Skip to comments.

Maybe Janet Yellen Hasn't Changed, But We Have

Real Clear Markets ^

| June 24, 2016

| Jeffrey Snider

Posted on 06/24/2016 4:04:42 AM PDT by expat_panama

Janet Yellen has been doing a lot of talking lately, with more and more attention paid to the words she says and the contexts in which she delivers them. Maybe, then, it just seems as if the Fed Chair is speaking more, since it may be just as likely that she isn't doing anything different and that it is us who have changed. The fact that the FOMC has failed to follow through but for that one time in December is very likely the cause. Two years ago, Yellen spoke a lot of words but they were familiar, unnoticeable noise drowning in a sea of almost exactly the same phrases and sentiment.

Lately, however, her verbal communication has taken on a different sort of attention. She and the rest of her committee is talking more about the so-called natural rate of interest, even to the point of admitting it may be a serious problem (to her orthodox views). At the press conference following last week's same-as-usual policy de-commitment, Yellen made an extraordinary statement that very few seem to have appreciated.

And I think all of us are involved in a process of constantly reevaluating where is that neutral rate going and I think what you see is a downward shift in that assessment overtime. The sense that maybe more of what's causing this neutral rate to be low are factors that are not going to be rapidly disappearing but will be part of the new normal. Now, you still see an assessment that that neutral rate will move up somewhat, but it has been coming down and I think it continues to be marked lower. And it is highly uncertain, for all of the dots.

The natural interest rate, or neutral rate as she called it, is an unobservable, theoretical interest rate that is supposed to define a long-run equilibrium that would keep the economy operating at full employment with stable inflation. It was developed by Swedish economist Knut Wicksell at the tail end of the 19th century and largely lay dormant in mainstream policy until Columbia University economist Michael Woodford seems to have performed something of a mathematical resurrection of the concept at the end of the 20th. As the Richmond Fed described last fall, Woodford, "demonstrated how a modern New Keynesian framework, with intertemporally optimizing and forward-looking consumers and firms that constantly react to economic shocks, gives rise to a natural rate of interest akin to Wicksell's original concept."

To an activist central bank, the natural rate is thought one of the few methods of calibration even theoretically available. As Wicksell described it and Woodford calculated it, the central bank can, in broad, general terms, manipulate market interest rates above or below in order to fine-tune the economic margins and momentum. Should the Fed or any other central bank push rates above it, then the theory expects prices to fall and the economy to contract. Manipulate rates in the other direction, as in the theory behind QE, the economy should experience upward pressure on consumer prices and the related increase in general economic activity.

It sounds terrifically straight forward, but there are any number of complications even for those who believe in it and its econometric applications. There are distinctions between real interest rates and nominal, as well as second derivatives - does pushing market rates below the natural rate cause prices to rise or merely accelerate from whatever level they may start from?

Perhaps the highest obstacle is that the natural rate, despite referencing long run tendencies and conditions, is not stable or static. In November 2001, Thomas Laubach and John C. Williams on behalf of the Federal Reserve Board of Governors wrote a paper that regressed potential natural rate trajectories and found them to be quite dynamic through history.

Economic theory implies that the natural rate of interest varies over time and depends on the trend growth rate of output...We find substantial variation in the natural rate of interest over the past four decades in the United States. Our natural rate estimates vary about one-for-one with changes in the trend growth rate.

The implication for monetary policy is obvious if devoted to this framework; policymakers better have a good understanding of both their policy and the natural rate lest they make significant mistakes in being far more aggressive or restrictive than they may think when crafting specific policy settings. Economists believe they have sorted all these complications out, as the Fed and other central banks have confidently referred to the natural, or neutral, rate all throughout the quantitative easing experimental age. It was used as justification for the size and the ongoing applications of QE purposefully against those who objected to balance sheet expansion on the grounds of inflation fear.

According to John Williams' later calculations at the San Francisco Fed, the natural rate had been depressed (in real terms) to as low as 0.27% by Q4 2010. Thus, (more) QE was necessary in awesome size in order to depress real market rates even lower in order to bring about the desired Wicksellian response. In the years since, despite two more QE's (the third iteration in October 2012 devoted to MBS, the fourth in December 2012 in UST) there has been little of the expected effects, most especially inflation that only trends lower and lower. Even in late 2014 and early 2015 it was (in the mainstream) still perfectly consistent to see oil prices, in particular, as a "transitory" depressive factor stemming in large part from the view of QE as having successfully brought real market rates down below the assumed natural rate - no matter how low that might be.

