Skip to comments.

Trump floats eliminating U.S. income tax and replacing it with tariffs on imports

CNBC ^

| June 13th, 2024

| Emily Wilkins and Kevin Breuninger

Posted on 06/13/2024 5:39:20 PM PDT by shadowlands1960

Key Points

-Donald Trump discussed the idea of imposing an “all tariff policy” that would ultimately enable the U.S. to get rid of the income tax, sources told CNBC.

-He also talked about using tariffs to leverage negotiating power over bad actors, according to another source in the room.

- Trump championed tariffs during his first term in the White House.

Donald Trump on Thursday brought up the idea of imposing an “all tariff policy” that would ultimately enable the U.S. to get rid of the income tax, sources in a private meeting with the Republican presidential candidate told CNBC.

Trump, in the meeting with GOP lawmakers at the Capitol Hill Club in Washington, D.C., also talked about using tariffs to leverage negotiating power over bad actors, according to another source in the room.

The remarks show Trump, who championed tariffs as a foreign policy multi-tool during his first term in office, is considering a drastically more protectionist trade agenda if he defeats President Joe Biden in November.

(Excerpt) Read more at cnbc.com ...

TOPICS: Breaking News; Business/Economy; Constitution/Conservatism; Foreign Affairs; Government; Politics/Elections

KEYWORDS: 16thamendment; fakenews; frnaysayers; incometax; neverhappen; pipedream; priceincreases; repealthe16th; rumormongering; salestax; tariffs; tds; trump

Navigation: use the links below to view more comments.

first previous 1-20 ... 181-200, 201-220, 221-240 ... 261-278 next last

201

posted on

06/15/2024 6:22:58 AM PDT

by

SunkenCiv

(Putin should skip ahead to where he kills himself in the bunker.)

To: Wuli

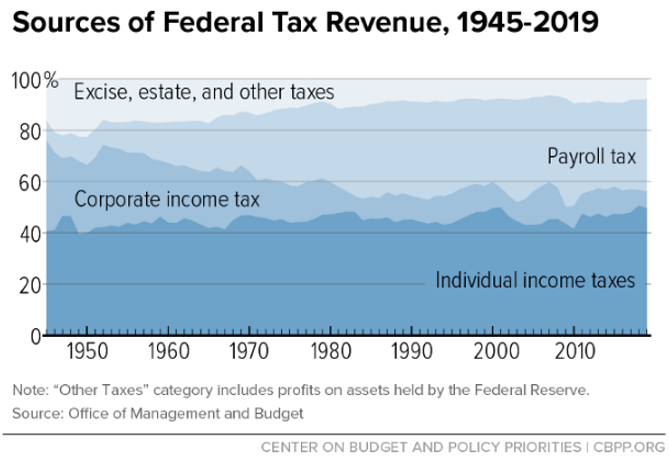

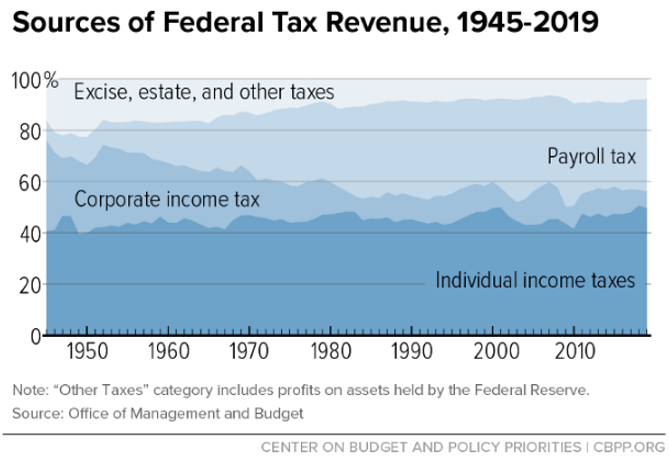

No kidding. Income taxes only finance half government spending today and tariffs are only 80-90% of existing revenue. Apple for one couldn’t source all component parts domestically even if it wanted to, so wouldn’t even HAVE an iphone without imports never mind the astronomical cost and supply/demand issues. Under this proposal the government would still be subsidizing manufacturing of radios, alarm clocks and compact discs.

202

posted on

06/15/2024 12:48:21 PM PDT

by

erlayman

(E )

To: dinodino

"The “Fair Tax” sucks ass."

Why exactly? I'm open to your position.

203

posted on

06/15/2024 2:01:16 PM PDT

by

A Navy Vet

(USA Birth Certificate - 1787. Death Certificate - 2021? )

To: erlayman

Not only that. In as much as we are borrowing so much, income tax revenue is only $2.5 trillion, while imports are valued at about $4 trillion. To get an equal amount of revenue, tarrifs would have to be accross the board at more than 60%. Anyone thinking our trading partners will not respond in kind is dreaming, and if and when our trading partners did respond in kind there will go a big percent of U.S. exports in things such as refined petrolieum products, crude oil and natural gas, cars, integrated circuits, semicinductors, civilian aircraft, aircraft parts, pharmaceuticals, medical devices/instruments, rice, soybeans, wheat, and more. Anyone thinking those “domestic indutsries” would benefit from a U.S. instituted tarriff war is aslo dreaming.

204

posted on

06/15/2024 2:45:47 PM PDT

by

Wuli

To: central_va

“Tariffs promote domestic industry and raise revenue.”

Tarriffs are not a zero sum game. There would be winners and losers, even among many “domestic industries”. As I have tried to explain.

The U.S. instituting tarriffs to replace the income tax, while most of our trading partners have not done that, will create a tarriff war, where U.S. domestic industries be hurt as well.

205

posted on

06/15/2024 2:50:10 PM PDT

by

Wuli

To: central_va

“Ok, that is good because skyrocketing means $$$, which means high profit margin which is the incentive for domestic supply to come on line”

I repeat it is not a zero sum game. There will be some domestic industry winners and there will be an equal number of domestic industry losers. For instance if a domestic manufacture gets raw materials or parts he needs imported for his domestic production, tarriffs will raise his costs. He will either suffer the costs with less profit and less new capital, or he’ll raise his prices to keep up with the new costs of the materials he needs. In the first instance it may drive him out of business (it happened many years ago in bycycles). In the second instance his new prices may make him less competitive with some import that remains cheaper even with the tarriffs.

You have a very simplistic notion of capitalism, pretending it will be very robust in an essentially closed national market - which high tarriffs would an attempt to do. Never worked.

206

posted on

06/15/2024 3:04:05 PM PDT

by

Wuli

To: Wuli

Why do you assume revenues must be the same? Think bigger.

207

posted on

06/15/2024 3:22:24 PM PDT

by

dinodino

( Cut it down anyway. )

To: Wuli

It already has and Trump’s own tariffs on steel and aluminum (which Biden wants to triple !) are a prime example. 1,000 jobs saved in steel manufacturing with 75,000 lost downstream.

208

posted on

06/16/2024 2:15:46 AM PDT

by

erlayman

(E )

To: dinodino

“Why do you assume revenues must be the same? Think bigger.”

Why do YOU assume the federal governments revenues OUGHT TO BE BIGGER??? Just to keep up with Biden’s massive spending???

209

posted on

06/16/2024 10:29:39 AM PDT

by

Wuli

To: x; central_va; DiogenesLamp; Reily; USA-FRANCE

![]() x

x to central_va:

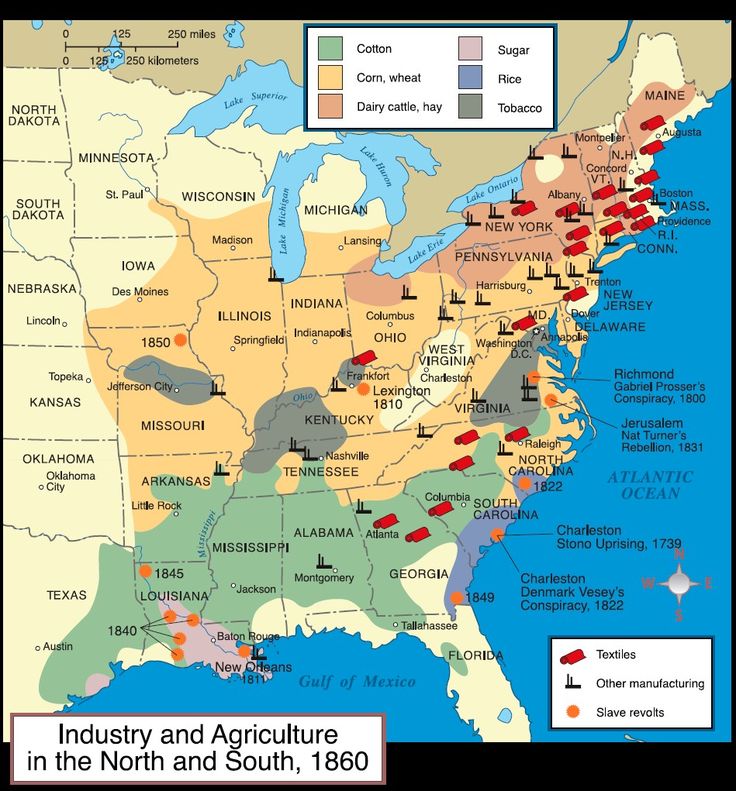

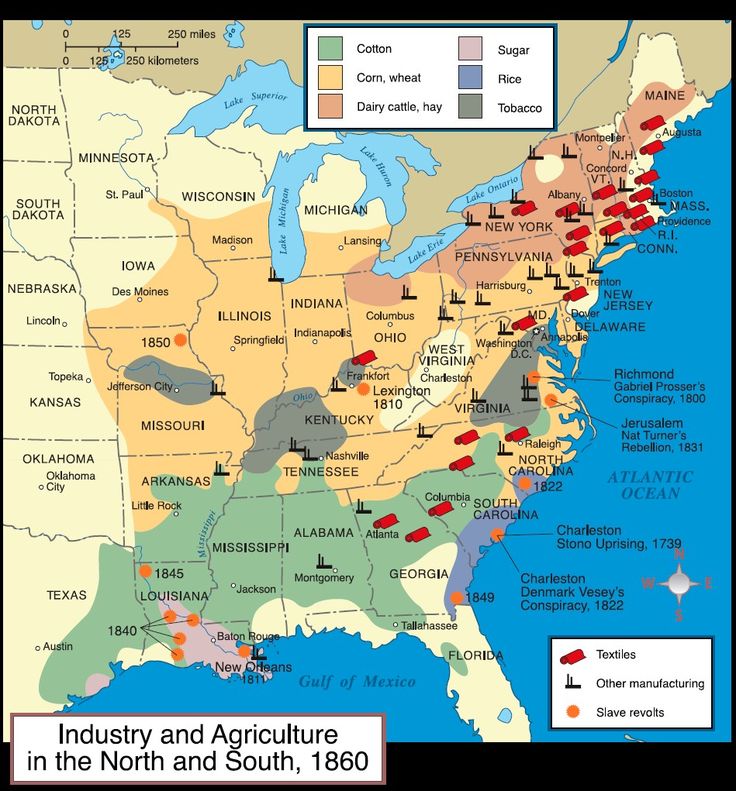

"It’s great that you’ve finally endorsed Abe Lincoln, but things have changed a lot in the last 160 years."central_va #139: "Abe Lincoln went both ways, he incorporated a temporary income tax and increased tariffs."

Since our pro-Confederates claim it was high Republican tariffs, not slavery, which drove secession and civil war, it can be a bit jarring to see a pro-Confederate FRiend, central_va, arguing for higher tariffs.

Is it even possible that all those arguments we made -- about how Lincoln's Republicans wanted to Make America Great by Putting Americans First -- actually sank in?

Naw! No chance, I'd bet.

Regardless, the single biggest problem with low tariffs and "free trade" can be boiled down to one word: China.

