Posted on 10/07/2010 9:23:22 AM PDT by Red in Blue PA

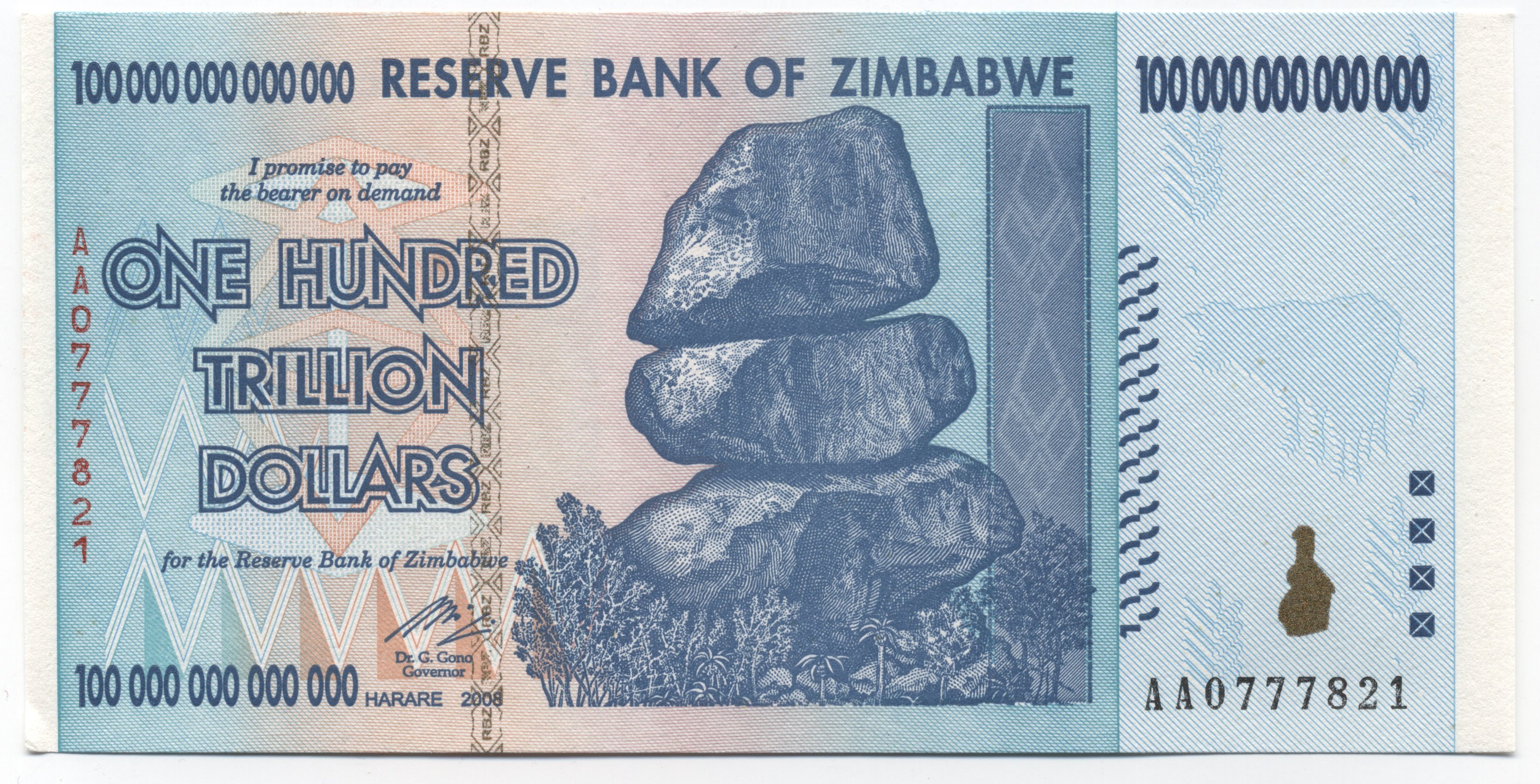

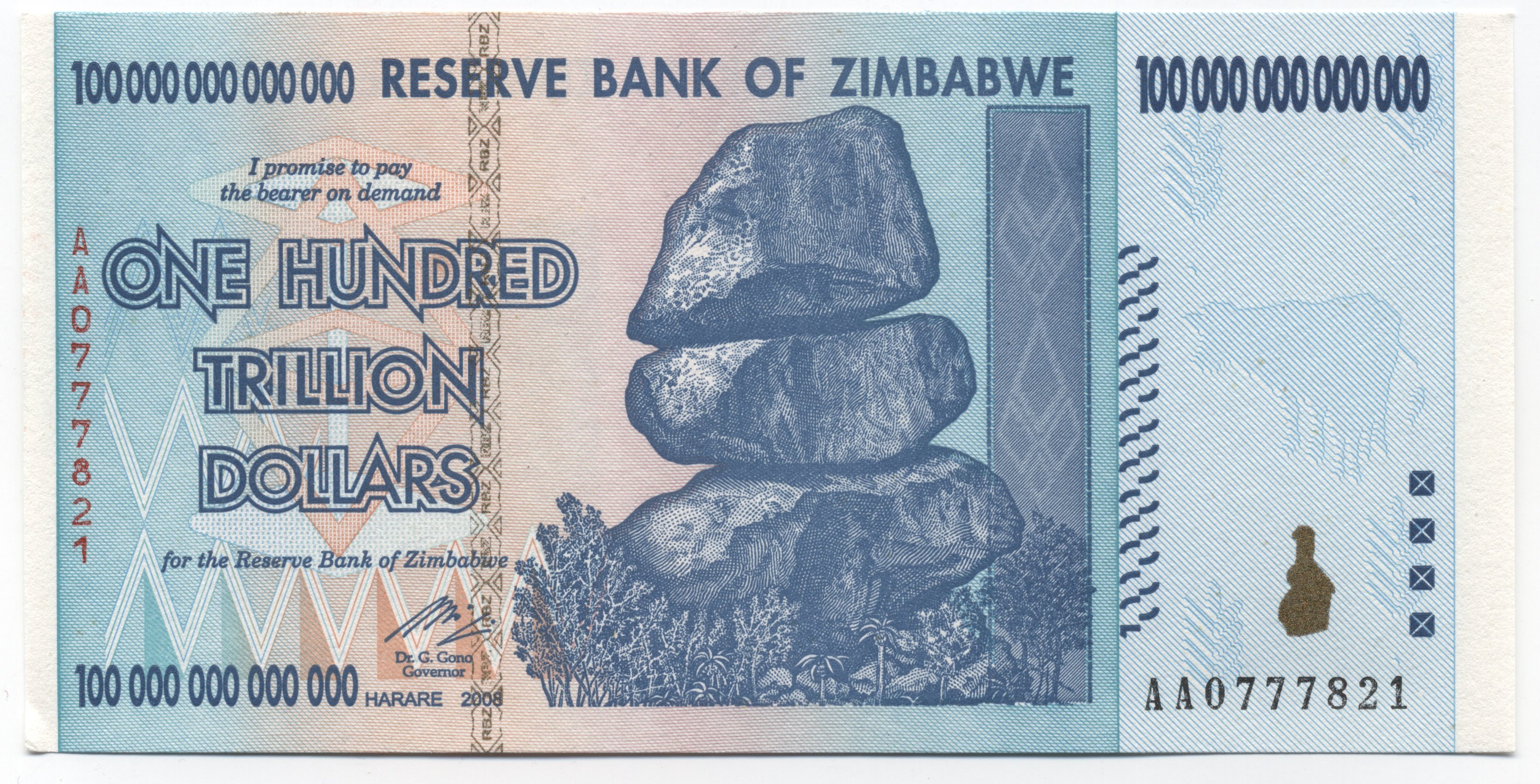

The Federal Reserve spent the past three decades getting inflation low and keeping it there. But as the U.S. economy struggles and flirts with the prospect of deflation, some central bank officials are publicly broaching a controversial idea: lifting inflation above the Fed's informal target.

The rationale is that getting inflation up even temporarily would push "real" interest rates—nominal rates minus inflation—down, encouraging consumers and businesses to save less and to spend or invest more.

(Excerpt) Read more at online.wsj.com ...

Complete and total lie. Anyone who shops for groceries can tell you inflation is very real indeed.

From what I’ve read here at FR we have trillions of dollars being held by nervous corporations that will be unleashed if the corporations gain confidence, leading possibly to serious inflation. Now the Fed is deciding to loosen money supply further (allow more inflation) to either create more of this overhang of unspent dollars or maybe worse, they will create more dollars just when the corporations are finally spending, increasing that inflationary effect.

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.”

- Ronald Reagan

Back in 2008 I thought they’d try this. It’s dumb, but some idiot is likely to think it’s a great idea.

High inflation - zero interest rates - oH! Whoopie!

From what I’ve read here at FR we have trillions of dollars being held by nervous corporations that will be unleashed if the corporations gain confidence, leading possibly to serious inflation. Now the Fed is deciding to loosen money supply further (allow more inflation) to either create more of this overhang of unspent dollars or maybe worse, they will create more dollars just when the corporations are finally spending, increasing that inflationary effect.

There’s a Cloward-Piven maneuver if ever I’ve seen one

Well, presuming my salary would keep up, it would help me pay my mortgage off a lot faster.

Not that I support the idea though.

Groceries are up 15% since 2007. Saw the stat yesterday. Gold has gone from $300 to $1350. Gas is headed up again towards that $3 range. Health insurance is definitely up. My electric bills are higher than they used to be by a big amount.

Well, presuming my salary would keep up, it would help me pay my mortgage off a lot faster.

__________________________________________________________

I saw an article yesterday where Bass was predicting high inflation in the USA. He previously took his Dallas TX area mortgage out . . . in Japan . . . because he expected inflation and currency devaluation in Japan. His mortgage went down by 20% . . . since May.

But people's biggest expesnive is their mortgage, and a lot of folks are having trouble paying that bill. If it's a fixed rate mortgage, and if inflation return, and if people starting getting cost of living raises, then perhaps that mortgage payment will start to seem smaller.

I don't support this, and I don't think it would work as expected, but I can see how a politician would think this was a brilliant way to slow down the foreclosure rate.

Problem is that raises are annual typically. With 10% inflation, you start the year with a $200 grocery bill for the family and end up with a $220 grocery bill. So $80 more a month. Electricity, insurance, service fees, etc. will randomly rise whehter or not your salary has yet.

Meanwhile your mortgage and salary are likely unchanged until the next year . . . and how is your business doing? Can they afford to raise salaries by the rate of inflation or will they undershoot it a little to help them survive or increase profits? Will your clients in business accept a 10% increase in price or are they somehow getting squeezed by the inflation also?

It’s a really unfair system to have faster inflation intentionally built in.

High inflation - zero interest rates - oH! Whoopie!

___________________________________________________________

Nice for all the folks that bought long term bonds isn’t it?

The government did not “keep inflation low” in that they did not fight against inflation. The government deliberately kept inflation in existence as a stealth tax on the economy. The Keynesians and other socialists are all for that because they generally believe in static wealth- that there is no wealth creation, only its concentration and distribution. Therefore for an economy to appear to be expanding there must be inflation. They also believe that inflation is only redistributing money from producers to the government(good) while actual economic expansion is theft of resources from other societies(bad).

That would not "lead to inflation." It is inflation already extant. The price effects of that inflation are in abeyance because the money is stuffed into corporate mattresses, but the inflation is already in the system. Rising prices are NOT inflation. They are an effect of inflation. Dumping of that money into the system is not to be feared as a a possibility. It is a certainty. Fearing it is no longer appropriate. Fearing the knife is silly after you have already been cut. The blood has not yet started to flow but it must.

Salaries and wages are always the last prices to rise in an inflation. Theoretically increased inflation rates are beneficial to debtors but that does not normally include debtors who rely on salaries and wages for their income.

” Groceries are up 15% since 2007. “

That must be a Government statistic - in 2007, on my weekly shopping trips, I could get out of WalMart (so shoot me...) for about $30.. (Single man, living alone..)

Last Saturday, my checkout bill was $42, which is substantially more than a 15% increase over essentially the same ‘shopping basket’ - way more, since I didn’t buy meat (except 2/$1 hot dogs and cheap bologna) or ‘junk food’ (chips/sodas)....

My eating habits haven’t changed (except being priced-out of buying meat on a regular basis), so price increases account for jut about all of it....

YMMV, of course.... ;)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.