Now, of course, policymakers are looking at their mistakes. In another paper written just recently, both Thomas Laubach (now director of the Federal Reserve Board's Division of Monetary Affairs) and John C. Williams (now President of the San Francisco Fed) update their work and find only distressing results. Not only do they figure the natural rate lower still in the US but that this reduction has taken place all over the world. They claim, "this is not a problem unique to the United States, but has broader consequences globally."

Interpreting these contentions via their earlier 2001 paper, we have to then assume that what they are saying is that global economic potential has plummeted as represented by the natural rate. If they were correct then, and they have not updated their accounting that I have seen to change that thesis, then a much lower natural rate corresponds "one-for-one" with potential. Worse, however, this paper suggests that natural rate fell to almost zero during the panic and financial crisis in 2008 and has never recovered.

Anyone familiar with my columns and articles over the years will note that this is perfectly consistent with what I have been saying especially with regard to the overall economy as viewed from labor. The participation problem is not an idle one; it is, in fact, central to all our problems and imbalances. The unemployment rate may have dropped to what appears to be "full employment" but that is only because at least 10 million Americans are "missing"; perhaps as many as 15 or 16 million.

The math is very simple in this regard: the potential labor pool, the civilian non-institutional population, has grown by 20.2 million since the last payroll peak in November 2007. The labor force itself, at least according to the official definition, only added 4.6 million of them (and 2 million of those were in what increasingly looks like a statistical oddity at the end of last year). Because less than one in four new laborers appear to have actually entered the labor market the unemployment rate gets to be less than 5% and economists can suggest in at least one statistic where QE worked.

In truth, there is no other way to frame this; the economy shrunk. Full employment in 2016 is entirely unlike full employment in any other cycle (except in that it resembles some of the results and processes in the suspiciously weak recovery after the dot-com recession). When Janet Yellen first took over as Chairman in 2014, she said that the updated models at the time suggested that it would take at least two more years to reach the "central tendency" of full employment, a range of 5.2% to 5.6% for the unemployment rate. It took less than half that time, yet we aren't finding any robustness anywhere in the economy, where recession and contraction are more the operative settings than what is normally associated with the condition.

The unemployment rate hit the upper boundary of the central tendency in just ten months, and then dropped through the lower boundary after only eighteen. The reason was this disparity between assumed payroll gains and the (lack of) change in the labor force. The Establishment Survey view of the numerator in the unemployment rate showed a total 3.2% gain in payrolls between February 2014 and August 2015; the labor force, by contrast, grew by just 1%, and more than half that gain was a likely discontinuity in January 2015 alone.

Despite continued claims of being the "best jobs market in decades", this was nothing like what had happened in past cycles of true recoveries. In the middle 1990's, for example, in order for the unemployment rate to perform the same change in level (from 6.7% to 5.1%) the Establishment Survey expanded by 7.9% while the labor force jumped 3.7%. Thus, it took twice as long to reach full employment because all the conditions that are associated with it actually occurred - people respond to a truly robust labor environment by joining it, not determined apathy. The results from the late 1980's are almost the same going from 6.7% to 5.1% unemployment: Establishment Survey 6.9%, labor force 3.8%.

By count of those cycles, there is no comparing labor utilization and growth today with the past. The dot-com recovery is the only cycle that comes close, where a 2.7% increase in the Establishment Survey combined with only a 1.5% increase in labor force expansion pushed the unemployment rate from its maximum of 6.3% June 2003 down to 5.1% by May 2005. In short, economic expansions in the 21st century are "somehow" both smaller and slower in labor terms (which is all that matters, or at least all that should matter), an entirely dangerous combination. What that does is further establish that the problem of labor utilization began not with the Great Recession but long before it (perfectly consistent with the BLS's Index of Total Hours, or what I called the US Index of Screwing Over American Workers); somewhere around the turn of the century and the appearance of asset bubbles and eurodollar extremes.

