Skip to comments.

Markets At Crossroads: Huge Moves Brewing In Stocks And Gold

Barchart ^

| May 05, 2016

| Taki Tsaklanos

Posted on 05/06/2016 4:50:52 AM PDT by expat_panama

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-35 last

To: gloryblaze

(.....There is absolutely nothing wrong with holding cash, now, then, forever.)

That’s a good recipe for losing buying power.

Seems like those who have been holding gold since forever did much, much better.

The economy is weaker than they are disclosing. Both the right (Trump) and the left (Yellen) don’t seem to be too keen on increasing interest rates. In a negative interest rate environment gold is king. As the supply of gold decreases, and it is expected to decrease as there hasn’t been much investment in exploration since forever, the price of gold will increase. Over the long run. Who knows what the short term fluctuations will look like.

To: expat_panama

....cash is stupidHey, I resemble that remark! Seriously, though, I've seen that chart a thousand times. But always it is at a specific moment, of course, and at that moment, is it a good time? Like right now? I'm really not stupid, but I'll still hold on.

To: expat_panama

If we lived for centuries, that would apply.

There are times when having cash to buy bargains can create tremendous gains. There are times when we perceive stocks to be “bargains” and those are the times usually create the biggest and most horrific losses.

To: expat_panama

24

posted on

05/06/2016 7:21:52 AM PDT

by

DCBryan1

(No realli, moose bytes can be quite nasti!)

To: expat_panama

Good analysis. I just don’t agree with it based on fundamentals. It all centers around the US$. If your theory of the US$ doesn’t pan out, everything else becomes the opposite, except the stock market which actually will do terribly if the interest rates rise and the US$ strengthens.

The only reason the US$ has increased in the last few years was in the erroneous belief that interest rates in the US are going to rise. The market kept expecting that quarter after quarter, year after year. And throughout that period the US$ kept strengthening and gold kept plunging. As the market realizes that higher interest rates are not coming, both will revert back to their levels before this erroneous expectation took hold. That means gold will be way higher, and the dollar will be way lower.

To: gloryblaze

I have all my clients in 10-20% cash right now. (actually, they are in US Treasury notes and strips).

26

posted on

05/06/2016 7:23:03 AM PDT

by

DCBryan1

(No realli, moose bytes can be quite nasti!)

To: Attention Surplus Disorder

If we lived for centuries....[WARNING: REPLY IN KIND]

What, you don't live hundreds of years? Wow, you poor poor darling.

Back to Planet earth.

A normal retirement savings span is say 40 years. You're the smart one, you tell me which 40-year span is the one that would have been bad for stocks and great for stupid cash? Yeah, sure there can be say a year or two that stocks are bad and if we only lived a year or two then you'd be right.

To: expat_panama

No need to be condescending. Easy enough. There are many of them.

1915 > 1942

1916 > 1948

1915 > 1942

1915 > 1943

1927, 8, or 9 > to 1973 or 1975 or 1977 or 1978 (that’s 3E4) which is 81 instances.

So there are 85 examples for you.

To: expat_panama

an I assume that chart is “normalized” for inflation?

To: Ghost of SVR4

“I see one last smack down coming for PM’s before the banks can no longer manipulate and control and PM’s take off in value/price.”

I sure hope so! I’ve been waiting 14 years for this! :)

30

posted on

05/06/2016 10:13:57 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: Attention Surplus Disorder

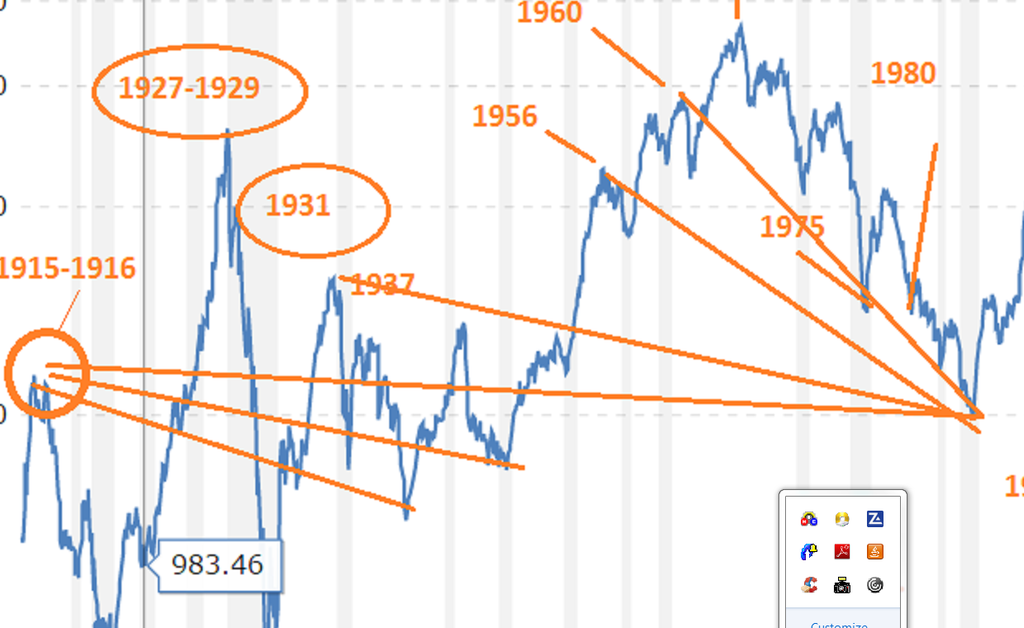

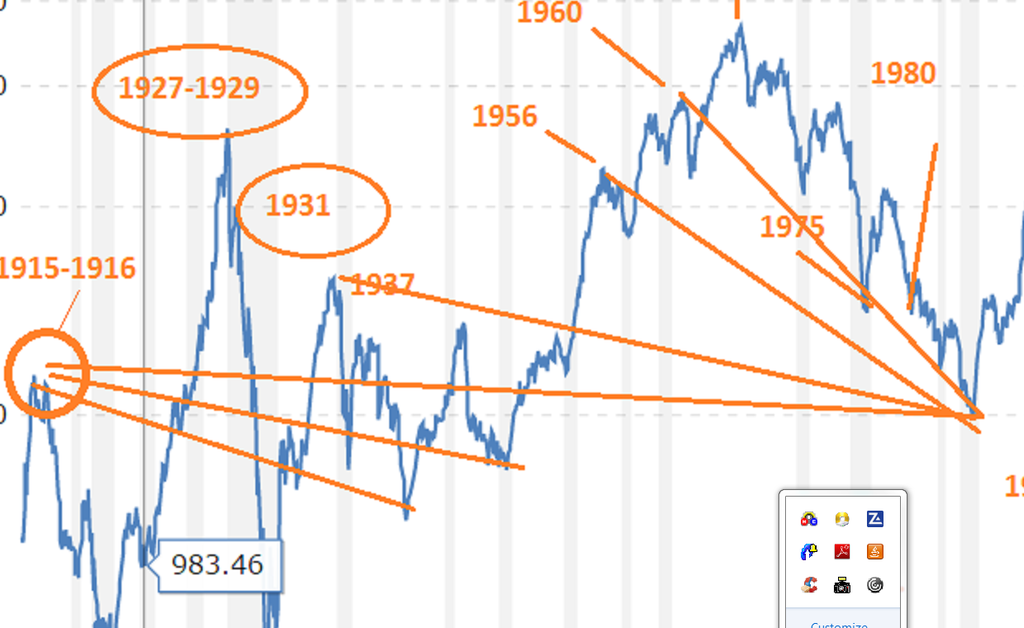

Here, in picture form.

There are many, many 20 and 30 and 40 year and even 50 and 60 year periods where the market experienced losses and some cases ghastly losses. One could not invest in the "DJIA" back then because there were not etfs, nor were there retirement plans, lifespans were shorter (so the "40 year" arbitrary benchmark applies somewhat less) and the DJIA also has "survivor bias", which means (as you surely know) that your investment in Eastman Kodak or Bethlehem Steel (once the largest company on the NYSE), or even GM for that matter which go to zero are replaced by something else.

To: DCBryan1

JC PENNY TAKING Emergency measures...Huh, now I seem to be hearing this everywhere. Got it from you first, tx!

To: mad_as_he$$

“normalized” for inflation?You're right to be concerned w/ inflation w/ investment planning.

Down in the lower right hand corner of the numbers is a grey line labeled "cpi" --the consumer price index.

It shows that a one dollar purchase in 1800 of the standard market basket of the index would be worth about $16 in current dollars.

We get an idea of the last 40 years of returns by seeing how that time-frame shows a tripling of inflation, a 20-increase in the price of gold, and a 10,000% increase in sales price of a bunch of Dow Jones stocks + dividends.

Since the past four-decade returns has been fairly typical of what we've had over the past two centuries it's reasonable to plan that the next 40 years can be much the same.

To: Attention Surplus Disorder

I will add one last comment on this topic.

From the chart I posted, one can see several things but one thing that is painfully obvious.

To invest long after a robust recovery, at an apparent “peak” into a period of war can be horrific. The absolute worst.

1914-1915 > 1918

1937 > 1942

1965 > 1972

Over and above the chestnut of “dca”, these are jaw-dropping ghastly losses. Sure, if you can stomach them, there is sweetness and light on the other side on a near-infinite timespan.

The market has tripled since SP 666 March 2009. Traders have been betting that rates will rise since “they can’t go any lower”. Those traders have been obliterated over the past 2-3 years. Murdered.

Now we have the concept of negative rates = NIRP. This is a synthetic construct. Nobody knows how stocks will perform under such conditions. Good div payers *should* do well. But there are many shoulds that do not turn out as expected.

To: expat_panama

why even look at the US market?...ex pats should invest in the country they call home...the USA is apparently not your home...

35

posted on

05/06/2016 11:52:28 PM PDT

by

cherry

Navigation: use the links below to view more comments.

first previous 1-20, 21-35 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson