Posted on 01/13/2024 7:20:17 AM PST by Red Badger

The Federal Reserve ran an operating loss of $114.3 billion last year, its largest ever, a consequence of its campaign to aggressively support the economy in 2020 and 2021, then jacking up interest rates to combat high inflation.

The losses added to already large federal deficits that have required bigger auctions of Treasury debt. The central bank’s losses could continue for as long as short-term interest rates remain near current levels. That has the potential to fuel new political attacks on the Fed, though there have been no signs of that so far.

The U.S. central bank announced preliminary, unaudited results of its 2023 financial statements on Friday.

The central bank paid more to financial institutions on interest-bearing deposits and securities than it earned from securities that it bought when interest rates were lower. That’s a result of it raising its benchmark short-term interest rate to a two-decade high, above 5%, last year.

The losses don’t affect the Fed’s day-to-day operations and won’t require the central bank to ask for an infusion from the Treasury Department. Unlike federal agencies, the Fed doesn’t have to go to Congress hat in hand to cover operating losses. Instead, the Fed created an IOU in 2022 that it calls a “deferred asset.”

The Fed has almost always turned a profit and is required by law to send its earnings, minus operating expenses, to the Treasury. Those gains turned to losses in 2022, meaning the federal deficit has been a bit larger than it would otherwise have been.

(Excerpt) Read more at wsj.com ...

$114 billion you say. How much have we given to Ukraine?

👍

Substantially more, but that was not all in cash, but the assumed value of the weapons and material supplies...............

Pretty soon we’ll be talking about some real money.

This year should prove interesting.

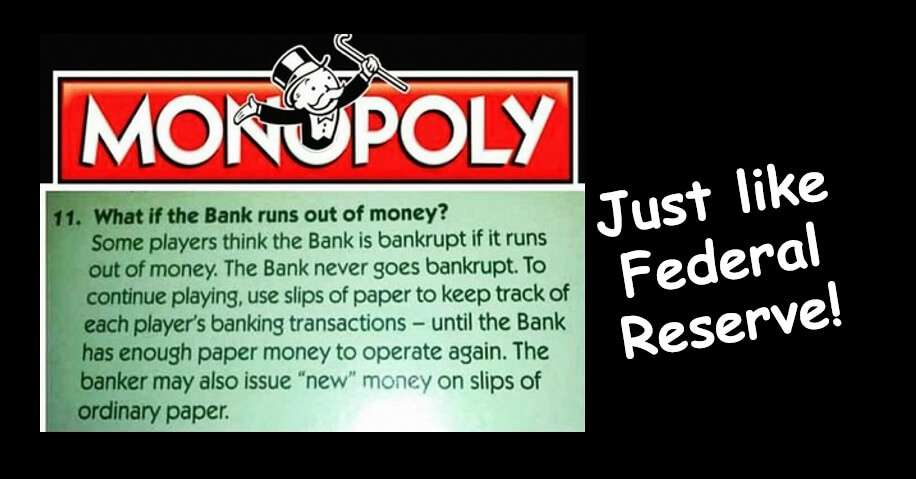

You can lose all the money you want if you have a printing press in the basement.

These days it is just keystrokes on a computer.

History: one of the prime reasons for the American Revolution was a central bank; the Bank of England.

The Founders abhorred central banks. The United States of America didn’t have one until 1913.

Propaganda.

Governments don’t produce fiscal ‘losses’, only excessive expenditures.

In a sane world heads would roll and new people would fill key positions both in DC and the bureaucracy.

We are doomed.

We had money that was made of gold and silver.

Now we have money made of paper and ink.

Eventually we won’t even have paper............

Instead, the Fed created an IOU in 2022 that it calls a “deferred asset.”

But not both to the same person.

“unaudited “

There is the keyword. The fed cooks the books and lies to the American people.

And the printing presses go Brrrrrrrrrrrrrrrrr!

I'm prepared. We have a bidet...

I bet they gave the chief operating officers huge bonuses.

If $114,300,000,000 is what they are admitting it is likely ten times that.

How do you lose money when you have a printing press?

Hamiltonians most affected!

So how exactly does the fed lose or make money?

What exactly are the transactions that the fed is involved in that cause it to make or lose money? What’s all the fuss about?

In this case, the fed bought a bunch of bonds when they were yielding a much lower dividend rate, like 2%. They still hold trillions of them.

Their asset is what these bonds are worth at today’s interest rates which are closer to 5%. Because the value of a bond is inverse of the dividend rate, that means that those bonds are worth less today than when they bought them with money they printed.

So all this “loss” is a “pretend bookkeeping” entry, because assets for the fed are always whatever it needs.

For a real bank this would be a real problem. It’s exactly what happened to the Silicon Valley Bank. They had “invested” in a lot long term bonds paying very low rate, so with the the rates shooting up, their balance sheet took a nosedive, which caused a bank run which they couldn’t cover because the value of their bonds had shrunk so much.

But there ain’t going to be any run on the fed. The only depositors there are commercial banks and they know their deposits are covered by the printing press. So no run on the fed.

We can sleep well tonight.

I'm not even going to try to address your moronic commentary opening after a totally asinine question.

Even John Maynard Keynes would recoil at your assertions.

Educate yourself (or don't; I could GAS in the face of what you're shoveling):

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.