It has been so long that the US economy has performed in at least passing resemblance to health that so much has been forgotten about what it was like. Because of this, economists have gotten away with their own reductionism, calling 2% retail sales growth, for instance, "strong" because it isn't a negative number. By historical comparison, 6% retail sales growth is consistent with "normal" and 8% more appropriately described "strong"; we find 2% retail sales associated with recession. The falling natural rate appears to have been applied in relativistic descriptions of the economy that are now the operative order for mainstream commentary.

Despite the fact that economists and policymakers have performed a wholesale change in the standards of economy, it hasn't gone unnoticed. Thus, when Janet Yellen claims the economy is strong there are only questions; when Alan Greenspan said the same twenty years ago there were only accolades and adoration. In fact, Greenspan and "his" Fed were creatures of nothing but words. He even made a point, as he admitted later after retiring, to say nothing by saying a lot. It was called "Fed-speak" originally by Alan Blinder, a term that Greenspan has apparently taken kindly.

But the fact that he said nothing only grew his legend, especially in the later 1990's. It was so much that by the height of the dot-com bubble his briefcase had become a full-blown Wall Street icon (this contemporary St. Louis Fed article on the "power" of Greenspan's briefcase should be saved for all history as a stark warning). It wasn't so much what he didn't say, it was that the public was incredibly anxious over what he could say. There was so much belief in him and the Fed's stewardship that everyone looked into the smallest, most absurd details to find the slightest nuggets of perceived wisdom and expertise; it was cultish superstition.

What did Greenspan's Fed actually do? In reality, next to nothing. The idea that he managed the entire economy based on quarter-point moves in the federal funds rate is absurd. In truth, that was the myth that was built, a correlation that was perceived but never aligned to search for causation. Greenspan spoke nonsense and purposeful obfuscation and was lauded and idolized because in truth the work was all done for him; he was just there to take all the credit, to bask alone in the sunshine of misplaced adulation.

Janet Yellen tries to speak plain and instead comes across as befuddled, confused, and, at best, unconvincing. But there is a vast difference between the conditions of her words and those at the height of Greenspan's briefcase. Where he symbolically played with the federal funds rate on occasion, Yellen (via Bernanke) has actually mobilized the full might of the Federal Reserve. Bank reserves, those monetary byproducts of the Fed's balance sheet, were practically zero during Greenspan's tenure; they are now two and a half trillion. Greenspan talked about the might of the Federal Reserve; Bernanke acted it out and left it to Yellen. Curious, then, that the Fed's esteem is inversely proportionate with its explicit activities. The more it does, the less there is to believe.

It all changed on August 9, 2007, as what was supposed to be implicit support yielded to explicit pleading. The private money market reacted in ways the Fed just was not prepared for (largely because they believed it all impossible). Before 2007, the Fed's whims were dutifully carried out under implicit belief in legend and myth; after 2007 they were all proved to be nothing more than that. Not only did the Fed fail to stop the illiquidity leading to panic, their balance sheet expansion has failed to do anything for the recovery thereafter. The Fed was finally asked to prove itself capable of doing what it said it could do for all those years and decades under interest rate targeting and activism; it only proved there was never any basis for Greenspan's aura and authority to begin with.

True monetary policy, especially expansion, took place elsewhere. As I wrote last week, it is not coincidence that wholesale funding levels have acted in exactly the same fashion as now described of the natural rate of interest. An extraordinarily low natural rate would tend to suggest an overall view of general "tightness" in money (working at it from back to front). In the orthodox context, it describes a condition where even large QE's just were not enough (and might never be enough) to push real rates where they could actually matter.

The results are perfectly consistent with the theory; inflation that is generally and persistently less than expected or targeted (it's been four years since the PCE deflator was 2%) and, most importantly, a malfunctioning labor market. As noted above, that is certainly the condition no matter how many times economists say the words "full employment." Like Greenspan's briefcase, the term in the context of 2016 corresponds entirely to myth. Economic potential has been destroyed sufficiently that even orthodox calculations are finding it.

That is what I believe these assertions generally tell us; not that anyone could actually describe what any such natural or neutral rate is let alone calculate it. Instead, these neo-Keynesian concepts are forcing economists to come to terms with reality - and it is shockingly different than what was expected all along. To their view, a persistently low natural rate implies that monetary policy has been "too tight" which contains a grain of truth. It is not that policy has been tight, but rather that actual "dollar" supply has; monetary policy is still irrelevant just as it was under Greenspan. All that mattered then, and all that matters now, is the eurodollar system, a fact proved when the Fed stepped in to explicitly support the money supply and the world economy saw no effect (outside of an initial, temporary, and arguable burst) from it.

