Skip to comments.

Trump’s tax proposal won’t actually help the middle class.

Washington Post ^

| 19 Oct 17

| By Catherine Rampell

Posted on 10/21/2017 1:59:09 PM PDT by SkyPilot

President Trump campaigned on helping the little guy. His latest tax proposal, he says, is about helping the middle guy.

“It’s a middle-class bill,” Trump promised an audience of truckers last week.

Other administration officials and House Speaker Paul D. Ryan (R-Wis.) have also claimed that their primary objective in reconfiguring the tax code is to help the middle class, not the wealthy.

(Excerpt) Read more at washingtonpost.com ...

TOPICS: Business/Economy; Constitution/Conservatism; Extended News; News/Current Events

KEYWORDS: congress; gop; middleclass; tax; trump; trumptaxcuts; trumptaxplan

Navigation: use the links below to view more comments.

first previous 1-20 ... 141-160, 161-180, 181-200 ... 261-273 next last

To: Mariner

Because they are stupid. Amen.

161

posted on

10/21/2017 6:06:47 PM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

I’m not kidding. Find the media quoting an actual named person to support what you have stated on this thread.

The media hates trump, 97 % of their donations go to democrats, they want to see tax reform fail, are YOU stupid enough to believe they won’t make up crap and lie?

162

posted on

10/21/2017 6:08:13 PM PDT

by

dynoman

(Objectivity is the essence of intelligence. - Marilyn vos Savant)

To: E. Pluribus Unum

Once a commie... Communists are people I fought against during the Cold War, Iraq War, Afghanistan War, and other conflicts. I served this nation.

Perhaps you did as well.

Tell me, and all of us......

Go ahead.....

163

posted on

10/21/2017 6:10:02 PM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

Corporations don’t pay taxes. It is a cost of doing business, so it goes in the price of the products they sell. A dollar bottle of juice costs 1.25

Lowering corp taxes makes their products more competitive in price.

Corporate taxes are essentially VAT taxes added to the cost of a product.

164

posted on

10/21/2017 6:10:19 PM PDT

by

xzins

(Retired US Army chaplain. Support our troops by praying for their victory. L)

To: SkyPilot

Post a quote from the plan.

165

posted on

10/21/2017 6:10:33 PM PDT

by

dynoman

(Objectivity is the essence of intelligence. - Marilyn vos Savant)

To: dynoman

Find the media quoting an actual named person to support what you have stated on this thread. Regarding the state and local tax deduction?!!

Are you serious?

How many news links do you want?

My God? Are you drunk?

166

posted on

10/21/2017 6:12:08 PM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

This tax bill will punish 44 Million Americans who claim the state and local tax exemption, all to "pay for" a massive tax break for corporations who have paid off K Street in Washington.

Prove it.

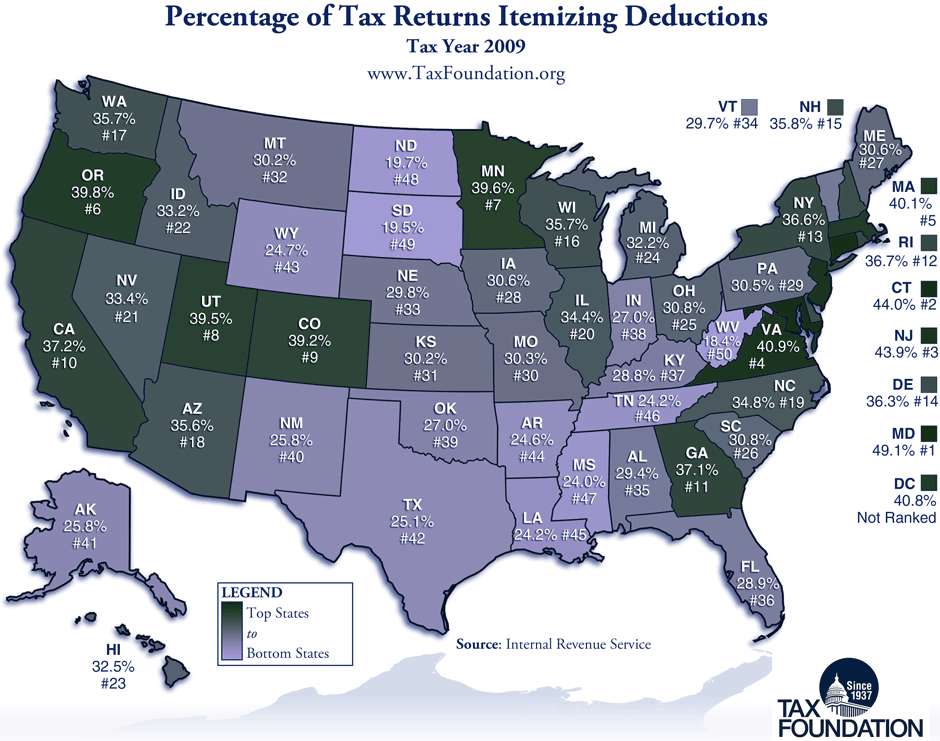

More than fifteen percent of taxpayers live in states with no income tax, such as Florida (6.38%) and Texas (8.62%). The 44 million number pertains to taxpayers who itemize, whether or not their states have local income tax, or whether or not they pay property taxes (which is more likely). They are not all equally affected. SALT deductions benefit the wealthier in larger states rather than the middle class and working poor, and are not not uniformly distributed across all states.

