Posted on 12/12/2021 2:12:39 AM PST by Kaslin

The Bureau of Labor Statistics just released its latest report on the Consumer Price Index. As expected, the data looks bad. The year-over-year increase in November was 6.8%. Inflation is now at its highest level since 1982 -- that is, in almost four decades.

Cue the blame game as media pundits seek to explain away the inflation. Supply-chain bottlenecks are the culprit, they say, together with a tight labor market, pent-up demand from the pandemic, price gouging, and the latest round of covid variants.

On the surface, these all seem plausible explanations for the recent price hikes. Inflation, after all, is a complex phenomenon; there are many variables that factor into the general price level.

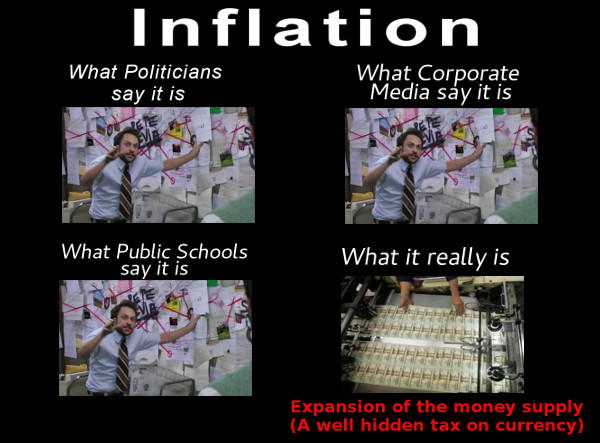

For some strange reason, however, few politicians or media pundits care to point out the 800-pound gorilla in the room.

The culprit behind our current inflationary crisis is manifest. The main culprit is the Federal Reserve and its extreme monetary response to the COVID pandemic.

Since the pandemic, the US money supply has increased by a whopping 37%. M2 (the most common measure of the money supply) was $15.5 trillion at the beginning of March 2020. By November 2021, a mere twenty months later, M2 exceeded $21 trillion.

This is the most rapid acceleration in the money supply since World War II.

The graph below (Figure 1) shows M2 over the last 40 years. While the money supply has drifted consistently upward over the last half century, the line goes almost completely vertical from 2020 to the present day.

(Excerpt) Read more at americanthinker.com ...

If you Google inflation it denies the monetary theory of inflation. Which is another reason you can't trust Google.

Given that the US Dollar is the world’s reserve currency inflating the US Dollar is a tax on the entire World.

And if you choose to think of it that way; a one world government already exist where a single nation can tax the entire world.

Or you could think of it another way. The entire world pays tribute to the United States much like much of the world paid tribute to the Vikings, the Danes or the Mongols in their turns.

Any way you look at it the US is being subsidized by the entire world by way of inflation of the US Dollar.

Hypothetically, let’s say I am sitting on a million dollars in T-Bills right now.

Where is the best place to invest?

What other currency will be stable? Swiss?

Natural resources?

This collapse will be sudden and big. What are the best option(s)?

I hate to say it, but at 19% debt-to-GDP, Russia has the most stable currency. Natural resources as well.

Please, pray for the full and complete conversion of Russia.

Btw. This is why the Democrats are insane over them. That and I don’t believe they used an mRNA vaccine.

I literally could tell you, but you won’t listen.

Great Tucker Carlson piece address this very issue.

https://www.foxnews.com/media/tucker-carlson-inflation

>>Given that the US Dollar is the world’s reserve currency<<

I suspect...not for long.

There is no inflation in a barter economy. Inflation is possible only when the currency issued by the government is based on nothing but the good faith and trust of the government.

The government has control over the currency and prints dollars as it wishes.

Inflation is deliberate and intentional.

.

I agree

With real inflation running at 15% plus.

The world will drop dollars as soon as anything better comes along.

One thing keeping the dollar alive is the requirement that petroleum be paid for in US Dollars.

The last world leader that tried to shift a payment for oil away from dollars to gold was Muammar Kaddafi. You might remember that he did not come to a good end.

+1

A small town in Connecticut used to have (and maybe still has) a barter system, which traded points for items or services. It worked very well for them, though I think only a subset of the population had access to it.

“Inflation is always and everywhere a monetary phenomenon.”

-Milton Friedman

As long as the government continues to expand the money supply by spending money that does not exist, inflation will continue.

Gold, silver and platinum. That is what the new currency is going to be backed by. I’m hearing that digital transfer of the new US notes will be allowed through XRP. All other digital currencies will go bye bye.

We need a catchy term for this World Tax. Pax Tax America?

On the off chance that someone here might be interested in a discussion of the Fed’s role in inflation, here are a number of points for consideration:

1. The Fed lost direct control of the money supply when it aggressively expanded excess reserves over a decade ago while simultaneously deciding to pay banks interest on those excess reserves. However, there was no particular catalyst that got money growth going until Covid came along.

2. Before Covid, the imposition of higher risk/capital requirements on individual banks combined with the interest they were being paid on excess reserves kept the excess reserves from circulating, i.e., from entering the money supply used by the public.

3. With Covid came trillions of dollars of direct payments to consumers and businesses. This bypassed the banking system, putting the new dollars directly into the hands of the public. This was the equivalent of Venezuela printing new bolivar notes and using them to pay for its expenses by making direct cash payments to individuals and businesses, an action that precipitated a hyperinflation.

4. As with Venezuela, the U.S. public began driving prices higher using the direct payments from the government. Since the Covid cash was deposited into personal bank accounts, total bank deposits, including M2, increased accordingly.

5. Then, with the banking system flush with cash and willing to lend, the initial price rises started to drive increased bank lending. For example, a house that sold for 20% more than a year ago generated a new mortgage loan 20% higher than it would have been a year ago. Ditto for car loans, personal loans, credit card loans, etc.

6. The result is that the Covid payments were the catalyst to get those excessive bank reserves started into circulation. Once that happened, and prices started rising, the risk is that it continues, with higher prices on everything generating higher lending. Rinse and repeat.

7. Now, with no impinging reserve requirements, hyperinflation of the U.S. dollar has become a distinct possibility. The “transitory” part of inflation might just be a transition from single-digit inflation to double and triple digit inflation, rather than back down to 0-2% again.

8. The Fed’s dilemma, as perceived by nearly all, is that it can’t remove several trillion dollars of unneeded bank reserves over a short period of time without destroying the bond market and it can’t raise interest rates to levels that would get in front of higher inflation. That would require short-term rates in excess of 5% today and possibly much higher. Either move would raise government spending significantly which would increase the deficit even further.

9. But there is a way for the Fed to restore normalcy. It’s just that it has gotten zero consideration. The way to soak up all of the existing reserves in the banking system without requiring the Fed to liquidate its portfolio to a large extent is to change the current reserve requirement from the present 0% to a rate high enough to absorb the entire reserve balance. That would mean setting reserve requirements at somewhere between 40% and 50%. Incidentally, Milton Friedman once advocated a 100% reserve requirement on transaction balances (checking accounts).

10. The result would be to remove the need for the Fed to sell any bonds, while successfully converting all of the present excess reserve balance into required reserves. At that point, the risk of a hyperinflation would be reduced to zero which would remove the need to raise short rates aggressively to get ahead of the present inflation rate, one that risks rising rapidly at present.

That’s it. I don’t see any alternative way out other for the Fed. Tapering certainly isn’t going to do it, nor will modest interest rate increases while inflation is accelerating rapidly.

The trouble for the world (and us) is finding something else.

Obama made precious metals less desirable because he made “profits” from the sale of precious metals subject to capital gains tax.

Where oh where is there a shelter from inflation that you won’t be gouged by taxes when you sell?

There is not much good to sheltering your money from inflation only to see it gobbled up by taxes when you nee to spend it.

I understand that the new precious metals are brass & lead with a little powder in between.

That too. 😆

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.