How else should we credibly explain what is perhaps the most significant of Laubach and Williams' findings? If the entire world has suddenly been afflicted by a low natural interest rate, what they are saying is that global money has been "too tight" as well. That points to eurodollars alone.

As the eurodollar system built, Greenspan was a genius even though he didn't do anything but talk and smile for the cameras. Now his Fed has been left to try to do everything, they can't seem to get anything right. And it is not just the Fed, as central bank after central bank sees their explicit activities all amount to nothing. As the eurodollar system falls, there is nothing, nor can there be anything, to offset it no matter how many trillions in idle and inert bank reserves are created. Even policymakers like Janet Yellen are starting to see the contours of this process even if it is couched in their own theoretical, mathematical way.

The question is how much more damage are we all willing to take before they eventually figure it out; assuming that they ever will or even can? As silly as I try to portray Alan Greenspan, deservedly so, in reality his myth was dangerous and destructive because it prevented the Fed and mainstream economics from progressing with the global banking and monetary system. He believed in his myth as much as the financial press did, and so he passed along to his descendants an unhealthy and unearned confidence. They were wholly unprepared for this 21st century shrinking even though it was their sworn duty (by their own self-assigned task to undertake activist management) to be.

In one sense there is the hint of optimism that they are finally starting to "get it"; but that is equally balanced by the shocking realization of how long it took just to begin the realization, and then further reduced by the fact that even if they view the global economic problem as properly monetary they will still attempt to address in the most orthodox of terms; and continue to fail some more. They are beginning to speak something other than nonsense, important stuff, but I doubt they will ever actually let themselves hear it.

Jeffrey Snider is the Chief Investment Strategist of Alhambra Investment Partners, a registered investment advisor.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; fed; investing

Long read so I'm providing a

Cliff Notes Version [MY TAKE]

Yellen has been doing a lot of talking

where is that neutral rate going and I think what you see is a downward shift

To an activist central bank, the natural rate is thought one of the few methods of calibration even theoretically available.

There are distinctions between real interest rates and nominal, as well as second derivatives - does pushing market rates below the natural rate cause prices to rise or merely accelerate from whatever level they may start from?

the natural rate had been depressed (in real terms)

policymakers are looking at their mistakes.

The unemployment rate may have dropped to what appears to be "full employment" but that is only because at least 10 million Americans are "missing"; perhaps as many as 15 or 16 million.

population, has grown by 20.2 million since the last payroll peak in November 2007. The labor force itself, at least according to the official definition, only added 4.6 million of them (and 2 million of those were in what increasingly looks like a statistical oddity at the end of last year). Because less than one in four new laborers appear to have actually entered the labor market the unemployment rate gets to be less than 5%

Despite continued claims of being the "best jobs market in decades", this was nothing like what had happened in past cycles of true recoveries.

...on August 9, 2007, as what was supposed to be implicit support yielded to explicit pleading. The private money market reacted in ways the Fed just was not prepared for (largely because they believed it all impossible). Before 2007, the Fed's whims were dutifully carried out under implicit belief in legend and myth; after 2007 they were all proved to be nothing more than that. Not only did the Fed fail to stop the illiquidity leading to panic, their balance sheet expansion has failed to do anything for the recovery thereafter.

Thus, when Janet Yellen claims the economy is strong there are only questions; when Alan Greenspan said the same twenty years ago there were only accolades and adoration.

Janet Yellen tries to speak plain and instead comes across as befuddled, confused, and, at best, unconvincing.

In one sense there is the hint of optimism that they are finally starting to "get it"; but that is equally balanced by the shocking realization of how long it took just to begin the realization, and then further reduced by the fact that even if they view the global economic problem as properly monetary they will still attempt to address in the most orthodox of terms; and continue to fail some more. They are beginning to speak something other than nonsense, important stuff, but I doubt they will ever actually let themselves hear it.

Hmm, maybe we need a short version of my Cliff Notes...

To: expat_panama

Greenspan made it look he like was in control. Now central bankers have found out that they don’t control much and certainly can’t manage the economic actions of their peeps. Dismal science, ecomomics remains.