Or, if you prefer -- CCP China, meaning, low tariffs and "free trade" don't work so well with freekin' enemies!!

It brings to mind the pithy quote often attributed to Lenin or Stalin:

"Capitalists will sell us the rope we'll use to hang them."

Even with our closest world friends and allies, "free trade" is not always fair trade -- for example, if we buy millions of their cars, but they don't buy any of ours -- what's up with that?

On the other hand, we have historical examples -- i.e., Smoot-Hawley from 1930, usually credited with deepening and lengthening the Great Depression -- for what happens when tariffs get too high.

Yes, I seem to remember a previous discussion with central_va on Smoot Hawley in which he gave an interesting answer.

And, this is not a simple matter, so let me throw some recent numbers at you, and invite you to consider them all, especially where imports from CCP China fit in:

- ~2.5% -- US GDP growth forecast for 2024

- 3.8% -- current US unemployment rate (it was 3.2% in 2019 only ever matched in 1953 and 1968)

- 62.7% -- current US labor participation rate

- 68.1% -- historical peak US labor participation in 1997.

- 91% -- peak labor participation of prime working age men, 1997

- 89% -- today's labor participation of prime working age men.

- 100% -- US steel production tons today compared to its WWII peak.

- 72% -- US steel production tons in 1945 % of global steel production.

- 65% -- US steel production tons today compared to its all-time peak in 1973.

- 5% -- US steel production tons today compared to total global steel production today

- $28 trillion -- value of all international trade per year

- 25% -- US portion of global international trade

- 90% -- portion of international trade transported by ships

- ~$3 trillion -- US exports per year

- ~25% -- US exports and imports percentage of total US GDP

- ~$4 trillion -- US imports per year

- ~15% -- China's percent of total US imports, meaning:

~$100 billion/year = potential revenues from a 25% tariff on imports from China. - ~20% -- total of US imports from potentially "unfriendly countries", like CCP China, meaning:

~80% of US imports come from our closest friends and allies in North America, Europe and Asia. - ~1/3 of US imports are finished consumer goods

- ~2/3 of US imports are raw materials, semi-finished components and equipment used in manufacturing or construction.

- ~1/4 of US exports are finished consumer goods

- ~3/4 of US exports are raw materials (including energy, metals and bulk food items), component parts and capital equipment.

- ~1/3 of the US workforce is in manufacturing, construction, transportation, retail and utilities, "the economy of things"

- ~1/2 of the US workforce is in "the economy of services" like private health care, education, entertainment, hospitality and financial services (i.e., banks, insurance, investments)

- ~1/6 of the US workforce is in all levels of local to national government, including military, law enforcement social services and public education

- ~$2 trillion -- US income taxes collected per year

- ~$6.6 trillion -- total US Federal budget for 2024

- ~$2 trillion -- US projected Federal deficit in 2024

- ~$29 trillion -- US 2024 GDP forecast

- ~$34 trillion -- US current total national debt

- ~120% -- US national debt to GDP ratio

- ~80% = value of the US dollar today compared to 2020

- ~50% = value of the US dollar today compared to the year 2000.

- ~5% = value of the US dollar today compared to 1945

So, for starters, considering these numbers, if the US imposed its historical average tariff rate of 25%, that could,

all else being equal, produce tariff revenues of $1 trillion, which would replace roughly half of current income tax revenues of $2 trillion per year.

However, however... all else would not be equal, beginning here: the vast majority of our imports and exports are not finished consumer goods, but rather raw materials, components and equipment used in US "Made in America" manufacturing of finished goods.

This means import tariffs will drive up not just the costs of foreign consumer goods we buy in stores (i.e., Walmart), but also of everything else "made in America" using imported raw materials.

Bottom line: import tariffs will increase prices of everything thus reducing American consumption, while tax cuts could potentially increase savings thus generating capital to support new investments in the long-term future.

So, historically speaking, a 25% average tariff is a traditional conservative Republican plan, which will make the Left's heads explode and will not come without risks -- such as resulted from high tariffs like Smoot Hawley in 1930 and even the "Abomination" of 1828.

Note the ~100 year interval, returning in 2026??

US average Tariff rates since 1820.

Again, note the ~100 year peaks circa 1830 and 1930:

210

posted on

06/16/2024 12:34:52 PM PDT

by

BroJoeK

(future DDG 134 -- we remember)

To: BroJoeK

Someone mentioned the late Herman Cain’s 9-9-9 idea but failed to mention that it was a transitional plan.

I don’t remember what final tax system Cain wanted us to transition to. Maybe he didn’t have one. Maybe the “transition” was to force us to one.

I’ve always been partial to the sales tax idea. I read somewhere back when there was discussion about it. The ideas that read about proposed a 17% rate. Let’s make it 20% for ease of arithmetic calculation. That 20% would be revenue neutral. (Note this was way before the COVID spending spree!) Yes, I know it is a VAT, however unlike the EURO crowd this vat would be embedded in the Constitution via amendment and the rate fixed. A much stronger constraint then relying on the whim of the next parliament. Have it collected and administered through the states. (Though I have mixed thinking\views about that!) However, no matter what is proposed, national sales tax or flat tax or a tiered system like we have it all goes back to the fact there is simply too much spending and no will to cut anywhere.

Note a “flat tax” unless the rate is locked in Constitutionally is a “tiered system” of one tier! If it’s not locked in in over time it will evolve into what we currently have. The original income tax rate was a two-tiered system of 1% & 6%. (But not locked into the Constitution!) Look how that evolved!

Please note social security about to enter another crisis. The proposed band-aid is cut benefits. The solution will eventually be never-ending cash infusions from the general revenue. You can’t even get people on this site to properly understand how social security is funded and that you have no asset ownership in what you put in. We can’t even solve that!

I have a hard time thinking that any tax proposal other than taking more and more is politically possible.

211

posted on

06/16/2024 1:35:33 PM PDT

by

Reily

To: BroJoeK

To: BroJoeK

Is it even possible that all those arguments we made -- about how Lincoln's Republicans wanted to Make America Great by Putting Americans First -- actually sank in? Wanted to make New York, Boston, Chicago and DC great.

These were the beginnings of the corrupt Government/Industrial complex that we are fighting today.

213

posted on

06/17/2024 6:52:26 AM PDT

by

DiogenesLamp

("of parents owing allegiance to no other sovereignty.")

To: USA-FRANCE; Reily; x

USA-FRANCE:

"Yes, higher tariffs alone won’t be enough to eliminate the income tax.

But it could help lower it."Reily: "Please note social security about to enter another crisis.

The proposed band-aid is cut benefits.

The solution will eventually be never-ending cash infusions from the general revenue.

You can’t even get people on this site to properly understand how social security is funded and that you have no asset ownership in what you put in.

We can’t even solve that!

I have a hard time thinking that any tax proposal other than taking more and more is politically possible."

Donald Trump has promised not to reduce Social Security benefits, so it will be up to Republicans in Congress to figure out a viable solution.

Regarding Trump-tariffs, I don't know what you guys think of PolitiFact, but here is something they put out in October 2023, regarding 27 campaign promises claimed made by Pres. Trump -- all great stuff!

Item 26 is a 10% tariff on imports, though whether of all imports or just those considered to be "dumping" is a question.

Current US imports are around $4 trillion per year (circa $3 trillion in exports), so 10% would generate around $400 billion in tariff revenues, all else being equal.

The 2024 Federal budget is $6.6 trillion, with a deficit approaching $2 trillion, so even $400 billion in new tariff revenues would not fix this problem.

So far, I can't find a Trump campaign promise related to Federal budget deficits and the National Debt, however, I do see where, once Covid years are subtracted, Biden's budget deficits are running about 50% higher than Trumps:

- Clinton/Gingrich (1993-2000) = 0.7% of GDP average deficits

- GW Bush (2001-2008) = 1.9% of GDP average deficits

- Obama (2009-2016) = 5.7% of GDP average deficits

- Trump (2017-2019) = 3.9% of GDP average deficits (Covid subtracted)

- Biden (2022-2024) = 5.7% of GDP average deficits (Covid subtracted)

Clinton's budget surpluses resulted from the "peace dividend" and Newt Gingrich's leadership in the House.

GW Bush's deficits resulted 2002 recession combined with War on Terror spending.

Obama's deficits resulted from increased social spending following the 2008 financial crisis.

Trump's deficits (before Covid) were 1/3 less than Obama's and Biden's, while inflation was about half of Biden's, and wages under Trump rose faster than either Democrat.

Biden's deficits (since Covid) are about 50% more than Trump's, while Biden inflation is double Trump's.

![]()

214

posted on

06/17/2024 7:56:23 AM PDT

by

BroJoeK

(future DDG 134 -- we remember)

To: BroJoeK

My stated position on states rights and secession transcend time and any specific reason; If the citizens of State A want out, vote for it, then they get to leave “Vaya con dios”.

215

posted on

06/17/2024 8:21:39 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn...)

To: BroJoeK; Reily

Trump has not proposed eliminating payroll taxes (SS,MC) with a tariff. Only income taxes.

216

posted on

06/17/2024 8:23:54 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn...)

To: BroJoeK

This puts you in a awkward positon, siding with the South and their anti tariff position. If you want to see a service/agicultural society that imports all durable goods, and are in favor of that, then look no further than the CSA.

217

posted on

06/17/2024 8:26:23 AM PDT

by

central_va

(I won't be reconstructed and I do not give a damn...)

To: All

No solution is possible without very very significant spending cuts!

Now that the discussion has stopped being serious and has degenerated into Yankee & Reb cats hissing at each other.

I have nothing more to say.

218

posted on

06/17/2024 8:59:35 AM PDT

by

Reily

To: DiogenesLamp; central_va; x

DiogenesLamp:

"Wanted to make New York, Boston, Chicago and DC great.

These were the beginnings of the corrupt Government/Industrial complex that we are fighting today." There are several points to make in response:

- The first US protective tariffs, in 1789 introduced by Pres. Washington and supported by Congressman James Madison, those had nothing to do with Chicago or DC.

- From Day One, those protective tariffs protected Southern products just as much as Northern.

For every dollar of import tariffs collected to protect Northern woolens and iron, there were equal dollars collected to protect Southern cotton and sugar. - It is absolutely not true that all manufacturing was in the North and all agriculture in the South.

In fact, for every Northern factory there were corresponding Southern works producing iron products, textiles, clothing, lumber, leather, booze and even woolens.

Yes, the Northern numbers were greater, but so was the North's population, and that alone accounts for a large portion of the differences. Point is, it wasn't only "The North" which benefitted from protective import tariffs, all US producers did, including Southern cotton, tobacco, sugar and manufacturing.

- The real problem with tariffs, as with any taxes:

- When tariffs were raised too high -- as in the 1828 "Tariff of Abominations" or the 1930 Smoot Hawley -- they could trigger major negative effects on global trade and the US economy.

- When tariffs were lowered too much -- as in the Democrats' Tariff of 1857 -- they reduced Federal revenues to the point of doubling the National Debt under Pres. Buchanan, from 1857 to 1860.

- Finally, your words "corrupt Government/Industrial complex" are meaningless nonsense, since all those words do is throw shade on something that has always existed and will always exist, regardless of how you describe it.

Just for starters, your word "corrupt" is a matter of legal definitions, and people who write our laws are never going to define themselves as "corrupt".

Regardless, leadership matters and new leadership starting after November will make a huge difference in our biggest issues.

![]()

219

posted on

06/18/2024 4:18:26 AM PDT

by

BroJoeK

(future DDG 134 -- we remember)

To: central_va

central_va:

"If the citizens of State A want out, vote for it, then they get to leave “Vaya con dios”." Our Founders' response was "no tan deprisa".

220

posted on

06/18/2024 4:25:23 AM PDT

by

BroJoeK

(future DDG 134 -- we remember)

Navigation: use the links below to view more comments.

first previous 1-20 ... 181-200, 201-220, 221-240 ... 261-278 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson