we had our insurance meeting yesterday and as expected EVERYTHING went up...

we had our insurance meeting yesterday and as expected EVERYTHING went up... at the end i ask the rep where my $2400 in savings i was promised was, everybody laughed except the RATS they just turned red in the faced and looked away

Posted on 08/14/2014 3:38:38 AM PDT by Innovative

A national business group representing the nation’s large employers reported Wednesday that companies desperate to avoid a 40 percent ObamaCare “Cadillac tax” are finding ways to shift the costs to workers.

The so-called “Cadillac tax,” now four years away, will affect health plans that spend more than $10,200 per worker.

Meanwhile, employers are shifting workers into plans with higher deductibles, just as ObamaCare does in the health care exchanges, and using health savings accounts to help defray the costs.

(Excerpt) Read more at foxnews.com ...

Obamacare was never about helping people get healthcare -- it was and is about government control of the entire population. The government decides what medical care you deserve.

It was primarily aimed at getting an enormous cost item off the ledgers of major U.S. employers and onto the backs of the employees themselves (either directly or as taxpayers).

But why should the government be involved — companies used to be able to decide for themselves whether or not to offer health insurance to the employees and how much.

Obamacare is mandating what they should cover — such as birthcontrol — and punishes, i.e. taxes them with prohibitively large penalties if they do provide good medical insurance.

Democrats, Unions Reach Deal on Taxing High-End Health Plans (2010)

Labor leaders and Democratic negotiators agreed Thursday to scale back a proposed new tax on high-end health-insurance plans, and the White House and congressional leaders pressed to reach a final deal on most aspects of the health-care bill by this weekend.

The tax, which was included in the Senate’s version of the health-care overhaul legislation but not the House plan, has been one of the key remaining issues as Democrats work to combine the health bills passed by the two chambers late last year.

Union leaders, as well as many House Democrats, are fiercely opposed to the tax on “Cadillac” insurance plans, which they say will hit many middle-class workers and undermine benefits unions have negotiated for their members. But President Barack Obama has supported the measure as a way both to pay for the health bill and to control overall health-care spending.

To make up for the lost revenue—and to increase subsidies for lower earners to buy health insurance—negotiators are considering increasing the financial hit on drug makers, nursing homes and medical-device makers, according to people familiar with the discussions.

I think the goal is to force everyone into a goobermint union.

CHART OF THE DAY: Bureaucrats Have Way Better Benefits Than You

http://www.businessinsider.com/chart-of-the-day-employer-cost-per-hour-worker-2009-12

The end result of all this is that employers will ultimately stop providing health insurance to their employees. That's exactly how it should be. Companies never really "decided for themselves" whether or not to offer health insurance to their employees. They were given enormous tax incentives to do it, and now the game has changed. It's really that simple.

The quality of the health insurance coverage at my wife’s company dropped immediately after ObamaCare began 1/1/2013, and the employees share of the premium significantly increased.

Prior to that we have a very high quality plan for only a couple dollars a day for both us.

They were not given tax incentives to offer health insurance to employees.

During WWII the government installed wage controls (good old FDR) and companies could not attract new workers. So they started offering health insurance which wasn’t frozen by government. It was government causing the problem in the first place.

King O is/was never a friend of corporations. The ACA Cadillac Rule is designed to scourge businesses which provide generous benefits to employees. The tax revenue was always destined to subsidize King O's redistribution plan and to punish success. This time, King O really screwed the pooch because the Cadillac Rule negatively impacts union members who boast some of the most generous benefit packages in corporate America.

It's also a tax-free benefit for an employee. This is also a huge incentive for both the employer and the employee. If your employer gave you $10,000 per year in bonuses, it would be taxable income. The same would be true if the employer paid $10,000 of your rent or mortgage payments every year ... or if they made $10,000 worth of car payments for you every year ... or if they paid $10,000 in life insurance premiums for your every year.

But for some reason health insurance has a special treatment carved out for it under Federal law, which is why companies even offer it these days -- decades after the wage controls of the 1940s were eliminated.

Why do people think this was ever an item which cost the employers? Ultimately all of the money for ANYTHING the company does comes from the people who buy or pay for that product. No company anywhere actually pays those costs, it is either passed on to the consumer directly, price inflation; or passed on indirectly, through wage stagnation or employee cuts, or cuts to benefits.

But it always goes back to the consumer sooner or later.

The ACA Cadillac Rule is designed to scourge businesses which provide generous benefits to employees. The tax revenue was always destined to subsidize King O's redistribution plan and to punish success.

Obama isn't terribly bright, but even the most rabid leftists who do his thinking for him and draft the scripts for his teleprompter knew well that the ACA Cadillac Rule would generate almost $0 in revenue. They know this because they recognize that even crummy business owners are smart enough to know that there's no reason to pay a 40% tax on a benefit when it's much easier to just drop the benefit.

Keep in mind that most of the workers in the U.S. who have had these "Cadillac insurance plans" over the years are union employees of major U.S. corporations. "King O" has basically 'effed these union workers on behalf of these corporations.

Somebody needs to tell the GAO the Cadillac Tax revenue shouldn’t be included in the budget.

Welcome to the club. I already have to pay a 20% deductible for any operation.

This abomination must be repealed before then.

...and the average cost of the healthcare plans for each of the nearly 3 million state employees in the U.S.? .....$11,500.

The companies were blackmailed by their unions to develop and provide the Cadillac plans.

The union members and their retired brethren are the ones to suffer as normalcy sets in

we had our insurance meeting yesterday and as expected EVERYTHING went up...

we had our insurance meeting yesterday and as expected EVERYTHING went up... at the end i ask the rep where my $2400 in savings i was promised was, everybody laughed except the RATS they just turned red in the faced and looked away

What the left is clueless about BIG Government is BIG Business. Yet, Big Government is exempt of many mandates, regulations & audits ie check & balances.

My company has no insurance, I have no insurance, I chose to NOT accept Obamacare.

Several weeks ago I was a victim of a violent crime, spent 6 days in the hospital, was told Obamacare was useless and would have not covered all the bills, instead Victims of Violent Crimes paid all my bills.

It was quite interesting to hear from a major hospital that they themselves thought Obamacare a useless travesty.

I am fortunate I believe to have listened to a higher calling to ignore signing up for Obamacare, it would have been wasted money probably diverted to democratic fundraising.

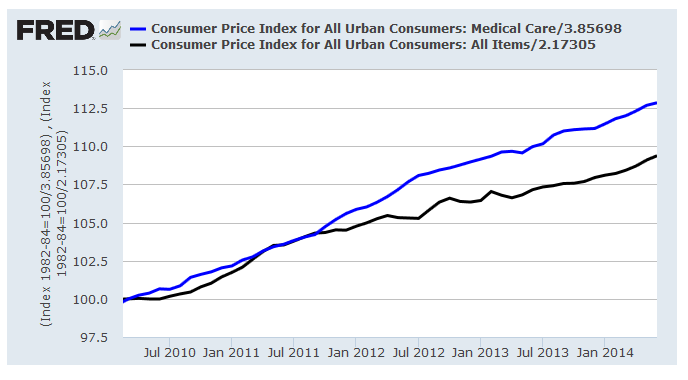

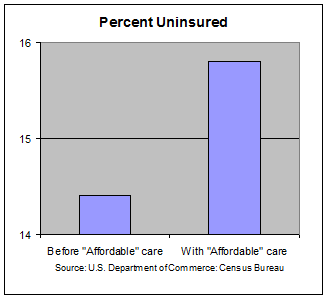

That's just it, "thinking" has nothing to do with it. A couple days ago an old buddy of mine was raving about how wonderful the PPACA was, and he was totally immune to the fact that medical costs are higher--

--and fewer have access now:

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.