2

posted on

06/24/2016 4:16:36 AM PDT

by

Paladin2

(auto spelchk? BWAhaha2haaa.....I aint't likely fixin' nuttin'. Blame it on the Bossa Nova...)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Alcibiades; Aliska; alrea; ...

GOODMORNINGHAPPYFRIDAY!!!!

Headline:

Brexit Wins! U.S. Stock Futures Dive, Pound Crashes To 30-Year Low

So while Brexit may be bad for journalists and the political faction that pays them the rest of us have stock futures soaring +1.81% and yesterday's gains have IBD resetting the official outlook to "market rally resumes"! Metals have already done their notching up w/ gold & silver's new highs at $1,318.30 & $17.87! FWIW metals futures see this as a metals new normal.

Reports this morning: Durable Orders, Durable Orders, ex-transportation, and Michigan Sentiment - Final.

More headlines:

To: Paladin2

That’s how the chairmen have been sounding, but I can never tell if they really believed it or were they just saying it because the press believed it.

To: expat_panama

Here is my take on it. The Fed and the central banks are like sticks trying to prop up a world-sized jellyfish. They make a move and billions of small operators flow around it to a position of their maximum advantage. The Fed and central banks are trying to manage the unmanageable. In so doing they have created a situation where an increase in interest rates to a paltry 4% would bankrupt most nations. This is because low interest rates have led politicians to print and then borrow billions for their pet projects. None of these projects pay for themselves, like a hydroelectric dam would. They are green energy debacles or social payoffs, which do nothing but create more debt and add to the burden the future must eventually pay for.

I agree that labor participation, or rather lack thereof is probably 16 million in the US alone. Much of this is caused not by the economy, but instead is an effect of countless regulations from federal and state agencies. I would like to hire an employee. But to pay the state required wages of $10 costs me about $20 per hour plus I have to spend hours and hours each year doing paperwork. If I miss one of the several required filings and payments required for the state and feds I will be fined hundreds or thousands of dollars. I simply can’t hire anybody.

Now, multiply that issue by all the people not employed.

To: expat_panama

“Janet Yellen tries to speak plain and instead comes across as befuddled, confused, and, at best, unconvincing.”

LOL, Understatement!

6

posted on

06/24/2016 5:04:09 AM PDT

by

Lurkina.n.Learnin

(It's a shame enobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Gen.Blather

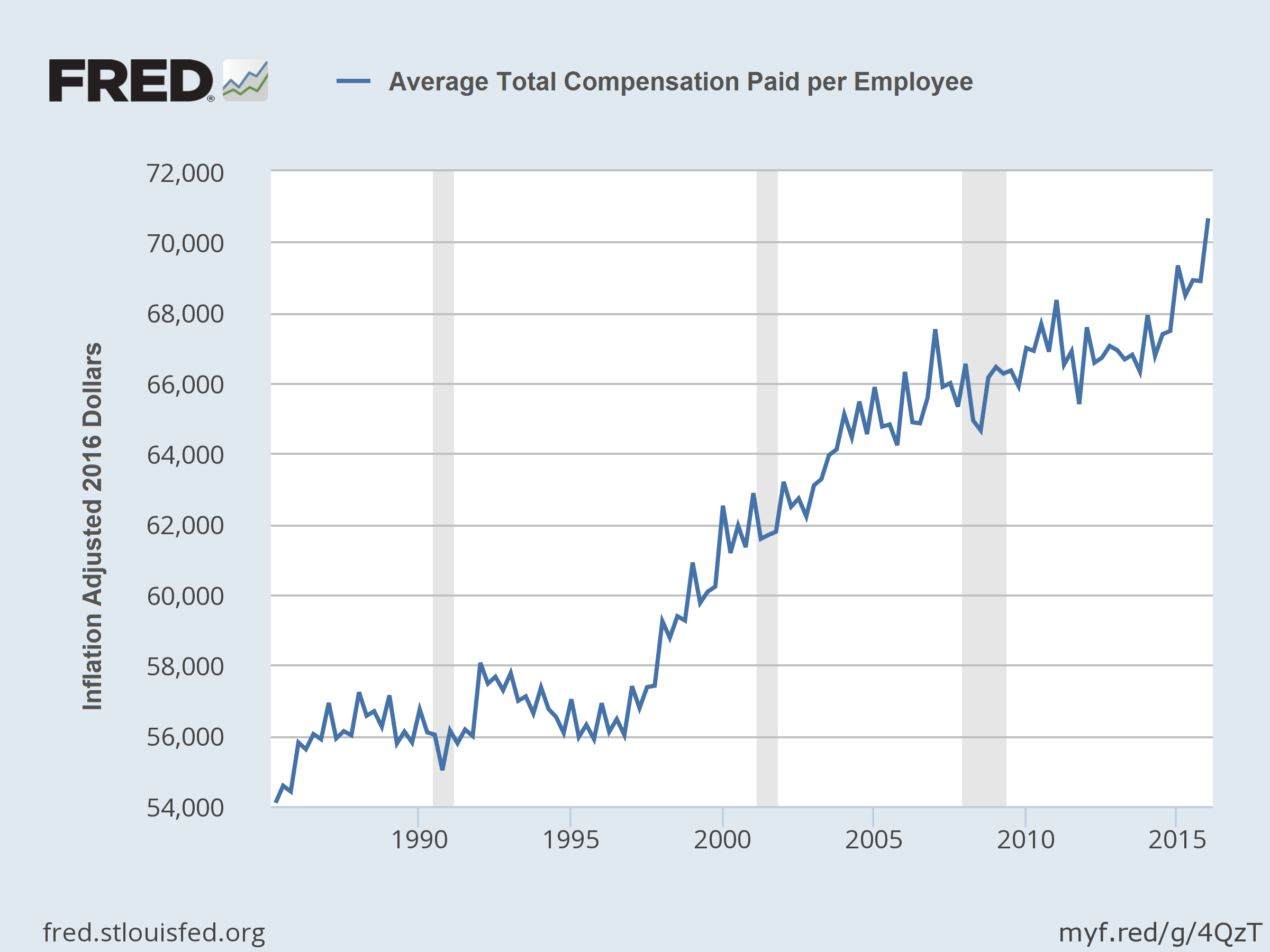

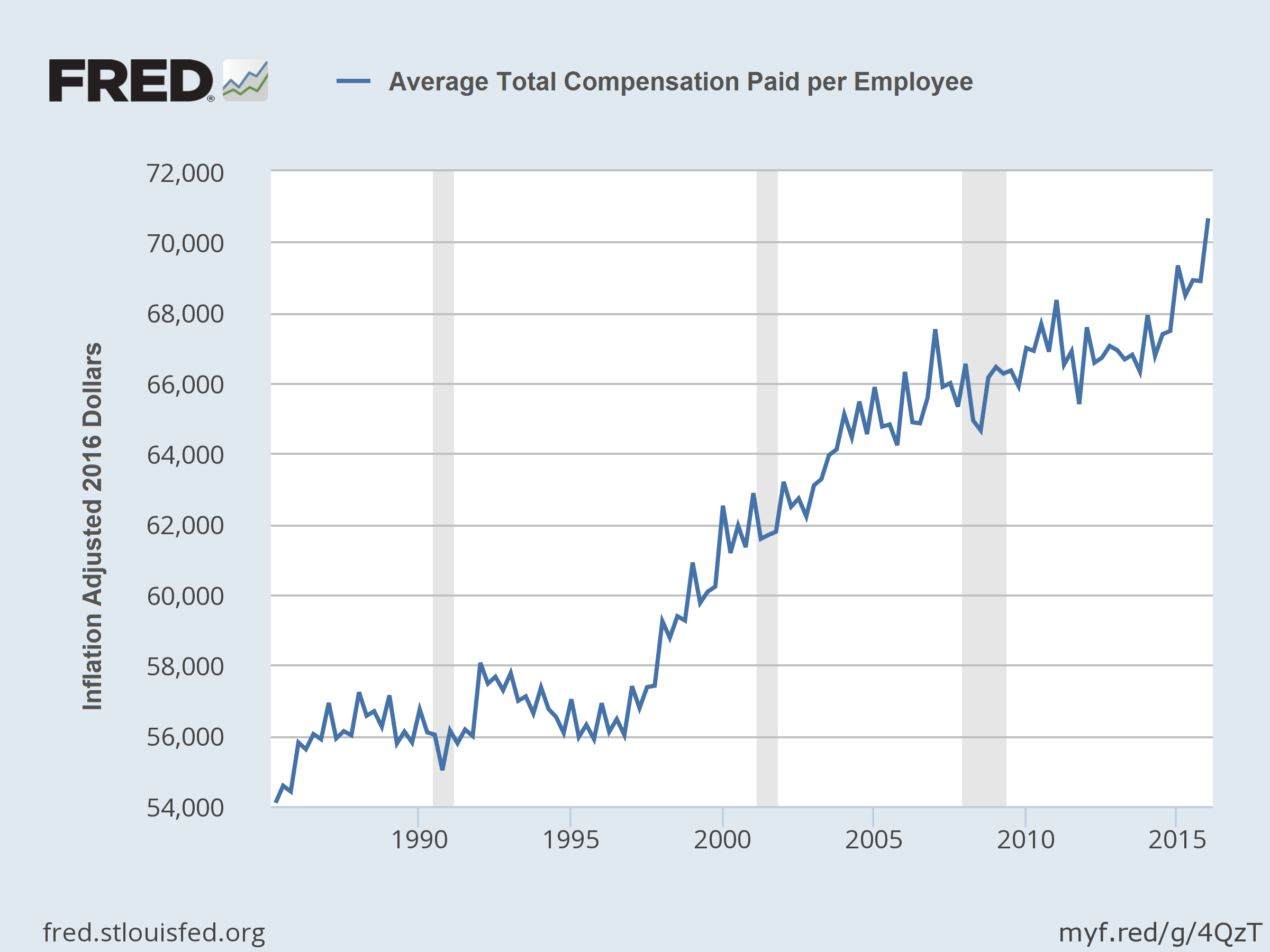

to pay the state required wages of $10 costs me about $20 per hour plusThis is the elephant in the room, the fact that the inflation-adjusted total that employers are paying is soaring even while everyone complains about mean old employers not wanting to raise their workers pay:

To: Lurkina.n.Learnin; All

...befuddled, confused, and, at best, unconvincing...She's not the only one. The stock futures at bar chart were way upbeat but right now they're crashing --just like IBD said the reaction to Brexit will be. I went and posted How Election Will Really Affect Your Investments and contrasted it w/ this mornings developements.

To: expat_panama

According to John Williams' later calculations at the San Francisco Fed, the natural rate had been depressed (in real terms) to as low as 0.27% by Q4 2010. Thus, (more) QE was necessary in awesome size in order to depress real market rates even lower in order to bring about the desired Wicksellian response. Too bad we can't dump these losers like the British dumped the EU and Trump dumped the GOPe. It is completely idiotic to believe that the "natural" rate of interest is anything other than what a free market says it should be. Sure there will be irrational exuberance affecting the rate but that quickly corrects itself.

The natural interest rate, or neutral rate as she called it, is an unobservable, theoretical interest rate that is supposed to define a long-run equilibrium that would keep the economy operating at full employment with stable inflation.

