Posted on 12/29/2017 5:28:20 AM PST by Kaslin

While gold is rising, the trendy electronic crypto-currency Bitcoin collapsed from $19,363 on Sunday, December 17 to a low of $12,148 (down 37% in five days) on Friday, December 22, before rallying to close above $13,000 over the weekend (Bitcoin trades 24/7 and also on weekends). Apparently, investors are starting to realize that Bitcoin is only a creative computerized fiction, while gold is the Real Thing.

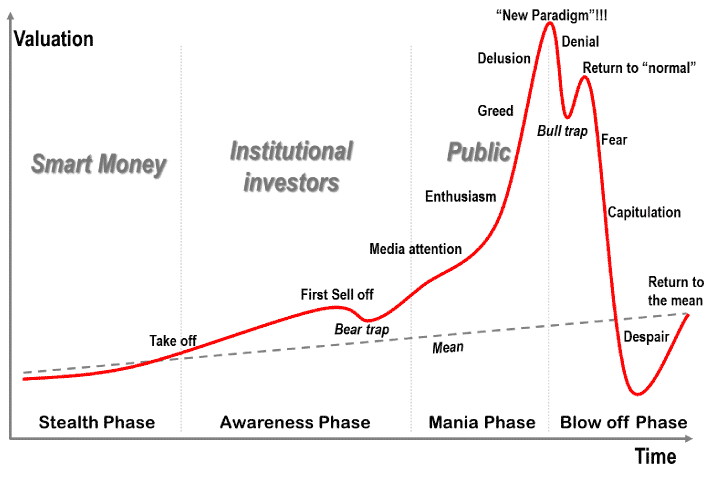

Although the “blockchain” technology of using Bitcoin for computerized buying and selling is probably an important technological advance for future economic exchanges, the market for cryptocurrencies is in its infancy – like automobiles a century ago, or computers 50 years ago or the Internet 20 years ago. There were hundreds of automakers in the 1920s, but only the Big Three survived. Same with computers and dot-com companies: Most fell along the wayside. The “hot stocks” of the 1920s were car companies, then computers in the 1970s and then dot-coms in the 1990s. Cars, computers and the Internet are for real, but most of the companies died. The same is true for Bitcoin. There are currently hundreds of obscure crypto-currencies competing for dominance. Bitcoin is the biggest, but it may not remain No. 1 for long. The technology is for real, but investing in a hot stock with a parabolic chart is usually not a smart move.

Some of the smartest minds in finance agree with this assessment. Warren Buffett called Bitcoin a “bubble,” in which “people get excited from the big price movements and Wall Street accommodates” them. Buffett added that “You can’t value Bitcoin because it’s not a value-producing asset.”

Jamie Dimon, Chairman and CEO of JPMorgan Chase, praised blockchain technology but called Bitcoin a “fraud,” saying that “it won’t end well.” Later, he added that “the only value of Bitcoin is what the other guy will pay for it. Honestly, I think there’s a good chance that the buyers out there are jazzing it up every day so that maybe you’ll buy it too, and take them out.” In addition, Janet Yellen and other central bankers have warned that Bitcoin is a “speculative asset” and not legal tender, as gold is. This is more or less a veiled threat that the central bankers of the world will not honor the validity of Bitcoin transactions.

It’s a pretty safe bet that gold will continue to hold its value in 2018, but Bitcoin will probably not.

Gold’s Amazing Winter Surges

Gold is having its best year since 2010, up over 11% for the year, with only a few trading days left in 2017. More importantly, gold has strong upward momentum in the last half of December, rising from a low of $1,240 on December 12 – the day before the Federal Reserve’s rate increase – to $1,283 the day after Christmas. Some technical analysts say that if gold closes over $1,280 as a “resistance level,” it could quickly rise to $1,300 per ounce, perhaps within the next few days – in its regular “winter surge.”

