Posted on 06/25/2021 4:00:41 PM PDT by blam

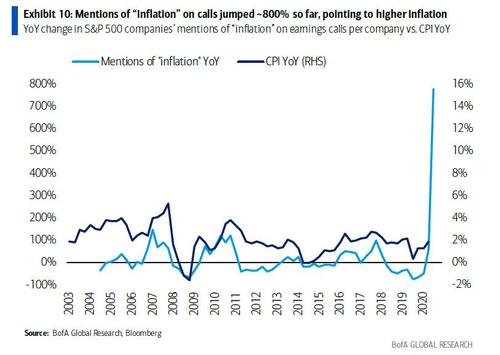

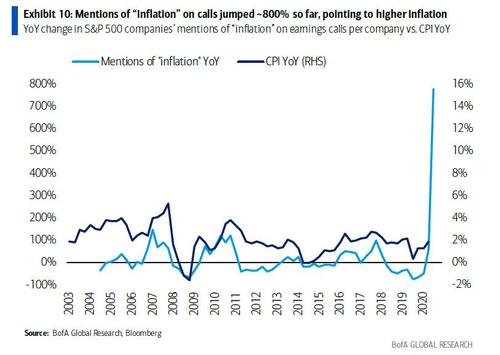

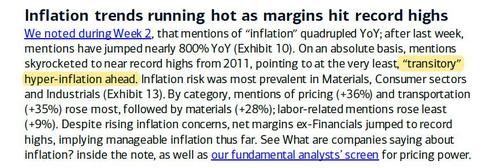

At the start of May, when observing the avalanche of “higher inflation” mentions on Q1 earnings calls, which had quadrupled YoY; and jumped by a record 800% YoY…

… BofA chief equity strategist Savita Subramanian summarized the current state of affairs as follows: “On an absolute basis, [inflation] mentions skyrocketed to near record highs from 2011, pointing to at the very least, “transitory” hyper-inflation ahead.”

Needless to say, a “serious” bank warning of hyperinflation – transitory or otherwise – was enough to spark very serious concerns that the Fed was losing control of prices, a panic which only grew after Deutsche Bank joined the chorus, earlier this month when it warned that inflation was about to explode “Leaving Global Economies Sitting On A Time Bomb.”

Of course, BofA had left itself a loophole, the same loophole used so generous by the Fed as often as several times each day: after all the definition of transitory is fluid, and could be as short as just a few weeks, making the coming period of pain somewhat manageable.

Not so fast.

While the Fed has bet what little credibility it has left on the benign meaning of “transitory” in setting its monetary policy (no rate hikes until 2023 by which point inflation will be in the double digits) and today’s UMichigan commentary echoed the Fed’s cheerful sentiment, predicting that soaring inflation won’t last long, with Consumer Survey economist Richard Curtin writing that “year-ahead inflation expectations fall slightly to 4.2% in June from May’s decade peak of 4.6%, [as] consumers believed that the price surges will mostly be temporary”, one of the most respected Bank of America strategists just crashed the “transitory” party, and in a note published today, BofA Chief Investment Strategist Michael Hartnett wrote that, far from transitory, soaring US prices may last up to 4 years.

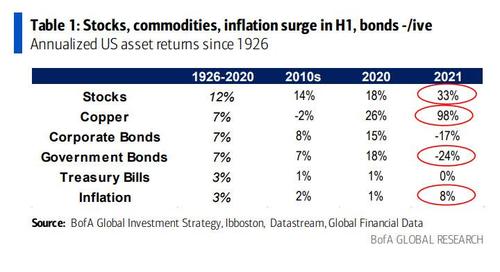

Observing that US inflation averaged 3% in the past 100 years, 2% in 2010s, 1% in 2020, and is “annualizing 8% thus far in 2021”, Hartnett writes that it is ” so fascinating so many deem inflation as transitory when stimulus, economic growth, asset/commodity/housing inflations (are) deemed permanent.”

As a result, Bank of America sees “US inflation firmly in 2-4% range next 2-4 years” consisting of “asset, commodity, and housing inflation.” And even though the Fed may have staked its reputation and credibility on keeping the current ultra-loose regime until well into 2023, Hartnett predicts that “only a market crash will prevent global central banks tightening next 6 months.”

Hartnett then lists the various factors that form his hawkish view starting with the fiscal policy bubble, writing that the latest Biden infrastructure plan ($600bn new spend) “takes running tally of global monetary & fiscal stimulus to $30.5tn past 15 months, an amount equivalent to entire Chinese & European GDP’s.” Just in case there is any confusion why despite millions still unemployed, consumer spending is now far higher than it was before the covid pandemic.

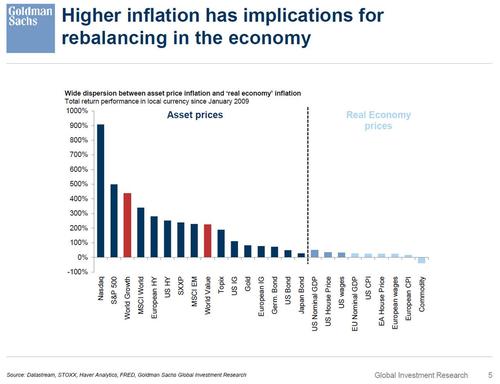

The BofA CIO then looks at asset inflation, which as even Goldman has shown is hyperinflating compared to the more dormant economic inflation (which however is also starting to move)…

… and pointing out that central banks have bought $900 million of financial assets every hour in past 15 months leading to “epic gains in stocks & commodities past 15 months relative to 100-year history (Table 1)” and pushing the global equity market cap up staggering $54 trillion over this period.

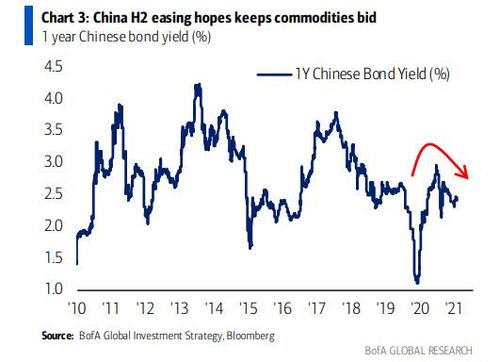

There’s more: after soaring for much of the past 6 months, commodity inflation has continued to rise, driven by hopes that China will ease further in the second half (China 1-year rates down 50bps past 6 months)…

(snip)

…

Well, some could posit that four years out of a hundred is transitory. Then again, pedo Joe sees no evidence of it. 😲

"In an interview where he expounded upon his claim that the US is already grappling with real inflation rates above 10%, the billionaire investor proclaimed that “in every single aspect of life, I see inflation.”

Bookmarking.

I listen when Kyle Bass talks.

I wonder if they would change their forecast if by some bizarre chance the Republicans take back control of the House and Senate in 2022?

Of course that presumes the Republicans are smart enough to figure out how to stop the Democrats from stealing the midterm election. And I think we all know they aren’t that smart.

Very true. Trust what the banks do, not what they say. The banks are still putting their billions behind long term low inflation.

You can still get a fixed rate mortgage from them with the same terms as two years ago.

Well, large averages against an annual value is always misleading.

Better they should use some 3 year averages to get a better comparison mark.

What happened to Carter’s massive inflation during his 4 year term?

They averaged it out.

Oh so true. What they say on CNBC, Bloomberg, Fox Business and in the WSJ/Financial Times is often a setup that is opposite of what they do. I don't trade news (I make my living trading, btw). I do enjoy kicking Big Bank Butt. (On a percentage basis)

So BofA is raising interest rates on savings accounts above 0.01%?

If the banks are doing that, it means they expect you to default on the loan due to hard financial times so that they can pick up the asset for a song.

Bkmk

Because we are in a Communist Revolution the Swamp may very well be using inflation to destroy the middle class. In any case I see double digit inflation for at least 2 years.

Almost all Republicans like to spend, too. Walter Williams said he could never win public office, because he would tell people he wasn’t going to vote for any of the government goodies they want. As long as people look to government to solve their problems and take care of them, government will keep getting bigger until it all collapses under the weight of the debt.

“The banks are still putting their billions behind long term low inflation.”

No. They are building cash in anticipation of higher rates.

“You can still get a fixed rate mortgage from them with the same terms as two years ago.”

Mostly they are only processors. The Feds own the loan.

bookmark

Having done serious trading for a few decades, when I read things like this I think “They loaded heavily into inflation positions and now want to start scaling out.”. The big traders are quiet while accumulating and very loud while distributing.

Good points! We won’t get anywhere until they reduce the size of government and really truly cut spending.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.