Posted on 03/13/2022 9:32:35 PM PDT by SeekAndFind

With Russia now officially cut off from both the USDollar and the euro, Russia's VTB Bank is seeing a surge in Chinese Yuan deposits, attracted by the bank offering significantly higher interest rates as Putin shifts focus to 'friendly' nations.

The state-owned bank is offering a Chinese yuan savings account with a maximum interest rate of 8%, hailing the currency as "one of the most affordable and promising options for investing funds" after the country was hit by Western sanctions.

Putting that in context, the three-month deposit rate is 8% in dollars and 7% in euros, while the six-month rate for ruble deposits is 21%, according to VTB.

Existing customers are reportedly able to open deposits remotely on VTB Online with a minimum amount of 100 yuan ($16). At VTB branches, they can deposit a minimum of 500 yuan. VTB also said that over the past week customers have placed more than 2 trillion rubles ($15 billion) in traditional savings products.

“Some Russian banks can’t get access to other currencies, so yuan is probably the best other alternative,” Khoon Goh, head of Asia research at the Australia & New Zealand Banking Group, told Bloomberg.

“Still, the easiest way for Russia to raise yuan would be to receive yuan via trades. Russian banks’ clients who are exporters could sell to China and receive renminbi as payment.”

As The Telegraph reports, the move comes days after it emerged that a string of Russian lenders including Sberbank and Alfa Bank were planning to use China’s UnionPay system to provide customers’ bank cards after Visa and Mastercard boycotted Russia in response to its invasion of Ukraine.

UnionPay is the dominant payments handler in China but has a small market share outside of the world’s second-largest economy.

I don’t think the average Russian is going to be comfortable with this. We may resent the Chinese Communists and their new ($ financed) swagger. The Russians possess an innate fear of them. One more log on the pyre Putin’s building for himself.

China sees a great opportunity to derail the dollar as a world trade currency.

China’s markets and economy are not doing well at all (yeah, boo hoo): https://freerepublic.com/focus/f-news/4046497/posts

I really do not see that happening.

The yuan (aka: renminbe) trades internationally at a fixed exchange price, and we have no idea if the Chinese domestic economic data published by the Communist Party is valid.

I would invest my US Dollar savings in bitcoin before I would invest in the CCP.

50 years from now economists will be talking about how Biden destroyed the U.S. dollar.

I think so too, but China seems to be more of a basket case

itself every few days.

I’m not convinced it can pull it off. Russia may be the

strain that brings it down.

It’s getting very messy for both countries.

Trump comes back on board in 2024, and we’ll be okay while

China and Russia exist as a puddle on the global floor.

Indeed they do.

China’s economic house of cards is real estate dependent, and real estate is not selling. 30% of their GDP is real estate. All assets are over leveraged, and their economic data is Baghdad Bob level credible.

The RMB will not become the reserve currency. No one trusts Biden or the criminal cabal in DC, but the world also knows this is transitory. China’s sleaziness is not.

What happens to Chinese economy with higher oil prices. Either they have to pay more which will hurt them; or they will get a subsidized price on Russian oil which will hurt Putin.

Other factors, agriculture may have big fertilizer problems this spring which will hurt a lot of people. Possible problem getting potash to market in large enough quantities.

Recent study on oil free energy. Was told big solar power issue is our high grade NC quartz gets shipped to China for manufacture into solar units and then shipped back to US. First Solar of Ohio is doubling their production capacity which uses Cadmium telluride, not quartz. Major savings in fuel costs if China shipment not needed. Loss of solar cell income to China.

“China sees a great opportunity to derail the dollar as a world trade currency.”

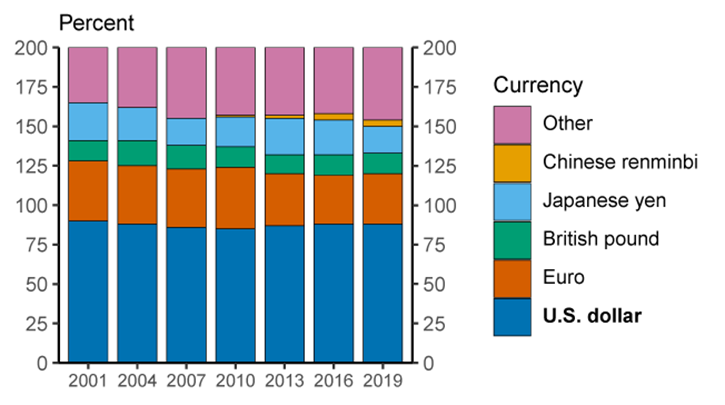

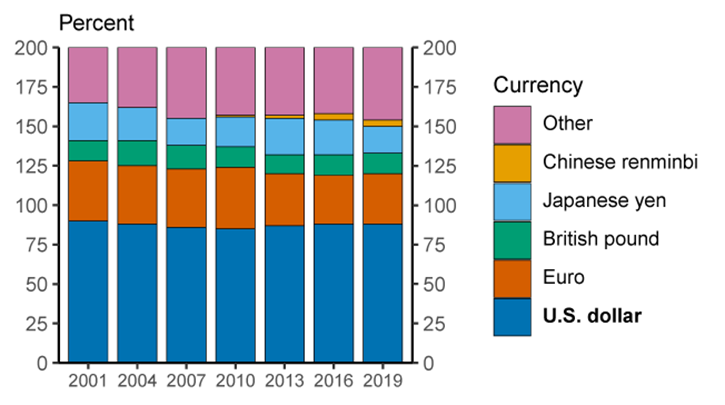

Only financial illiterates think that. The yuan is TWO PERCENT of foreign currency reserves. IT IS NOTHING, IT IS LOWER THAN WORM POOP in the rankings of useage.

The yuan may soon be the de facto currency of the new vassal State/ semi-autonomous territory of China, that the rump State of Russia is rapidly becoming.

Crashing the value of the ruble, and hitching the fate of their economy to Chinese Monopoly money, may not turn out well for Russia.

Compared to the mountains of Chinese currency that has been printed, the amount of gold on hand to back a new currency would just be a drop in the bucket.

Depends how they would value the gold and what percentage of gold would be assigned to each dollar.. Awhile back (probably 15 years ago) they figured 50,000 oz gold would be doable for the mountains US dollars back then. One thing for sure, ALL unbacked fiat currencies have failed over time.

China has a money supply of about 250 trillion yuan (about $40 trillion), with gold reserves of about $120 billion. About 2,000 times as much paper money as gold.

Russia had less than one trillion dollars worth of rubles in circulation before this war, with about the same amount of gold reserves. About eight times as much paper money as gold. Russia’s proportion of foreign reserves in hard currencies (before the recent seizures/freezes) similarly dwarfed the proportions that China has, relative to its domestic money supply. China has wantonly printed money, like never before in human history.

Trump is too old and so is half of congress and the senate. I fear if Tulsi Gabbard gets in the race against him on a “wink wink nod nod” anti old persons in government campaign she would probably win. Desantis or some other younger Republicans are needed.

I will vote for Trump if he survives the primaries because I’ll never go for what the Dems put up. Never!

Gabbard will be heard from again and she already is...a news conference here, a trashing of the old Dem paradigms speech there...building up her visibility. She is smart and dangerous.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.