“Sell Mortimer, Sellll!...turn those machines back on!”

“Sell Mortimer, Sellll!...turn those machines back on!”

Posted on 08/27/2014 5:07:06 PM PDT by SkyPilot

Edited on 08/27/2014 5:09:23 PM PDT by Admin Moderator. [history]

Markets could soon face a fall of up to 60 percent, two experts told CNBC on Wednesday.

A jolt to international confidence in central banks will lead to a 30 to 60 percent market decline, David Tice, president of Tice Capital and founder of the Prudent Bear Fund, told CNBC's "Power Lunch." When this happens, he said, markets will face a "period of extreme turmoil."

(Excerpt) Read more at cnbc.com ...

The problem is that median income is down, government dependence is up, the world is a tinder box and zirp leaves the Feds ammo belt empty. Don’t know when but bulls running for 5 years plus absent meaningful corrections is not something that compels me to run with the fed these days.

Add to your list inflation. Oh, that’s right, the BLS says there isn’t any. Good thing they don’t count food or energy in the statistics anymore also.

“and the love of it is the root of all evil”

Maybe. I personally think that ego is the root of all evil.

http://www.freerepublic.com/focus/chat/3197623/posts?page=44#44

“Sell Mortimer, Sellll!...turn those machines back on!”

“Sell Mortimer, Sellll!...turn those machines back on!”

Eat thumb drives and heat you your house with tablets and you will from government inflation stats.

I wish I had a dollar for every expert that has forewarned of the imminent crash of this amazing bull market we’ve been in since 2009. One of these days one of them is going to be right.

A Classic! Watch out for those orange juice futures.

I’m not seeing it. There has been a multitude of gloom and doom predictions for years now, generally with far better reasons for catastrophe, but not have materialized.

The reason I can say this with certainty, is that for even longer, the stock markets have been manipulated to such an extent that the indexes *can’t* fall drastically.

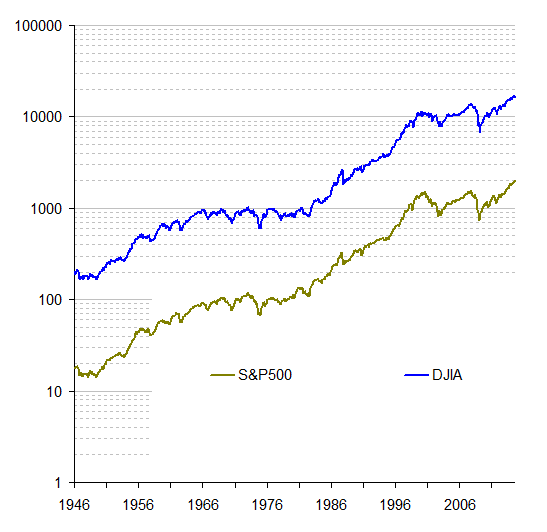

Let’s examine the most popular index, the Dow Jones Industrial Average. It is an index that shows how 30 large publicly owned companies based in the United States have traded during a standard trading session in the stock market.

Imagine if you had, say, 10 billion dollars that you could insert or remove from the stock market without *anyone* knowing you did. You could completely manipulate the stock prices, and thus the index, and nobody would know it.

If you did not do this too often, just when the market index was too volatile, the only thing the public would see is a stable stock market. The only indicator that hanky panky was happening would be that trading volume would be low, because when you intervened, the reaction trades would halt.

it could be a looong cold winter ahead...

it could be a looong cold winter ahead...

What utter nonsense that just makes me want to buy more. These idiots have been saying this for 3 years.

Well, it’s tough to be a bear when the rest of the world yells “bull”.

Great graphic and what a damning post. No man knoweth, do they?

We're overdue for another few decades of growth.

“I think people are putting money into the stock market simply because there isn’t another place to put it.”

Yep. Fed has kept interest rates ridiculously low. CDs? forget it. Bonds? Maybe but with interest rates nowhere to go with up that means bond funds will go down. Thus people are in the market. I have 25% in but that’s only because I am about at retirement. If I was 25 I would be all in

You can’t time the market. If one has a long investment horizon just asset allocate and save 20-30% a year or more and one will do fine in 30 years. If one is young and does NOT have some money in the market they are foolish because inflation will take you done.

On the other hand if one is about to retire like me it is indeed dicey. I think a terrorist attack is the next shoe to drop and will be reminiscent of 2001. Gird your loins.

The “slope” is a little different when you line it out from 2010 to present day...

Not to say the inhale and exhale of the market is not trending, or potentially going to do what is predicted here...

This is yet another example of why I do not put much into the health of the overall U.S. economy, and the rest of the worlds markets based upon this particular “market” reference...

The media seems to believe its own press when it uses this for that purpose, to somehow draw the success of any political parties administration and policies...

I can be honest when I say I and my family made a ton of money when Clinton was in the oval orifice, then when Bush was Chief Executive...

I went a little riskier in the previous, and went conservative more when Bush was running the show...And by that I meant the country, not the market..

Does that make me liberal in my investments??? Certainly not what I am implying...I’m just saying the market is kinda like that living, breathing Constitution the liberals think that that is...Something I know they are full of crap about in the first place...

It is why some who look at this without blinders on have already safe’d their investment portfolio’s...Mine to the tune of 85% total net worth out of the market, and left the 15% in to accrue, to minimize a possible crash (loss) when the bubble bursts...

I can say I might reign it in even more before the end of the year...The next elections might give us a better perspective, if you wish to put politics into all of this...

Like Cheney said, it is not a question of where, and how...

But when...

Glad you posted this graphic...

One dollar...

The usual wager!!!

Fine, that’s the way they wanna play...

[shotgun action sound effect]

;-)

Let me assure you, my natural tendency is towards the bear side. I am a skeptic.

But my “association” w/Tice dates to 2001-2...when the tech wreck post 2001 bottomed, which is when I found him and his site. (I never invested in BEARX) And I and all manner of very astute (or ass-toot) people talked endlessly about how impossible it would be that the market would ever climb out of the hole it had gotten into, that people would never pay anything but cheap-as-dirt prices for any equity ever again and that the market was a a place where people went to flush their money down the toilet buying overpriced nonsense.

All of that being true, LOL, it’s not *always* true, and indeed, it’s *very* often not true and indeed, it is true so rather infrequently that it is a viewpoint that in the main is generally not worth bothering with.

It is true that no man knoweth, but there comes a point when even a bitter or unaware or indifferent or stubborn man must change his mind. We are seeing this now, with the last last last last bears capitulating, and if you want to call that a topping sign, I will not argue. Top or no top, that DOES NOT MEAN ONE IOTA that a giant catastrophic dip from hell is awaiting around the corner. And THIS is what the permabears permanently get wrong. Wanna call it a top? Fine. Been wrong 57 times, maybe this time they’ll catch it. But if there is no giant dump after they are short, most likely they will make a tiny bit on a dip, cover early (and thus NOT be short for the big dump) but because they have been run over so many times they cannot stay short for more than....mere days.

The market is not about certainties. There are no certainties, there are only probabilities.

I believe the market is rather extended, here, but IMO to think that SP2K will not be defended is quite naive.

Furthermore, each and every one of the last 37 dips has been bought. Oh yeah, one of these days, the next one won’t be. But all you have to do is to short the market on these dips and lose 3% 37 times and you are now wiped out. So on that time when thing really comes apart, you are not there for it and you’re too bruised from all your selling failures to date.

It is an odds-based playing field, it is probabilities, not certainties. If the behavior of the market were certain, and you (and I) could see it, that would mean that a zillion other people could see it and if there was unmarked value (eg; a $40 stock sitting there for $30) people lots smarter than you and me would bid the price up to $40 in milliseconds. This is the paradaox. There can never be certainties. If there were, the market would not move, would not rise over time, would not recover from corrections, nor HAVE corrections.

At present, there is no other place to put money that makes the ROI that the market can do and I don’t believe it is much more complex than that. If the money, to you, or to Joe Blow is fake fiat money, then don’t try to make more of it. No skin off my back if you do or if I do.

I’m with you brother. I’m a skeptic, but I think that’s healthy. I find most financial advice here to be contrarian in nature.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.