Skip to comments.

China's Moves Away From US Dollar Hit New Milestone

Newsweek ^

Posted on 05/20/2024 11:11:26 AM PDT by navysealdad

China sold a record amount of U.S. government bonds in the first quarter of 2024, according to U.S. Treasury data, continuing what many economists believe is a strategic shift away from dollar assets.

In the first three months of 2024, China sold $53.3 billion worth of U.S. Treasuries and agency bonds.

(Excerpt) Read more at newsweek.com ...

TOPICS: News/Current Events

KEYWORDS:

Navigation: use the links below to view more comments.

first previous 1-20, 21-33 last

To: politicket

Unlike gold, silver is also an industrial commodity.

Sudden price spikes in silver - up or down - are often related to industrial demand.

21

posted on

05/20/2024 12:43:01 PM PDT

by

zeestephen

(Trump "Lost" By 43,000 Votes - Spread Across Three States - GA, WI, AZ)

To: politicket; All

" These nations are going to disrupt the US dollar as the reserve currency.

Please..."

---------------------------------------------------

. A "Superpower" that can't even produce artillery ammunition is not in a strong position to mock the economic capacity of other nations.

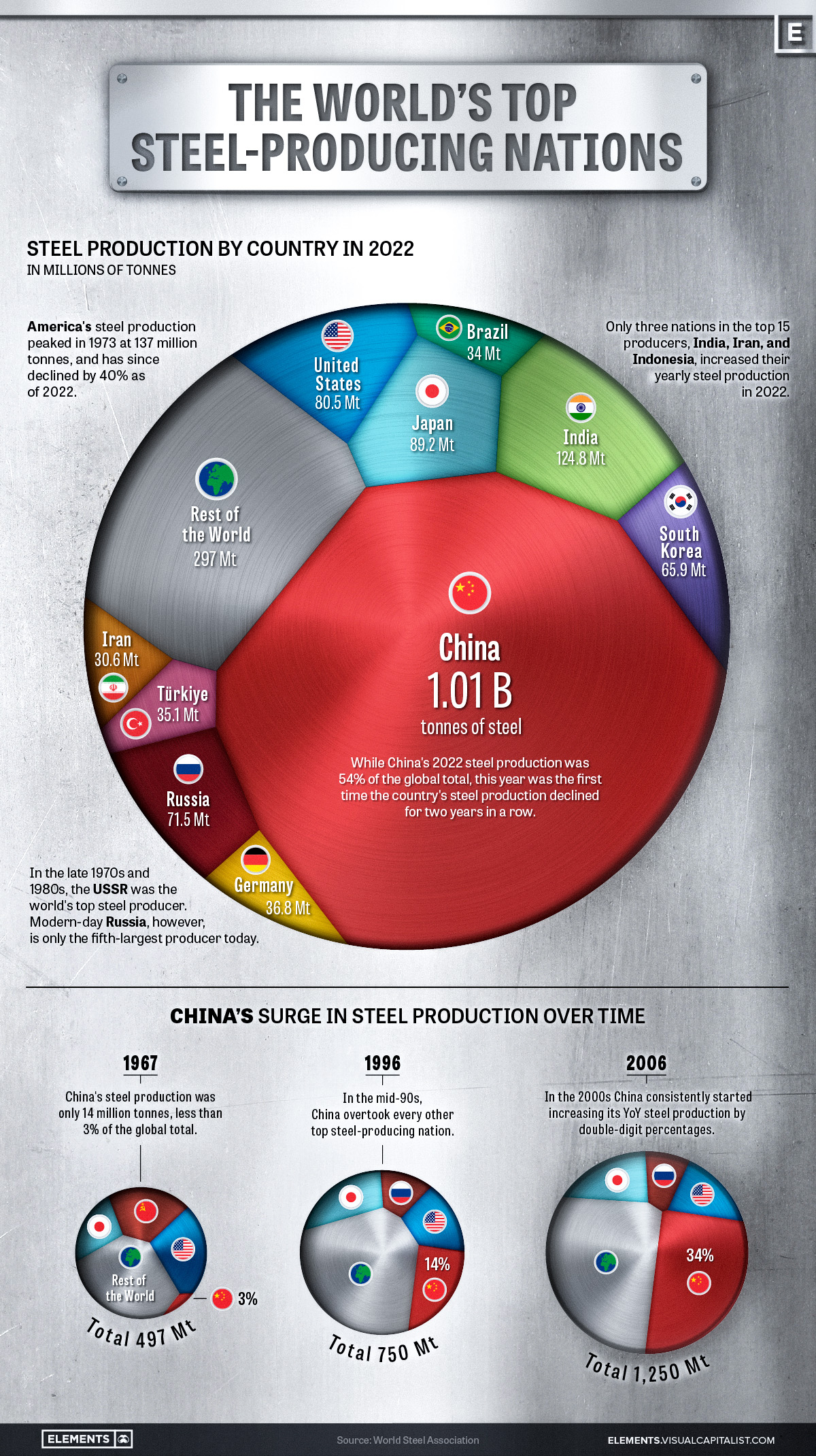

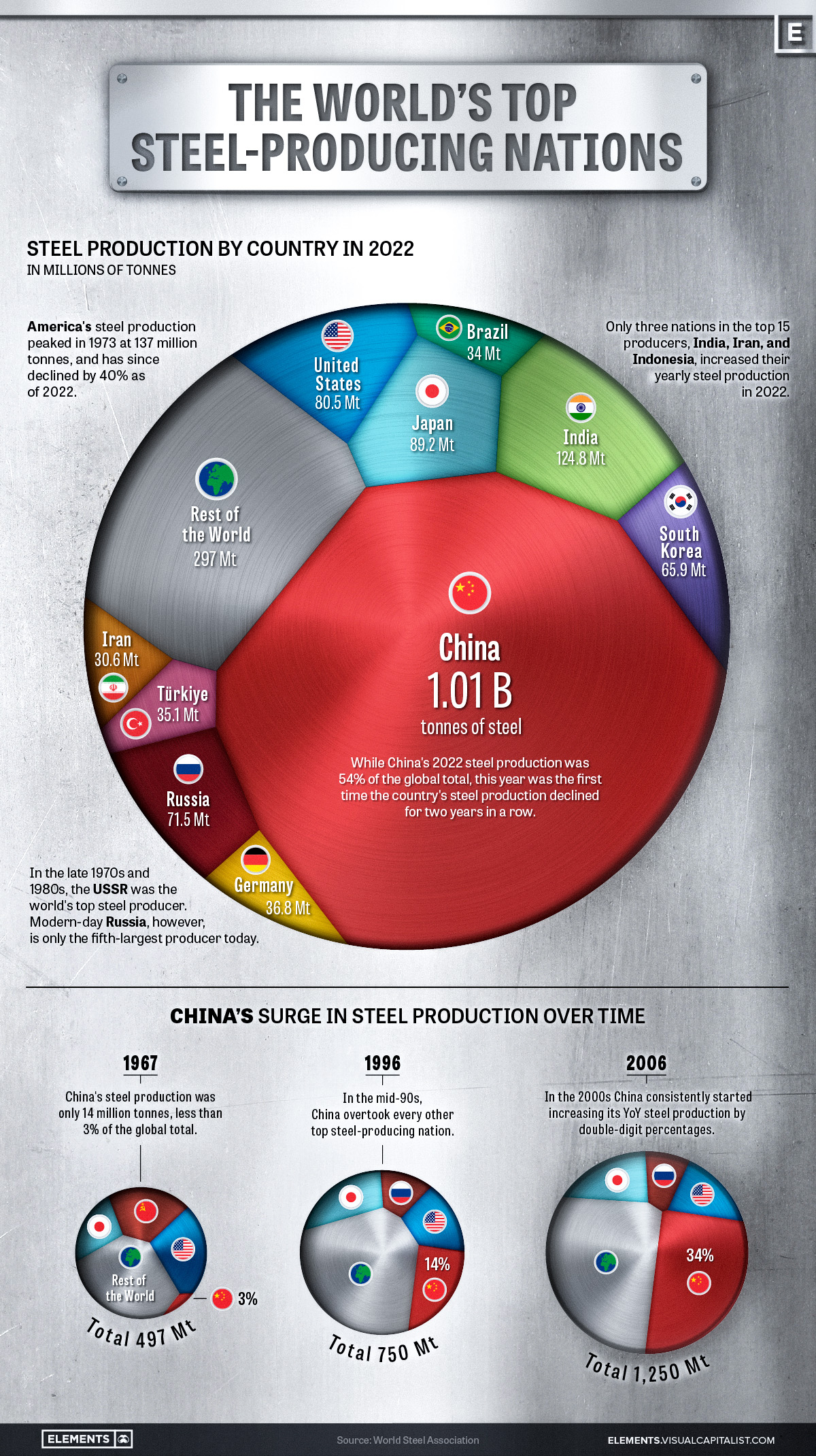

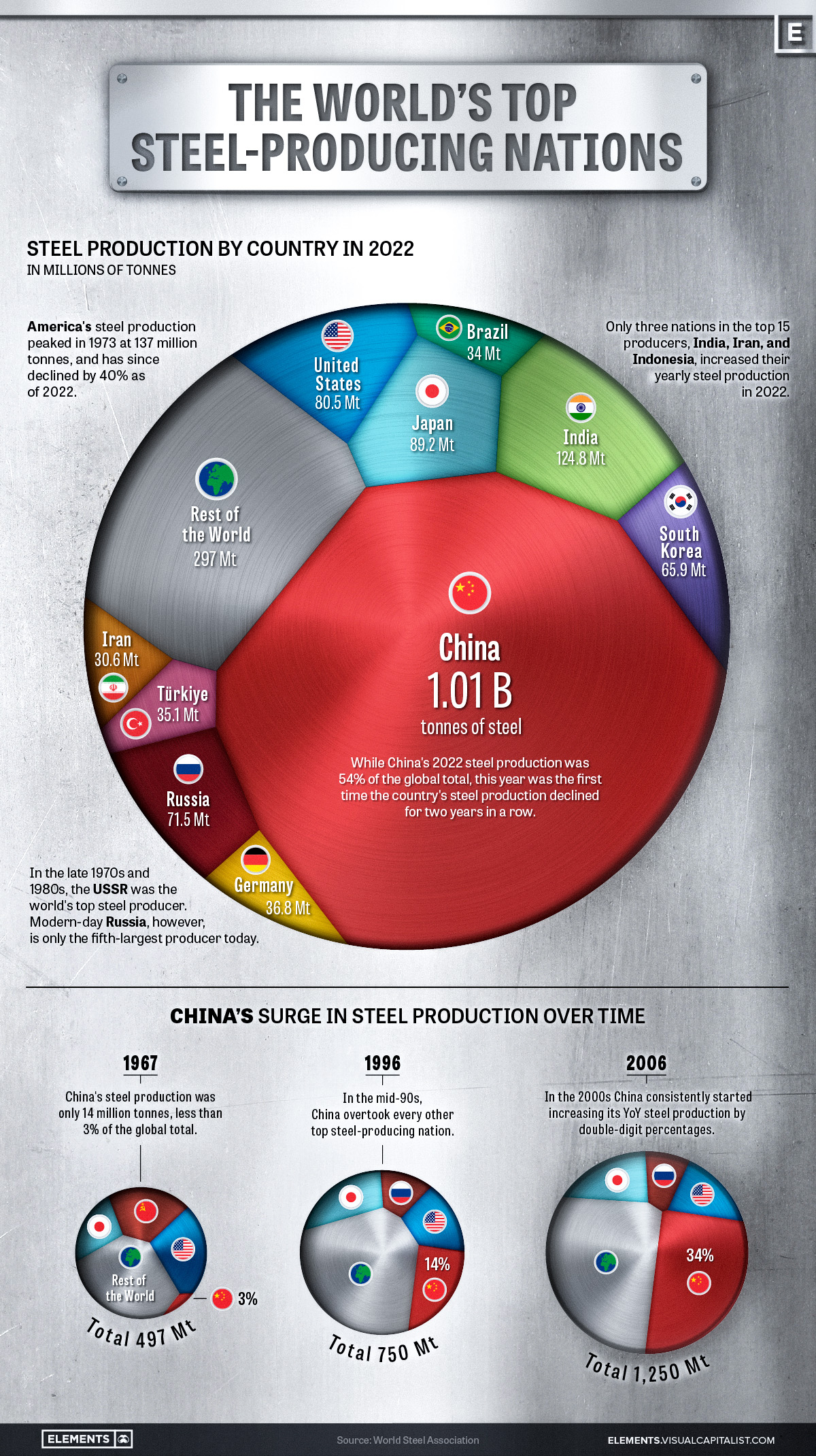

Steel production is a good proxy for industrial capacity, as it is 95% of metal production, and a good proxy for overall manufacturing capability.

USA and Europe now barely register.

22

posted on

05/20/2024 12:44:36 PM PDT

by

Reverend Wright

( Everything touched by progressives, dies !)

To: politicket

Instead, we should have the Treasury issue our money supply against completed work - not by selling debt instruments enslaving the US population. The presidents who attempted to bring this about were assassinated.

Is there a good book I can read on this?

23

posted on

05/20/2024 12:53:22 PM PDT

by

Jan_Sobieski

(Sanctification)

To: Reverend Wright

When you sell bonds you end up with dollars. Its the only way to sell US notes and bonds. So now they have more dollars. They could be using them to buy bitcoin and gold. Or they could be buying some