Posted on 10/12/2021 1:06:05 PM PDT by blam

Atlanta Fed president Raphael Bostic finally broke away from the fake narrative bandwagon created by his Fed peers, the complicit media and Wall Street sycophants, when during a virtual speech at the Peterson Institute of International Economics, he said that price surges caused by supply-chain disruptions or the reopening of the services sector are likely to last, i.e., they are not transitory, and seem to be broadening to more parts of the economy, i.e., getting worse.

Or precisely what we have been saying since May.

“It is becoming increasingly clear that the feature of this episode that has animated price pressures — mainly the intense and widespread supply chain disruptions — will not be brief,” Bostic said says in prepared remarks during the virtual presentation, which have assured he will not be on any lists for internal promotion once Powell decides to call it quits when “transitory” hyperifnlation can no longer be contained.

“Data from multiple sources point to these lasting longer than most initially thought. By this definition, then, the forces are not transitory.”

Powell has stubbornly maintained the rise in inflation is “transitory” with projections from the Fed’s rate-setting meeting predicted an annual inflation rate of 4.2% by year’s end, an increase from 3.4% in June before cooling to 2.2% next year, in line with their goal range.

But Bostic, a voting member of the Fed’s rate-setting committee next year, disagreed with that sentiment: He said that inflation risks are not starting to diminish and noted that evidence is mounting that price pressures have “broadened beyond the handful of items most directly connected to supply chain issues or the reopening of the services sector.”

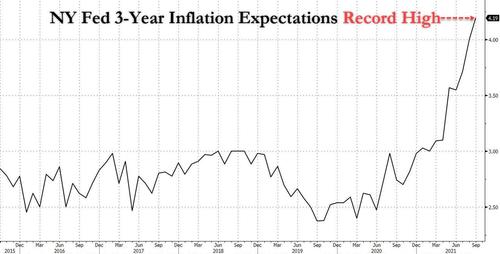

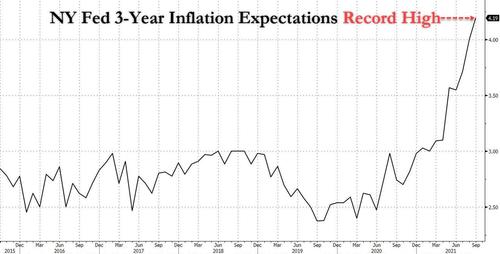

“Longer-run inflation expectations measures have climbed, with many reaching levels we haven’t seen in about a decade. These upside risks to the inflation outlook bear watching closely” he said, perhaps eyeing the latest staggering consumer inflation expectations released by the NY Fed earlier today.

“The real danger is that the longer the supply bottlenecks and attendant price pressures last, the more likely they will shape the expectations of consumers and businesspeople, shifting their views on pricing and wages in particular,” he said.

Still, Bostic said he believes that many of the upward pricing trends caused by the pandemic will “unwind by themselves,” though he cautioned that supply chain disruptions could last longer than expected.

“If highly accommodative monetary policy is meant to correct past inflation shortfalls, then we have accomplished that mission. Up to now, indicators do not suggest that long-run inflation expectations are dangerously untethered. But the episodic pressures could grind on long enough to unanchor expectations.”

In a separate interview with The Financial Times, Bostic said that Fed’s taper timeline should not shift, despite the worse-than-expected September jobs report: “I’d be comfortable starting in November,” he said in the interview. “I think that the progress has been made, and the sooner we get moving on that the better.”

And while we wait for the Fed to engage in immediate damage control and define the word “transitory” to include “everything up to and beyond one lifetime“, we also look forward to Bostic’s stock trading records being leaked in the coming days as his shocking honesty could finally crush what little credibility the Fed has left

One man that leftists will never ever listen to is Captain Obvious. Yup, oh loathsome woke folk, Obvious was a man. (At least until DC or Marvel changes him to an it/something/whatever.)

Except for EVERYONE ON FREE REPUBLIC!

I had a list of simple building materials i needed. I hit a Gulf coast, Ace, two Home Depot’s and two Lowe’s. I was unable to get the entire list. The price of everything was twice what I expected.

Oh.

They sould have raised rates starting back in April when the housing market exploded. Now when they raise them the markets will crash much worse then the would have before. They just keep trying to push it down the road. Well, they are about out of road. We’re screwed.

Money printing + bloated regulatory system + activist government + neo-marxist ideology = massive inflation

“the longer the supply bottlenecks and attendant price pressures last, the more likely they will shape the expectations of consumers and businesspeople”

Meaning that once businesses know you’ll pay $10/lb, they’ll never want to sell it to you for less.

WHAT! Butt, butt, butt........

Bunch of geniuses we have in our government.

The horizon looks a bit bumpy

Inflation will continue until morale improves.

Yup—and once you get inflationary expectations from every player in the economy, there is a multiplier effect.

Nobody wants to get stuck being underpaid for their product.

That is part of the cause of the supply craziness at the moment. All you need is a small percentage of suppliers thinking “Why sell the product now if you can get a lot more for it just by waiting a month or two?”. While many products have high costs of inventory (and won’t go there) there are enough that do not that this effect is real in an inflationary environment.

“The price of everything was twice what I expected.”

Twice? What were your expectations based on? Where they on recent purchases of the same items or were you just guessing?

Prices are definitely up but not anywhere near 100%

Nothing that a $3 trillion infrastructure budget won’t help.

Expectation of 5% inflation, REALLY?!

Triple that or more would be more realistic.

Family member said inflation is already up 10% and moving higher.

Maybe more like a sinkhole opening up on the road ahead. All you can do is cry as it swallows everything.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.