Posted on 10/02/2022 6:26:12 AM PDT by PK1991

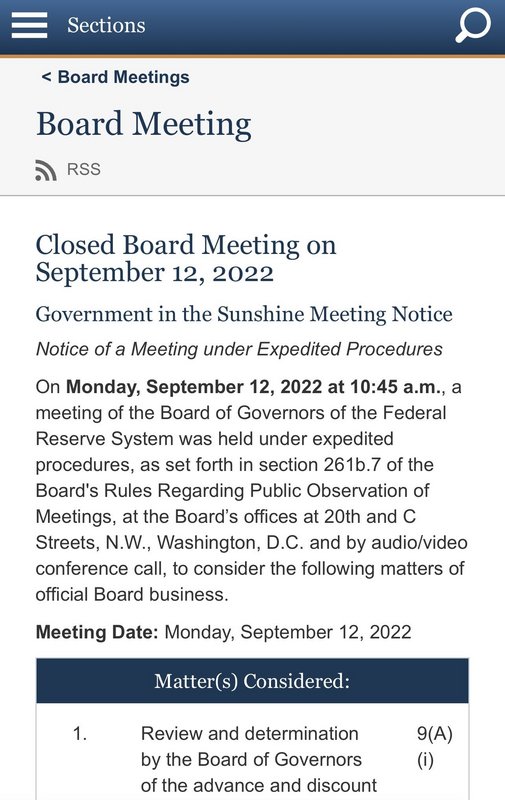

Government in the Sunshine Meeting Notice Advanced Notice of a Meeting under Expedited Procedures

Closed meeting of the Board of Governors of the Federal Reserve System at 11:30 a.m. on Monday, October 3, 2022, will be held under expedited procedures,

Meeting Date: Monday, October 3, 2022

Matter(s) to be Considered: 1.Review and determination by the Board of Governors of the advance and discount rates to be charged by the Federal Reserve Banks.

(Excerpt) Read more at federalreserve.gov ...

They will soon pivot and follow the Bank of England to lower rates.

there are rumors flying around about Credit Suisse ... maybe related?

Put your head between your knees and brace, brace, brace.

I saw that also. Credit Suisse is the next Lehman.

Could be couple of things:

1) notice to go live with digital currency

2) interest rate adjustment because of economic problems

The election is coming soon and the stock market Fall is killing Democrats. They’re going to try to do something that will save them and that’s most likely an interest rate drop.

Yeah, credit swisse is junk

The 3rd quarter just ended and it is now abundantly clear that we are in a recession.

Biden has single-handedly destroyed everything that Trump built in just two years. And it’s getting worse.

Impeachment is the only recourse now to save our country.

You want Kamala?

Stand by for heavy rolls.

The Fed could also increase the purchase of treasuries and/or MBS.

I think this is more likely than a rate adjustment since the treasury and MBS markets are starting to break, and a rate adjustment would be a knock to the Fed’s credibility.

I did a quick search here... Didn’t find anything about England Fed lowering rates... Saw they started buying some bonds cause pension funds fund are getting margin called. Got a link to rate cut?

Why am I getting this classic flashback from Star Trek.

Scotty!!!

More Power !!#

\

I’m giving it all she’s got captain !!

Could this (posted earlier) also be related?

So, Brandon...my neighbor is trying to take over one of my five acres. How’s about ya send me a quick million or so...a girl’s gotta eat, ya ol’ freekin’ fool!

Yes, they are moving to QE. Printing $5 billion per month up to $65 billion. The rates will drop. Watch for the Fed to move to QE also. There is no way they can keep raising rates without bringing the whole system down.

Without a major cash infusion the big 5-6 US banks are going bye bye. They hold the silver shorts and billions in derivatives. Its a house of cards.

“ The election is coming soon and the stock market Fall is killing Democrats. They’re going to try to do something that will save them and that’s most likely an interest rate drop.”

The announcement of a successful soft landing and suspension of any further increases would do the same.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.