Something amazing has been happening under the radar in the last five years. Normally, September through December has been the “golden season” for gold’s increase, due to seasonal gold fabrication demand for jewelry gifts in preparation for fall and winter holidays in various cultures. In the last five years, however, mid-December to March has been gold’s annual “hot spot,” perhaps due to the Chinese New Year, but more recently due to three Federal Reserve interest rate increases in mid-December.

The first mid-winter surge took place in early 2014 in conjunction with the Winter Olympics in Sochi, followed by Putin’s audacious takeover of the Crimea and invasion of eastern Ukraine. Then, during the last three years, gold’s low point came in the second half of the year – twice within a day of the Federal Reserve’s announcement of a 0.25% interest rate increase.Oddly, the reigning belief of the anti-gold market pundits is that gold would fall after interest rates rise, since gold “offers no interest income” and is therefore at a disadvantage to higher-interest currencies, but it turns out gold rallies when rates are raised:

We don’t know how far gold will rise this winter, but gold has risen by double-digit percentages in each of the last four winters. So far, gold is up about 3% (in the last two weeks), so it could have a lot of room left to grow before March. Now is the time to get on board before the bulk of gold’s winter gains arrive.

can you explain in simpler terms ? Seems like searching Sahara Desert with a metal detector. If you find the treasure you get rich. But the treasure was hidden by someone who created this treasure.

“Bitcoin is only a creative computerized fiction”

Someone who gets it.

Another one: “You can’t value Bitcoin because it’s not a value-producing asset”.

Gold is desirable for its beauty and usefulness in manufacturing. There will be demand for gold until the Sun expands and burns the Earth to a crisp. Although you can’t eat gold, you can’t eat money either.

In desert analogy there are more and more locations to search. But there is no person or machine that knows where the lump of metal is. The miners are searching for a new non-random random number each time. The new one, every 10 minutes, has no relationship to the old at all. Every search is brand new, from scratch.

Blockchain currencies are not intended to be investment vehicles. They are intended to be mediums of exchange that bypass the big-government/big-credit-card industrial complex and their skimming operations. The technology is new and will be subject to wild fluctuations until people get used to it. Eventually it will settle down.

The manufacturing demand for gold is roughly 2000 tonnes for jewelry and 1000 tonnes for bars and coins. Manufacturing uses very little. Gold mining produces 2400 tonnes. The difference is made up by melting unwanted jewelry. The gold economy is pretty constant so the gold price is fairly stable.

With the cryptocurrencies the trading is very thin. The demand far exceeds the supply which very tightly controlled. So instead of bitcoin people have created forks of bitcoin and various other currency chains. The bubble in alt-coins far exceeds the bitcoin bubble and is growing much faster. That the writer didn't mention it shows how clueless he is. These bubbles have a long long way to go.

I understand THAT just as much as I do bitcoin.

Buy cheap. Sell high.

Dont forget Fereingi Rule of Acquisition #23!

$14,489.00 today

Cool! You’ve got enough virtual money to buy my virtual bridge!

“To: Kaslin

the idea of mining a bitcoin using massive computers to find one? I still do not get it.”

I am with you on this. You get paid for doing complex equations (logarithm), have yet to figure out what the math is for and who exactly is “paying” for this service. Sounds like a bad sci-fi movie to me.

“You’ll never be able to do this with bitcoin!”

Actually, yes you could. But you wouldn’t be using bitcoin. You would be using the block chain technology to securely purchase the two dinner plates attached to the tinfoil covered thingymabob.

Doing it on your own doesn’t work now because every four years the amount available to mine halves. So it takes way more computing power. It’s the perfect scam for greedy speculators, limit the total to 21 million, halve the amount available to mine every four years. Create hype. Then sell at the top. See post 31.

To speculators.

When this happens, humans will be nothing more than pesky ants being stepped on at an AI picnic.

Blockchain currencies are not intended to be investment vehicles. They are intended to be mediums of exchange that bypass the big-government/big-credit-card industrial complex and their skimming operations.

they see a lottery ticket.

14,488 to be exact.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.