Posted on 01/14/2015 5:41:59 PM PST by SkyPilot

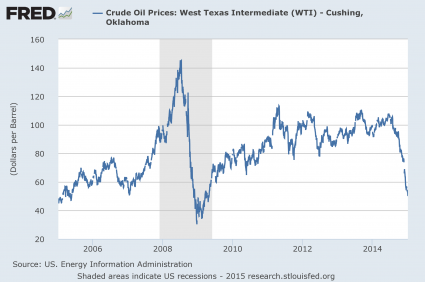

If you were waiting for a “black swan event” to come along and devastate the global economy, you don’t have to wait any longer. As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression. But following the financial crisis of 2008, the price of oil rebounded fairly rapidly. As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get. At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before. So let’s hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

(Excerpt) Read more at seekingalpha.com ...

Keep an eye on capital expenditures.

If you see Caterpillar, Schlumberger, and other BIG capital expenditure companies hurting, that is where the rest of the economy will start to slow down.

I think, at BEST, we are headed for another recession. But I personally think it will be a lot worse. We just do not have the method of stimulating any more.

But the guys having to take a $50 loss on each barrel they deliver are just going to shake it off?

Someone is paying the piper. We just haven’t figured out who yet.

You might want to start by looking at who got screwed with the Swiss Franc move last week. That could very well be the Black Swan no one saw floating down from the sky.

Bad guys got hurt, good guys made money, how evil!

.

This is a combination of a few things. Yes, it is manufactured in the sense that the Saudis are not adjusting the way they have in the past.

The fracking from the US has increased supply.

The consumption of oil is down.

Supply and demand. And if it costs you a lot to supply...tough luck.

Its happening too fast. The decreases have not had a chance to make it into the pipeline yet.

Large transport companies hedge their purchases at least a quarter or two in advance. That means that big fuel users are STILL paying higher prices because that was their contract.

The same with the frackers and what not. They, like farmers, are selling their “crop” in advance. Then they take insurance out in case there is a problem. Those derivatives are going to be the problem.

No I don't, but I am sure you are an expert on everything. By all means, continue.

Mark your post an come back to see if its true in six months.

I disagree with your optimism. But we will see.

The question has been answered by others.

Inflation and the cost of capital is one answer.

But, read the other answers on the thread. There are some really smart folks here. But to assume that the way things were thirty years ago are constant is just not a practical way to look at things. Think about how you do everything today compared to thirty years ago. Has it changed? Is it more simple, or more complex.

The financial world rarely moves in a straight line.

Well, I guess there is Investing, Hedging and Gambling.

Thank you

Exactly. And you are right, it could easily get that bad that fast.

You are one of the more astute Freepers out there.

Governments seek inflation to remain in power, but unless you are living on “other peoples money,” inflation is bad for individuals.

Deflation is good for those that live wisely, and disaster for those that live foolishly.

Falling prices are good for consumers, and bad foe tax collecters.

Let the cry babies cry, I’m ready for a solid round of deflation, so that I can sell my gold to the banks at my terms when deflation has them in freefall.

.

Why would you sell you gold to a bank, in a collapsing market? For what, in return? Just asking? Thanks.

401Ks do not get cut by falling prices.

The wise never got into 401Ks, but their buying power will rise if prices fall.

The insanity of electric cars, and rolling hazardous waste called hybrids is in for a well deserved crash, but that is good for the stability of our power grid and the morality of our society.

Here in California, all of the public schools will end up having to close due to the foolish deals they cut with solar bushwackers, but that is good for families and especially the kids that will not have to suffer through homo-indoctrination, and Common core diseducation.

I see this all as a big win for sensible people.

.

As the market collapses, the banks need for gold will rise exponentially, and the price thereof too.

That is why holding gold is solid for both inflation, and deflation.

.

I’ve always enjoyed your posts, one way or the other. Regardless, when a real market dies- it is dead. The paper no longer amounts, real value has the line. Now, who has the line? I like your optimism, as to holding markets. Yet, in a real life collapse danger- trade value is very local and fatal. Get your actual gold, in your physical control.The hard year is upon us. Take care. All the best to you and yours

“I am not saying it will, but consider if we have another Lehman situation.”

Lehman went under because they had held on to some of the crappy mortgage paper that they had been cranking out. Poetic justice. No one writes that paper anymore because no one will buy it. We won’t have “another Lehman” for 70 years, the same amount of time it took for everyone to forget what Glass and Steagall knew.

“what will the Fed do? All of their ammo has been shot without great results.”

They prevented a banking collapse like we experienced over 1930-33. That time we had a 30% collapse of the money supply.

“Are they going to drop their rates under zero? Or are they going to print more money?”

If it’s a systemic problem they will buy bad assets to keep the banking system alive. If it’s not they let banks fail and roll the remaining assets into a healthy bank.

“Too many people took out too much risk. For the average Joe on the street....they will not know what hit them when their jobs disappear and their 401ks are cut by 80%.”

Risk got wrung out of the economy with the collapse of the housing bubble. There’s nothing close to that going on right now.

“Its the folks who took their margins to the limits to invest in oil, thats who is going to get hurt. “

Happens all the time in the commodities market. People who need to hedge their product have a reason to be there, everyone else is gambling. Anyone who does it on margin is a fool. Fools like that are a minute fraction of the number of homebuyers, which is why the housing bubble was a far greater problem.

“They will dump their assets to cover their debt. That will cause more deflation. And it starts a horrible spin out of control.”

They already had to put up collateral to cover their position. They will lose those assets. That’s not deflation. Deflation is a banking phenomenon where the money supply contracts because the assets underlying the banks’ loans disappear. Like when millions of mortgages default.

“The drop in oil will cause the Russians to pull some junk in Europe with gas.”

I have no idea what “pull some junk” is supposed to mean.

“The “majority” of the world does not have to own high yield bonds for the world to turn upside down.”

Actually they do. There was something on the order of $62 trillion floating around the world in credit default swaps alone at the top of the housing bubble.

401Ks do not get cut by falling prices.<\i>

I believe The point of some of the economic analysts is that falling oil prices can lead to a collapse of junk bonds in rapid succession, and a collapse of junk bonds at the present time will completely tank the rest of the markets.

The current US Depression (and yes I too believe we are in one) has been masked by EBT and debt.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.