Boneheads. There's no such thing even in theory. The price of money in a free economy will rise or fall with the economic outlook. Jury rigging the rate does not change the economy or the outlook, it merely distorts the economic signal that the market rate would have provided. So intead of the necessary deflation or inflation or whatever the economy needs at the moment the rates cause the perversely opposite effect.

In 2008 we needed rates to rise substantially to unwind the bubble quickly and efficiently. Instead the idiots lowered rates which cause the unwind to continue to the present day and beyond. It is in slow motion preventing the subsequent recovery.

9

posted on

06/24/2016 9:13:29 AM PDT

by

palmer

(Net "neutrality" = Obama turning the internet over to foreign enemies)

To: expat_panama

10

posted on

06/24/2016 1:57:51 PM PDT

by

cherry

To: palmer

Idiots arrogantly think they can control it all.

They have overcontrolled and set up a crash condition.

11

posted on

06/24/2016 8:33:15 PM PDT

by

Sequoyah101

(It feels like we have exchanged our dreams for survival. We just have a few days that don't suck.)

To: Gen.Blather

Paperwork and fines for one or a few days late on a ZERO dollars due report. Tell me about it.

Im closng the doors on my business soon.

12

posted on

06/24/2016 8:37:09 PM PDT

by

Sequoyah101

(It feels like we have exchanged our dreams for survival. We just have a few days that don't suck.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson