Skip to comments.

California hints at bottom to housing slump

Reuters ^

| Aug. 1, 2008

| Jim Christie

Posted on 08/02/2008 9:55:02 AM PDT by SmartInsight

California's battered homes market may be hitting bottom, suggesting a national housing recovery may follow, veteran banking analyst Charles Peabody said on Friday, citing a rebound in home sales as renters become owners.

As goes California, the most populous state, so goes the rest of the United States, according to Peabody...

Reasons to believe California home prices will firm may be found in data from the California Association of Realtors, Peabody said.

Notably, buyers are responding to sharply lower home prices. The realtors' group reports the state's June home sales rose 17.5 percent from a year earlier while its median home price plunged 37.7 percent. June also marked the third consecutive month of increases in home sales from year-earlier levels in the state.

California's backlog of homes for sale shrank to 7.7 months of supply in June from 16.8 months in January. The days a home for sale stayed on the market fell to 49.1 in June from 71.6 in January.

"At last, the carrying cost of purchasing a home equals rental rates, a condition that should lead to more stable home pricing going forward," he said.

(Excerpt) Read more at reuters.com ...

TOPICS: Business/Economy; Extended News; US: California

KEYWORDS: economy; foreclosures; housing; housingbubble; housingslump; realestate

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 141-155 next last

To: SmartInsight

To: NormsRevenge

“I see houses selling, folks moving in and out.. I also live in one of the less price affected counties in the state, knock on a fault line, urr, knock on wood.

With rates still well down there,, and now some properties and their asking prices,, time to get ‘er done!”

We are seeing the same here in the better neighborhoods.

One nearby home sold in 48 hour at the asking price well over 6 figures.

There was a small bidding war on another smaller home about 6 blocks away, closer to the school so kids could walk to the good local elementary school. The house was on the market less than a week. We told a lady, we know, who was interested in that area. Her husband dragged his feet, and a week later the house was sold with several backup offers.

Another nice home nearer to the school was up for rent and apparently the owners got an offer they couldn’t refuse.

Depending on the area, the average time on the market is between 30 and 40+ days in this area.

22

posted on

08/02/2008 11:05:15 AM PDT

by

Grampa Dave

(Obama gets the special-ed treatment as our untouchable affirmative action candidate)

Comment #23 Removed by Moderator

To: SmartInsight

Uh... how many times so far have people called a “bottom” to the housing deflation and the attending bank problems?

One of these days, such people will be right, simply because housing prices won’t go to zero, but to call a bottom now ignores the wave of Option-ARM loans which are just starting to reset.

We’re mostly done with the sub-prime problems, which might lead to a temporary situation of relative stability, but to look at the situation from the credit/bond side of things, we’re just about to the halfway point.

There’s now a whole new set of problems that will be a drag on California housing: banks, now suffering third degree burns, are going to actually require such old-fashioned and outdated nostrums as actual down payments (gasp!), real credit checks (the horror!), appraisals that are done by people not involved with making the loan, etc.

Oh, and banks might actually stop lending to people who have a history of not paying loans back. What a business plan!

This is going to slow down any recovery to previous levels.

24

posted on

08/02/2008 11:36:05 AM PDT

by

NVDave

Comment #25 Removed by Moderator

To: SmartInsight

In cenCal we aren't even close to the bottom. The market was gamed by national buliders catering to Bay area commuters with adequate income for the initial variable loan rates. When gas went to $4+/gal and the VRL went up, these commuters panicked and are gone. They left behind homes wildly overpriced for the income of the San Joaquin Valley. Merced, Madera, Fresno, Kings and Tulare County's modal resident is an illegal, Mexican alien earning $27K annually.

Compounding the problem was the size of homes, designed to facilitate multiple family occupation, the hall mark of blue collar anchor babies and their illegal alien extended family. Many tracks featured cheap homes, priced well above $600K because they were multistory with 5 to 7 bedrooms.

To: SmartInsight; Dutchboy88

I recently looked at buying a home south of Tucson. I didn’t, because I think the prices are still too high. The house I came closest to making an offer on was asking for 150% of their purchase price - and they bought in 2002! It has been on the market for 15 months...

There are homes on my street that have been on the market for 12-18 months, but the asking price hasn’t dropped.

I’m taking all this to mean that people are NOT nearly as desperate to sell as the media is making out.

27

posted on

08/02/2008 12:46:05 PM PDT

by

Mr Rogers

(Old, pale and stale - McCain in 2008! but we're only one vote away from losing the 2nd amendment...)

To: SmartInsight

I saw a chart on the net last week that shows “as reported GDP” vs “GDP minus M.E.W.”(mortgage equity withdrawal)for the years 96-06. If what it shows is truthful then folks, our economy has been in the tank since 2000. 01-02 negative growth and 02-06 about 1%/yr.

It seems to me that giving away our manufacturing economy, which adds value, to becoming a service economy of burger flippers, strippers, computer programmers, gamers, lawyers, mowers, real estate flippers and debtors that we have gone down the scuppers.

28

posted on

08/02/2008 12:46:29 PM PDT

by

biff

To: sf4dubya

That’s a VERY good point I forgot:

We need to look at seasonal adjustments for real estate transactions. Most parents prefer to move in between school years, so sales pick up in May, June, July and August.

We’ll know much more about whether we’re near the bottom in January, as you properly indicate. That’s the nadir of the real estate market, and I’m betting that we’re going to see some steep price declines on the high end of the price range, since that’s where the Option-ARM loans were most used - higher priced houses. I think we might have seen the worst on the lower-end housing, where now prices are in line with what household incomes will support at 2.6 to 3.0 times median household incomes.

29

posted on

08/02/2008 2:11:54 PM PDT

by

NVDave

To: vietvet67

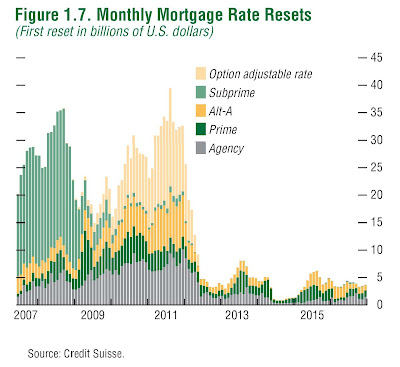

The chart you refer to is the following:

One big way that people get in trouble is with mortgages that reset after the first few years to a higher monthly payment that they really can't afford.

We can look at mortgages that are already in affect now, and see how many will be resetting to a higher payment, and in which future year they will do that.

If there are alot of mortgages out there now, which will reset in say 2009 or 2010, we can be pretty sure that at least some of the riskier of these will fail, and go into foreclosure.

Furthermore, we can categorize these resetting mortgages by how risky they are. Those held by the Agencies (Fannie Mae, Freddie Mac and Ginnie Mae) tend to be the highest quality mortgages, and probably won't have as many failing.

The "Prime" mortgages, which I guess are those which are held by those with adequate documented income, and which were bought with a decent sized down payment, won't fail as frequently either.

The huge peak of sub-prime mortgage (lighter green color) resets are in this year, 2008, from mortgages that were issued three years ago. These are 3/1 (three years until the first reset, then reset once each year thereafter) liars loans on which the owner is paying interest only. Alot of these loans were issued in 2005 (not many before then), with their first reset in 2008. The flood of failures from those resets is a big part of what's hitting us now. When people took those loans three years ago, they figured (if they figured anything at all) that they could just sell the house at a profit in three years if the higher reset monthly payment was too much. With the declining real estate prices, they can't get out anymore with that profit.

But we can see an even bigger problem coming in 2010 and 2011, with the "Option Adjustable" mortgages that were issued in the last year or two. You don't even have to pay interest-only on these Option mortgages. You can pay less than the monthly interest, and let what interest you didn't pay just accumulate on the mortgage, increasing even more what you owe.

These "Option Adjustable" mortgages are like handing out hand grenades to crack heads. Unless the prices of real estate are rising even faster than the balances owed on these mortgages, they are pretty much guaranteed to blow up when the reset date comes.

There is a big pile of them, coming due in 2010 and 2011. See the light orange colored bars. That will cause a big pile of additional foreclosures, which continues to undermine both (1) real estate prices (when a house on your block forecloses, it tends to pull the appraised value of all the houses on that block down) and (2) mortgage backed securities.

A major risk our economy faces is all the mortgage-backed securities that banks had pyramided on top of mortgages. These toxic notes trade between banks, investment firms and hedge funds like Monopoly money. They are worth about what an IOU from a crack head is worth. They are failing catastrophically, with even the best worth a few cents on the dollar. Their total claimed value is worth ten or a hundred times the value of America. They have almost entirely come into existence in just the last four or five years.

If the Secretary of Treasury, the Federal Reserve Chairmen and the head of the Securities & Exchange Commission all woke up tomorrow and decided to destroy this nations banking system (hence the worlds currency) they could do so within the week, easily.

One can see from that chart that we will continue to see high rates of foreclosed mortgages, from almost certainly failing "Optional Adjustable" mortgages, through early 2012.

We're just in the second inning of this game, and it may well be a doubleheader. What's more, it may morph from a gentlemanly game of baseball, into hand to hand combat.

Morals of the story:

- Stay out of debt.

- Stay liquid and flexible -- be prepared to downsize ones lifestyle and change ones financial arrangements dramatically.

- Don't plan on borrowing any money from banks anytime soon.

- Figure there is a decent chance your bank will fail, so keep some money in more than one bank, don't keep more than $100,000 (FDIC insured max) in any one bank, and be able to get by for a week or three without access to your bank.

- Even FDIC insurance may well be overwhelmed at some point, likely resulting in more national debt.

- There's a good chance that the stock market has a long way down still to go. Buying and holding quality stocks could be a good way to lose most of your invested money.

- The increase in the national debt for this bailout, along with the debt already implied by the unfunded promises of Social Security, Medicare and Medicaid, are F'ing huge ... hundreds of thousands of dollars for every man, woman, child and illegal in the country. Almost certainly, a dollar will be worth quite a bit less in ten or twenty years than what it is worth now. There is no other way out, short of genuine revolution, or the even less likely morphing of our government into an honest, responsible body willing to deal with hard issues in a proper fashion.

The powers that be are clearly using this opportunity, as they did in 1930, to increase the powers of the government and central banks. Americas government and economy are becoming increasingly socialized. It sucks. I don't see anyway to stop it.

30

posted on

08/02/2008 2:29:25 PM PDT

by

ThePythonicCow

(By their false faith in Man as God, the left would destroy us. They call this faith change.)

To: 101voodoo

I don’t know when Fla will bottom but keep in mind they don’t ring a bell when a market hits bottom. Most times it isn’t known when that occurs until about 6 months afterwards. I don't know about Florida, but in many other regions, one can pretty easily estimate when it's at or near bottom with a computer and the right software or site.

Just watch overall inventories, as they shrink, and homes start selling at a faster pace, you can bet the bottom is there, or almost there. As the frequency of home sales increase, and inventories shrink, the prices will go up. Prices will increase more slowly, but they will inch up.

This is what is exactly what is happening now in So. Cal. I can tell you personally, we watch the market, and homes are selling again and taking less time to sell. Two in our immediate area have just closed escrow this week, with new owners moving in, both were priced surprisingly on the high end.

31

posted on

08/02/2008 2:43:25 PM PDT

by

dragnet2

To: Psycho_Bunny

It’s unlikely he’s correct.

For sure...two to three years for even bottoming out around here; just tons and tons of For Sale signs rusting on front lawns all over town.

This inventory has to change hands - all of it - and then the market will be "flat" for quite some time, with little or no appreciation.

32

posted on

08/02/2008 2:47:09 PM PDT

by

ErnBatavia

(...forward this to your 10 very best friends....)

To: biff

“It seems to me that giving away our manufacturing economy, which adds value, to becoming a service economy of burger flippers, strippers, computer programmers, gamers, lawyers, mowers, real estate flippers and debtors that we have gone down the scuppers.”

Adjusting to the new economy is hard for many people....

...yet an excellent career choice seems to be “Community Organizer” which confirms that “government” is a growth industry.

To: ErnBatavia

This is exactly what we are seeing in our area.

>>California's backlog of homes for sale shrank to 7.7 months of supply in June from 16.8 months in January.<<

I know about the Inland Empire area. It got hit bad in the down turn. Other areas have fared much better.

34

posted on

08/02/2008 2:53:56 PM PDT

by

dragnet2

To: Mr Rogers

Yes, I believe you are absolutely right. But, the media needs to yell “fire” to sell copy. If all were stable, they would be ignored.

Here is a little tidbit about the South Tucson area... The Dept. of Trans. for AZ anticipates 23 million people in the megalopolis of Prescott (yes, Prescott) to Nogales Golden Corridor by 2050. Bullet train and widened freeways all the way. New International Airport at Casa Grande.

What just passed J. N.’s desk is the new almost $ 1Billion amusement park called Decades themed on Rock & Roll (Presley, Beatles, etc.) rides and attractions to be located midway between Phx. & Tuc. 250 acres of rides and music. Also, a Universal Studios-type park nearby.

That makes the Tucson to Phx area the next LA and the owner probably figures they will wait till the bidding starts.

Thought you might be interested.

To: Dutchboy88

If I were an investor I’d be very sceptical of that. Standing in lines at amusement parks in Arizona, under 110 degrees, wouldn’t seem very appealing.

36

posted on

08/02/2008 2:59:46 PM PDT

by

dragnet2

To: dragnet2

Of course much of the reason for local stagnation could be based on the fact that it’s been around 110 degrees much of the summer, which tends to discourage lookies...

37

posted on

08/02/2008 3:06:25 PM PDT

by

ErnBatavia

(...forward this to your 10 very best friends....)

To: ThePythonicCow

Thank you for that excellent explanation.

With the housing crisis, inflation and the feds destruction of the dollar, it appears to me that a “perfect storm” has been created and the consequences will be more far-reaching that most realize.

Your advise for protecting oneself appears spot on.

Thanks again..

To: dragnet2

The engineers are all over this. They are going to be misting nearly every outdoor area throughout the park. Designed to lowere sensible temp about 20 degrees. That has been the reason AZ has previously not had amusement parks. And, much of it will be indoors.

Here is a oddity. Apparently Orlando’s mean temp is only 3-4 degrees cooler than where they are going to locate Decades. And, I undestand the FL humidity makes DisneyWorld miserable for more days than it will be in at Decades. Just passing the info along.

To: vietvet67

You're welcome, sir.

By the way, one of the bumper stickers on my car reads:

Welcome Home, Vietnam Vets.

I put it on my car when John F'n Kerry was running for President (did you know he served in Viet Nam too?)

40

posted on

08/02/2008 3:12:36 PM PDT

by

ThePythonicCow

(By their false faith in Man as God, the left would destroy us. They call this faith change.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 141-155 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson