Skip to comments.

China’s Debt Problems Continue to Fester: Containment Strategy Failing - Instead of abating, financial strains are intensifying.

Epoch Times ^

| 10/08/2021

| Milton Ezrati

Posted on 10/08/2021 8:58:18 PM PDT by SeekAndFind

News Analysis

Beijing’s containment strategy is failing. Instead of abating, China’s financial strains are intensifying.

Last month, when concerns first arose with the insolvency of the real estate giant Evergrande, Beijing held back from getting too involved. The nation’s leadership no doubt hoped that the financial waves would calm without much effort on their part.

Now with the announcements of more failures and defaults, it is apparent that financial problems are deepening and becoming more widespread. Indeed, the news is beginning to resemble the beginnings of America’s 2008-09 financial crisis. Beijing cannot avoid acting for long.

The latest news is disturbing. The first tentative signs emerged in August when Sunshine 100 China Holdings Ltd. defaulted on some of its dollar-based notes. A few weeks later, the much more significant Evergrande failed to make an interest payment on a much larger issue of dollar-based debt and announced that it was effectively insolvent. Hope of a resolution rose earlier this month when Hopson Development Holdings, a rival of Evergrande, floated the idea of buying Evergrande’s property management division. Should the deal go through, it might enable Evergrande to meet some of its obligations, but as of this writing, no deal has emerged.

In the meantime, a smaller real estate developer, Fantasia Holding Group, failed on Oct. 4 to pay on a bond issue that had come due. During this same time, another property developer, Sinic Holdings Group, failed to make two domestic bond interest payments.

Credit rating agencies began to downgrade much Chinese corporate debt to levels that point to default, while all eyes turned to Oct. 15, when some $229 million of the Beijing-based Xinyuan Real Estate Company’s dollar-denominated debt will come due.

Widespread debt problems of this sort were always a likely outgrowth of China’s past breakneck pace of development. When any economy grows at the pace China’s was, opportunities abound. Company managements face an almost irresistible temptation to borrow funds to take advantage of those opportunities. Evergrande used debt to expand from its original base in Guangdong Province to pursue developments all over China, as well as move into other lines of business. Other firms behaved similarly, if less grandly. As long as the economy developed at speed, revenue flows more than kept up with the debt burden. But when China’s economy began to slow, so did revenues, and those debts have become increasingly difficult to sustain. The growing list of defaults testifies to this reality and points to still more troubled firms than have not yet made headlines.

The announced losses, even if the Hopson-Evergrande deal goes through, will cause trouble enough, but Chinese finance, and Beijing, now face a bigger problem. It lies in the impact of these failures on the general level of trust in the financial system.

Trust is an essential ingredient in finance. Without it, no participant can have any confidence that the person or firm with which he or she is dealing can meet their obligations. Without that trust, people shy away from all activity, and trading, lending, stock purchases, whatever, stops. Finance then fails in its essential function, which is to channel funds from savers and investors to innovators and established firms. Expansion and hiring then also stop, and the economy collapses.

This is what threatened the United States during the 2008-09 financial crisis. All knew that the system could have absorbed the mortgage losses at the root of the problem, large as they were. But because no one could tell where those bad mortgages were held, everyone pulled back from dealing with everyone else. A borrower, for instance, who had a good credit history might in the interim have acquired some of the failing mortgages and so fail himself. Or even if he did not hold any of the questionable mortgages, he might depend on another who held some of them and pass the failures through the presumably sound borrower to others. Such fears prevented trading, investing, and lending.

More than anything else, concern over how this loss of trust could impact the economy was why the federal government and the Federal Reserve (Fed) stepped in to help financial institutions meet their obligations. The one extended credit to the banks so that everyone else would have confidence that banks were sound. The Fed flooded the financial markets with liquidity at low interest rates so that anyone experiencing problems could readily borrow on easy terms to meet their obligations. The aim was to protect the economy by re-establishing trust and confidence.

Now in China, the stage is set for a loss of trust among financial players. The fears that lie behind this loss may extend beyond that country’s borders. After all, these companies have borrowed and acquired equity capital from many sources around the world. Unless luck runs high, Beijing must act to restore that essential trust. The moral imperatives on which so much of China’s leadership has dwelt are secondary. Blame and punishment can come in the fullness of time. Now is a time for action, to use official and central bank funds to reassure all that counterparties will be able to meet their obligations. China’s prosperity depends on it.

Views expressed in this article are the opinions of the author and do not necessarily reflect the views of The Epoch Times.

