Posted on 01/10/2011 6:17:58 AM PST by IbJensen

The Patriot-Liberty movement has railed against the Federal Reserve for decades. Inexorably attached to the abolishment of the private banking monopoly, the entire political career of Ron Paul is an inspiration for any citizen who values liberty and defends the U.S. Constitution. The Federal Reserve is the Enemy of America.

The central cause for the financial collapse of the country rests upon the fractional reserve debt created money racket, which relegates the taxpayer to chattel slave status. You know this is true, and the politicians fear that at some breaking point you will rise up and force a return to honest money.

Ron Paul states the obvious in the Congressional Record.

“Though the Federal Reserve policy harms the average American, it benefits those in a position to take advantage of the cycles in monetary policy. The main beneficiaries are those who receive access to artificially inflated money and/or credit before the inflationary effects of the policy impact the entire economy. Federal Reserve policies also benefit big spending politicians who use the inflated currency created by the Fed to hide the true costs of the welfare-warfare state. It is time for Congress to put the interests of the American people ahead of the special interests and their own appetite for big government.

Abolishing the Federal Reserve will allow Congress to reassert its constitutional authority over monetary policy. The United States Constitution grants to Congress the authority to coin money and regulate the value of the currency. The Constitution does not give Congress the authority to delegate control over monetary policy to a central bank. Furthermore, the Constitution certainly does not empower the federal government to erode the American standard of living via an inflationary monetary policy”.

Is it possible to replace a private banking cartel as the issuer of money? Career politicians spend trillions of Federal Reserve Notes that accrue interest payments upon the very creation of money. In this political environment, can this tribute payable to the central bank, be eliminated?

Listen to an NPR radio “All Things Considered”, and compare the fairy tale viewpoint of the role and function of the Federal Reserve by NPR to the rational and fiscally sound solutions that Congressman Paul presents. The apologists for the central banking swindle are “Tools” not of capital but of elite’s bankstersthat hold hostage an entire economy. Business no longer has the effective ability to overcome the excessive burden of unnecessary systemic interest. This is the inevitable consequence of a debt pyramid, when governments are required to pay tribute on money created by an accounting addition. It is sad that self-professed intellectuals are so ignorant of the functions and ultimate purpose of the Federal Reserve.

Viewing Ron Paul 0wnz the Federal Reserve and on Dylan Ratigan Jan 6 2011 provides valuable background and a hint of what may be possible. Expectations need to be realistic. While the dam is buckling and a flood is poised to wipe out the valley, only a perspective from high ground can attempt to ease the pain, which is inevitable. Paul is playing down the immediate prospects of replacing the Fed, not because he lost his nerve, but because of the squishy, all things considered mentality, that permeates the society. In order to right the ship of state, the bailing needs to start with stopping the bail outs.

Such measures are pale when placed in context with the real power that rules both the money centers and the political suites. Remember your history before you risk its repeat . . .

“The high office of the President has been used to foment a plot to destroy the American's freedom and before I leave office, I must inform the citizens of this plight.” — President John Fitzgerald Kennedy - In a speech made to Columbia University on Nov. 12, 1963, ten days before his assassination!

Challenging the Central Bank stands as a risky venture and surviving not always guaranteed. The following is from President John F. Kennedy, The Federal Reserve And Executive Order 11110.

Section 1. Executive Order No. 10289 of September 19, 1951, as amended, is hereby further amended-

By adding at the end of paragraph 1 thereof the following subparagraph (j):

(j) The authority vested in the President by paragraph (b) of section 43 of the Act of May 12,1933, as amended (31 U.S.C.821(b)), to issue silver certificates against any silver bullion, silver, or standard silver dollars in the Treasury not then held for redemption of any outstanding silver certificates, to prescribe the denomination of such silver certificates, and to coin standard silver dollars and subsidiary silver currency for their redemption

and --

By revoking subparagraphs (b) and (c) of paragraph 2 thereof.

Sec. 2. The amendments made by this Order shall not affect any act done, or any right accruing or accrued or any suit or proceeding had or commenced in any civil or criminal cause prior to the date of this Order but all such liabilities shall continue and may be enforced as if said amendments had not been made.

John F. Kennedy The White House, June 4, 1963.

Just coincidental or is there a direct message when one seeks to remove the gravy train from the inside circle of the real conspirators? Note that devoted followers of Ron Paul need to recognize that one man standing alone needs protection. The best way to secure that a serious audit of the Federal Reserve will take place is to coordinate among all factions and ideologies the imperative requirement that the Central Bank is accountable to the People. An audit is not nearly the resolution to replace the Fed, but it can be the starting point to invoke righteous outrage of the populace that might spread to the newly elected representatives on the Hill.

If Congressman Dennis Kucinich can agree with Ron Paul, The Tea Party freshmen can take the leap. In 2007, Paul Introduces H.R. 2755: To Abolish the Federal Reserve. Section (b) Repeal of Federal Reserve Act- Effective at the end of the 1-year period beginning on the date of the enactment of this Act, the Federal Reserve Act is hereby repealed. The enactment of this simple directive would be the most earth shattering and economic liberating action seen in the lifetime of everyone alive. If you doubt this conclusion, examine the significance of the American Financial Stability Act of 2010. Thomas R. Eddlem states, “In short, the bill would allow any investment risks that federal government regulators find acceptable and ban any regulators find unacceptable”.

Federal Reserve Bank of Philadelphia admits that the Dodd-Frank Financial Reform Act will increase the power of the Fed.

“The Financial Stability Act establishes the Financial Stability Oversight Council, which will have the responsibility to promote market discipline, coordinate with other regulators to identify and respond to threats to financial stability, and resolve gaps in regulation.

The council will have the authority to place a systemically important financial institution under the supervision of the Federal Reserve. Nonbank institutions may be required to establish an intermediate holding company to be regulated by the Federal Reserve and may be required to divest holdings. The Federal Reserve, in consultation with the council, will tighten prudential standards for the large, interconnected BHCs and financial institutions it supervises. These firms will undergo annual stress tests and will be subject to credit exposure limits. Conferees added a House-passed provision that will require such institutions to maintain a leverage ratio of 15 to 1”.

Just imagine expanding the Fed to regulate banking when the Federal Reserve should be under the microscope as the most vicious criminal syndicate of all time. When the Central Bank buys government bonds that must pay interest by the Treasury, this rigged game of extortion is out of control. “Now with holdings of $821.1 billion, the Fed is officially the second largest holder of U.S. Treasury’s, next to China and is just $25 billion away from being the Treasury's largest creditor”.

The Daily Paul is the flagship site for all things Ron Paul. Their total number of visits since 1/21/2007 reported to be over 42,403,507. The Ron Paul Forum on Liberty Forest has over 27,290 members. Both services have a devoted and loyal following. Nevertheless, this core group of activists is not enough to drive a national campaign with a single purpose. ABOLISH the Federal Reserve.

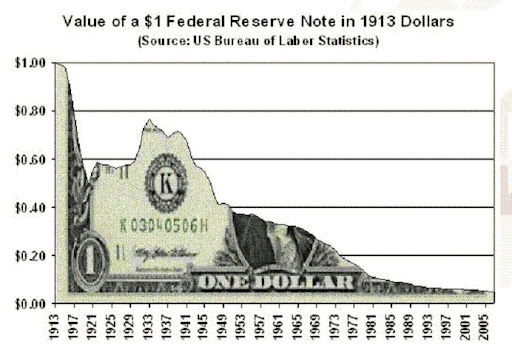

A Bloomberg National Poll conducted by Selzer & Company, has the top two issues as Unemployment and jobs at 50% and the Federal deficit and spending at 25%. The jobs and deficit issue is a direct result of the criminal central banking system. A major component of excessive spending is interest. In FY2010, the Treasury Department spent $414 Billion of your money on interest payments to the holders of the National Debt. The reason for the decline in the purchasing power of the Dollar is inescapable. In order for Ron Paul to lead the crusade against the Fed, he needs a bodyguard of millions to save the American Dream. The life you save is really your own.

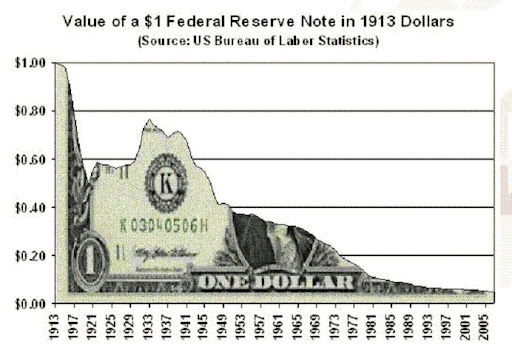

Since the Fed was established they have had on goal (two after Humphrey/Hawkins) - maintain a stable currency.

By any objective standard they have failed. So let’s start with the PREMISE that something has to change.

We need to discuss what a new currency system will look like and stop focusing on the idiosyncrasies of the people calling for change.

I listen to NPR a fair amount, so I know what they are like. But just a few days ago I heard them discuss the Fed and they had my mouth hanging open in disbelief.

Basically (they said) the Fed has no connection to the government, and can create trillions of US dollars out of thin air any time they want. Apparently this is a good thing. And (they said) this has no impact on taxpayers in any way. Why is that, you ask? Because the Fed has no connection to the government.

You have to willfully suspend all disbelief in order to drink this kool-aid. No one with an open mind would buy it.

BTTT

Private banking and private money. Money is too important to be in the Governments hands.

After we take care of our own economic interests, then the government can levy a tax to get money. But not to have the ability to print( yeah, I know ), and raise debts as it pleases.

This of course would destroy the modern welfare/corporate state. Which I would like.

So, I think we will slouch along, each year getting more welfare, more weakly and pathetically dependent upon Fedgov cheese, money, ‘assistance’ until we are serfs, generations deep into financial serfdom and no youth remembers liberty as it died out generations before.

Heck, we are already there.

Ron Paul is planning an audit of the Federal Reserve thus he is clearly a threat to those who own it. History bears out that persons in the past who have tried to establish a national currency which would have circumvented the bank that operated under the Congressional charter and now the Federal Reserve bank met their untimely deaths by bullets. I pray for Ron Paul and his family’s safety.

Problem is most politicians and their lap dog economists define “stable currency” as a controlled descent.

The hump between 29 and 45 shows that DEflation is just as dangerous as INflation.

Borrowing increases the money supply, even under the gold standard.

which relegates the taxpayer to chattel slave status.

Huh?

The main beneficiaries are those who receive access to artificially inflated money and/or credit before the inflationary effects of the policy impact the entire economy.

When the Fed buys a bond, the seller gets cash with 0% yield. How is that a benefit?

In this political environment, can this tribute payable to the central bank, be eliminated?

What does the central bank do with the "tribute"?

Viewing Ron Paul 0wnz the Federal Reserve and on Dylan Ratigan Jan 6 2011 provides valuable background and a hint of what may be possible

If you watch Dylan the Rat, you may be too stupid to breathe.

The high office of the President has been used to foment a plot to destroy the American's freedom and before I leave office, I must inform the citizens of this plight

Fake quote!

If Congressman Dennis Kucinich can agree with Ron Paul...

It's proof that they're both nutz.

A slow rate of inflation is actually good for the economy.

Key word being slow.

That is what we have been taught. I don’t believe it.

What I know is true is that the author is an idiot. And he/she doesn't have a clue about economics or his own idiocy."

What about Oil Price shock, Consumer Psychology, Bush Standing up before the nation and scaring the heck out of us demanding $700 billion bank bailout, Bank Reserve Rates at historic lows, Repeal of banking industry protections, Failure to regulate derivatives, Failure to regulate bank use of credit default swaps, Credit Card companies raising rates and forcing their customers into bankruptcy, unwise trade policies that have stripped our manufacturing, etc. This is the real cause, not the Fed, or lending.

That was an INfalatioany period. The dollar was buying less from 1929 to the end of the war. Prices were going up, and there were shortages. From 29 to, say, 37 or so, the government was doing what it is doing now, doing everything it can to keep crop, commodity, wages( some ) high, even though a lot of people had no work and could not afford those INFLATED prices. ( They said the Depression wasn’t bad if you had a job ) The late 30’s though the war was total government printing money, chasing totally socilist/command manufacturing, so goods and service prices soared and savings became worth less. Like now. Prices kept, or attempted to be kept high, savings at zero.

Don’t expect currency to be a long-term store of value. If you want to hoard dollars, do it in an interest bearing asset or in precious metals.

Currency only needs to be a stable short-term store of value to facilitate transactions.

Or, would you prefer that the Fed get it exactly right every time? That's easy, right? They should simply hit the button......

There is no “The Economy”. There are 300 million economies, each with different values, wants and needs.

What you mean to say as “The Economy” is some vague, elitist notion of what they as a class feel is the present desired economy. Basically big gov, big fiance and their associated Mini-me’s.

The notion of a single, unifying economy is very anti-democrat, anti-liberty. It is vaguely central finance planning to the benefit of the state and those that strap them selves, and the state to themselves as one.

Price is information. Inflation/deflation corrupts the information.

I would prefer that the Fed’s GOAL is stable prices. If your goal is slight inflation you will end up with more inflation than you want.

What is the politically corect time frame? Who made the state, and traders the arbiters of when, how long, how fast trades should be made? Is it any wonder, long term projects can not be economically undertaken when you are unable to plan on stable values? From the late 1700 until the beginnings of the Federal Reserve we had a stable US dollar, and with primitive finance, bad to no information, no to very poor infrastructure, we built the wealthiest nation in the world, literally from nothing. We built cities to rival anyone. From nothing. Now? We can't pour concrete. Yeah, this is working out good.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.