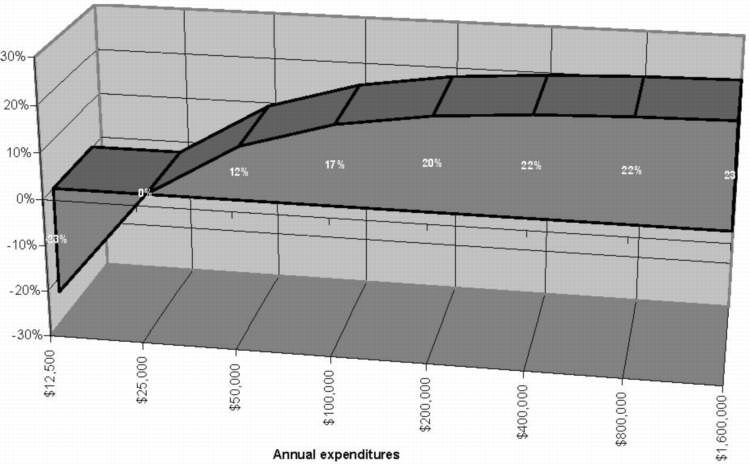

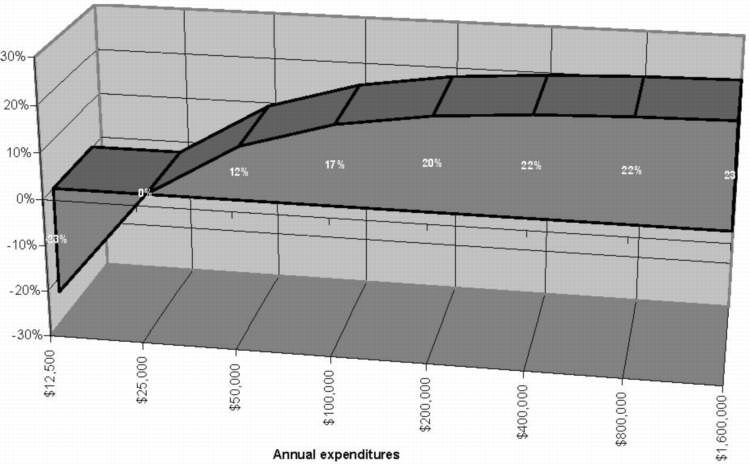

Geez, can you post the graphic of effective rates by spending levels?

With FCA sales tax rebate for family of four taken into account.

http://www.fairtaxvolunteer.org/smart/faq-main.html#48

Posted on 12/18/2005 4:46:00 PM PST by FairOpinion

YES! 83% (8832 votes) A consumption tax would be great for the American economy. Do away with complicated income taxes!

NO! 17% (1761) A consumption tax would not be fair for low-income households. Keep the current income tax system!

We'll send your vote to your congressional representative and senators.

It is additive with state and local sales taxes; however, when stated as a sales tax, the rate is 30% for the Fair Tax, not 23% (23% is the inclusive rate; sales taxes are stated at exclusive rates, which is 30% for the Fair Tax.) So that would be 37%-39% in total sales taxes for a Fair Tax of 30% added to existing local sales taxes of 7%-9%.

Good point. Will look deeper into that.

Fair enough. I'll look at it again with that in mind. I continue to want to keep an open mind for pro and con.

Your assumption is correct, but not limited to those you listed. In this, I am not trying to categorize specifics when I know there will be others who defy description.

Not changing my argument, but the aspect I'm thinking about has nothing to do with the less fortunate.

An example. Society has an interest in people buying and owning homes. The tax code as it is now stimulates and rewards home ownership. Would the Fair Tax do this? Not as I read it. In Canada, using a comparison, there is no reward for home ownership taxwise and fewer people own their homes. As I understand the Fair Tax, there would be no tax benefit to buying a home. (There is a similar problem in the UK and other countries.) My point is not this specific example alone. My point is that society has reasons to stimulate an ownership society, and helping people get to that status benefits society, without the Fair Tax aspect of being totally neutral.

The morons who make up the rank and file of the Democrat Party, of course, believe anything their sociopathic leaders tell them.

The problem with the flat tax is "flat tax on WHAT"?

When President Reagan reformed the tax code, he eliminated a lot of the deductions, and lowered the % tax, then Clinton raised the taxes and now we had no deductions.

The consumption tax is the fairest, you have a choice whether or not you want to buy something and whether you want to buy something expensive or less so, and pay the taxes based on that.

Flat tax only means that everyone pays the same % regardless. If they eliminated the mortgage deduction, almost everyone who bought houses in recent years in places like CA would lose their house, because they couldn't afford to pay the tax and the mortgage.

In CA there is no sales tax on food, but there is sales tax on everything else. I see no reason why that couldn't be done with Federal sales tax.

I can tell you unequivocally that the fair tax is not at all similar to the French version of VAT. Please go to the fair tax website (fairtax.org) before posting. I think you are on the path discovery but please know what you're talking about.

Have we all lost our minds? The government is us.

"General Washington, we are surrounded, out of ammunition and food, should we surrender?"

The tax on the Rolls will be thousands, the tax on the baby formula will be cents.

Never happend my a$$.

A Taxreform bump for you all.

If anyone would like to be added to this ping list let me know.

John Linder in the House(HR25) & Saxby Chambliss Senate(S25) offer a comprehensive bill to kill all income and SS/Medicare payroll taxes outright and replace them with with a national retail sales tax administered by the states.

H.R.25,S.25

A bill to promote freedom, fairness, and economic opportunity by repealing the income tax and other taxes, abolishing the Internal Revenue Service, and enacting a national retail sales tax to be administered primarily by the States.Refer for additional information:

Geez, can you post the graphic of effective rates by spending levels?

With FCA sales tax rebate for family of four taken into account.

http://www.fairtaxvolunteer.org/smart/faq-main.html#48

"The problems with the flat tax is it retains the IRS and it's 60,000+ page tax code and people will still have taxes deducted from their paychecks. Many people will the IRS is far from fair."

No. The central idea behind the flat tax is that it would eliminate all deductions. The 60,000-page tax code could be reduced to six pages.

I personally prefer a flat tax (15%) than a national sales tax (23%).

I personally prefer a flat tax (15%) than a national sales tax (23%).

I notice you aree not counting the SS/Medicare tax in that 15% replacement.

The National Sales Tax implemented by HR25 replaces both income and SS/medicare taxes with a single rate tax on new consumer goods and services.

A 15% replacement for income taxes with a 15% SS/Medicare tax on wages as well is a hefty tax rate on wage income that you are agreeing to.

I'll take 23% of expediture less the FCA rebate paid on replacing both sets of federal taxes anyday.

"Politics" (as someone once said) "is the art of the possible".

Sales taxes are perceived as "regressive" since they affect everyone equally regardless of income level. For this reason, there is NO possibility in the US of creating a "fair tax" (however you want to try to mitigate the regressive features with complicated "rebates" or "negative income taxes" which would involve an IRS every bit as complicated as the current one).

Taxes are taxes. The question is NOT how we pay them, the question is "Are we getting our money's worth for what we pay?"

Despite what the fair-taxers say, a retail sales tax would:

a) punish the poor by make everything instantly 25-30% more expensive;

b) not change ANYTHING in terms of loopholes for the rich since they would simply use their corporations to purchase everything "wholesale" to avoid paying the tax;

c) end up masking the TRUE cost of government by hiding the tax amount... (Be honest... last time you purchased a gallon of gas did you say to yourself "Gee... .45 cents of every gallon I purchased went for Federal Taxes?").

At the risk of offending my FreeP friends with an agenda here, the "Fair Tax" will never fly.

And for good reason.

If that is the case then I make a law that the IRS is disbanded and a flat tax is initiated.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.