Skip to comments.

Donald Trump, The Gold Standard, Maynard Keynes, And Our Madmen In Authority

Forbes ^

| Jun 5, 2016

| Ralph Benko

Posted on 06/06/2016 4:56:40 AM PDT by expat_panama

Today, June 5th, is the anniversary of the birth of John Maynard Keynes, once upon a time the great foe of the gold standard. Today also, coincidentally, happens to be the anniversary of the date celebrated of FDR’s “taking America off the gold standard.”

These events are not mere historical curios. The current presidential campaign, and underlying political climate, shows we are finally, maybe definitively, emerging from the academic economists’ anathema on the gold standard...

...Trump, the presumptive GOP presidential nominee, is on record as strongly appreciating the gold standard...

...The “interwar gold standard” in fact was a barbarous relic. It very likely was the main cause of the Great Depression.

The classical gold standard had closed shop in August 1914 and was innocent of causing the Depression. FDR in no way took America off the gold standard. Unschooled in economics, he may well have believed that he did. But that doesn’t make it so. As a 2011 Congressional Research Service report noted, “Under the system adopted by the Gold Reserve Act of 1934, the United States continued to define the dollar in terms of gold.”...

...FDR ignored the conventional wisdom of his Washington and Wall Street experts. He followed the advice of agricultural economist George Warren, the greatest expert in commodities prices of his day, who called for rebooting the system by revaluing the dollar to $35/oz as the slow erosion caused by the “interwar gold standard” required.

FDR set the gold standard back to rights, if temporarily. The economy soared.

Alas, FDR did not have a firm grasp ...

...mass confusion ended up giving the gold standard pariah status. Now it is re-emerging from the misconceptions and myths that have enshrouded it for four score years.

(Excerpt) Read more at forbes.com ...

TOPICS: Business/Economy; News/Current Events; Political Humor/Cartoons

KEYWORDS: auditthehead; dismalscience; economy; fdr; georgewarren; gold; goldbugs; goldstandard; investing; johnmaynardkeynes; keynesianeconomics; ntsa; nuttery; tinfoiledagain

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-42 next last

To: abb

A gold standard prevents an excessive growth of the money supply and the resulting devaluation of the dollar.

21

posted on

06/06/2016 7:54:53 AM PDT

by

Pelham

(Barack Obama. When being bad is not enough and only evil will do)

To: Lurkina.n.Learnin

22

posted on

06/06/2016 7:58:31 AM PDT

by

Pelham

(Barack Obama. When being bad is not enough and only evil will do)

To: expat_panama

I am all in favor of an “expanded” gold standard, that could be called a “precious metals” standard.

Gold is lovely stuff, but there just isn’t enough of it, which makes it both a volatile and fragile market. However, if you combine other precious metals in the same monetary regime as gold, you get lots of added value.

While each metal still floats in its own market, their interchangeability with each other stabilizes all of them. For example, say the price of Rhodium suddenly skyrockets. You can take advantage of that jump by selling your Rhodium and buy more stable Palladium. That is, you are much less hesitant to profit-take

If you think about it, you could even include valuable metals like various kinds of stainless kept in good condition after processing.

America also has boucoup copper, silver, and aluminum. And last but not least, having all this metal as currency makes it the equivalent of a strategic reserve.

23

posted on

06/06/2016 8:06:04 AM PDT

by

yefragetuwrabrumuy

("Don't compare me to the almighty, compare me to the alternative." -Obama, 09-24-11)

To: expat_panama

It is my understanding based on one of Ayn Rand’s books that Britain tried to remain on the gold standard after WW1.

To help the Brits, America adopted a low interest rate policy.

The low interest rates of the 1920’s produced a tremendous boom. The introduction of massive consumer credit availability, cars, radio and electrical appliances also helped make America boom.

Booms are always created by busts. Why?

Prices get too high during booms. People stop buying because they are priced out or realize the prices are unreasonable. Then construction and production workers lose jobs - this make boom prices seem and be even more absurd.

Things get restored by corrections. Stock markets adjust within about twelve months. Real estate markets can take years or even a decade to adjust.

There is also a product durability factor. The new cars and radios bought in the 1920’s continued to function in the 1930’s and through WW2.

[The car manufacturers in the 1970’s thought they found a way around the product durability factor. Honda and Toyota taught the US carmakers a lesson by 1980.]

A new generation after WW2 was ready to buy cars and houses for itself, so the civilian economy recovered.

The way to manage an economy is to pull the interest rate punch bowl away as soon as the party gets into the swing.

To: Pelham

He was married to a Russian ballerina He never had sex with her. He was too busy drilling little boys.

To: ROCKLOBSTER

In addition to media putting the sheople to sleep, there is also the drugs that amazingly end up in small towns.

26

posted on

06/06/2016 8:12:10 AM PDT

by

huldah1776

( Vote Pro-life! Allow God to bless America before He avenges the death of the innocent.)

To: expat_panama

A gold standard isn’t really possible in a world with seven billion people.

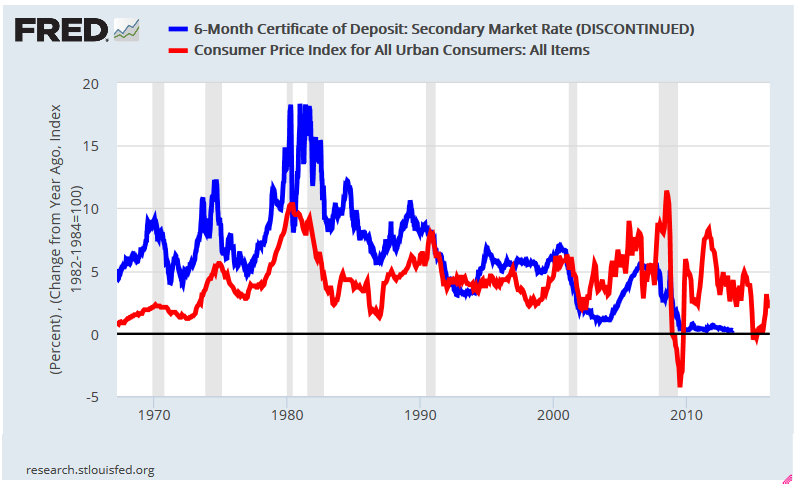

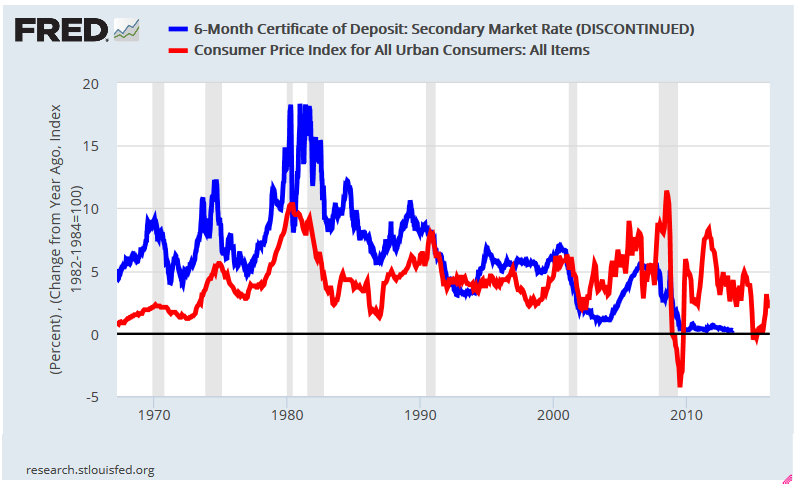

As a money holder, what I look for is bank interest rates that exceed in-store inflation.

If the local banks pay ~1% or less on CDs and grocery stores raise their prices by about 5% a year, the money stinks.

If there is a real chance an Obama or Hillary can stay in office for eight years, I’ll not trust the money.

Anybody who buys a 10-year 1.79% bond is a fool. At no time in my life did prices rise by less than 1.79% over a ten-year period. And that doesn’t factor in the harmful impact of taxation on the interest paid.

To: crz

28

posted on

06/06/2016 8:27:56 AM PDT

by

jcon40

To: Ethan Clive Osgoode

29

posted on

06/06/2016 8:45:41 AM PDT

by

Pelham

(Barack Obama. When being bad is not enough and only evil will do)

To: Brian Griffin

I look for is bank interest rates that exceed in-store inflation.Of course you wouldn't want to hold your breath on that.

that.

