Posted on 08/24/2022 9:24:18 PM PDT by SeekAndFind

President Joe Biden is expected to announce $10,000 of student loan “forgiveness” for low- and middle-income Americans earning less than $125,000 on Wednesday. While the move is ostensibly to give lower-income Americans a lift in Biden’s recession, a closer look at the numbers shows it will disproportionately aid those who are better off.

According to an analysis of Biden’s plan from the University of Pennsylvania out Tuesday, such a wide-ranging bailout will come with a price tag of $300-$980 billion for American taxpayers. Furthermore, the university calculated, “Between 69 and 73 percent of the debt forgiven accrues to households in the top 60 percent of the income distribution.”

The school’s conclusion is supported by prior data analyzed by the liberal Brookings Institution in 2020 as Democrats vying for the presidential nomination touted similar loan forgiveness as central to their platforms.

[FLASHBACK: Hardworking Iowa Dad Explains Why Making Taxpayers Pay Off Student Loans Is Unfair]

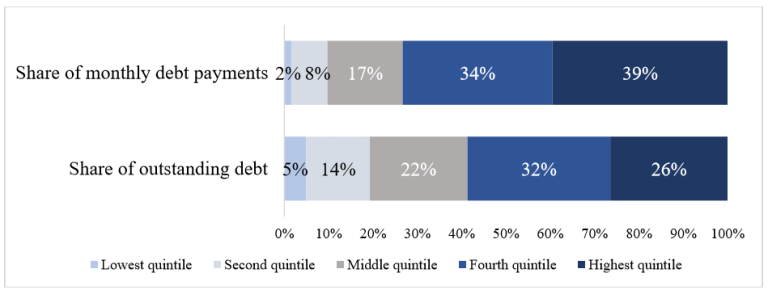

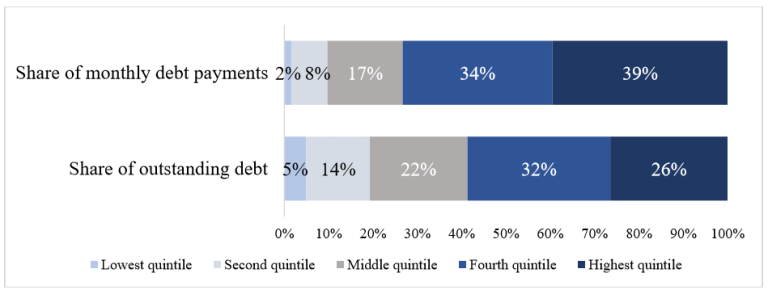

According to Brookings, “the highest-income 40 percent of households (those with incomes above $74,000) owe almost 60 percent of the outstanding education debt and make almost three-quarters of the payments.”

“The lowest-income 40 percent of households hold just under 20 percent of the outstanding debt and make only 10 percent of the payments,” the Washington D.C. think tank published along with the chart below:

Meanwhile, students who took the loans are far better equipped to pay them off than many other American taxpayers. A typical worker with a bachelor’s degree is likely to earn nearly $1 million more over their career lifetime than the same person with just a high school diploma.

“About 75 percent of student loan borrowers took loans to go to two- or four-year colleges; they account for about half of all student loan debt outstanding,” the Brookings Institute reported in January 2020. “The remaining 25 percent of borrowers went to graduate school; they account for the other half of the debt outstanding.”

At the same time, the White House’s unilateral plans are legally questionable at best. In January last year, the Department of Education released an eight-page memo stating that the agency lacks the statutory authority to “cancel, compromise, discharge, or forgive, on a blanket or mass basis, principal balances of student loans, and/or materially modify the repayment amounts or terms thereof.”

In other words, without congressional approval, Biden’s decision to wipe out a minimum of $300 billion in student debt at the stroke of a pen is unconstitutional, according to the department.

Regardless of incomes, another slap in the face to those who used to be the back bone of the Democrat party - blue collar labor

Smells like privilege to me.

It’s vote buying, and it not only smells, it stinks.

Millions of people ought to sue biden and fedgov for return or our loan payments. We either get repaid or he ends this illegal action.

I worked night shift and overtime to make sure my child had no school debt. She saved up and paid her own way through graduate school

Why should either of us have to pay for the overly stupid white kids who used college for a party time?

So if I read this right, the wealthy hold a higher proportion of student loan debt than the poor. So the more wealthy benefit more from student loan forgiveness. Is that right?

I thought the Congress had to pull this kind of BS. Where does the Pedoprez get off doing this? It’s time to impeach the crook.

Actually, the sweetest way of handling this now....insist upon three new taxes: (1) for any university text book, a $10 fed tax, (2) a $5 tax for each entry into a NCAA sports event, and (3) a $100 per semester hour fed tax for classes at any US university.

Millions of American taxpayers are going to be forcibly made involuntary cosigners for loans they never would have agreed to nor will ever benefit from.

“Top 60 percent” includes some in the lower half of the income distribution, and yet it’s labeled a scheme to benefit the rich. Define rich and stop with the class warfare BS and statistical sleights of hand already. Student debt forgiveness still a bad idea and net negative on the economy.

NOW......watch the pedos approval numbers go up......with some Bidung fairy dust.

Everything You Need to Know About Filing RICO Claims against govt

BY WEISBERG LAW.COM, 04, 2021

Racketeer Influenced and Corrupt Organizations Act (RICO) is a federal law designed to combat organized crime in the United States. The law was passed in 1970 and was meant to be the “ultimate hitman” in mob prosecutions. Today, individuals or organizations can still use the RICO Act to file civil claims against racketeering activities performed as an ongoing criminal enterprise.

If your business or property suffers at the hands of a criminal organization, such as a corporation or bank, you may have a RICO claim.

Which Activities Qualify Under RICO Claims?

Racketeer Influenced and Corrupt Organizations (RICO) Act continues to help attack organized crime in the US, although it was originally enacted to combat organized criminal groups like the Mafia. RICO can be applied in public and private civil suits against violators, and it contains broad provisions on violations regarding consumer protection, commercial fraud, bribery, official corruption, and security violations.

RICO claims often involve “a pattern of racketeering activity” that breaks either state or federal crimes such as murder, bribery, fraud, money laundering, extortion, kidnapping, and more. The criminal RICO statute provides prison terms of 20 years and severe financial penalties.

What Is Needed to Prove a RICO Claim?

Anyone can bring a civil suit if they have been injured by a RICO violation, and if they win, they will receive treble damages. To succeed on a RICO claim, a plaintiff must prove the following:

Criminal Activity: You must demonstrate that the individual or organization committed one of the RICO crimes, which include a broad range of crimes, such as blackmail and wire fraud. If you bring a claim on a fraud basis, the court will apply strict scrutiny.

Pattern of Criminal Activity: To have a successful RICO claim you must prove that there is a pattern of criminal activity – of at least two or more crimes. A pattern requires the crimes to be related in some way (or continuous), meaning it was conducted over at least a year.

Within the Statute of Limitations: The Supreme Court held that RICO has a five-year statute of limitations. Therefore, you must file a claim at least five years before discovering the criminal activity.

What Can I Recover from a RICO Claim?

If you win your RICO claim, you will be awarded treble damages, attorney fees, and litigation costs. “Treble damages” mean three times the amount of damages caused by the defendant.

The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation.

Vote buying?

Must be an election coming up soon. And Bidenflation has hit the vote market hard. It used to be that a pack of cigarettes was enough to buy a vote. Now a vote costs thousands of dollars.

And those blue collar workers just keep voting for those slaps in the face. What does it say about those blue collar workers?

Congresswoman Alexandria Ocasio-Cortez has about $17,000 in student debt, despite making about $174,000 a year off taxpayers.

Just saying’.

Cui bono?

Watch her now support Brandon in 2024.

Not to mention the hundreds of billions in endowments Deep State won’t touch...

It’s good to have low friends in high places, eh?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.