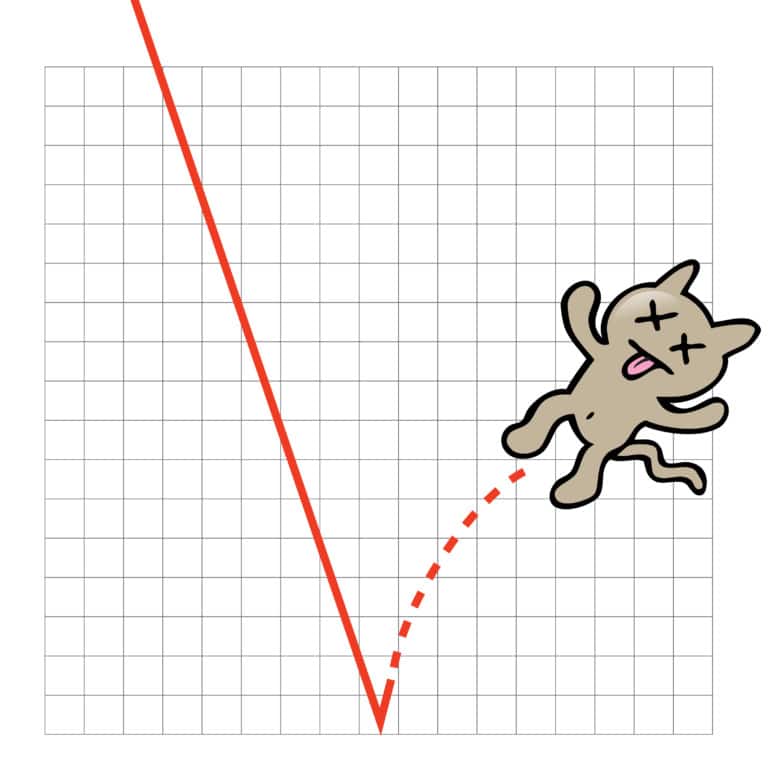

Dead cat bounce.

Are people selling short?

The opening prices are based on all the pre-placed orders being filled. They mean nothing about what will happen throughout the day. If recent trends hold, the indexes may well close well down.

The economy is contracting due to the lunatic green assault on fossil fuel production and transport facilities. Farming is severely affected as natural gas, the core ingredient of fertilizer and diesel fuel becomes scarce and expensive. There will be hunger wars.

Great, markets come down 3,000 and the media trumpets a gain of 400.

Gas goes up 2/gallon and the media cheers when it drops 5 cents.

People see these numbers, they aren’t stupid.

That about covers it. Free-fall elevator down and rickety stairs up.

There was a day when something like Peloton would still be wishing it could be listed. Buffet is right about the market having become a gambling house. Question is though, what else can you do but look for value adding essential investments?

The thing I wish I had done when I first began all this mess nearly 50 years ago now would have been to buy solid blue chip and/or dividend aristocrat stocks. Just less than 10 so I could monitor them well enough. Lots of the Generals would have failed me though... General Electric, General Mills, General Motors... Similar funds would do just as well with less work.

Up 101.92 now…

He’s dead, Jim.

as of this minute @ 10:54 the DOW is up just 16 points

How much longer can they prop it up?

S&P 500 just went negative for today. Starting to look like the relief rally might have failed for today.

And it’s already in the red.. wtg guys.

Until sanity is returned to our domestic energy markets we are doomed. A nation runs on energy. Actual energy, not wishful energy. You can’t policy drive what isn’t there.

Now down 175. LOL.

After it goes down, it goes up. After it goes up, it goes down. So why the sheer panic and hysteria the other day when it went down? It always goes back up again, so the news of its “plunge” is not news.

They always pick the DOW, which is now around 32,000. That’s because a “400” point “plunge” sounds like more than it is.

An equivalent point “plunge” for the Nasdac would be 150 points. Doesn’t sound as dramatic.

Didn’t hold….yet.

The brief dead cat bounce to scare people out of their puts and shorts has already faded, the market is still headed down. I held on to my UVXY throughout, they didn’t fool me.