Posted on 03/18/2022 6:58:42 AM PDT by Leaning Right

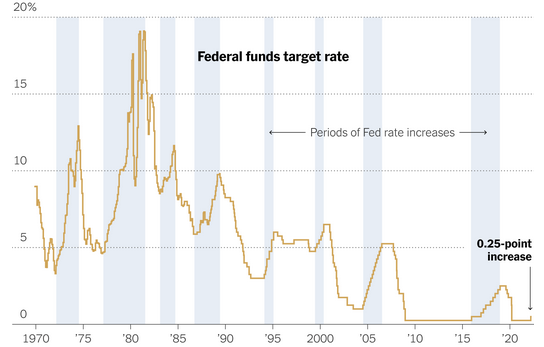

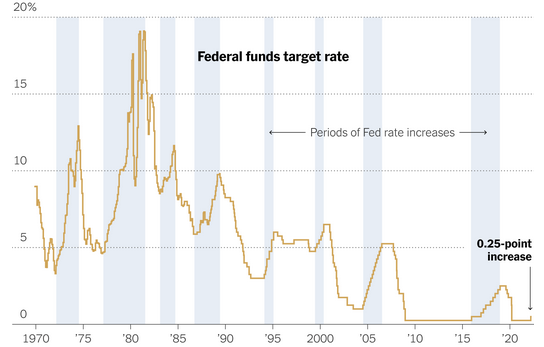

St. Louis Federal Reserve Bank President James Bullard has released a statement explaining why he dissented when the Fed elected to raise interest rates by a quarter-point.

(Excerpt) Read more at marketwatch.com ...

Even that small jump would impact Congress’s main function these days - spending money it doesn’t have.

It may well be at 3 points by the end of the year but best to ramp up a little too slow than too fast.

40% of the US dollars in existence were printed in the last year. IMO inflation is here to stay.

Yep, it’s going to take years to wring inflation out of the system. Probably the plan is to move things along to a digital dollar that supposedly doesn’t inflate.

With their border, foreign, justice and monetary policies its really hard not to believe the goal of this administration is to collapse our system and invite anarchy.

The market is whistling past the graveyard. Wait till the consumer starts really cutting back on spending.

“Yep, it’s going to take years to wring inflation out of the system.”

I predict a lot of people are going to be surprised to find inflation dropping by next year.

“Yep, it’s going to take years to wring inflation out of the system.”

When inflation drops sooner than “years” people will just claim the numbers are fake since everyone just makes up what they want these days. Inflation will be dropping by next year.

EVERY home mortgage that was in the approval process is in jeopardy.

Its ok. Nanzi says government spending lots of money is good.

Inflation couldn’t possibly have anything to do with devaluation of the dollar.

/s

They painted themselves (us) into a corner; there WILL be pain.

“Why It May Not Matter Anyway.”

The inmates are running the asylum.

Why would the Biden administration want to slow inflation until the economy just won’t work at all? Remember, they tax everything which means if more have more, they get a piece of the action. And when the smoke finally clears, who’s going to have the most toys?

wy69

When inflation drops sooner than “years” people will just claim the numbers are fake since everyone just makes up what they want these days. Inflation will be dropping by next year.

Based on...??

A responsible balanced budget coming out of Washington?

A decrease in the monetary supply?

Our “leadership” reducing regulations that are throttling the free flow of goods and the operations of commerce?

Crops in Ukraine being bountiful?

I’m not sure I see any of the above happening, but I’d love to hear the factors you believe will direct lower inflation.

(Note: Keyboards can be tricky... I’m not trying to be snarky at all. I’m genuinely interested in your perspective. I take actions based on what I see, and I believe it’s wise not to allow blinders or tunnel vision to deceive me! Thanks!)

> I predict a lot of people are going to be surprised to find inflation dropping by next year. <

Interesting. What do you think will happen to cool things off?

The Fed continues it's policy of quantitative easing. Opps, forgot the plain English. The fed continues printing money. That's more money and it is worth less. The dollar doesn't buy as much as it once did.

Democrats and RINOs keep passing massive spending bills into law. There is not the associated tax revenue to pay for the spending. Government can either borrow or print money. They do both.

There are several ways to eliminate inflation. These are the generic tools used to cure inflation:

1.) Shrink the money supply. This works because the inverse to the economic law above: Less of something makes it worth more. The Fed can reduce the M1 money supply - take it out of circulation to achieve this. But they are doing the opposite.

2.) Raise interest rates. This has makes money less unaffordable to borrow and slows business growth. This almost always leads to recession when done multiple times.

3.) Stop spending money you don't have. That includes the government. It also reduces the need for printing money.

4.) Increase productivity. When people produce more for the same cost you get more of something. The more of something then costs less and reduces inflation. Expanding government and spending money does not increase productivity. Government makes it more expensive to do business. As a general rule, government doesn't do anything efficiently or effectively. They are not productive. Government employees are the lowest of low, lazy asses in the world. They rarely are productive.

If you want to get rid of inflation, the solution is simple. Every solution will be painful, but this time we need to make sure the appropriate people receive the pain. The appropriate people are those employed by government. They caused the inflation. They need to be the solution.

1.) Government needs to be massively cut so that it is no longer spending more money than it is taking in. The pain will be all those unemployed lazy ass government employees. Government will not be able to be in the way of businesses seeking to be more productive. The Fed will not have to print more money.

2.) Taxes must be cut. This will put money into the hands of the productive and take it out of the hands of the non-productive. Government needs to be cut even more to "pay" for the tax cuts. This item neither reduces or increases the money supply, but it does make more things which costs less. It is actually a very effective way of letting people more of what they earn, which can be seen as a pay raise that can be used to offset today's higher costs.

3.) The Fed can raise interest rates, not by a little, but by a lot and all at once. This is one part of the equation, the Fed must also take money out of circulation since there is less demand due to increased interest rates. Get this over with quickly instead of dragging it out over years. The inventive will find ways to do more without borrowing money.

I would add one more item to the solution.

4. Biden must reverse all of his energy policies. Oil at over $100 per barrel is huge contributor to inflation.

A quarter point bump on an overheated housing market will not be a disaster. We're not talking the double digit rates of 40 years ago.

Everyone on fixed income wants to see a FULL 1% increase, per quarter, until all signs of inflation have disappeared.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.