Posted on 01/14/2015 5:41:59 PM PST by SkyPilot

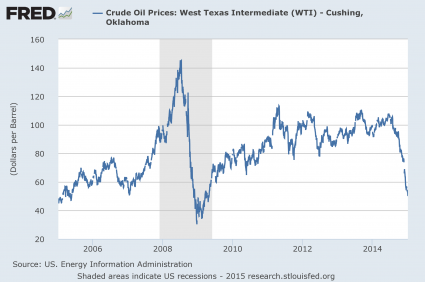

If you were waiting for a “black swan event” to come along and devastate the global economy, you don’t have to wait any longer. As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression. But following the financial crisis of 2008, the price of oil rebounded fairly rapidly. As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get. At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before. So let’s hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

(Excerpt) Read more at seekingalpha.com ...

Universities are no more than cash cows forgovernment money laundering.

Good quote, nice catch.

But the risk from central-bank involvement and sudden moves by motivated central bankers has been there ever since James Baker arrived at Treasury in 1987. Six months later he had a spat with the German bankers, and the market crashed.

Wall Street insiders, as you pointed out, have been playing the "Greenspan put" ever since.

We’re all gonna die. Film at 11.

I've been following the financial markets for the past 35 years.

I can't remember a time when someone wasn't preaching the world would end tomorrow.

All of this is political, not economic. If you are Saudi Arabia, and you had Russia and Iran gearing up to destroy you, and you had this weapon at your disposal, would you use it?

The Saudis are doing this on purpose, and its political.

ROFL!!!

I don't know if there's ever been a credible economic study that filtered out all other factors. You also have to ask, compared to what?

There's no doubt that $140 oil was a drag on the economy, especially considering how much of that oil was imported. The domestic production boom has been doubly stimulative in that it has decreased the world price of oil and kept more $$$ at home. Win-win.

Some estimates put the effect on the economy at 2% additional GDP growth from jobs alone. As far as the favorable effect of lower costs and lower balance of payments, who knows?

One of the shortcomings of the "Science of Economics" is that it just speaks to that which can be reasonably measured. If economics can't (or, in some cases, won't) measure activity, we're left to our theoretical knowledge to make our best judgment. The quality of our theoretical framework will determine the quality of the judgment.

The effects upon the industry are comparatively easier to measure. Layoffs can be tracked. Payments to vendors and other components can be measured.

It's harder to measure the effect lower prices has on small business not directly affected. Lower business at restaurants across from facilities is probably offset by higher business at other restaurants.

Manufacturing has become much more competitive. Small businesses such as mine are making buying decisions for the next year based upon projected fuel costs.

Negative effects can be easily measured because they are localized. Positive effects are much more diffused and harder to recognize and measure.

It doesn't mean they don't exist, or that they are not substantial. There's no doubt it's incredibly disruptive.

The point is, all other factors are part of the equation.

Oil doesn't move without other factors. And slowing global demand for oil is a symptom of those factors.

My point, very significant drops in oil prices and the associated gasoline prices, have resulted in a booming economy in the past. I don't see it happening today. It is because gasoline prices are not the only thing going on.

Also at this time, the oil industry has become a larger percentage, of our domestic economy. Combine a lower percentage of the population actually earning paychecks, and a oil industry that has been hiring like crazy for a few years, the impact is likely to be greater than before. Lots of associated businesses have been doing well due to selling, pumps, pipe, switchgear, cables, housing, heavy equipment, etc that are going to see a large drop in sales.

I believe lower fuel prices are a net plus for the economy.

Do you think they are buying that in Switzerland?

If you are seriously asking that question, it is clear you do not understand how this whole thing works.

The entire economy is based on constant increases in prices. When those prices decline, the revenues to pay the debts (leverages at 100:1) fail to come in.

Consider that you’ve had a steady stream of income, and you rolled that into mortgages on big apartment complexes. All you need to do is fill all of the apartments and keep the rent coming in.

But all of a sudden, you have a vacancy problem. And the revenues are not coming in.

You default on your mortgage.

The bank, counting on hour revenues increasing every month, rolled their investments up at 100:1. Now they cannot pay their mortgage....

Do you understand how this goes from the oil companies losing money to the bank on the corner going broke?

Snyder is pulling your leg!

Low oil prices are the best thing that could ever happen.

Money going to oil producers destabilizes the world.

But there are trillions of dollars in derivatives that are going to go belly up.

Just ask the guys who were shorting the Swiss Franc last week. They got wiped out in ten minutes. TEN minutes. Billion dollar operations were wiped out. Do you think that might leave a mark somewhere?

The “majority” of the world does not have to own high yield bonds for the world to turn upside down. It doesn’t take much to get the ball rolling.

The drop in oil will cause the Russians to pull some junk in Europe with gas.

Its the folks who took their margins to the limits to invest in oil, thats who is going to get hurt. They will dump their assets to cover their debt. That will cause more deflation. And it starts a horrible spin out of control.

Too many people took out too much risk. For the average Joe on the street....they will not know what hit them when their jobs disappear and their 401ks are cut by 80%.

And yes, it could get that bad, that fast.

I am not saying it will, but consider if we have another Lehman situation...what will the Fed do? All of their ammo has been shot without great results. Are they going to drop their rates under zero? Or are they going to print more money?

Its to hurt the US, but mostly Russia, Iraq, and Iran. They want to hurt the OPEC and non OPEC companies who were not playing by the rules. Saudis can take us and the rest of the world to the mats.

I dont think they really want to do that, but we also do not know what goes on behind closed doors in the Kingdom.

Fill up your spare tanks. Now.

Yes, life is just a dream...from paradise up above

What do you mean?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.