Milton Ezrati is a contributing editor at The National Interest, an affiliate of the Center for the Study of Human Capital at the University at Buffalo (SUNY), and chief economist for Vested, a New York-based communications firm. Before joining Vested, he served as chief market strategist and economist for Lord, Abbett & Co. He also writes frequently for City Journal and blogs regularly for Forbes. His latest book is "Thirty Tomorrows: The Next Three Decades of Globalization, Demographics, and How We Will Live."

TOPICS: Business/Economy; Culture/Society; Foreign Affairs; News/Current Events

KEYWORDS: baluchistan; china; debt; economy; hongkong; hunterbiden; obor; onebeltoneroad; pakistan; southchinasea; taiwan

To: SeekAndFind

Remember: for China this is not about Evergrande, it's about preserving confidence in the property sector.

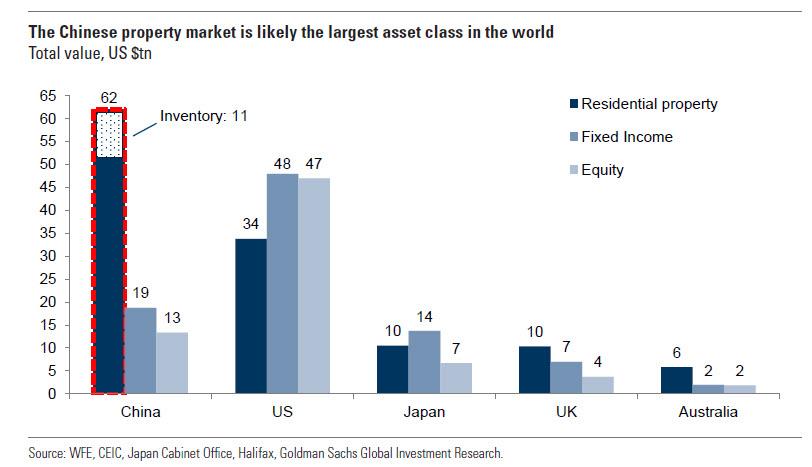

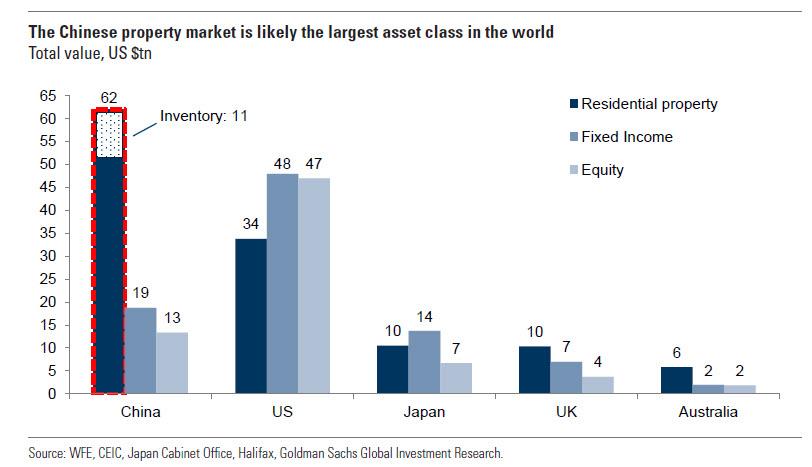

Any contagion from the ongoing turmoil sweeping China's heavily indebted property sector will impact not the banks, which are all state-owned entities and whose exposure to insolvent developers can easily be patched up by the state, but the property sector itself, which as Goldman recently calculated is worth $62 trillion making it the world's largest asset class, contributes a mind-boggling 29% of Chinese GDP (compared to 6.2% in the US) and represents 62% of household wealth.

To: SeekAndFind

Maybe there is something behind the Milley contact after all? I get a nervous feeling when it comes to regimes and failed economics. They always lead to some kind of a confrontation to re leave pressure. Sometimes its a stage event to direct attention away from the real problem. Event = a small war that will end in a draw to benefit the parties having equal problems. Oh, there I go again with conspiracies. It must be past my bed time. Democrats in power give me the shutters, its how they resolve their problems that scare me the most.

3

posted on

10/08/2021 9:12:09 PM PDT

by

Bringbackthedraft

(In politicians we get what we deserve, usually the best that money can buy, guaranteed.)

To: SeekAndFind

“Now is a time for action, to use official and central bank funds to reassure all that counterparties will be able to meet their obligations.”

In the USA in years past if I wrote a check without sufficient funds it would come back in a few days.

Obviously, the banking system knows if sufficient funds are on account.

The banks were able to do this in the 1970s and I believe many decades before that.

How about a little honesty - the condos are selling slowly.

Instead of 50 unsold condos and $2 million on hand as expected we have 60 condos and $1 million on hand.

We can not pay $1.5 million as per the contract.

How about $1 million plus either a $500,000 IOU or six condos with a retail value of $100,000 each.

