Posted on 07/21/2025 9:29:26 PM PDT by SeekAndFind

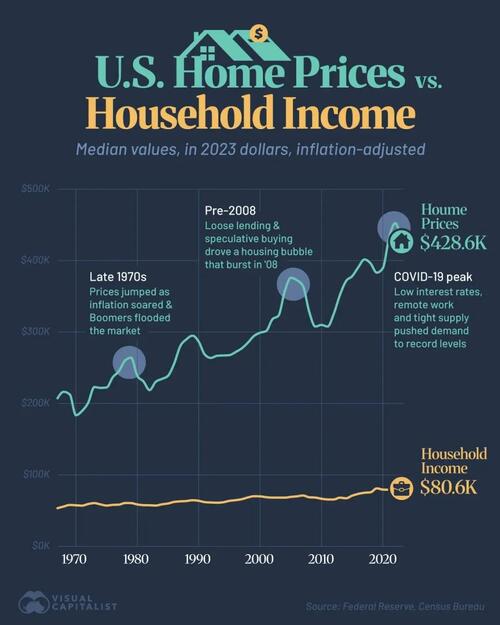

The cost of a typical American home has raced far ahead of paychecks.

This graphic (and below video), via Visual Capitalist's Pallavi Rao, charts how the median sales price of a newly-built privately-owned residential units (including houses and apartments) and the median household income have moved since 1967.

Data for this graphic is sourced from the Census Bureau (both home prices and household incomes).

The Federal Reserve’s CPI-U index was used to convert both to 2023 dollars for an apples-to-apples comparison.

The median sales price of a new U.S. home reached $428,600 in 2023. That price was more than five times the median household income of $80,610 that year.

See how both metrics have moved since 1967 in the video below.

The widening gap underscores why today’s buyers feel squeezed, even with low-down-payment loans and longer mortgage terms.

It also hints at deeper forces, from land-use rules to interest-rate cycles, shaping the housing market’s boom-and-bust rhythm.

Dividing price by income yields a home-price ratio, a quick gauge of affordability. A ratio of 3 is often cited as a sustainable benchmark.

Back in 1970, the typical new home cost just 3.2 times the median income.

| Year | Median Household Income (2023 Dollars) | Median Home Prices (2023 Dollars) | Home-Price Ratio |

|---|---|---|---|

| 1967 | $53,530 | $207,346 | 3.87 |

| 1968 | $55,810 | $216,372 | 3.88 |

| 1969 | $58,010 | $212,640 | 3.67 |

| 1970 | $57,580 | $183,645 | 3.19 |

| 1971 | $57,090 | $189,631 | 3.32 |

| 1972 | $59,330 | $201,110 | 3.39 |

| 1973 | $60,610 | $223,036 | 3.68 |

| 1974 | $58,780 | $221,845 | 3.77 |

| 1975 | $57,180 | $222,510 | 3.89 |

| 1976 | $58,160 | $236,658 | 4.07 |

| 1977 | $58,450 | $245,337 | 4.20 |

| 1978 | $60,720 | $260,172 | 4.28 |

| 1979 | $60,610 | $264,082 | 4.36 |

| 1980 | $58,720 | $238,856 | 4.07 |

| 1981 | $57,730 | $230,893 | 4.00 |

| 1982 | $57,570 | $218,817 | 3.80 |

| 1983 | $57,210 | $230,362 | 4.03 |

| 1984 | $58,930 | $234,356 | 3.98 |

| 1985 | $60,050 | $238,795 | 3.98 |

| 1986 | $62,280 | $255,752 | 4.11 |

| 1987 | $63,060 | $280,232 | 4.44 |

| 1988 | $63,530 | $289,865 | 4.56 |

| 1989 | $64,610 | $294,952 | 4.57 |

| 1990 | $63,830 | $286,609 | 4.49 |

| 1991 | $61,960 | $268,476 | 4.33 |

| 1992 | $61,450 | $263,841 | 4.29 |

| 1993 | $61,150 | $266,823 | 4.36 |

| 1994 | $61,800 | $267,237 | 4.32 |

| 1995 | $63,770 | $267,743 | 4.20 |

| 1996 | $64,710 | $271,968 | 4.20 |

| 1997 | $66,050 | $277,145 | 4.20 |

| 1998 | $68,470 | $285,059 | 4.16 |

| 1999 | $70,210 | $294,504 | 4.19 |

| 2000 | $70,020 | $299,039 | 4.27 |

| 2001 | $68,870 | $301,489 | 4.38 |

| 2002 | $68,310 | $317,787 | 4.65 |

| 2003 | $68,350 | $322,991 | 4.73 |

| 2004 | $68,250 | $356,511 | 5.22 |

| 2005 | $69,310 | $375,861 | 5.42 |

| 2006 | $70,080 | $372,580 | 5.32 |

| 2007 | $71,210 | $364,303 | 5.12 |

| 2008 | $68,780 | $328,474 | 4.78 |

| 2009 | $68,340 | $307,774 | 4.50 |

| 2010 | $66,730 | $309,934 | 4.64 |

| 2011 | $65,750 | $307,764 | 4.68 |

| 2012 | $65,740 | $325,413 | 4.95 |

| 2013 | $68,220 | $351,714 | 5.16 |

| 2014 | $67,360 | $371,326 | 5.51 |

| 2015 | $71,000 | $378,214 | 5.33 |

| 2016 | $73,520 | $390,768 | 5.32 |

| 2017 | $75,100 | $401,637 | 5.35 |

| 2018 | $75,790 | $396,065 | 5.23 |

| 2019 | $81,210 | $383,175 | 4.72 |

| 2020 | $79,560 | $389,573 | 4.90 |

| 2021 | $79,260 | $431,240 | 5.44 |

| 2022 | $77,540 | $452,385 | 5.83 |

| 2023 | $80,610 | $428,600 | 5.32 |

By 2004, that ratio had breached 5x for the first time, and it has rarely dipped below 5 since the Great Financial Crisis. In 2022, the ratio peaked at 5.83—an all-time high.

Even with a slight pullback in 2023, the multiple remains about two times higher than it was half a century ago, signaling persistent affordability pressure.

The 2000-2006 housing boom pushed home prices up faster than incomes, inflating the ratio from 4.3 to 5.4 in just six years.

After the 2008 crash, prices corrected, trimming the multiple to 4.5 by 2009.

Yet incomes stagnated while credit conditions eased, allowing prices to roar back. Each bust resets the market, but the floor keeps rising—suggesting structural supply shortages and demographic demand that quick corrections cannot fully unwind.

Record-low mortgage rates and a surge in remote-work moves propelled home prices in 2020-22. Median new-home prices jumped nearly $63,000 in two years—while median incomes fell slightly.

Even as interest rates climbed in 2023 and prices cooled, the typical buyer still needed more than five years of gross income to purchase a newly built home.

Unless incomes rise faster or supply meaningfully expands, the era of “stretch” affordability looks set to continue.

Median values are good for quick understanding but hide variance across the country. For more nuanced data, check out The Income Needed to Buy a Home in Every U.S. State on Voronoi, the new app from Visual Capitalist.

bttt

Wages never kept up. The price of homes now has taken an even larger percentage of people out of the buying a home game. It’s almost as if they don’t want anyone to own private property.

They don’t. Stop paying your property taxes and you’ll see who owns your house very quickly.

Everything leftists touch is perverted and destroyed. They are a pox on the world.

When you bring into the USA 30-40 million foreigners in a short time period, the inflation in housing costs HAD to skyrocket.

Yes, things have changed for the worse in that regard.

And as this information shows, adjusted for inflation, housing is far more expensive than it was decades ago.

It certainly makes it difficult for young people nowadays, if they are trying to buy a house.

I think this information shows in part why there are so few stay at home moms anymore. In many families, mom is working because her paycheck is needed to pay the mortgage.

immigration is only a contributory factor to why housing prices are increasing vs. income. Sure they push up demand but the larger problem is that supply is not increasing properly. Right now the only new construction that is feasible in most of the country is bigger and more luxurious homes. Zoning laws have become ever more restrictive. Want to build a new detached garage with a studio apartment over it? Fat chance. Want to build some 12-unit apartment buildings with a mix of 2 and 3-bed apartments? Fat chance where I live. The local towns will fight you tooth and nail. What is often feasible to build for lower priced starter homes is too highly dense for current zoning laws. Attached housing like townhouses or even half-duplexes (one building with two separate units) might be economically feasible. But usually zoning won’t let that happen. Suburbs where I am from have a bias for single family detached homes with a yard and they zone the towns for only that in most areas. However the market wants cheaper and more affordable options and it’s illegal to build new supply for that segment that wants it.

I’m from the Chicago metro FYI. The City of Chicago did a zoning overhaul 20+ years ago. Most of the vacant lots are now sitting on zoning that is single family that requires either a lot with 35 or 50 food frontage. Yet most vacant lots are 25 or 30 feet wide. You’ll need to “know somebody” to get a permit to build. And then it will only be a single family detached home.

2) We want more from houses than we did half a century ago. Two many young people I know expect their first home to be bigger than the one I grew up in. Bigger houses cost more. As do houses with more amenities like central air, lots of windows, large master bath, etc. that now are considered standard. None of these are bad things. They just cost more than smaller houses with less amenities.

Right. Forget taxes on tips and overtime. If Trump somehow eliminated property taxes he would be king.

Onerous zoning regulations and building codes have prevented modest-sized homes from being constructed for much of the last few decades.

I often hear older people giving advice like "Stop buying coffee at Starbucks" as the real key to enabling home ownership. I'd say the problem is a little bit bigger than that.

The Marxists that run the city I live in are doing what you say your suburbs don’t want. They have eliminated single-family zoning in favor of high density apartment buildings. These do not belong in suburbs or anywhere. Communistic behemoths that are designed with govt control in mind and end result of people not owning land.

Yep.

“It’s almost as if they don’t want anyone to own private property.”

Ya THINK? - LOL!

“TBTB realized that they could jack prices through the roof.”

And employers realized they could pay men less and get away with it when mothers entered the workforce.

No more stay-at-home wives. Children became latchkey ferals and now are destroying the country.

You know what has kept up?

Property taxes.

In my neck of the NYS woods an existing 2,000 sq ft home can have an annual property tax bill of $5,000.

Imagine what the nicer homes rum.

Those aren’t moving, BTW, unless the price is dropped.

And some still aren’t selling.

Nobody wants to assume the property taxes.

But owners are still on the hook.

See my reply #17.

Government has more to do with it than employers.

“In my neck of the NYS woods an existing 2,000 sq ft home can have an annual property tax bill of $5,000.”

We had considered retiring in western NYS / Southern Tier area to keep an eye on my elderly parents. The taxes on the houses we looked at were between $15K and $20K annually.

We did live in Corning for a year. $7K property tax.

Demographics and affluent aging play a huge role in this. In many regions of the U.S., the prospective buyer of a starter home is competing with a 55+ couple who is downsizing while having two major advantages in buying a home: (1) a higher income, and (2) hundreds of thousands of dollars in equity from the larger home they are selling.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.