It used to be that way 25 years ago back when banks needed money (and even that was an aberration), but for the most part since then banks were just not a place to put your money for the sake of earnings.

These days folks we run into who expect to create wealth with their bank deposits are poor sots who haven't a clue how to handle money.

To: Lurkina.n.Learnin

...supposed to blame Nixon for taking us off the gold standard.--or FDR depending on your politics and gold preference, the entire process took a long time from '14 to '72 with the biggest jumps in '33 and '72. This writer's notion that FDR put us on the gold standard was a new one for me. Sounds like something from Orwell's 'Ministry of Truth'.

To: Pelham

Correct, succinct explanations in posts 21 & 22. Thank you.

32

posted on

06/06/2016 12:40:18 PM PDT

by

goldbux

(When you're odd the odds are with you.)

To: yefragetuwrabrumuy

It’s been done before under bimetallism, with silver and gold being monetized.

That just complicates things and creates arbitrage issues. A basket of metals would be even more difficult. You don’t really need a lot of underlying specie to make the gold standard work, you just have to peg the dollar to it at some set price.

There was very little gold in the Treasury when Alexander Hamilton pegged the dollar to gold. As long as you guarantee convertibility it stabilizes and anchors your money.

33

posted on

06/06/2016 1:16:48 PM PDT

by

Pelham

(Barack Obama. When being bad is not enough and only evil will do)

To: Brian Griffin

“It is my understanding based on one of Ayn Rand’s books that Britain tried to remain on the gold standard after WW1.”

Britain attempted to return the Pound to “parity”, it’s pre-War price in gold. This was deflationary. They would have been wiser to peg it to it’s lower current market valuation instead.

“Booms are always created by busts. Why?”

Austrian School theory is because the booms are the result of artificially low short term interest rates that spawn them. I think I’d go with more of a Real Business Cycle theory explanation which I suppose could include the Austrian School explanation.

34

posted on

06/06/2016 1:24:21 PM PDT

by

Pelham

(Barack Obama. When being bad is not enough and only evil will do)

To: Brian Griffin

“A gold standard isn’t really possible in a world with seven billion people.”

Yeah it is. You aren’t backing your entire money supply with gold. A large portion of the money supply under the gold standard was always “bank money” aka “credit money”. A gold standard just sets a peg at which the dollar is valued making excessive creation of new money impossible. You don’t get the constant erosion of the value of the dollar that we experienced after Nixon closed the gold window.

35

posted on

06/06/2016 1:28:16 PM PDT

by

Pelham

(Barack Obama. When being bad is not enough and only evil will do)

To: jcon40

” but pins some other presidential assassinations to the same cause”

Pure kook conspiracy nonsense. US Notes were nothing more than Lincoln’s Greenback issue carried forward on the books of the Treasury and the Bureau of Printing and Engraving.

There used to be a valid distinction between Silver Certificates and US Notes, US Notes being entirely fiat. When American minor coinage had the silver removed and Silver Certs were called in the distinction between Silver Certs, US Notes and Federal Reserve Notes became moot.

And this decision was made by Congress and the President, not the Federal Reserve who had no such authority.

36

posted on

06/06/2016 1:35:30 PM PDT

by

Pelham

(Barack Obama. When being bad is not enough and only evil will do)

To: expat_panama; Lurkina.n.Learnin

FDR changed the nature of the gold standard rather than ending it. The public could no longer exchange dollars for gold but governments could.

The distinction is often made as one of the Gold Standard before FDR, the Gold Exchange Standard after 1933.

All of it ended with Nixon in 1971. But that came after a long period of monetary policy trouble due to a phenomenon known as the Triffin Dilemma which began with Eisenhower’s Presidency. We needed to cut the dollar loose from being the world’s reserve currency.

37

posted on

06/06/2016 1:41:43 PM PDT

by

Pelham

(Barack Obama. When being bad is not enough and only evil will do)

To: Pelham

thanks for response

38

posted on

06/06/2016 2:01:10 PM PDT

by

jcon40

To: jcon40

39

posted on

06/06/2016 4:34:26 PM PDT

by

Pelham

(Barack Obama. When being bad is not enough and only evil will do)

To: Pelham

That’s pretty much my understanding too. Along w/ that the Fed came into its own w/ the FOMC and the lessons it learned about money supply in ‘29.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-42 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

that.

that.