Skip to comments.

Wall Street better brace itself for shocks: We’re still in the thick of the turbulence. The dust hasn’t settled

The Spectator ^

| 08/07/2024

| Kate Andrews

Posted on 08/07/2024 6:15:33 AM PDT by SeekAndFind

After experiencing its worst crash yesterday since Black Monday in 1987, Japan’s stock market has all but recovered, rising by more than 10 percent today — its biggest single-day gains in history. Nearly all markets in Asia are on the up. But while the FTSE 100 looked set for a rebound, stocks continue to slump today as worries about the US economy intensify.

We’re still in the thick of the turbulence. The dust hasn’t settled

Overall it’s been a miserable couple of days for investors. All eyes were on Wall Street’s opening this morning, with particular attention…

After experiencing its worst crash yesterday since Black Monday in 1987, Japan’s stock market has all but recovered, rising by more than 10 percent today — its biggest single-day gains in history. Nearly all markets in Asia are on the up. But while the FTSE 100 looked set for a rebound, stocks continue to slump today as worries about the US economy intensify.

We’re still in the thick of the turbulence. The dust hasn’t settled

Overall it’s been a miserable couple of days for investors. All eyes were on Wall Street’s opening this morning, with particular attention paid to the tech-heavy stocks that have taken a major hit, including Apple. The company was down by almost 5 percent when the market closed yesterday, after it was revealed that Warren Buffet has sold approximately half his shares in it.

We’re still in the thick of the turbulence. The dust hasn’t settled. Some economists are urging for calm — issuing reminders that, after such a booming time for the stock market, stock value can also fall. Others are not so convinced, as concerns over the health of the world’s biggest economy have yet to be fully understood. It is not yet possible to call this week’s stocks tumble a blip — or the catalyst for a far deeper crash.

What we can be sure of, however, is that another wave of economic uncertainty has hit, and the implications of this will become clear with time. Just over a year ago I wrote about the looming “crash test” — the quick rise in interest rates taking place worldwide that was bound to unearth the skeletons lurking just under the surface of domestic and global economies. The regional banking crisis in the United States became the prime example of what happened when business models were highly sensitive to rate hikes they thought would never come.

Now we are dealing with new circumstances: what happens with central banks that wait too long to start cutting rates, as has been the accusation leveled at the Federal Reserve, which decided to hold rates last week, right before the Bank of England opted for its first cut in over four years. What happens when trillions of dollars of stimulus are no longer covering up the real state of an economy, as US growth rates slow and unemployment rises? What happens if the promised revolutionary technology of the future — like artificial intelligence — doesn’t pan out or pay out as quickly as anticipated and the world’s biggest investors start saying so?

And despite some attempts to pin it all on single factors, it’s the longer trends that are creating this yo-yoing effect in the markets, making it difficult to predict where they’ll settle.

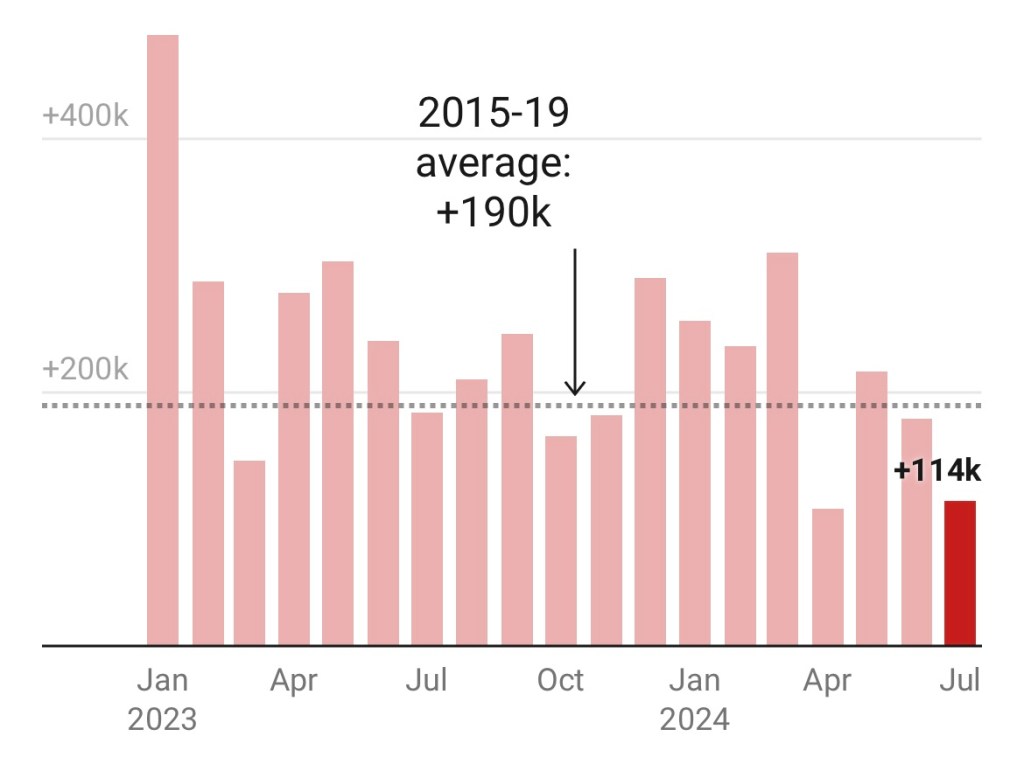

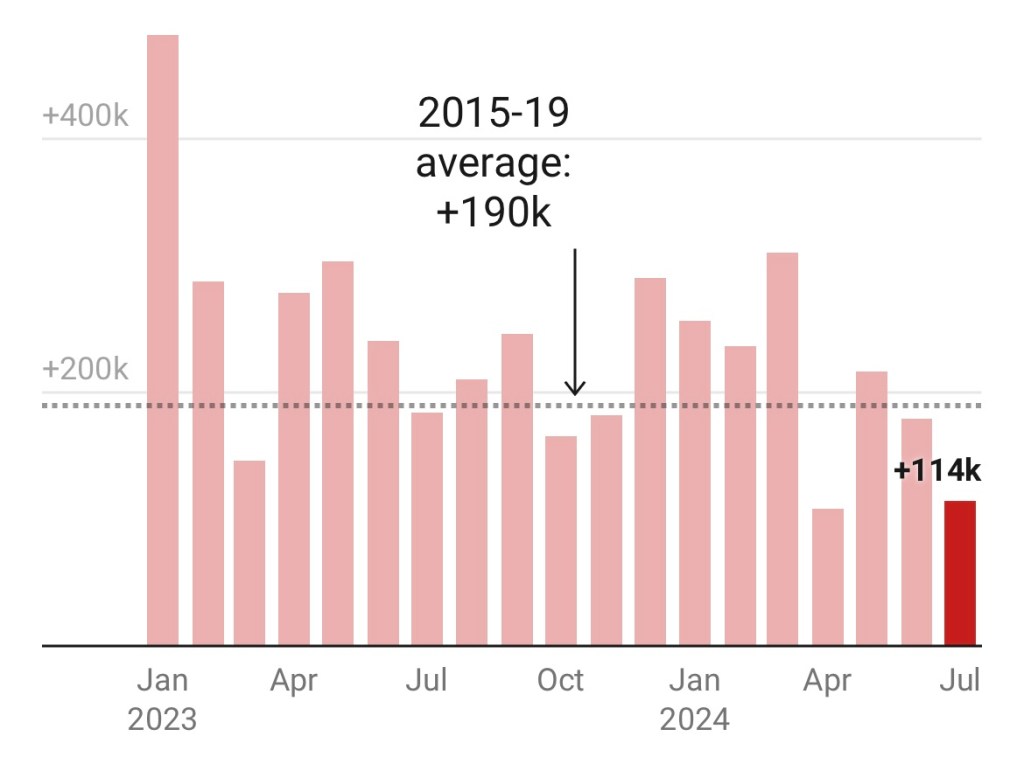

While US job creation in July came in much lower than expected — at 114,000 new jobs added to payroll — this was not wildly out of kilter with lower job figures from recent months. But the spike in unemployment on top of the job creation news — to 4.3 percent — is what seems to have sparked worries for the second half of the year — not least because forecasts for US economic growth this year now look as though they were far too optimistic for 2024.

Monthly US jobs growth

Month-on-month change in seasonally-adjusted nonfarm payrolls

Figures for June and July 2024 are preliminary

Chart: The Spectator (h5XKt)Source: BLS series CES0000000001, 1-Month Net Change Get the data

That the Fed has still held back on its first rate cut since the inflation crisis has investors questioning if it’s already too late for America to avoid a recession (Matthew Lynn explains why those fears are justified here). Again, this is not an isolated concern or incident: if the Fed has waited too long, adding to pressures that could tip the US into recession, it will be a wrong call that follows along from all the wrong calls that were made when the inflation rate was starting to rise back in 2021, and central banks insisted this would be “transitory.” A delayed rate hike from the Fed is simply another mark against recent decision-making, creating far more investor volatility than might be necessary.

And it’s not just the Fed: the Bank of Japan is in hot water for inching up rates last week, to 0.25 percent — a move that is thought to have sparked lots of the stock volatility, as investors realized it would become more difficult to get their hands on cheap yen. It wasn’t the only big realization this week: Warren Buffet’s decision to sell almost half his Apple shares has not only caused a plunge in tech stock value, but has sparked a far wider discussion about whether the investment going into AI development is worth what it will produce.

That these events have overlapped have no doubt contributed to the levels of volatility we’re seeing from Tokyo to New York City. But it’s the underlying causes of these trends that are most concerning — and suggest that even if markets settle relatively quickly, there are more waves, and crashes, to come.

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: bondmarket; stockmarket; wallstreet

To: SeekAndFind

If anyone is bamboozled into thinking all is well needs their head checked. The US PPT ( Plunge Protection Team) ,Japanese government and others jumped in quickly to avert a worldwide crash, this time.

It is mathematically impossible to avert what is coming.

2

posted on

08/07/2024 6:20:16 AM PDT

by

delta7

To: delta7

They will butter the economy together until Kamala is installed.

3

posted on

08/07/2024 6:23:48 AM PDT

by

VTenigma

(Conspiracy theory is the new "spoiler alert")

To: SeekAndFind

With a Kamalala/White Dude ticket, I’ve got a feeling we haven’t seen nothing yet. Their kind of government is what all the illegal alien invading America are running away from.

4

posted on

08/07/2024 6:31:23 AM PDT

by

FlingWingFlyer

(If you liked the Joe Pedo show, you're going to love the Jamaican Queen's "White Dude" Job Corp.show)

To: SeekAndFind

Hedge Funds/Corporations/banks dumping high then buying the dip (Federal Reserve cronies at the ready to take care of their risks)/another money shifting scheme, “non-members”/individuals have a harder time reacting. Intel crapping the bed to along with other mismanaged happenings. Everything is just propped up by funny money, nothing about that racket is morally, ethically, and fundamentally sound. P/Es are a joke due to the funny money and grift (Moving BS around). The implosion can't come soon enough but “the road” still has some distance left. Have fun traders, you are part of the problem too though. Interest rates need to be raised not lowered.

To: SeekAndFind

Pffft….sure! I don’t believe one single word. They’re not about to let the stock market or anything else go down until after the election. No way no how! Trillions are at risk here. And the socialist will do everything they can to keep it afloat until after the election and beyond if Harris wins.

To: FlingWingFlyer

They are running away from but will likely try to recreate it in this country once they are in a position to do so.

7

posted on

08/07/2024 6:53:13 AM PDT

by

Jean2

To: rollo tomasi

My powder is dry and waiting for the 50% haircut in the markets.

My kids will thank me someday. Life has been good. Had I paid any interest on credit cards, ordered pizza’s, fast food, and bought drinks at gas stations I’d be living in poverty instead of upper middle class retirement. It’s a choice you make everyday. Every dollar you save must be saved everyday.

8

posted on

08/07/2024 6:55:44 AM PDT

by

Jumper

To: SeekAndFind

“We’re still in the thick of the turbulence. The dust hasn’t settled”

It can be turbulent at any moment and the dusk never settles long. Investing in the market is not for everyone.

To: SeekAndFind

That was just a minor Wall Street earthquake. Watch when the big one hits. That’s going to be real fun!

To: SeekAndFind

Usher in the one world currency.

11

posted on

08/07/2024 6:59:10 AM PDT

by

Bulwyf

To: SeekAndFind

This wasn't a crash. This was inside investors pulling out money from "peacetime" investments to shift to "wartime" investments due to the escalating conflict in the Middle East.

A quick look at stocks such as Lockheed and Raytheon over the last seven days spells it out.

To: SeekAndFind

Turbulence is to be expected after that long quiet rise as the election approaches. Market leadership is changing after the huge tech run-up. The market is actually spreading out instead of concentrating, that’s a good thing. Many investors will want different holdings depending on who they think will win the election. Expect a lot of shuffling as that is sorted out.

I’m sticking with an income/tax advantaged approach since I’m old. Don’t need any big scores, just slow and steady.

13

posted on

08/07/2024 7:56:45 AM PDT

by

SaxxonWoods

(Are you ready for Black Lives MAGA? It's coming.)

To: RoseofTexas

IMO-—THE DEMS HAVE DONE everything they can to prop up the markets since OBAMA got power.

THERE is no more “THERE” there.

14

posted on

08/07/2024 8:05:17 AM PDT

by

ridesthemiles

(not giving up on TRUMP---EVER)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson