- Perhaps those with more knowledge can explain this chart.

http://calculatedrisk.blogspot.com/2007/10/imf-mortgage-reset-chart.html

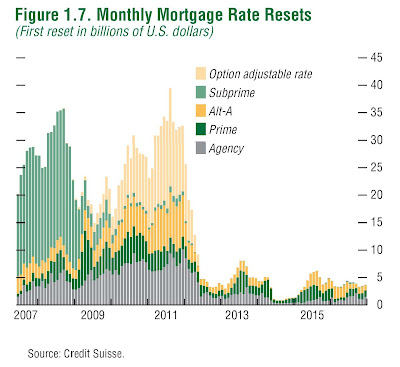

We can look at mortgages that are already in affect now, and see how many will be resetting to a higher payment, and in which future year they will do that.

If there are alot of mortgages out there now, which will reset in say 2009 or 2010, we can be pretty sure that at least some of the riskier of these will fail, and go into foreclosure.

Furthermore, we can categorize these resetting mortgages by how risky they are. Those held by the Agencies (Fannie Mae, Freddie Mac and Ginnie Mae) tend to be the highest quality mortgages, and probably won't have as many failing.

The "Prime" mortgages, which I guess are those which are held by those with adequate documented income, and which were bought with a decent sized down payment, won't fail as frequently either.

The huge peak of sub-prime mortgage (lighter green color) resets are in this year, 2008, from mortgages that were issued three years ago. These are 3/1 (three years until the first reset, then reset once each year thereafter) liars loans on which the owner is paying interest only. Alot of these loans were issued in 2005 (not many before then), with their first reset in 2008. The flood of failures from those resets is a big part of what's hitting us now. When people took those loans three years ago, they figured (if they figured anything at all) that they could just sell the house at a profit in three years if the higher reset monthly payment was too much. With the declining real estate prices, they can't get out anymore with that profit.

But we can see an even bigger problem coming in 2010 and 2011, with the "Option Adjustable" mortgages that were issued in the last year or two. You don't even have to pay interest-only on these Option mortgages. You can pay less than the monthly interest, and let what interest you didn't pay just accumulate on the mortgage, increasing even more what you owe.

These "Option Adjustable" mortgages are like handing out hand grenades to crack heads. Unless the prices of real estate are rising even faster than the balances owed on these mortgages, they are pretty much guaranteed to blow up when the reset date comes.

There is a big pile of them, coming due in 2010 and 2011. See the light orange colored bars. That will cause a big pile of additional foreclosures, which continues to undermine both (1) real estate prices (when a house on your block forecloses, it tends to pull the appraised value of all the houses on that block down) and (2) mortgage backed securities.

A major risk our economy faces is all the mortgage-backed securities that banks had pyramided on top of mortgages. These toxic notes trade between banks, investment firms and hedge funds like Monopoly money. They are worth about what an IOU from a crack head is worth. They are failing catastrophically, with even the best worth a few cents on the dollar. Their total claimed value is worth ten or a hundred times the value of America. They have almost entirely come into existence in just the last four or five years.

If the Secretary of Treasury, the Federal Reserve Chairmen and the head of the Securities & Exchange Commission all woke up tomorrow and decided to destroy this nations banking system (hence the worlds currency) they could do so within the week, easily.

One can see from that chart that we will continue to see high rates of foreclosed mortgages, from almost certainly failing "Optional Adjustable" mortgages, through early 2012.

We're just in the second inning of this game, and it may well be a doubleheader. What's more, it may morph from a gentlemanly game of baseball, into hand to hand combat.

Morals of the story:

- Stay out of debt.

- Stay liquid and flexible -- be prepared to downsize ones lifestyle and change ones financial arrangements dramatically.

- Don't plan on borrowing any money from banks anytime soon.

- Figure there is a decent chance your bank will fail, so keep some money in more than one bank, don't keep more than $100,000 (FDIC insured max) in any one bank, and be able to get by for a week or three without access to your bank.

- Even FDIC insurance may well be overwhelmed at some point, likely resulting in more national debt.

- There's a good chance that the stock market has a long way down still to go. Buying and holding quality stocks could be a good way to lose most of your invested money.

- The increase in the national debt for this bailout, along with the debt already implied by the unfunded promises of Social Security, Medicare and Medicaid, are F'ing huge ... hundreds of thousands of dollars for every man, woman, child and illegal in the country. Almost certainly, a dollar will be worth quite a bit less in ten or twenty years than what it is worth now. There is no other way out, short of genuine revolution, or the even less likely morphing of our government into an honest, responsible body willing to deal with hard issues in a proper fashion.