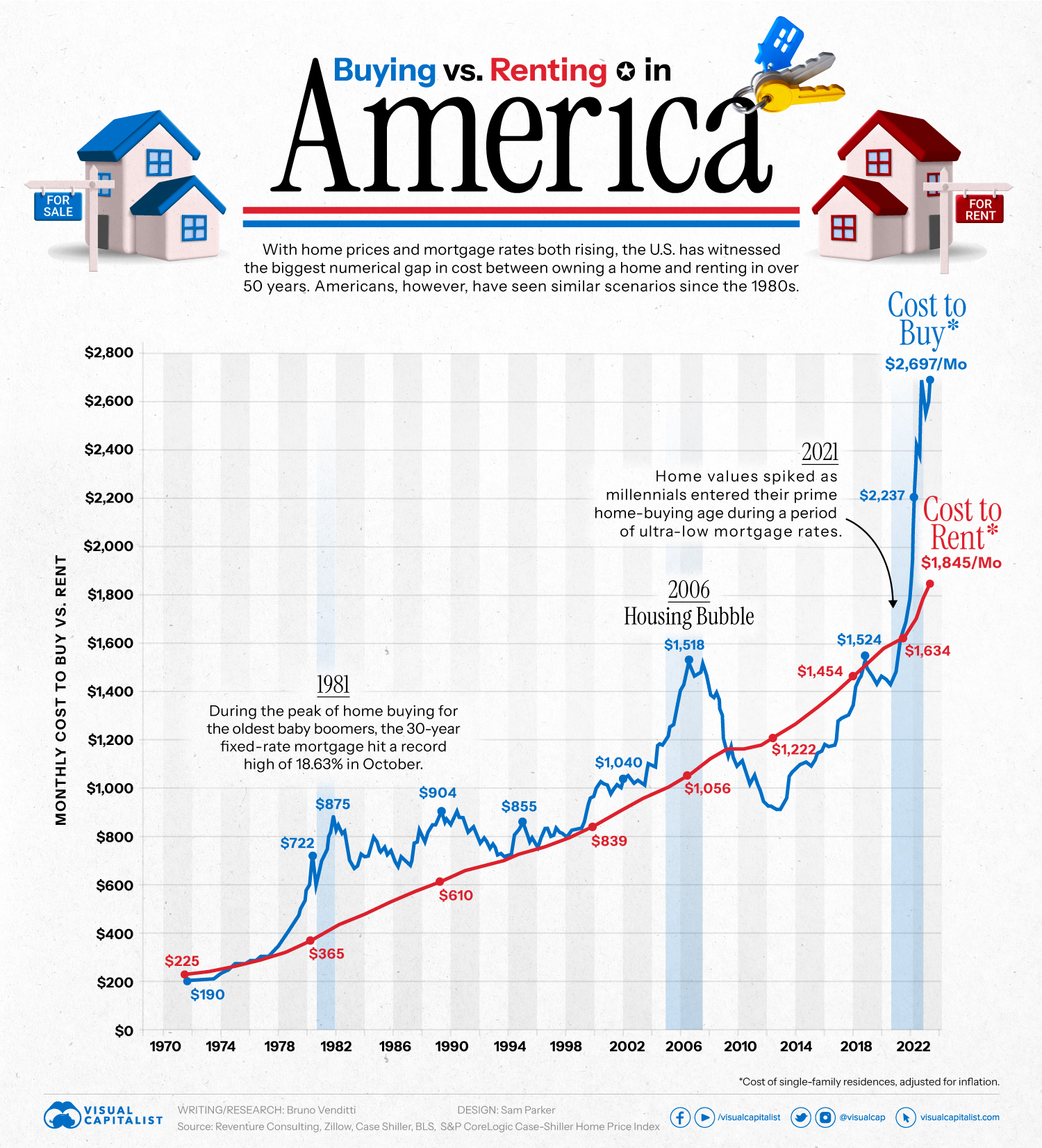

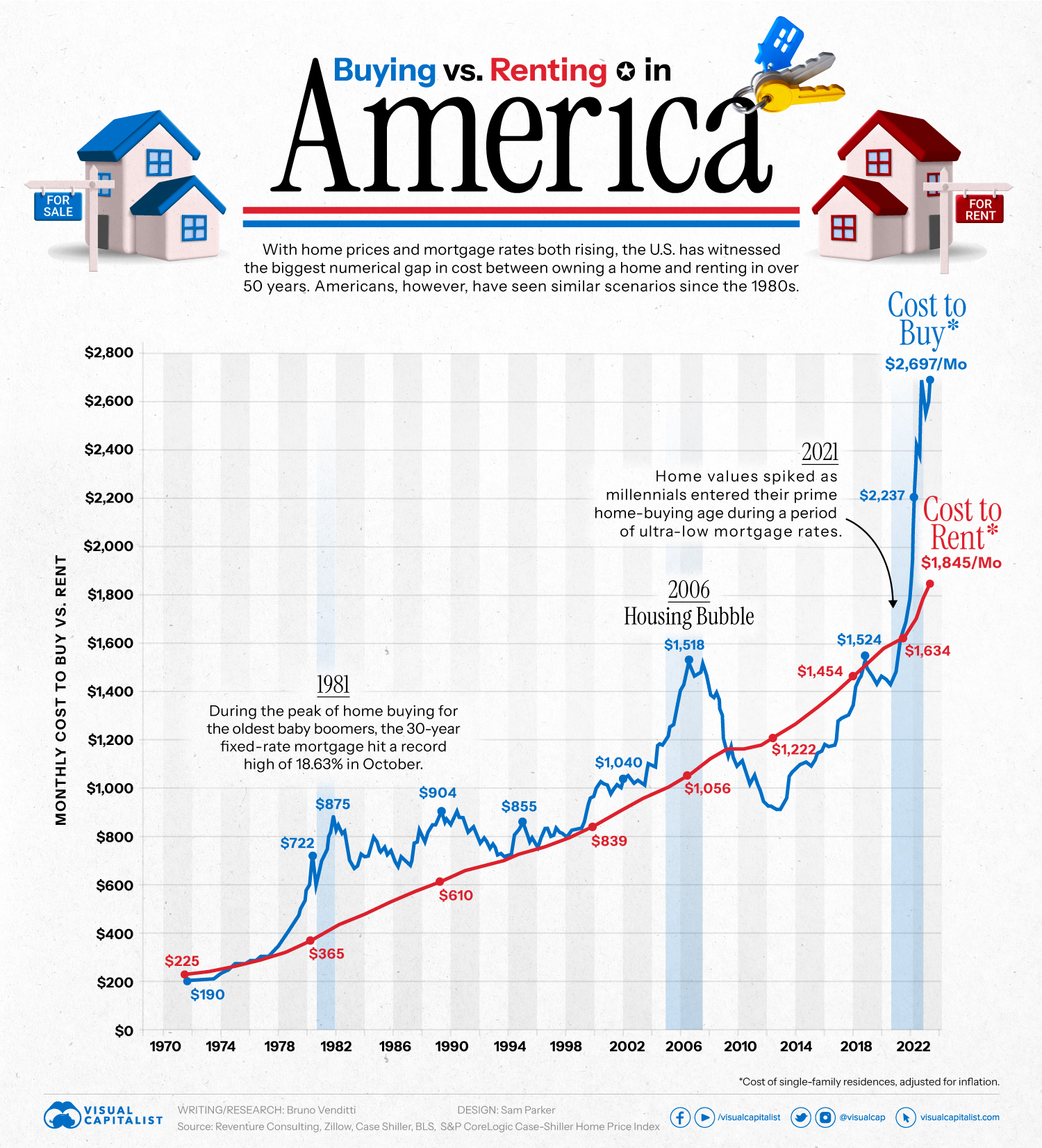

If it costs less to rent than to buy, you should rent.

That ought to tell you something right there.

More people need to be homeowners.

Dave has done good ideas but his homebuyer advice isn’t always realistic .

I work in this business .

Buying a home is a big wake-up call to many .

Once they own a home it makes people grow up and make better decisions .

Waiting until everything is perfect just isn’t realistic of a good idea.

Sorry Dave

Off topic side bar, and maybe no one will care, but Ramsey lost me the night I heard him tell a parent that trade school was just not a very good plan, that only dumb people who can’t do college work become electricians or plumbers or the like, and did the parent really want his child to not have the best in life and be looked down by peers.

Also, he tells everyone that children should not live with their parents after a certain age, and to do so is to be a loser. As a real estate investor this advice profits Dave Ramsey but not families or adult children.

Dave may have been genuine at one time. His time is past. Most if not all of his shows are handed off to his younger employees now. And his daughter has some junk legal things he pawns off.

I only listen to his show by accident and only long enough to make sure it’s as bad as I think it is.

Dave filed Bankfuptcy because of his foolish leveraged real estate situation a long time ago. Out of the rubble he came up with much of his prevailing wisdom regarding finance and began a radio show counseling people who were emerging from similar situations.

. He still dabbles in real estate....not because he needs to.

One size doesn’t fit all. You won’t go broke following his advice.

Wife and I didn’t buy a house until we were in our 40’s.

It’s good to go from Dave Ramsey problems to your fee-paid fiduciary’s problems.

p

And his advice about 15-year mortgages is idiotic. I would never advise anyone to take out a 15-year mortgage even if they can easily afford the payments. Except in rare cases, you are always better paying down a 30-year mortgage and putting the difference between the 15-year payment and the 30-year payment aside in a pool of diversified investments. That way, you get to Year 15 and you may find that you have more than enough money on the side to pay off the remaining balance on the mortgage.

My one criticism of Ramsey is that he seems to have no concept of what value LIQUIDITY has for most people.

Credit Card math, Home buying math, and Car buying math

ARE NOT TAUGHT TO ALL HIGH SCHOOL STUDENTS...

I WONDER WHO’S AGAINST THAT ? ? ? ? ?

I can listen to Ramsey for about 5 seconds before that voice drives me crazy. Don’t know what that accent is called, but it’s nerve wracking.

Dave doesn’t follow his own advice, and what he does say is really stupid.

The fact is, for a down payment, and for many times no down payment, a person can leverage large sums of money to buy an investment property they get to also live in.

Where else can a person borrow $100,000 $500,000, even a $1 million at low interest rates?

If it costs less to rent than to buy, you should rent.

Dave:

——————How to get out of a car loan-——————

So, how do you get rid of a giant car payment? One option is to pay off your loan faster. Start by getting on a budget, cutting back your spending, and picking up a side hustle.

Throw as much money as you can toward your car loan. It’ll take some discipline and determination, but you can do it.

Thanks for the Dave Ramsey post. That guy has inspired thousands of people to get out of debt and in to financial security.

So, FreeRepublic is taking seriously a Redditor douchebag? "A single 27 year old male" "without a degree" who lives with mommy and daddy in the basement? Who says he is from "the Middle East"? Who, when he talks about a "one-bedroom in the bad part of the country", doesn't mean some mudslime ghetto like Newark, but means some white town in Idaho!

WTF is wrong with you people?