Posted on 02/23/2013 11:58:09 AM PST by blam

Sorry Bears, We're In A Secular Bull Market

February 22, 2013

by: Jonathan Verenger

I know some people will view this article as a sure sign that the top is in. Keep in mind, however, that I have been a raging bull since July 2009 when I realized that the market wasn't coming back and was ignoring bad news permanently. In the almost 4 years since, we have had numerous things thrown at the market and yet it has crept higher and higher. The latest negative news are the fears of sequestration, a supposed all time high in bullish sentiment (more on that later), a crash in Apple (AAPL) being a sure precursor to pain in the overall market, and fears about supposed currency wars.

Misguided Gurus

For the past 4 years now the general public has missed huge gains in the market because of their own bias clouding objective thinking and because of the excessive fear spread by bloggers and the media alike. From Porter Stansberry's ridiculous calls for the End of America to Bob Prechter's ongoing claims of imminent collapses in the market to the latest diatribe from Marc Faber about how the markets have peaked (didn't he say that in 2009, 2010, 2011, and 2012?), the general investing public has been bombarded by these seemingly eloquent and smart "gurus" whose short thesis is so well thought out and convincing. As Laszlo Birinyi often says, the "short thesis is always the more articulate one". But facts are facts. And speaking of them, let's look at the facts.

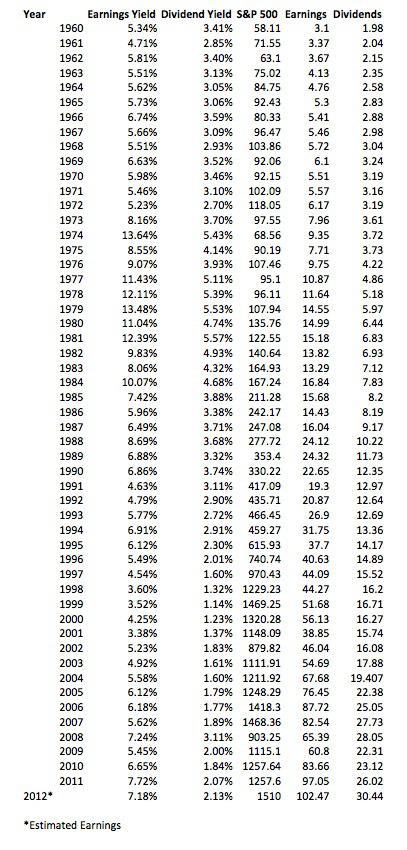

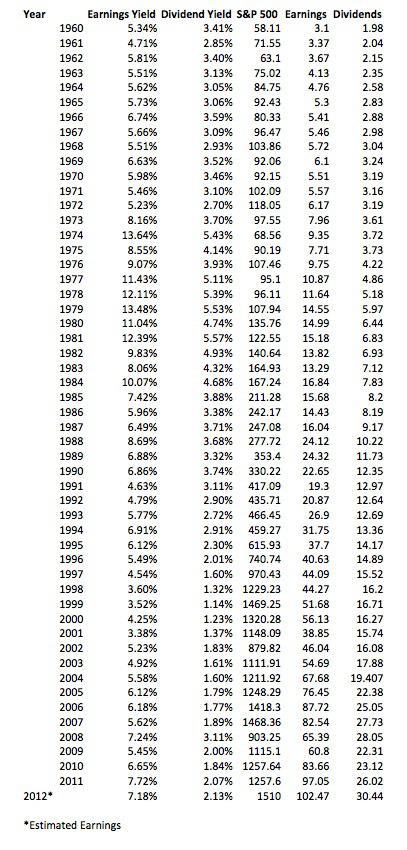

Historical S&P Data

Take a look at the data below, which includes the earnings yield, dividend yield, price of the S&P 500 at the end of the year, S&P 500 earnings, and dividends for the past 53 years.

(snip)

(Excerpt) Read more at seekingalpha.com ...

be careful, however.

the market goes “up” if the fed prints zillions of new dineros out of thin air... and gives them to the big banks...who are afraid to make most kinds of normal loans in the Obama Great Recession ... so they invest the fake $$$ into the stock market (hoping its liquidity will permit them to bail out of anything when it starts to go down again).

If you were a banker, you’d do pretty much the same thing right now.

But since so much of the “demand” is concentrated in the hands of just a few big-time institutions, it will only take decisions of a very few people to have that “demand” suddenly vaporize (and be replaced by large sell orders)

ok to make hay while the sun shines, but keep your jogging shoes on... be ever watchful...

hey, watch that crap around here! Don’t you know that it’s treason to say anything good about the economy unless a Bush is in power? Ideology has to trump reality or ‘they’ win’ (yes, laughing my ass off at the sky is falling all economic bad news is good news asshats).

It sounds as if “the 1%” is doing pretty good. I guess that #Occupy Wall Street thing didn’t work out the way the rich kids wanted it to. Mommy and Daddy are still bringing in the big bucks.

Have the figures been corrected for inflation? Now a question for the informed: I have heard that the Federal Government, or one of its offshoots, has been directly or indirectly supporting the stock market. Is that true, and if so how?

I had an interesting conversation with some smart, middle aged people about a month ago. Their 401Ks are going up under Obama, so they voted for him. As long as their retirement is OK, they like our “leader”.

That’s funny.

The fed is “buying its own debt”, AKA printing money without any backing of any kind to the tune of about 5% to 10% of our economy each year, debasing our currency. Meanwhile prices go up but the federal government claims inflation is low to keep the smoke and mirrors going. And then people like you come along saying how the stock market is going up so all is well... Never mind that the dollars purchasing those stocks are worth less each day so it take more of them to buy the same quantity of stock... In addition since the government is faking the inflation numbers CD’s, savings accounts, bonds pay practically nothing compared to the rate the dollar is declining in value so you are loosing money in any of these type “investments”. So the only game in town to try to hold on to any wealth you may have is precious metals and the stock market. Gee I wonder why those have been rising... And you think that’s a good sign... Amazing...

And yet most of them have a continuing declining standard of living and can’t figure out why...

I got a sell signal just yesterday. My brother-in-law, who knows bupkis about investing, was dispensing advice on 401K’s. Now all I need is my brother, who has been 180 degrees wrong on EVERY top and bottom, to call and ask what stock to invest in.

And look at the 2012 dividends... An all time record... And these “smart” people say that’s a good sign... Never mind that many of the dividends that were paid at the end of 2012 were advanced from future years, and even borrowed, to avoid the 2013 tax increases for their share holders...

Are CD’s reflecting inflation? Sometimes you have to go with the best available.

It also goes up if Obama doesn't get his major legislation through.Ex: When it became evident that cap and trade wasn't going to make it through a Dem Senate the market roared upward.

Same thing when the Dem Congress passed the Bush tax cut extension a couple years ago.

Now we have some fairly meaningly sequester cuts coming which IMO should be fodder for more upward movement.

Translation: The big institutional buyers would like to cash out and needs the general public as a bag holder when this turkey drops.

The stock market is rigged now. Stock prices no longer have a relationship to earnings. An easier game to play is commercial real estate where prices do track earnings, and capital gains taxes can be avoided forever. The way to deal with low interest rates and high inflation is borrow as much as you can and sink it into an income producing property. Most investors leverage their money times 4. If you can't by a medical office building for the Obamacare wave you can start out with a 4-plex rental. If you live in one unit you can get a 30 year fixed loan with very little down. Sometime in the next 30 years that fixed rate will be worth more than gold. Commercial real estate investors typically make 12% annual return on their money which is better and safer and taxed less than anything else right now.

It seems, to a stock-market know-nothing like me, that the market is completely decoupled from reality.

My entire IRA is in money market funds and has been since the low point of 2009.

As a result, I missed out on the stock market recovery. I've never bought back in, because the conditions one would expect to be present for the stock market to climb have never been in evidence.

I fear that once I buy back in, reality will finally dawn on Wall Street and my already crashed IRA will crash even further.

I suck at investing.

11.4% right here.

I would not touch commercial right now. As the economy tanks they will go empty! empty! empty!

There will be no need for doctors offices, because they will all become hospitalists and the hosptial will provide offices.

Gold and silver have been used as money and a store of wealth for thousands of years. Every fiat currency that has existed ultimately collapsed. Every. Single. One.

Is our decoupled from reality, Fed supported market becoming similar to Zimbabwe’s ever soaring stock market-—the one were an average portfolio can purchase a few eggs?

On the other hand:

The Big Dogs On Wall Street Are Starting To Get Very Nervous

Like every 'bubble' the last guy in will be left holding the bag and then crying 'how could this happen'!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.