Posted on 09/22/2014 4:15:05 PM PDT by SkyPilot

Billionaires are holding mountains of cash, offering the latest sign that the ultra-wealthy are nervous about putting more money into today's markets.

According to the new Billionaire Census from Wealth-X and UBS, the world's billionaires are holding an average of $600 million in cash each—greater than the gross domestic product of Dominica. That marks a jump of $60 million from a year ago and translates into billionaires' holding an average of 19 percent of their net worth in cash.

"This increased liquidity signals that many billionaires are keeping their money on the sidelines and waiting for the optimal moment to make further investments," the study said.

(Excerpt) Read more at cnbc.com ...

Either or. LOL

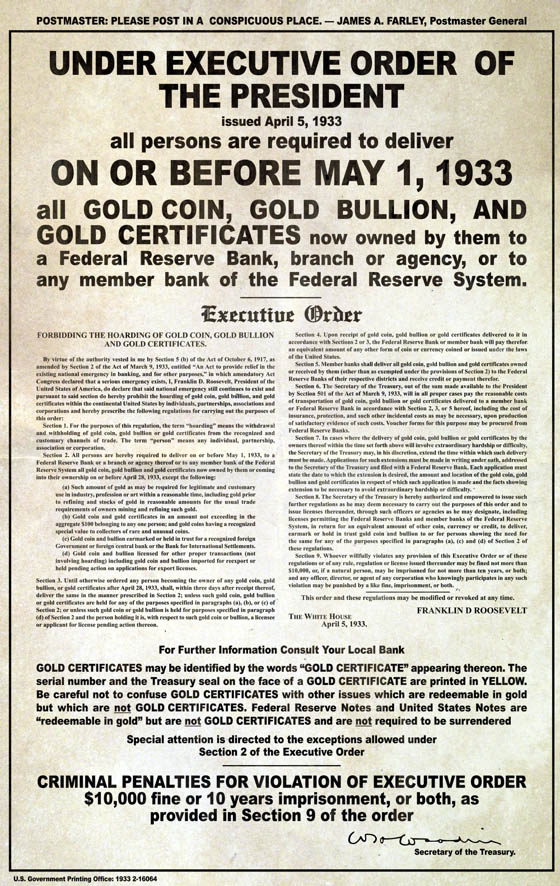

Hoarding is a word used by governments before they arm up and take your stuff.

Exactly. Venezuela here we come.

This could never happen in 2014, right?

I mean.....it's not like Obama has a history of issuing Executive Orders and.......ummmm......

It is one more straw that will break the camel's back.

So these things keep happening; but here is the problem, Chris: the Fed has printed almost four trillion dollars to put out the fire from 2008. What is going to happen if we have a liquidity crisis next month or next year? They are at the limit of their balance sheet. They are already insolvent on a mark-to-market basis. And again, that is not guesswork. I actually was told that by a member of the Federal Open Market Committee. They are leveraged 80-to-1. They cannot do more. So the next crisis is going to be bigger than the Fed. It is like they build a five foot sea wall and here comes a forty foot tsunami. There is only one clean balance sheet left in the world and that is the IMF. So the only way you are only going to reliquify the world in the next liquidity crisis is by the IMF printing their world money, these Special Drawing Rights or SDRs, and that is going to be the end of the dollar as a global reserve currency.

Hording cash? If things get really nasty cash is the last thing you would want. Gold, Diamonds and such are better. Guns and bullets are best.

CC

http://www.peakprosperity.com/podcast/85207/jim-rickards-coming-crisis-bigger-fed

"A long time ago back in 1995 I quit making contributions to my 401k. Here is why: 1-No trust in government to fairly tax such accounts by 2030. 2-Fear of government mandated "roll-in". 3-Too restrictive with the potential to get extremely restrictive. A "roll-in" would be the same as a "bail-in" except for retirement accounts. The government with the enforcement of the US Fed would demand such action under a catastrophic market crash similar to the one Rickards spoke of. Your 401k and other retirement accounts would be "rolled into" social security, which essentially means government debt(bonds), thereby liquidating whatever you had into a G FUND, like what Blackrock manages."

What that millionaire says is true - all of the 401Ks and IRAs, I see, being seized.

You will get "bonds", but your Social Security and other retirement will be dictated by what the Government says you will get.

many families made their riches during the great depression because they were the only ones left with cash to buy everything that was for sale at rock bottom prices.

You’ll need a wheel barrel of $5 and $10’s to buy a loaf of bread. Be sure to stash a wheel barrel...

Candy was a nickel when I was just a kid.

I have 50 wheel barrels I’m going to sell at a nice profit.

I’ll time it so I’m out of $1’s and $5’s when wheel barrels are necessary. Then I dig out the big bills.

Seriously, it would/will be a mess.

Gold, Silver in various sizes as well as cash stash. Not so much for investment as for holding physical precious metals when/if dollar collapse occurs.

1/10, 1/20 Maple leafs, Kangaroos, Panda .9999 gold coins

1oz silver bars, maple leafs, silver dollars.

Chi-com government has been preparing for decades to confront the U.S. and it's coming. Perhaps Taiwan, Japanese Isles...whatever.

Point is, China has spent billions modernizing their military capabilities. China will not only fight using their military, they will attempt to rock our economy, attack our satellites, cyber warfare. They will attempt to cripple the U.S. during a conflict.

There are thousands upon thousands of surface to surface missiles aimed squarely at Taiwan across the straight. China has upgraded their anti-ship missile capability in the sunburn cruise system. They have advanced submarines and working on super cavitating technology.

The Chicoms are focusing heavily on the ability to sink an American aircraft carrier. Times are looking pretty perilous these dayz.

But why?

What is going to happen if we have a liquidity crisis next month or next year? They are at the limit of their balance sheet.

Why are they at the limit? They have no need to borrow. They can create money at will.

They are already insolvent on a mark-to-market basis. And again, that is not guesswork.

Insolvent? That's when you can't pay your bills. What bills does the Fed have? Why can't they pay them?

As far as mark to market, they've been buying bonds for 5 plus years, from when rates were higher. They have capital gains, not to mention income of $80 billion or more per year.

It's not guesswork, it's just wrong.

They are leveraged 80-to-1. They cannot do more.

Sure they can.

You’re right on all points.

Whiskey, Gin, Vodka, Tequila, Scotch

When times are tough...what the heck, eat some beans and rice and slug some brown water.

Yummmy

Higher denomination bills aren’t going to happen.

The reason is that the US has only two currency printing offices (Fort Worth and D.C.), and they work around the clock producing mostly $1 bills, and proportionately fewer higher denomination bills. Because other countries *have* to have dollars, most of our $100 bills are sent to them.

Yet with all that work, only about 4% of US daily retail is backed by paper. And this may create a “currency split” in which virtual money can be inflated or hyperinflated with the touch of a computer key, but not only *can’t* more paper money be printed, but neither can higher denomination bills, for the simple reason that nobody could make change for them.

And if there is a currency split, paper money is instantly *deflated* by 25 times. At the same time virtual money inflates. This can happen practically because only paper money and coin are legal tender, virtual money is not.

The government and banks have total control over virtual money and any instrument used to convey it, like credit and debit cards, bank checks, etc. And if paper money is in a bank, they can control that, too.

But “mattress money” is out of their control, and its value is dictated by sellers and buyers.

Related story: Former smokers attempting to shirk paying cigarette taxes have come under heavy scrutiny by the Treasury Dept....

I've bought $500 bills and $1000 bills for "collectors value", but the understanding is that they are STILL legal tender.

Even if the government collapses.

BTW, my grandpa told me how when he bought his house in 1946, that he made the down payment in $500 bills.

He was so "awed" by that, it struck him.

Because in 1946, a single $500 bill was the result of untold hours of labor.

He guarded them like they were gold.

And his mortgage in 1946? $8000

Err, dude. Billionaires do that sort of thing.

Yeah; My question is why is this "news"?

Very funny. Now go to your room!

Despite the picture, where does it say they are holding literal paper money?

They aren’t. By cash they mean liquid “cash” as in immediately available for access. Like your checking or regular savings account. As opposed to being tied up an asset that has to be traded or sold to acquire money..

I really don’t think this piece is saying that the rich have giant vaults full of paper money, like Scrooge McDuck or Richie Rich

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.