To: SeekAndFind

It’s been known for over a decade that Chinese R.E. has been ridiculously overbuilt and overleveraged. Anybody who hasn’t factored this into their portfolio will deserve what they get.

Unfortunately for the wiser heads, the implosion in China cannot be contained.

Reminder: The Crash of 1929 was accelerated in 1931 when an overleveraged bank in Austria failed.

This is 1000 times worse.

To: SeekAndFind

“But because no one could tell where those bad mortgages were held, everyone pulled back from dealing with everyone else. A borrower, for instance, who had a good credit history might in the interim have acquired some of the failing mortgages and so fail himself. Or even if he did not hold any of the questionable mortgages, he might depend on another who held some of them and pass the failures through the presumably sound borrower to others. Such fears prevented trading, investing, and lending.”

If I am dealing with X Bank I need to know X bank’s situation.

X bank knows the payment status of every loan it has.

loan 1

borrower: password level too low

street: 1 BirdDog Way

zip:15206

tax assessment value: $356,700

original amount $300,000

current balance $287,000

current

Jan 2017 payment due $1,500 paid 12/31/2016

...

Oct 2021 payment due $1,500 paid 10/01/2021

loan 2

...

Banks are audited like other businesses.

Net Capital 09/01/2021 $1,567,987,432

certified by Big 8 #7

Sam Sharp, chief bank auditor

report available at

https://www.big8number7.com/bankX/09012021/main.html

Counterparty Bank C

09/01/2021

net capital $3,654,987,123

exposure $77,222,846

Counterparty Bank D

09/01/2021

net capital $113,456,468

exposure $14,683,734

To: Chad C. Mulligan

China will handle this I believe......remember automated warehouses, smart ports running on 5G networks, mines operated by remote control, factories run by self-programming robots and driverless taxis.

All of this is happening now in China, and at scale. The linked videos on Youtube provide more information than anything you will read in the Western media. China’s artificial intelligence (AI) applications look like science fiction, but they are real as rain, and happening before our eyes.

Just as the US hit some road blocks as this nation was built...so too will China but they will weather them and continue their climb.

7

posted on

10/08/2021 9:57:28 PM PDT

by

caww

( )

To: SeekAndFind

The real estate inventory of China has about the value of the whole UK real estate market (or that of Japan).

To: SeekAndFind

Our equity markets are valued at about twice the rest of the countries listed combined.

To: SeekAndFind

Comparing Residential Property to Fixed Income for China seems to indicate that that Residential Property is to a large extant owned outright (excluding the urban land, which in China is government owned).

To: caww

You grossly overestimate both the competency of the CCP and the tolerance of the Chinese citizens.

There are so many things wrong inside China, and their populace is growing weary of it.

Like us, they see that their government sucks, they just have millennia accepting that (and no guns). But the internet and international travel are showing them that their gold plated bird cage is just that: a cage.

11

posted on

10/08/2021 10:40:25 PM PDT

by

datura

(The voice that brought you peace has nothing left to say.)

I’m paying attention because people here have predicted 147 of the last two crashes.

12

posted on

10/08/2021 10:50:23 PM PDT

by

SaxxonWoods

(Leave. Us. Alone )

To: datura

Well I look at their history....how they play.....and how they can and do control their people, directly and indirectly. I don’t overestimate them...and surely not grossly so. Watch and see....

13

posted on

10/08/2021 11:02:01 PM PDT

by

caww

( )

To: SeekAndFind

China has over $3 TRILLION worth of foreign assets. This might be a bump, but nowhere near a collapse. The Chicoms will allocate funds where needed, such as, for example, if needed to make a new submarine, they will let the Uighur slaves starve.

14

posted on

10/08/2021 11:37:36 PM PDT

by

VanShuyten

("...that all the donkeys were dead. I know nothing as to the fate of the less valuable animals)

To: Bringbackthedraft

.....”Democrats in power give me the shutters, its how they resolve their problems that scare me the most”........

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so. “ – Mark Twain

15

posted on

10/09/2021 12:07:06 AM PDT

by

caww

( )

To: SeekAndFind

Tend to wonder if China’s aggressions towards its neighbors isn’t some kind of “wag the dog” policy. Look at the shiny airplanes over neighbors’ countries.

To: Chad C. Mulligan

It’s been known for over a decade that Chinese R.E. has been ridiculously overbuilt and overleveraged.And shoddy to the point of being criminal. I learned a new phrase "Tofu-dreg", a Chinese term for crappy construction.

Hairy video on results of some construction practices Check out 7:40 where they show the quality of materials.

17

posted on

10/09/2021 6:59:23 AM PDT

by

Oatka

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson