Posted on 09/09/2012 2:42:29 PM PDT by blam

Why The Fed Will Not Launch QE3

Interest-Rates / Quantitative Easing

Sep 09, 2012 - 10:46 AM

By: Tony Pallotta

Whether the Fed decides to launch QE3 this week is far more a complex decision than they lead us to believe. It is not as simple as monitoring economic data and deciding whether to expand the balance sheet or not.

Yet the Fed rarely discusses what that other criteria is in making such an important decision. The recent Jackson Hole speech by Chairman Bernanke did offer some insight to the other factors, as well as his recent Congressional testimony.

And there are many factors to consider beyond a weaker than expected non-farm payroll. From inflation and market liquidity to balance sheet risk and confidence the Fed needs to weigh all the risks and rewards in finding the right balance.

I am not a fan of the Chairman's policy but do not believe he is a mad man, determined to "support the banks" at all costs. I don't believe he intends to expand the balance sheet to create massive inflation. Nor do I believe a drop in equity prices will be an automatic trigger of QE. But I do believe we will never understand the true nature of the Fed's decision making policy. We have no idea of the political pressure being applied (remember Chuck Schumer's comments) for example.

But based on what we do know, my belief is the risks currently outweigh the rewards. And that is why I continue to believe we will not see QE3 launched this Thursday.

Inflation VS Deflation

This is the biggest factor in my view. In a slowing global economy the risk is one of deflation. There is simply no overheating economic output to push demand above supply and force prices to rise (beyond abnormal weather patterns). In the summer of 2010 there was a clear deflationary trend. And that was the basis to launch QE2. The Fed had "room" to risk creating an inflationary threat. And that is exactly what QE2 created. In combatting the deflationary risk, inflation expectations have since pushed up to the 2% upper limit targeted by the Fed.

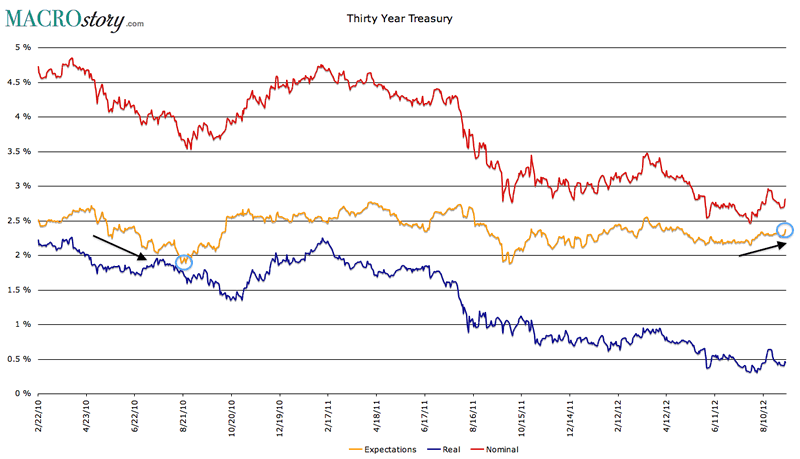

So now absent any deflationary risk, there is no further "room" for inflation expectations to expand. While the economy represents a deflationary risk, expanding the balance sheet represents an inflationary risk. The two must be balanced. And balanced they are right now. Though one could argue based on levels now pushing 2.5% that there is an inflationary bias.

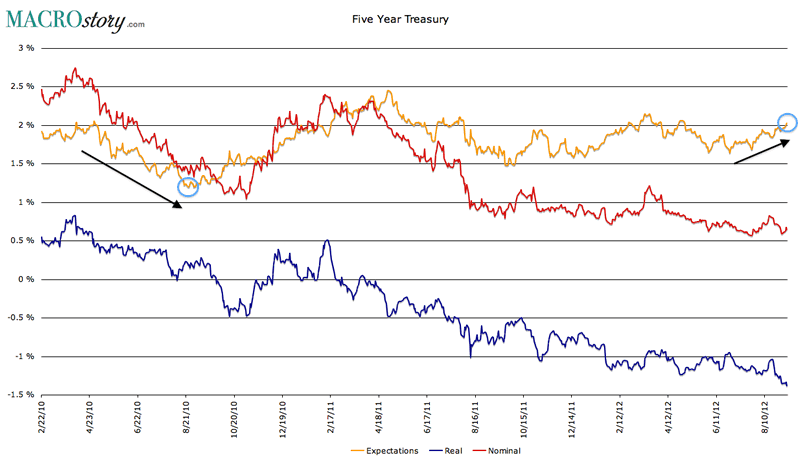

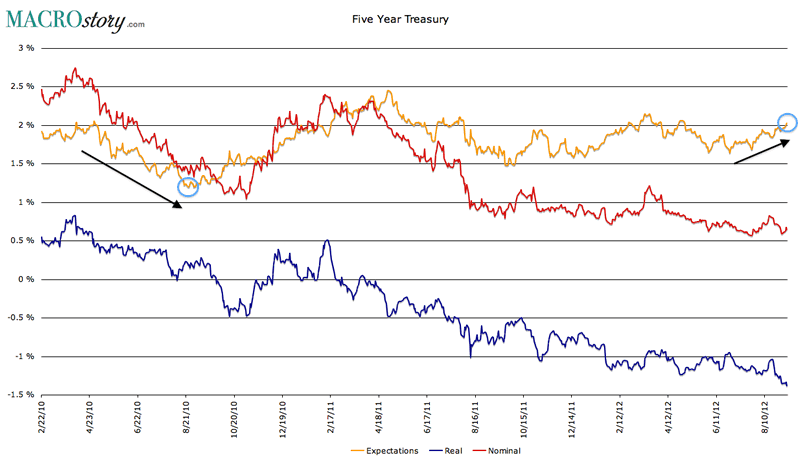

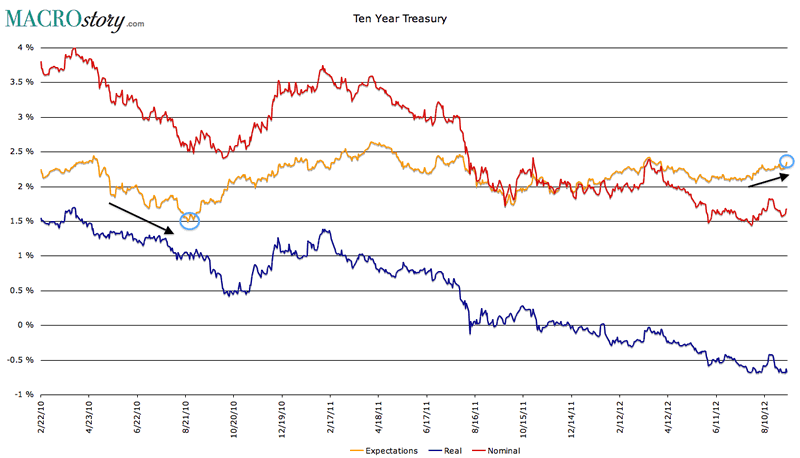

That alone says the Fed cannot launch QE3. Yes, a simple subtraction of TIPS and nominal yields answers a mighty daunting question. Just look at what happened during QE2. Ten year inflation expectations moved from 1.5% to 2.6% in about six months. That alone told you there was no way QE3 would come immediately thereafter.

Five Year Expectations

Ten Year Expectations

Thirty Year Expectations

Market Function

Chairman Bernanke outlined the following risk to expanding the Fed balance sheet during his Jackson Hole speech.

"Conceivably, if the Federal Reserve became too dominant a buyer in certain segments of these markets, trading among private agents could dry up, degrading liquidity and price discovery. As the global financial system depends on deep and liquid markets for U.S. Treasury securities, significant impairment of those markets would be costly, and, in particular, could impede the transmission of monetary policy. For example, market disruptions could lead to higher liquidity premiums on Treasury securities, which would run counter to the policy goal of reducing Treasury yields."

And this week UBS highlighted how the Fed may have pushed the limits in finding such a balance (courtesy of ZeroHedge).

"the Fed owns all but $650 billion of 10-30 year nominal Treasuries." Also as pointed out above, Twist 2, aka QE 3.5 is already absorbing all of the long end supply. And herein lies the rub. To quote UBS: "Taking out, say, $300 billion in long-end Treasuries almost certainly would put tremendous pressure on liquidity in that market....Ploughing ahead with a large, fixed size QE program could cause liquidity to tank."

Less Is More

Rising prices for non-discretionary purchases like food and fuel amid a fixed consumer income will reduce demand for discretionary purchases. The result, "more" QE would likely inflate demand away, causing economic weakness, contrary to what the Fed is trying to stimulate. And from a political standpoint, with stock prices elevated going into the election, the risks shift to rising prices at the pump to upset voters. Why else has the SPR release rumor surfaced twice in just the past month.

Going It Alone

Other than a muted policy response from the ECB this week (sterilized and conditional), no other central banks have been aggressive in altering policy. In fact China through reverse repurchase operations is removing liquidity in an attempt to combat food inflation. Why would the Fed launch their own effort when no one else is? Remember, the Fed may still need to fight the monetary war on another front if and when Europe deteriorates and TALF type facilities are needed by MS and others with such exposure.

Balance Sheet Risk

Again during Jackson Hole, Chairman Bernanke was quoted.

"A fourth potential cost of balance sheet policies is the possibility that the Federal Reserve could incur financial losses should interest rates rise to an unexpected extent. "

If inflation were to truly take off, the Fed would be powerless to stop. Unless they wanted to incur some serious losses. The Fed would be selling debt securities to soak up liquidity into a market in decline. Any rise in yield would directly result in a drop in market value for the underlying assets they own.

Imagine the Fed having to acknowledge such a blunder. It would crush any remaining confidence investors have, another risk highlighted during the Chairman's speech

"A second potential cost of additional securities purchases is that substantial further expansions of the balance sheet could reduce public confidence in the Fed's ability to exit smoothly from its accommodative policies at the appropriate time."

Bottom Line

By no means is the above meant to be an all inclusive list of factors going into the "QE decision." There are many I simply am not aware of such as political pressure (on both sides of the aisle). But when I put it all together, with a big focus on inflationary risks, I do not see the Fed acting this week.

I am not naive though. And I do remain a bit cautionary of the unknowns and how the members of the FOMC weigh each risk and reward. People like Charles Evans and Eric Rosengren truly scare me. But the Chairman may have made it very simple for us to understand what the FOMC will do on Thursday. He finished his Jackson Hole speech as follows.

"Overall, however, a balanced reading of the evidence supports the conclusion that central bank securities purchases have provided meaningful support to the economic recovery while mitigating deflationary risks."

The environment today versus two years ago when QE2 was launched is completely different. The balance between risk and reward is far more skewed towards risk. QE3 would not allow the Chairman to make such a proud and confident statement. Instead he would be forced to say something like the following.

"Capital losses were incurred to mitigate uncontrolled inflationary risks."

With a little over a year left in his tenure, that is not the legacy he wants to be known for. The man who truly blew up the Fed.

The article makes the rash assumption that logic and good faith are at play in the decision. Einstein’s definition of insanity has yet to get through the unstoppable banging of their heads against the brick wall.

Does Chairman Bernanke worry about being hauled into court on TREASON charges? Maybe not but he knows if he pulls any more QE Crap he will be driven out of Washington.

No chance. The politicians love free money and inflation. That is why the fed continues doing what it does best. Sanity will not prevale until there is a wipeout and the politicians are hunted down. Watch Argentina to get a sense of how this plays out.

Since there are so many seemingly good reasons why the Fed should NOT launch QE3, if it does go ahead with it will mean the economy is so extremely bad the Fed had no choice — it was QE3 or disaster.

That rate is near -0-.

No room to move. No "moral suasion" to exert.

People who don't understand what they have to do to survive in the wilderness had better take a crash course.

People who do understand need to fortify their positions and top off their stores.

Well said.

Am worried about interest rates. They are artificially (and historically) low. Near zero. Any real recovery should cause them to rise as demand for capital increases.

I think the general population is so used to zero interest rates that any increase - all for nowmal macro economic reasons - will freak people out and kill the expansion.

Savers and investors would surely not "freak out." They matter, too, though no one talks about them anymore.

Please note. I am not advocating the above described policy, I am only pointing out that the author's view may prove incorrect. And that the Fed may in fact make additional moves designed, in its view, to stimulate the economy and reduce the risk of deflation.

Last word that I saw from Bernanke was that the rate might be raised in 2014. Who knows? It will eventually go up. When bonds get risky enough, the spread of rates from yields to interest rates elsewhere should be pretty fast.

Bernanke is owned by the banks and a political shill of obama’s. He’s QE us not once, twice, or thrice, but many, many more times after this. Cash and metals, cash and metals.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.