commodities. We know that their currency is falling. The dollar is very high against all currencies and especially China and Japan. The dollar has been falling against gold and bitcoin but not oil. China would normally be getting dollars through trade deficits with US consumers. But the trade deficit with China has shrunk dramatically in 2023 and 2024. China would need to sell $100 Billion in US 10 year notes annually to make up the difference.

China needs America or they turn back into the third world country they were in 1980. America has its spending problems. But China dumping US dollars is not an issue.

America’s biggest issue is that our governments from local to national are spending and taxing so much that it is taking over the economy. Our low unemployment is because governments are absorbing all the excess workforce. Pretty soon that will become the issue. Governments are obscuring the natural business cycle. We can’t have a real recession because the government is too big and it keeps spending right through a would be recession. Local property taxes and high inflation will make life too expensive in the US. Expect life to get very expensive in the near future. Government dominated economies don’t have recessions, but they don’t have growth either.

24

posted on

05/20/2024 1:01:07 PM PDT

by

poinq

(thics and customs and did not take an oath to the country. And did not follow the country's traditio)

To: politicket

Excellent ananlysis. Five years ago the yen was 100/dollar; now it is 156/dollar. Two years ago, the yuan was 6.3/dollar; now it is 7.2/dollar. The Chinese economy is a mess, and propping up the yuan will only worsen its export sector.

To: politicket; Reverend Wright

Reverend Wright thinks “BoomerCons”, conservatives age 59 or older are the problem in America and on freerepublic.

If you are older than 58 and a conservative then he disagrees with you, because conservatives are blind.

26

posted on

05/20/2024 1:04:52 PM PDT

by

ansel12

((NATO warrior under Reagan, and RA under Nixon, bemoaning the pro-Russians from Vietnam to Ukraine.))

To: navysealdad

Didn’t they get dollars when they sold them? And what did they do with those dollars?

27

posted on

05/20/2024 1:14:38 PM PDT

by

aquila48

(Do not let them make you "care" ! Guilting you is how they control you. )

To: poinq

" China needs America or they turn back into the third world country they were in 1980. "

------------------------------------------

You are the one stuck in a time warp from 1980. The industrial capacity of China etc....now dwarfs the USA and the EU.

But according to you, the USA must have lost WW2 to the Japs, because the USA couldn't export after the war started !

28

posted on

05/20/2024 1:15:36 PM PDT

by

Reverend Wright

( Everything touched by progressives, dies !)

To: Jan_Sobieski

Is there a good book I can read on this? Sadly, no.

Most economists go with the flow of MMT (Modern Monetary Theory) or following other theories such as Austrian, Keynesian, Marxian, or Neoclassical.

In reality, economics isn't that hard if one understands the base (sin) of human nature - to control the future labor and actions of others. To be a master over them.

That's what debt-based money is - "money" is a claim on "debt". "Debt" is a promise of future labor.

Math shows that to be: "money" = "a claim on the future labor of others".

Those most successful in this messed up economic model are those who position themselves to have first-order claims on debt.

Prior to the 1690's, most of the world ran on "completed labor" economies. Their money suppies were not based on debt.

King William of England (who shouldn't have had the throne, but Queen Mary wanted to honor her husband so had Parliament make him co-regent) is who implemented this in the modern world. It built upon the messed up Bank of Amsterdam and created the Bank of England.

To: Reverend Wright

Look at the amount of steel America makes. That is the amount of steel America needs. China can over produce lots of products. And they have. But that does not make them strong. It makes them dangerous. China over produces poorly made products all over the place. From Apartments to electric cars. China has no idea how much of anything should be made. And there seems to be no penalty for producing bad products. So China, the worlds trash heap, will implode. And their dysfunction will screw up many other economies along the way. Hopefully they will right size their production before they start a war. Which is the way that poorly planned economies usually end up trying to find some usefulness of their over production.

30

posted on

05/20/2024 2:13:35 PM PDT

by

poinq

(thics and customs and did not take an oath to the country. And did not follow the country's traditio)

To: politicket

Exactly.

The one problem with their plan, was finding another nation

whose currency was remotely as sound as the dollar. And yes

I understand the dollar is suspect now, but again, who else

are they going to turn to?

This was a brilliant plan with absolutely no chance of

working.

Sorry to disappoint so many FReepers.

31

posted on

05/20/2024 2:26:48 PM PDT

by

DoughtyOne

(I pledge allegiance to the flag of the USofA & to the Constitutional REPUBLIC for which it stands. )

To: poinq

“Look at the amount of steel America makes. That is the amount of steel America needs. “

Actually it’s not. The USA imports 30 percent of the steel it consumes.

The Russia sanctions starting in 2022 created shortages in products like rebar which has only eased as the economy went down.

In the event of war, for the USA, 30 % of steel supply disappears when imports cease.

Half of current USA steel production is mini-mill scrap recycling. Which is fine in peacetime, but when you go to total war, and domestic production ends, people don’t scrap ANYTHING because they can’t buy a replacement.

So in that case, the USA is down to a small fraction of the current steel supply. Which was minimal to begin with because USA industrial production has declined so much.

But this is what happens when you outsource everything and become an industrial joke.

32

posted on

05/20/2024 2:28:38 PM PDT

by

Reverend Wright

( Everything touched by progressives, dies !)

To: wiseprince

If an institutional investor is selling off U.S. government bonds that are paying 3% and maturing in 2030, that tells me they’ve taken a bath on bonds that: (1) they bought at face value in 2020, (2) they are now worth 15%-20% less due to the erosion of the value of the U.S. dollar, and (3) they believe are going to be worth EVEN LESS in 2030 than they are right now due to a continual loss of dollar value.

33

posted on

05/20/2024 2:32:42 PM PDT

by

Alberta's Child

(If something in government doesn’t make sense, you can be sure it makes dollars.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-33 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson