Skip to comments.

This Is The Start Of The Selloff, Not The End

BI - Bonner And Partners ^

| 8-27-2015

| Bill Bonner

Posted on 08/27/2015 3:15:14 PM PDT by blam

Bill Bonner, Bonner and Partners

August 27, 2015

BALTIMORE, Maryland – Is Donald Trump broke yet?

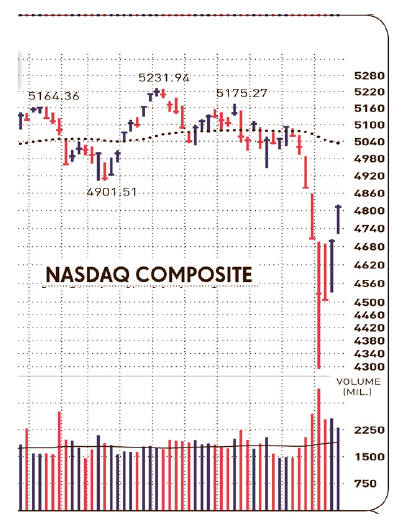

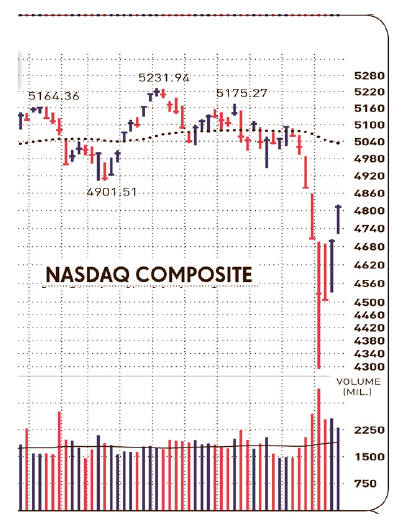

We don’t know. But at the end of the first quarter, investors held about $24 trillion in stocks. Stock prices are down about 10% since then… leaving the rich $2.4 trillion less rich.

Government bonds have generally gone up. Junk-grade corporate bonds have gone down.

And real estate?

It takes longer to react. Real estate is not “marked to market” immediately. Buyers and sellers discover prices slowly.

Phony Wealth

The “wealth” created in Stage III of the U.S. credit boom was largely phony. It came as the Fed dropped the price of money to zero.

Underpriced credit gave the gamblers, schemers, and cronies the wherewithal to manipulate markets and bid up their own assets.

But now…

(snip)

(Excerpt) Read more at businessinsider.com ...

TOPICS: News/Current Events

KEYWORDS: economy; investing; markets; stockmarket; stockmarketcrash; stocks

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41 next last

To: ForYourChildren

21

posted on

08/27/2015 4:00:08 PM PDT

by

shibumi

("Have you driven a Fnord lately?")

To: Hugin

So, if they or you bought Cisco at $80 a share in 2000 and they/you still hold those shares at todays price of $26 a share, are you saying that you/they haven’t lost money?

22

posted on

08/27/2015 4:08:29 PM PDT

by

Zeneta

(Thoughts in time and out of season.)

To: blam

If you predict doom every year, one year you will eventually be sort of right. But some of us will remember you were wrong for seven years.

To: Lurker

that’s why they call it investing, and not printing money.

24

posted on

08/27/2015 4:49:06 PM PDT

by

C. Edmund Wright

(WTF? How Karl Rove and the Establishment Lost...Again)

To: Zeneta

ah, mark to market....the real stinky and secret culprit of the economic crash....a cancer from the despicable Sarbanes Oxley bill.

25

posted on

08/27/2015 4:50:05 PM PDT

by

C. Edmund Wright

(WTF? How Karl Rove and the Establishment Lost...Again)

To: wideawake; blam

Everything is relative.

I am not a fan of either Gold or Silver.

When or if the SHTF, I want US DOLLARS !!!

And lots of them.

Not in a bank, but in my hands.

26

posted on

08/27/2015 4:51:48 PM PDT

by

Zeneta

(Thoughts in time and out of season.)

To: C. Edmund Wright

“Mark to Market”, where tax codes meet reality and distort the public’s perception of wealth.

27

posted on

08/27/2015 4:56:38 PM PDT

by

Zeneta

(Thoughts in time and out of season.)

To: Zeneta

Only if you sell it. If you planned to hold it anyway, it’s just on paper. But in the meantime it’s still paying you dividends. You still own an asset that’s putting money into your pocket, which is the only real definition of an asset anyway. As for stocks that don’t pay dividends, to me that’s gambling, not investing.

28

posted on

08/27/2015 5:03:01 PM PDT

by

Hugin

("First thing--get yourself a firearm!" Sheriff Ed Galt)

To: C. Edmund Wright

BTW, it was really the repeal of Glass-Steagall under Clinton that has caused this mess we are in.

The Banks wanted to be Brokers and the Brokers wanted to be Banks and Glass-Steagall kept them apart.

29

posted on

08/27/2015 5:05:46 PM PDT

by

Zeneta

(Thoughts in time and out of season.)

To: Hugin

You seem to be well meaning but actually have absolutely no clue.

Try to get a loan on your “Stock” you bought at $100 that is now trading at $5.

Dividends?

Do you have any fundamental understanding of the difference between Debt and Equity?

30

posted on

08/27/2015 5:15:16 PM PDT

by

Zeneta

(Thoughts in time and out of season.)

To: wideawake

"If you predict doom every year, one year you will eventually be sort of right. But some of us will remember you were wrong for seven years." I just post articles. I've never made any predictions. Albeit, I believed many of those articles and do feel a little foolish now.

The S(will)HTF before everything eventually 'rights'itself.

It's just a matter of when.

If it's necessary for you to say that I was wrong and you were right, then, go ahead, I probably have 'it' coming.

31

posted on

08/27/2015 7:25:03 PM PDT

by

blam

(Jeff Sessions For President)

To: wideawake

32

posted on

08/27/2015 7:27:09 PM PDT

by

blam

(Jeff Sessions For President)

To: blam

There will be a flight to quality in the stock markets as investors get more conservative. Real estate will respond to market pressure primarily location also

I do not see a huge market crash coming. A caveat. If the Fed raises rates now the economy will contract

33

posted on

08/28/2015 3:31:22 AM PDT

by

Jimmy Valentine

(DemocRATS - when they speak, they lie; when they are silent, they are stealing the American Dreaml)

To: Zeneta

Glass Steagall was a factor, but not the factor Sarbanes was, nor the factor the Community Reinvestment Act was - not the factor the oil shock was (gas went up 2 bucks a gallon in just a matter of months, tipping all narrow margin family budgets into the tank).

All of those were underlying macro economic cancers. Glass Steagall certainly spoke to contagion however.....along with the realities of international banking, which was going to happen with or without Glass.

34

posted on

08/28/2015 3:55:46 AM PDT

by

C. Edmund Wright

(WTF? How Karl Rove and the Establishment Lost...Again)

To: Zeneta

“Mark to Market”, where tax codes meet reality and distort the public’s perception of wealth. Not sure I see where you're going with that...but I'd say mark to market is where the theoretical is assumed to be the now reality - and distorts a bank's financial stress test.

35

posted on

08/28/2015 3:59:09 AM PDT

by

C. Edmund Wright

(WTF? How Karl Rove and the Establishment Lost...Again)

To: Zeneta

When or if the SHTF, I want US DOLLARS !!! When the S really does HTF, what makes you think USD will be worth anything?

36

posted on

08/28/2015 4:01:08 AM PDT

by

ShadowAce

(Linux - The Ultimate Windows Service Pack)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Good morning campers! It's sure been a lovely rebound but fading volume means something. Today that something is index futures at -0.70% while metals are staying flat/soft at-0.10%. On top of that we got to put up w/ this stuff:

8:30 AM Personal Income

8:30 AM Personal Spending

8:30 AM PCE Prices - Core

10:00 AM Michigan Sentiment - Final

Seems we really do live in interesting times....

To: RoosterRedux

It's getting stronger (slowly but surely).And yet we see reports that the home-ownership rate is at a 50-year low.

38

posted on

08/28/2015 5:34:38 AM PDT

by

IYAS9YAS

To: IYAS9YAS

I do market conditions studies weekly and see the uptick.

That said, we do hear that millennials prefer to rent and probably do not have enough money to buy a home anyway.

When I say the market is improving slowly, I mean this improvement has only begun to appear in the last couple of months.

And, of course, we hear that housing starts are at an 8 year high (which would take us back to 2007).

This uptick is tenuous at best. But the demand is strong and the supply is weak.

In general, the economy is solid (not strong, just solid) because Obama has held back growth. It would like to grow, but impediments like Obamacare and threats of a rise in minimum wage prevent that.

If we get a Republican President, it will take off.

39

posted on

08/28/2015 5:57:58 AM PDT

by

RoosterRedux

(First they ignore you, then they laugh at you, then they fight you, then you win. Mahatma Gandhi)

To: RoosterRedux

But the demand is strong and the supply is weak.It's just weird everywhere. One thing I did note. I was talking to my dad a few days ago about the housing market back up in my home area (Nampa, Idaho). He said the house they're currently living in has nearly doubled in value (he bought it in 2010 at around $60,000) because all the local builders shifted their price points up because they were building fewer homes. So those wanting to buy, but not having 200+ thousand or unable to qualify, are buying the older, smaller homes. His $60,000 purchase is now worth well over $100,000. He also said most of the homes around him that have sold recently were to investors looking for low-cost rental properties. Rents are treble what the mortgage would be on something like that.

40

posted on

08/28/2015 6:25:49 AM PDT

by

IYAS9YAS

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson