Posted on 12/15/2021 12:31:27 PM PST by SeekAndFind

The Fed statement and economic projections saw the central bank double the pace of its asset purchase tapering to USD 30bln per month (consisting of USD 20bln Treasuries, USD 10bln MBS – this will be doubled again in January, with similar reductions likely be appropriate each month thereafter), which puts it on course to conclude asset purchases by March, from the prior landing zone of around June, although this could be adjusted if warranted.

Its updated projections now see three rate hikes in 2022, revising up its view from one hike pencilled in at the September FOMC (recall that September, the Committee was essentially split on the potential need for a second 2022 rate hike); longer-term, it has left its terminal rate view unchanged, however.

Inflation forecasts were revised up to 2.6% for headline PCE by the end of next year (prev. 2.2%), while the core measure is seen at 2.7% by end 2022 (prev. 2.3%).

On the labour market, the Fed sees the jobless rate return to the 3.5% mark next year (prev. saw 3.8%), where it is likely to stay over its forecast horizon.

The bottom line is that this was largely in line with what the market was expecting (accelerating taper, raising inflation forecasts, seeing continual progress in the labour market), where the Fed sees the economy continuing to grow (its growth view for next year was revised up, although 2023’s pace was revised down a touch).

As Brian Coulton, chief economist at Fitch Ratings, notes:

“This is a major pivot from the Fed, prompted by clearer evidence that inflation is broadening...

...Most significantly, inflation is described as having already exceeded 2 per cent ‘for some time’, so it looks like the Fed feels enough progress has now been made in compensating for earlier shortfalls in inflation.”

As the dust settles, money markets now see a 90% chance of an April rate hike.

* * *

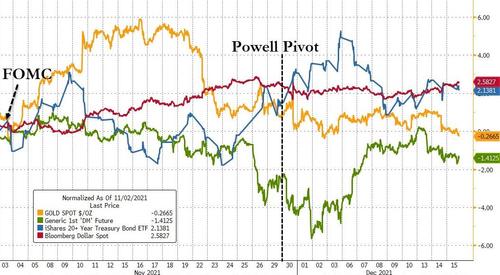

Since the last FOMC statement on Nov 3rd, where Jay Powell 'reportedly' unveiled a 'Dovish Taper' - only to unleash the Powell Pivot a few weeks later - bonds and the dollar are higher, gold is unchanged, and stocks are lower...

Source: Bloomberg

Real Yields have surged higher since the Powell Pivot (5Y real yields are the least negative since early Dec 2020)...

Source: Bloomberg

But, since the 'Powell Pivot', the STIR market shifted dramatically more hawkish, now pricing in at least one full rate-hike before June 2022...

Source: Bloomberg

Which is dramatically more hawkish than the 'current' dots assumed by The Fed...

Source: Bloomberg

What is even more notable is that the market is pricing in an end to the tightening cycle in 2024 (as the 12th-16th ED future has now inverted)...

Source: Bloomberg

Expectations are hawkish and as follows:

Turbocharge the taper bringing monthly bond buys to $75bln ($25bln cut instead of planned $15bln). This is very consensus; a $20bln cut would be seen dovish.

Dot plot to include higher 2022 core PCE forecast (median 2.4%, up from 2.2%)

Dot plot to include 15 of 18 forecasts with liftoff in 2022, creating narrow median of 2 rate hikes.

Powell to re-emphasize need for "policy flexibility" as the reason before accelerating the taper.

Powell to push back on need for immediate rate hikes, *emphasizing that the test for hiking is much stricter than the test for tapering.

Powell to emphasize that while inflation risks have risen, Fed is still waiting to look through economic bottlenecks before making a decision.

So, just how will The Fed adjust to its new hawkish stance and will it entirely fold to the market's demands?

The Fed doubled the pace of the taper to $30 billion per month

The Fed blames elevated inflation on "supply/demand imbalances"

And the Dot Plot shifted dramatically, showing The Fed expects 3 hikes in 2022 and 3 more in 2023.

That is in line with market expectations...

That is a dramatically more hawkish shift from the previous dots... 10 of the 18 were looking for three hikes in 2022 and two were looking for four hikes.

The Fed also lowere d its unemployment forecast but raised its inflation forecast dramatically in the SEPs...

* * *

Read the full redline below:

And fed borrowing was shifted to short term notes to make it cheaper. This is a double tap to the head.

Yah think!? Indeed, the Fed has done an outstanding job of making sure to have at least 2% inflation. (And since when has there been a shortfall in inflation??)

The Federal Reserve and the Biden Administration are in between a rock and hard place...

If they don’t taper and raise interest rates, inflation will become Weimar Republic style inflation especially if the Democrats manage to somehow pass the BBB legislation. Plus we will enter a stagflation cycle that makes Jimmy Carter’s economy look great.

If they do taper, interest rates will spike and cause a severe stock market sell off and exploding federal deficit creating a near depression....

So the end of free money is near at hand...

“Fed has done an outstanding job of making sure to have at least 2% inflation.”

I really don’t know how this will affect me personally, but there a lot of bogus numbers. Inflation is over 6% for normal every day products. But, Rents have gone up 20%, Gas is over 33%, and I don’t see prices going down anytime soon.

The 3.something unemployment is nonsense too. Everyone is leaving the workforce, this can’t be good for the economy.

It’s about time. The fed was practically paying people to take out loans for the longest time. The insanity needed to stop.

Will this mean a cut in the i-bond interest rates? Asking for my cat.

It’s funny that the market rallied on this news.

Perhaps a sober assessment in the morning might make a change.

Can a recession be far behind?

Crazy. For the last two weeks the market has tanked anticipating a taper, and the latest Covid scam and now, suddenly, the markets are cheering the taper they hated. Weird.

Market M.O.

Sell the rumor, buy the news. Or is it backwards?

This is the most artificially boosted market I have seen since 1962 when I began trading stocks.

I'm sure the Fed is trying to walk a fine line between cooling things down and prompting a recession.

Should push them up.

They’ll try to raise rates. It will backfire big-time and then very shortly you will see them lower again.

Was still a can kick..everything is always “later” for 10 years now.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.