The 10 highest income tax states on the FTA's 2016 list were:

California 13.3% (12.15% of U.S. population)

Oregon 9.9%

Minnesota 9.85%

Iowa 8.98%

New Jersey 8.97% (2.77 % of U.S. population)

Vermont 8.95%

District of Columbia 8.95%

New York 8.82% (6.11% of U.S. population)

Seven U.S. states currently don't have an income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.

According to the most recent IRS data, for the 2013 tax year, 30.1 percent of households chose to itemize their deductions (44 million returns). 68.5 percent of households chose to take the standard deduction (101 million returns).Feb 22, 2016

167

posted on

10/21/2017 6:12:17 PM PDT

by

af_vet_1981

(The bus came by and I got on, That's when it all began.)

To: xzins

Corporations don’t pay taxes. You are wrong Chaplain.

And you know it. They do pay taxes, and they have paid off K Street to relieve them of taxes.

168

posted on

10/21/2017 6:13:48 PM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: af_vet_1981

169

posted on

10/21/2017 6:15:19 PM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

170

posted on

10/21/2017 6:18:57 PM PDT

by

af_vet_1981

(The bus came by and I got on, That's when it all began.)

To: af_vet_1981

Nice graphic.

So after all of this, let me ask you:

Does the current "Tax Cut" proposal include a tax increase on 44 million Americans who currently claim the state and local tax deduction?

The answer is: YES

You can be honest about it, or deflect. The choice is yours.

171

posted on

10/21/2017 6:21:49 PM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

Your link disproves your assertion:

"Of the 44 million tax filers who claimed state and local tax deductions in 2013, 38.8 million had household incomes of $200,000 or less, according to the Tax Policy Center. The major benefactors of the tax deduction live in high taxed states, like New York and California, where $200,000 doesn’t go as far."

On the other hand,

Between 2015 and 2016, US median household income rose 3.2% from $57,230 to $59,039, according to a new report released by the U.S. Census Bureau on Tuesday.Sep 12, 2017

172

posted on

10/21/2017 6:22:01 PM PDT

by

af_vet_1981

(The bus came by and I got on, That's when it all began.)

To: SkyPilot

No; 44 million itemize but not all 44 million pay state and local income tax because there are very large states that do not charge state and local income tax.

173

posted on

10/21/2017 6:23:59 PM PDT

by

af_vet_1981

(The bus came by and I got on, That's when it all began.)

To: Mariner

Or buy things. The assumption is that the tax break will be poured into expansion and paychecks. Except that typically won’t happen. Why would my company making more money mean I get a bigger paycheck? Typically, it goes to E level bonuses, dividends, or into all sorts of rat holes.

If your employee is already working for the current pay rate, you don’t give them more just because you make more. That would land you in all sorts of trouble with the investors.

And if you’re in a small company, they will be paying more taxes under the bill any way

To: SkyPilot

Yes, they technically send in money, but they make it up in the price of their product. They cannot pretend that cost doesn’t exist. You reimburse them for that tax when you buy that product.

That is one of the reasons a national sales tax is the only fair tax.

175

posted on

10/21/2017 6:28:59 PM PDT

by

xzins

(Retired US Army chaplain. Support our troops by praying for their victory. L)

To: xzins

Do you know what it all totals up to me sir? The corporations get a HUGE tax cut, and the little people don't figure it out until it is too late.

Tell me I am wrong.

176

posted on

10/21/2017 6:32:01 PM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

177

posted on

10/21/2017 6:35:09 PM PDT

by

dynoman

(Objectivity is the essence of intelligence. - Marilyn vos Savant)

To: SkyPilot

178

posted on

10/21/2017 6:36:55 PM PDT

by

dynoman

(Objectivity is the essence of intelligence. - Marilyn vos Savant)

To: SkyPilot

We will get a personal tax cut, the price of products will drop, and wages will increase. A drop in business taxes helps us. We pay less.

Every April for 15 years I’ve been writing the fed a big check beond what has been deducted from my pay. It increased when Obamacare showed up. I have good reason to hope that check will be smaller this year.

I’m truly disappointed ocare wasn’t repealed.

179

posted on

10/21/2017 6:39:47 PM PDT

by

xzins

(Retired US Army chaplain. Support our troops by praying for their victory. L)

To: SkyPilot

You’re a perfect example of the political adage “Don’t tax me, don’t tax thee, tax that man behind the tree!” LOL!

IE: you don’t see the tax included in the cost of an item you buy from a corporation- so you don’t think it’s a tax on you.

Say, when there’s REAL information available tell us what your net change in tax is after the doubled (or whatever they end up with) standard deduction.

180

posted on

10/21/2017 6:40:34 PM PDT

by

mrsmith

(Dumb sluts: Lifeblood of the Media, Backbone of the Democrat/RINO Party!)

Navigation: use the links below to view more comments.

first previous 1-20 ... 141-160, 161-180, 181-200 ... 261-273 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson