Posted on 04/30/2022 9:52:33 PM PDT by SeekAndFind

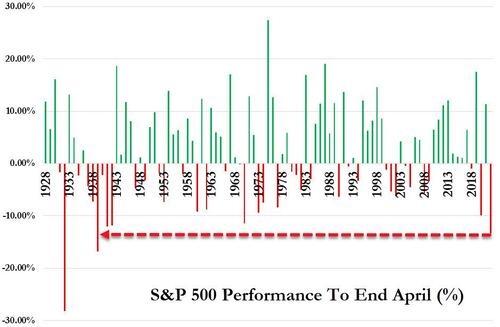

After a tumultuous week of violent lurches higher (but mostly lower), the S&P 500 has ended April with its worst start to a year since the start of World War 2...

Vacation bookings are soaring, car sales are booming and Americans continue to spend with abandon, thanks to higher wages and brisk hiring; and yet, the economy unexpectedly contracted in the first quarter, led by trade deficits and a drop in inventory purchases.

“The market is worried about a very fragile economic outlook, as it should be," said Joe LaVorgna, chief Americas economist at Natixis and former Trump White House economic adviser.

“The economy is fundamentally soft: The Fed is going to hike next week, the situation in Ukraine is not getting better and high inflation is cutting into costs."

All this chaos and divergence appears to have 'triggered' 91-year-old Warren Buffett who lambasted Wall Street for encouraging speculative behavior in the stock market, effectively turning it into a "gambling parlor."

Having announced that Berkshire Hathaway suffered a $1.58 billion loss in the first quarter of 2022 (a huge reversal from the nearly $5 billion gain it saw at the same period of 2021), Buffett spoke at length during his annual shareholder meeting Saturday about one of his favorite targets for criticism: investment banks and brokerages.

“Wall Street makes money, one way or another, catching the crumbs that fall off the table of capitalism,” Buffett said.

“They don’t make money unless people do things, and they get a piece of them. They make a lot more money when people are gambling than when they are investing.”

Buffett bemoaned that large American companies have “became poker chips” for market speculation. As CNBC reports, he cited soaring use of call options, saying that brokers make more money from these bets than simple investing.

Still, the situation can result in market dislocations that give Berkshire Hathaway an opportunity, he said:

"That's why markets do crazy things, and occasionally Berkshire gets a chance to do something."

98-year-old Charlie Munger also chimed in, warning that “It’s almost a mania of speculation."

“We have people who know nothing about stocks being advised by stock brokers who know even less,” Munger said.

“It’s an incredible, crazy situation. I don’t think any wise country would want this outcome. Why would you want your country’s stock to trade on a casino?”

CNBC noted that an audience member made an inaudible comment while he was talking.

“Was that a banker screaming?” Buffett joked.

The Buffett/Graham model still works because it minimizes the risk of investing in an emerging technology company that goes out of business. As Buffett himself once said: "If I'm not comfortable holding a stock for ten years, I don't want to own it for ten minutes." There's a lot of wisdom to that.

One of the smartest investors I know was an ardent believer in the future of e-commerce as far back as the late 1990s. And yet he never had any dot-com stocks in his private equity fund. I once asked him why this was the case, and his answer was a great one. He said: "I don't know which of these companies is going to thrive and which are going to be out of business in five years. So I invest in the companies that will do well in a growing e-commerce world regardless of what happens with the individual players."

His top picks for his "e-commerce portfolio" were FedEx and UPS.

True. Berkshire Hathaway shouldn't even be considered a publicly traded company. It functions more like a mutual fund. It's considered a "consumer products" company in terms of its industry sector, but its largest holdings include companies in banking/finance, energy, telecommunications, and transportation (it owns the Burlington Norther Santa Fe Railroad in its entirety).

Understood. But what exactly is Facebook (for example) doing with its capital -- writing more software code?

Buffett kills millions of children by funding abortion. He buys politicians and destroys at least 70,000 jobs in the US and Canada so his train can carry oil instead of a safe pipeline.

As an aside, I am not a fan of FB.

Very true...which is why I buy ETFs of the tech sector. Take QQQ for example.

Have done this for many years.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.