Posted on 01/14/2015 5:41:59 PM PST by SkyPilot

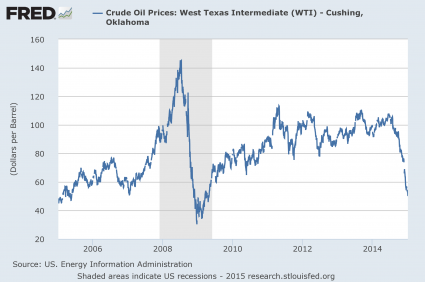

If you were waiting for a “black swan event” to come along and devastate the global economy, you don’t have to wait any longer. As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression. But following the financial crisis of 2008, the price of oil rebounded fairly rapidly. As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get. At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before. So let’s hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

(Excerpt) Read more at seekingalpha.com ...

Kern County.

http://fuelgaugereport.aaa.com/states/california/california-metro/

The banks will securitize the defaulting loans, the Fed will buy those securities, and the can will be kicked down the road yet again.

Not a petro expert like you thackney, but regional/anecdotal evidence is what it is...doesn’t mean we in CA necessarily trend with the Nation at large. We’re one refinery fire/shutdown/supply “hiccup” away from “exploding” fuel prices.

$2.81 a gallon is “almost” $3.00 a gallon...at least in a rounding exercise...and the price went up $0.06 per gallon between the 31st and 1st.

There are some stations selling gas for around $2.40 a gallon. But overall, CA, because it has to be “special”, has “special” CA only gas in addition to higher gas taxes.

CA is going to mitigate/eliminate the benefit of falling fuel prices by following that witch Pelousy’s lead [”Now is the time to increase gas taxes.”] of enacting the “Global Warming Solutions Act” and all of the tax increases that come with it.

Maybe not the whole state, but according to AAA, the 25 major regions are. And according to the daily updated prices at GasBuddy.com, so is the whole state.

There are some stations selling gas for around $2.40 a gallon. But overall, CA, because it has to be “special”, has “special” CA only gas in addition to higher gas taxes.

True, and all the sites reflect a higher price in CA than the national average, no one is denying that. But the trend is mostly in line with the national average in decreasing prices. The "jump" at the first of the year was only a few pennies.

We can all have our own opinions, but that won't change the actual data.

Don’t get me wrong, not arguing with the “data”...I know in my area of Kern Co. that the prices have essentially stalled for the past 2 weeks [1 Jan $2.65, today - $2.63 for Regular]...yet, I read of prices continuing to fall all across the country.

It depends on where the surveys are conducted in generating the data and we are talking averages...so there’s that.

I have no idea where they are getting their prices but before the first ARCO was selling regular for $2.39. I filled up right before then. Hubby has been in the hospital so the 2 trips a day depleted our usual months supply to 2 wks. I filled up again day before yesterday. It had gone up 30 cents a gallon.

It depends on where the surveys are conducted

- - - - -

Agreed. I tend to discount individual reports of the price of a single service station compared to the state wide averages.

As you said, you can post anything you want.

I’ll stick with the reports from the national companies surveying the whole state.

Cheers!

Because they could collect a pile of miscellaneous fees from originating the loan and then sell it to the FHA/FNMA and let THEM worry about getting paid back.

History tells us it won't be successful but we may endure quite a bit of pain while they are attempting it. In fact, we are enduring the pain now, a bit.

One caveat. We are reaching a time, technologically, where they very well may have the capabilities to keep "the world" under the boot. Think Hunger Games meets Chinese dissent crushing mobile hit squads in the hinterlands meets drones.

“Question: Help me understand...Why would any mortgage company/bank make a loan that they knew would not be paid back? Only a law like CRA would make this possible? No one goes into business to lose money.”

Argent, Ameriquest, and the similar firms that they had spawned didn’t hold on to the mortgages that they wrote. So the mortgage writers weren’t exposed to the default risk. The mortgages were bundled and sold off to investors as CDOs, CDOs Squared and a variety of similar products.

The CDO buyers weren’t able to gauge the quality of the mortgages inside the CDOs without examining them individually and they weren’t going to spend the time to do it. You’re talking about thousands of mortgages in each CDO. In many cases they only “owned” slices of a particular mortgage anyway, making the whole deal more complex.

CDO investors were accustomed to the ‘conforming loan’ paper required by Fannie and Freddie. Conforming loan paper has a very good record of safety. But the new mortgage paper that the investors were buying from private bundlers wasn’t conforming paper. It was exotic and high risk with no proven track record.

CDO buyers trusted the ratings given this paper by the big rating agencies. Moodys, S&P, that sort. The problem is the rating agencies were rating the paper as AAA when it turned out to be junk.

One big reason that the entire investment industry blundered into this extremely risky world is because they were all relying on a risk formula that few of them appeared to understand. This is David X Li’s gaussian copula function which he had borrowed from the life insurance industry. The financiers grabbed on to this formula because it appeared to give them a way to calculate the risk of these hard to value products. But unless they understood the math behind it they didn’t appreciate its limitations.

Another more sinister reason these risky mortgages were written involves credit default swaps (CDS), a sort of insurance product for bonds. It was possible to buy CDSs that would pay off if a CDO bundle of mortgages defaulted. And you could buy as many CDSs against a particular CDO as you wanted. In essence it was like buying a bunch of life insurance policies on your neighbor’s life. You might make a bundle if you had inside knowledge that your neighbor was very sick.

By the end of the bubble the demand for high risk mortgage paper was driving the writing of the mortgages, a tail wags the dog situation. CDO makers wanted all the high risk paper that they could get so that they could write derivatives against the CDOs. They appeared to want the riskiest paper possible. If someone knew that the mortgages inside these CDOs were doomed to fail then that someone could buy a load of credit default swaps against the mortgage paper and be guaranteed a huge windfall when the mortgages blew up. There are some hedge funds that made billions of dollars in just this fashion when the bubble popped. No one has been prosecuted so apparently no laws were broken.

Because the mortgage companies were selling them to Wall Street companies who were bundling them by the thousands into CDOs, then selling tranches of those to investors who were looking for return, misleading them as to the risk. Everyone along the line up to those investors was making money off fees and didn't care about risk, since they weren't going to hold the loan.

Those graphs don’t provide useful information without including the size of the GDP and the government’s percentage of the GDP.

It’s easy to make the sheer size of the debt look scary when compared to the past. It won’t look as frightening when the debt is compared to the size of the GDP. The ratio is more important than the quantity.

Thank you. I know what I pay for. ;)

If anyone can get a job now it is an educated black woman, they will all be hired before a white male gets an interview.

All symptoms... Who assumed the risk? Not the banks? Why? Freddie and Fannie purchased the Mortgages. They may have used those other organizations to do their dirty work...

Government intervention into the free market (getting into the mortgage business just like healthcare) could cause such catastrophic results. The free market quickly exposes bad business practices. Governments create perverse incentives that last a long time...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.