion about good news.

To: zeestephen

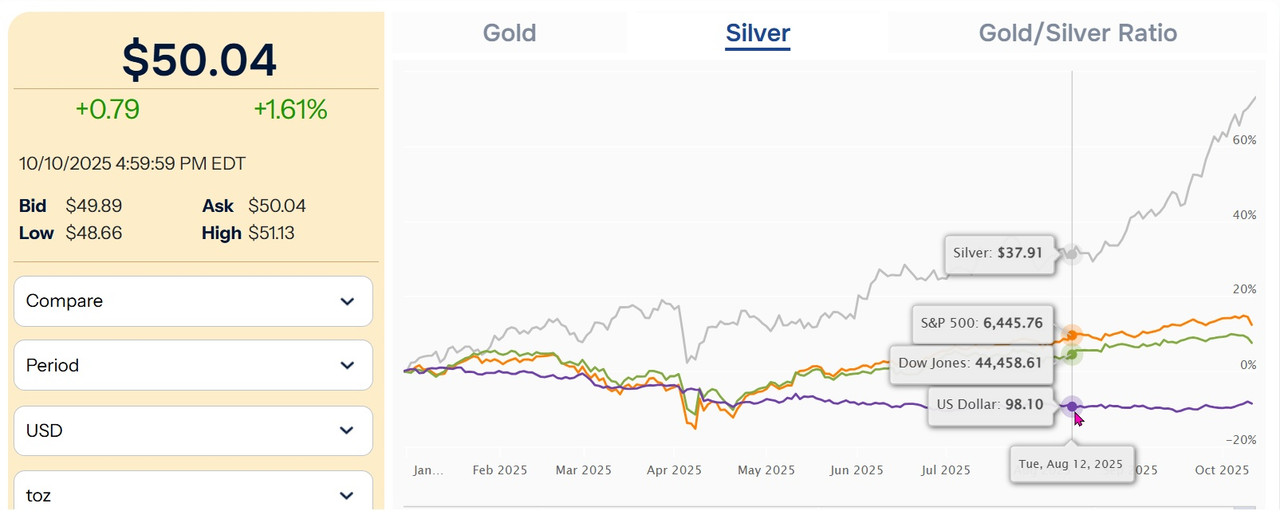

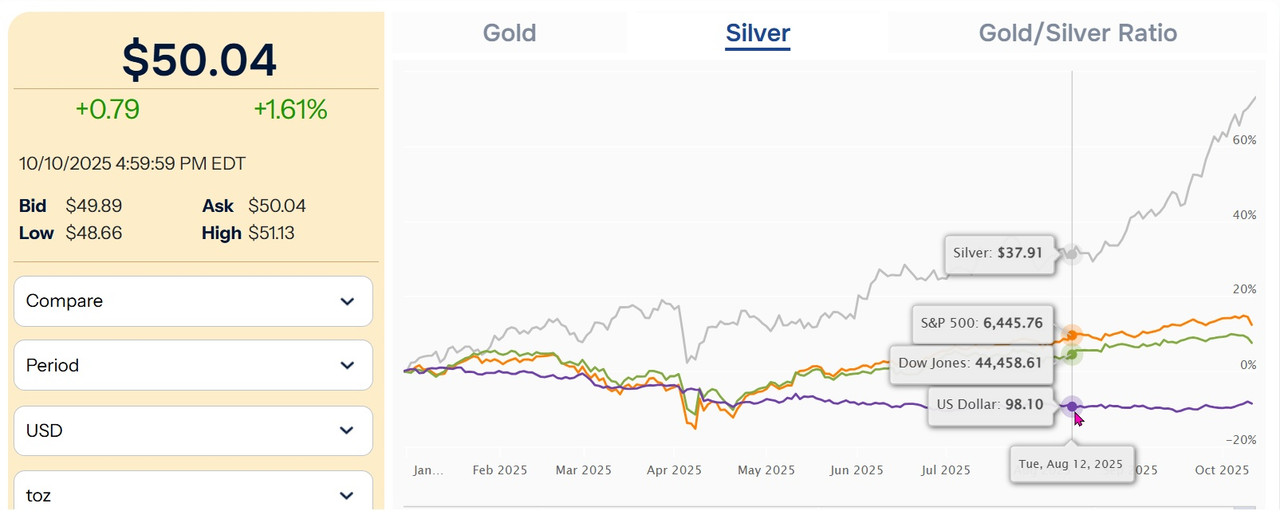

In the meantime, the dollar is crumbling.

Backwardation in the Silver market, 10 to 20 cents a week ago, was $1 a couple of days ago, and now is around $2.50. This is unprecedented. People don’t want “paper” or derivative silver in the future. They are increasingly opting for more “expensive” physical silver today.

2

posted on

10/10/2025 12:40:03 PM PDT

by

C210N

(Mundus vult decipi, ergo decipiatur.)

To: zeestephen

Why is the market down 750 points today?

To: C210N

When Gold hits $5000 that is when the Dollar will go down the toilet...And that is use around the corner...

To: zeestephen

The “CP Lies”…..everyone who eats knows this. Been a joke since the early 90’s.

5

posted on

10/10/2025 12:51:06 PM PDT

by

delta7

To: zeestephen

“ My first instinct...

Labor Department employees will do every thing they can think of to create bad inflation news for Trump.

If bad news is not possible, they will deliberately create suspicion about good news.”

*****************************************************

Maybe… but they’d have to be mighty creative. As I understand the process ALL the DATA FOR THAT REPORT WAS ACTUALLY COLLECTED IN SEPTEMBER before the government shutdown. So that raw information is all there and ready to be “analyzed”, collated and “massaged” into their final report for September by the headquarters’ bureaucrats.

6

posted on

10/10/2025 12:51:28 PM PDT

by

House Atreides

(I’m now ULTRA-MAGA-PRO-MAX)

To: dpetty121263

The dollar is already swirling, and yes, as you say, about to go down into the toilet.

The “kick the can” option is to revalue gold from its current $42.22, up to $4000. Or $5000.

The “kick the can” for another year or so, up to $10000 or more.

Q: Do we have the gold?

A: Yes. Gold shall destroy FED.

Epilogue: Silver buries it.

7

posted on

10/10/2025 12:53:43 PM PDT

by

C210N

(Mundus vult decipi, ergo decipiatur.)

To: dpetty121263

When Gold hits $5000 that is when the Dollar will go down the toilet

—————-

It already has, at 97, minus 11 percent since January, in 2000 it was 120, before that 160…..debasement, happens to ALL paper currencies….we are nearing the “End Game” in the paper currency world.

8

posted on

10/10/2025 12:55:52 PM PDT

by

delta7

To: zeestephen

Whatever the report is, the truth will be the opposite. Guaranteed.

9

posted on

10/10/2025 1:18:25 PM PDT

by

MtnClimber

(For photos of scenery, wildlife and climbing, click on my screen name for my FR home page.)

To: God luvs America

Why is the market down 750 points today? President Trump suggested there may be much higher tarrifs against China.

10

posted on

10/10/2025 1:20:09 PM PDT

by

MtnClimber

(For photos of scenery, wildlife and climbing, click on my screen name for my FR home page.)

To: C210N

Re: "In the meantime, the dollar is crumbling."

I do not really follow the precious metals, although I do check the price of gold each day.

The US Dollar (USD) went up close to 4% against a basket of foreign currencies when gold was making new highs this week.

The USD went from $96 to about $99.5 during the gold run.

Not what I expected.

$100 is considered neutral. Over $100 - USD strength. Below $100 - USD weakness.

11

posted on

10/10/2025 1:43:35 PM PDT

by

zeestephen

(Trump Landslide? Kamala lost the election by 230,000 votes, in WI, MI, and PA.)

To: God luvs America

Re: "Why is the market down 750 points today?"

The Nasdaq 100 (QQQ) has had a HUGE run in the last six months.

Up 52% since April.

Today - at 2 PM Pacific - QQQ is down 4%.

This is a three day weekend.

A lot of the speculators think it is the right time to book some profits.

12

posted on

10/10/2025 1:57:45 PM PDT

by

zeestephen

(Trump Landslide? Kamala lost the election by 230,000 votes, in WI, MI, and PA.)

To: God luvs America

Why is the market down 750 points today?

—————-

My guess, Silver just topped the all time high of $50 USD and Gold right at $4,000 USD/ oz.

13

posted on

10/10/2025 2:15:19 PM PDT

by

delta7

To: zeestephen

October seems to always be the most volatile month for the stock market.

To: zeestephen

One way to view the strength of the dollar is as in your reply - compared to a basket of currencies. That would be all well and good, in normal times.

All the major currencies are fiat-based. So, consider another way of viewing "money", when there is something fundamentally wrong with fiat: Compare fiat (gold/silver derivatives, which is money substitutes) versus money itself (gold/silver).

When all fiat is having problems, all fiat is in deep kimchi, then comparing one versus another is very relative. At any moment, this one is ahead, this one behind, and some time later, they flip. The useful life of the fiat dollar is coming to an end. What was $1 in 1913 is today between 2 and 3 cents. The value has been inflated away.

When currencies fail, and history is strewn with the carcasses of failed currencies, real money makes a return. Could be constitutional money (coin), or perhaps a new paper, but with metal backing.

15

posted on

10/10/2025 3:01:14 PM PDT

by

C210N

(Mundus vult decipi, ergo decipiatur.)

To: zeestephen

Trump, best President for Gold and Silver ever!

.

.

To: delta7

President Trump wants a lower Dollar.

17

posted on

10/10/2025 5:10:13 PM PDT

by

cowboyusa

( YESHUA IS KING OF AMEbRICA AND HE WILL HAVE NO OTHER GODS BEFORE HIM!)

To: cowboyusa

Correct. He has said so.

That is one of the reasons people are buying gold and silver.

18

posted on

10/10/2025 8:33:02 PM PDT

by

chud

To: C210N

Isn’t there a stock / investing ping list here on FR? I’d like to be on it if you or anyone else knows. Most of my stuff dived today except for my lil gold mining stocks..

To: cowboyusa

President Trump wants a lower Dollar.

———————-

Here is his reasoning: a lower USD promotes our manufacturing industry, nations will purchase our goods and services because their currency buys more American products for less. Theoretically, our manufacturing sector then hires more workers. A good thing.

The flip side, foreign goods purchased from overseas costs Americans more dollars to buy, a bad thing.

The monster in the room? Our unsustainable debt. It throws a wrench in his reasoning, fewer nations are buying our debt instruments which finance our day to day operations. We shall see how his gamble works out.

20

posted on

10/11/2025 6:26:39 AM PDT

by

delta7

Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson