Posted on 11/09/2007 6:52:59 AM PST by Hydroshock

Wachovia said Friday it suffered a $1.1 billion loss on subprime mortgage-related debt in October, while Capital One Financial said more customers are having trouble paying their bills as the U.S. credit crisis deepened.

Wachovia, the fourth-largest U.S. bank said the value of so-called asset-backed collateralized debt obligations it holds fell to $676 million as of Oct. 31 from $1.8 billion on Sept. 30. The $1.1 billion pretax loss is in addition to $347 million in the third quarter, Wachovia said.

Wachovia also said it expects to boost loan losses by $500 million to $600 million this quarter, largely in geographic areas that have faced "dramatic declines" in housing values.

Wachovia shares dropped $1.83, or 4.5 percent, to $38.47 in early electronic trading.

Charlotte, North Carolina-based Wachovia joined a growing list of financial companies -- including Citigroup, Merrill Lynch and Morgan Stanley -- that have reported losses from worsening conditions in consumer credit and capital markets.

(Excerpt) Read more at cnbc.com ...

Economy/Credit/Housing Issues Ping List

If you want on or off this list let me know.

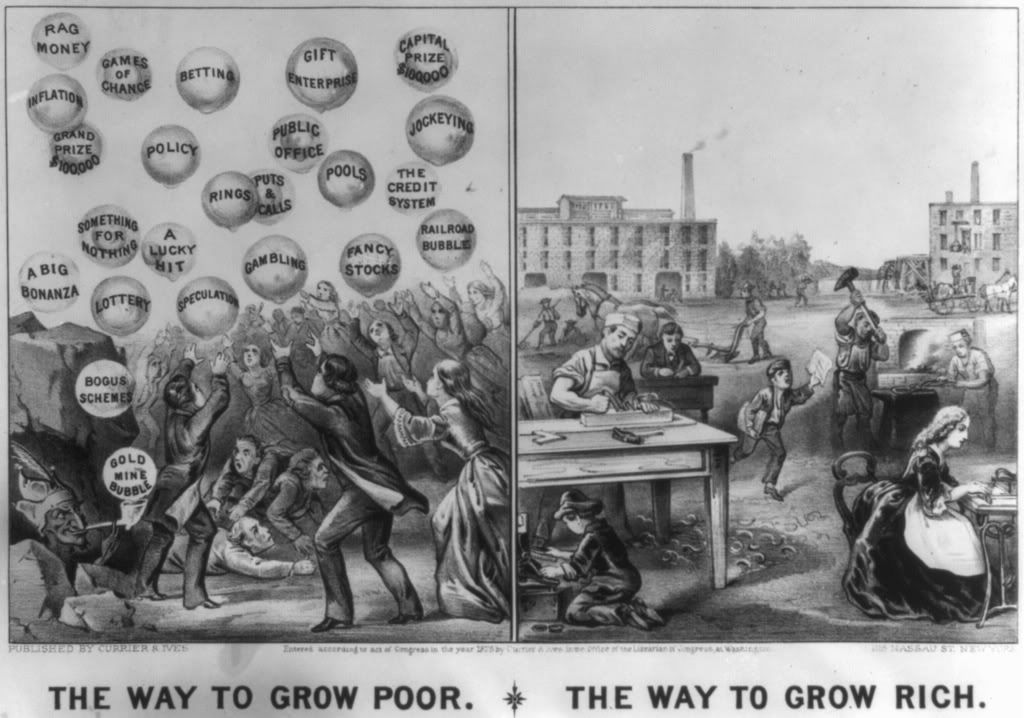

I don’t loan money to my deadbeat brother-in-law, no matter how much he asks.

Reason being - I know he won’t pay me back.

Seems these credit companies should have had the same thought-process before giving $300,000 loans to someone who makes $12 an hour.

Yeah, you would think. But then again denigning loans might cut into their quarterly bonuses.

What ever happened to common sense lending? Huge realty corporations with in house mortgage and transfer companies can be trouble. They own the whole package and made large sums off each transaction x 3. Title, mortgage and seller / buyer agency. It is illegal to represnt both but they did it easily.

These banks did this to themselves. I have virtually no sympathy for them. The silver lining to this dark cloud is that I don’t have to endure ad after ad on radio/TV for easy-money mortgages.

10:02 AM, ET. Dow down 196.80 to 13,069. I did not think the shakeout from crappy loans would hit so soon or so hard. We are looking at the Dow down 1,500 points from October by the end of November.

Is it time for me to offer .60 on the dollar to settle my CITI credit cards?

I agree with you, but fear that their greed and stupidity will filter into the economy and hurt a great many people.

The credit companies are getting what they deserve. They had the bankruptcy laws changed so people would not have their credit card debt wiped out. So now as people with poor credit are forced to pay their credit card bills, they have to let their homes go into foreclosure, especially if they have an ARM going up after bankruptcy restructuring. The credit card companies get first dibs on debt repayment and the mortgage companies get screwed when there isn't the money to pay a resetting ARM. This link explains it.

In other words, people have to let their homes go in order to make credit card payments.

This is not all banking folly, much of this was the (needed) revision of GM practices. In the long run, hell, even in the short run, well managed companies which sell a needed product or service will do well.

Capital One Financial said more customers are having trouble paying their bills

Well ... DUH!

Quit sending everyone with an address a 'Your Pre Approved for a $10,000 Credit Card' junk mail packet every other day.

I get so ticked with these asshats and the cr@p they keep sending, I told the wife I should take them up on their offer. Then max out the card in a couple days and then tell them to screw off, I'm declaring Bankruptcy.

So Capitol One, what's in your wallet?

They deserve everything they get. Or more accurately -- don't get :-)

Are you current on your payments?

Our economy runs on credit. The dollar is really a debt instrument. If you aren't creating debt you aren't creating dollars.

How can the economy expand if we don't have access to cheap credit ?

Why are we caught in this cycle where the banks inflate the money supply and asset prices, then deflate it later causing those assets to crash ?

Sounds like a scam to pick up cheap assets while still holding the debtors responsible for paying off their debts.

You can't. They spent tens of millions in bribes Lobbying fees and political donations to change the law. Well, it was not their money that was spent, it was the payers of 30% default rates who did.

Just 10 weeks ago Bernanke, Paulson, and W were saying that the subprime mess was contained and would stay that way.

You need to turn off the computer and get to work.

Well they got that one wrong.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.