Posted on 05/19/2023 8:12:32 PM PDT by MinorityRepublican

Central banks have been credited with averting a global depression twice over the past 15 years: Once after the 2008 financial crisis, and again at the height of the coronavirus pandemic.

But the tactics they deployed to restore confidence and keep money flowing from banks to the economy amounted to a high-stakes experiment — one that may be impossible to unwind without destabilizing the financial system.

Central banks purchased tens of trillions of dollars worth of government bonds and other assets in a bid to bring down longer-term borrowing costs and stimulate their economies. This measure, known as “quantitative easing,” or QE, created a flood of cheap cash and gave policymakers newfound sway over markets. Investors called it the era of “easy money.”

But since inflation hit its highest level in a generation last year, central banks have embarked on the quest — unprecedented in scale — of shrinking their bloated balance sheets by selling securities or letting them mature and disappear from their books. “Quantitative tightening,” or QT, by top central banks will suck $2 trillion in liquidity out of the financial system over the next two years, according to a recent analysis by Fitch Ratings.

A liquidity drain of that magnitude could amplify strains on the banking system and markets, which are already grappling with a sharp run-up in interest rates and edgy investors.

(Excerpt) Read more at cnn.com ...

Ramping down QE would have been a lot easier without insane restrictions on oil production and delivery.

The really insane experiment was letting the Biden gang run the country - and the planet - off the rails.

Understatement.

The debt that was created to inflate the money supply does not go away, just because you deflated the money supply. The debt is constant, for what hasn’t been paid down. It means repairing the inflation is going to leave a debt that has grown since the covid lie was started.

Yep...

Until it's repudiated.

I give it 24 months, at the outside.

The Austrian school knows immediatley what is wrong with QE, i.e. easy money created out of thin air. It leads to malinvestment-putting enormous resources into ventures that will not pay off in the sense of increasing net productivity. You know like build windmill farms and solar towers of power at great expense that at the end of the day don’t produce enough power to suppor their operating costs much less pay back the enormous investment to begin with.

Or investinging in ESG education which makes a people both unfit to govern and ungovernable rather than providing them with the normal skills of reading, writing arithmetic and other mechanical or creative arts that make people productive members of society. Or putting money into giving invaders a free ride rather than defending the borders and only letting in people who will be peaceable and productive members of our society. QE will be a gift that is going to be giving for a long time.

While this is technically true, what is missing is that the US put up all the cash. The world was crashing and we made all the rich people of the world whole.

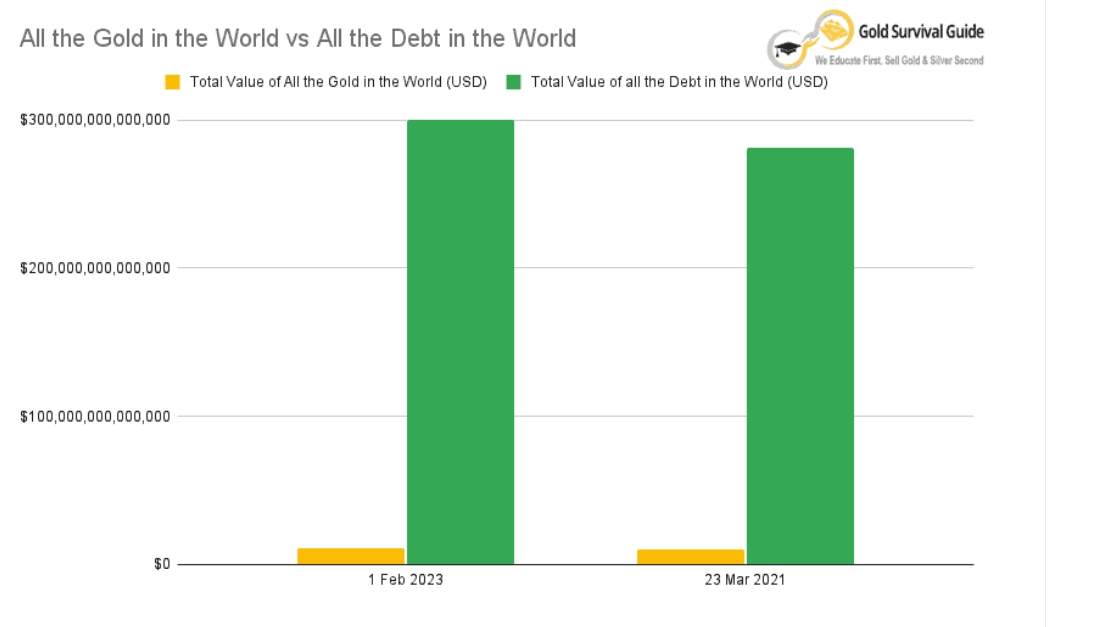

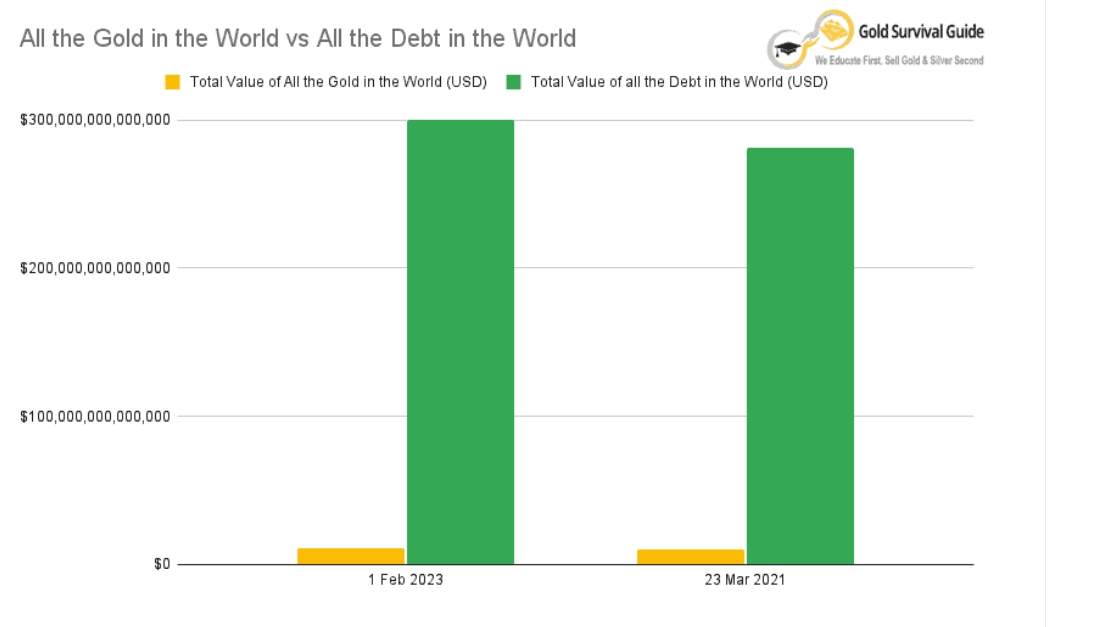

“At close to $305 trillion, global debt is now $45 trillion higher than its pre-pandemic level and is expected to continue increasing rapidly,” the IIF said.

.

I wish had generous credit card company like that.

$2 Trillion is just petty cash to FedGov. Look at the way they spend and spend and spend. They might try to scare us into trying to scale down but Washington DC is never going to slow down their spending, believe you me.

Well, you said it all so I don't have to....thanks!

Imagine the losses on the bonds Fannie May, Freddie Mac, and Ginnie May issued to be able to lend for 30 years at 3% to 4%.

They borrowed short term and lent long term.

All their debt is not part of the “National Debt. “

When the combined u funded liabilities of just about every nation on earth is probably in the quadrillions what’s 2 trillion lousy dollars? The tax payers can be milked for that.

Do you have a Degree in Business and/or major in econ?

Bottom line they are preparing for a non monetary digital system with complete control from the central bank

trump wants to avoid SS math and pay people to have babies. I notice he didn’t say taxpayers or citizens.

We know he means anyone, legal or not We are being invaded and he wants to pay them instead of something common sense like audit SS and strip it of everything except it’s original intent.

If you want to keep it as is. You are unaware of the blue state deep state slush fund it is.

:...Or investing in ESG education which makes a people both unfit to govern and ungovernable...”

Or allowing homosexual depravity to run amok in schools and society.

Our constitution was made only for a moral and religious people. It is wholly inadequate to the government of any other: John Adams

That is a huge pitfall, that an operating bank should avoid, but it is not the underlying problem. If the money had been put into productive investment - you know building factories and training workers for a thriving industry that would be the backbone of our economy for the next 30 years that would be one thing. But that is not where the money went. It was consumed. ESG favored "investments" is just as frivolous as coke and whores.

An investment is like a blacksmith providing a farmer a steel plow in return for which he get's a percentage of his increased agricultural production, sufficient over time to pay him back for his labor and materials in making the plow, plus a reasonable additional return on top of his costs, while also providing the farmer with an increased income from the sale of his increated production. Good investments lead to increased economic activity such that it is profitable for both the investor and investee. Such opportunities are "rare" and their identification and exploitation is hard work.

Where did they (whomever) get the money to 'loan' out?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.