Posted on 09/28/2020 8:59:22 PM PDT by SeekAndFind

A new study on China’s real estate market reported by state media paints a bleak picture: 76 of the biggest real estate developers need to repay 2,500 trillion yuan ($367 trillion) in the next 12 months, including 177 trillion yuan ($25.69 trillion) in interest.

Such enormous debt has prompted real estate firms to refinance.

A second study, conducted by private financial data service supplier Chinese Beike Institute, revealed that Chinese property developers issued 307 bonds in the third quarter of 2020 and collected about 324.7 trillion yuan ($47.67 trillion) from Chinese and overseas financial markets.

“The scale of financing in Q3 is 14 percent higher than Q3 in 2019, and is the highest one in history,” the study concludes.

Property developers also gave big discounts to new buyers, and sought to restructure to pare their debts.

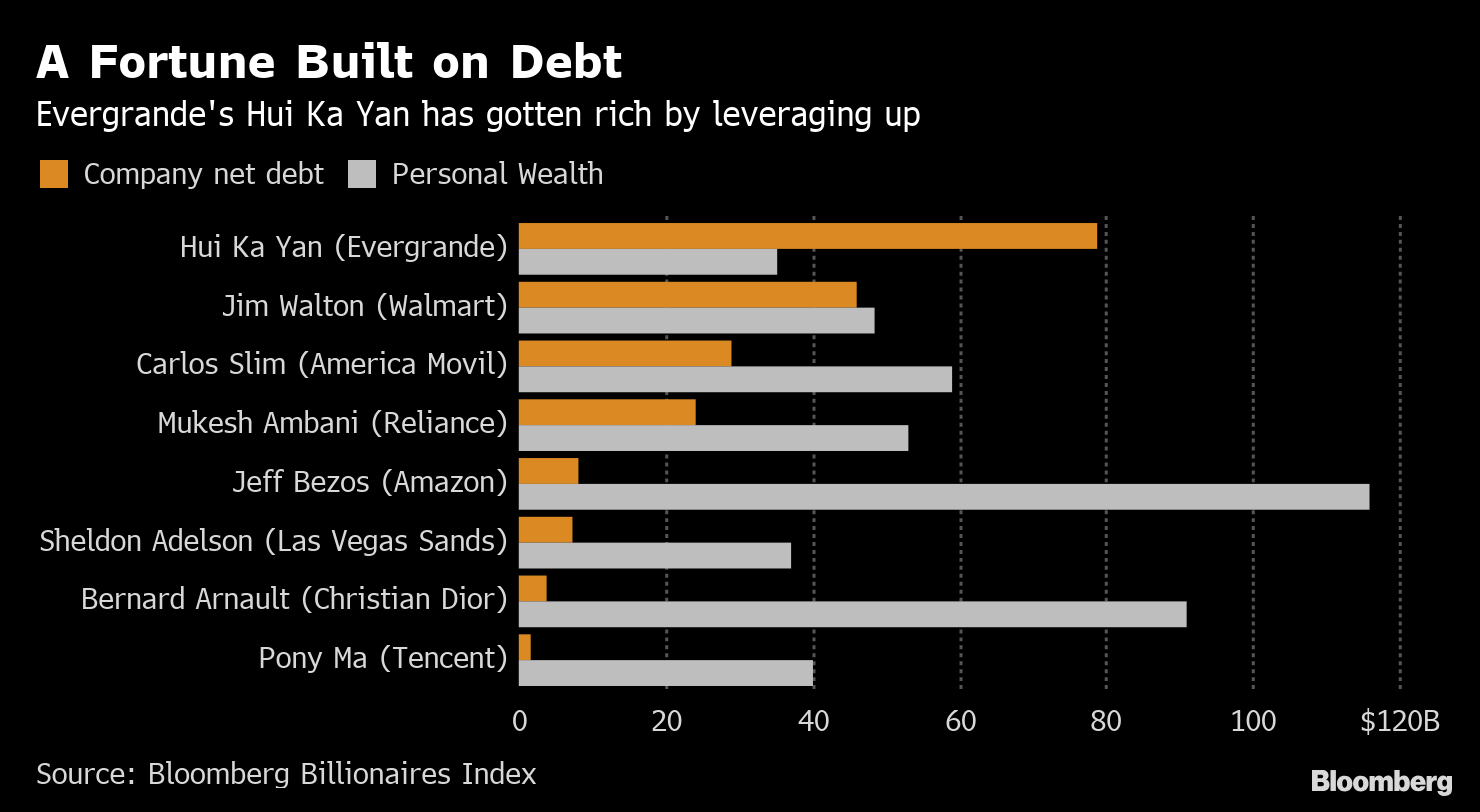

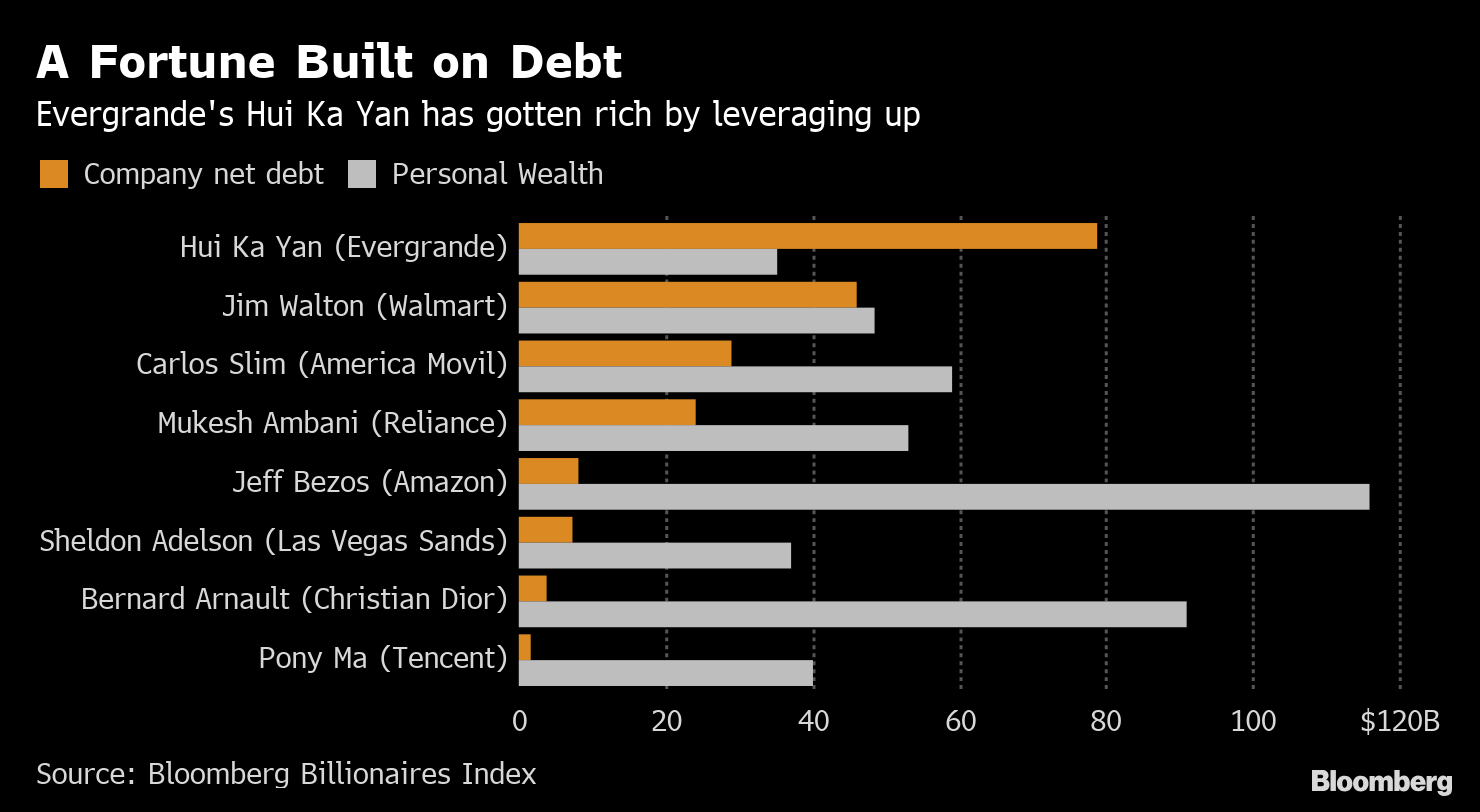

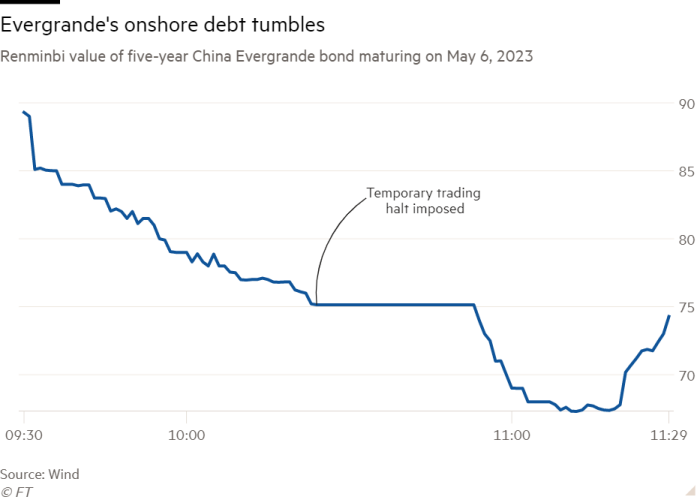

In August, Evergrande, China’s largest real estate firm by sales volume, asked the Guangdong provincial government to help restructure its assets to avert a cash crunch.

Chinese state-run 21st Century Business Herald published on Sept. 27 the results of a study conducted by state-run Nandu Big Data Research Institute.

The Nandu study found that Evergrande needed to pay 395.7 trillion yuan ($58.1 trillion) in debt with interest in the next 12 months. China’s second-largest property developer by sales volume, Country Garden, has to pay 105.8 trillion yuan ($15.53 trillion), third-largest Vanke has to pay 96.8 trillion yuan ($14.21 trillion), and fourth-largest Sunac has to pay 140.6 trillion yuan ($20.64 trillion).

The four companies with the largest debts—Evergrande, Sunac, Greenland, and Country Garden, respectively—would have to repay more than 100 trillion yuan ($14.68 trillion) in debt (with interest) within a year.

In total, 76 of the top firms owe more than 2,500 trillion yuan in “interest-bearing liabilities,” or about 35 percent of total

(Excerpt) Read more at theepochtimes.com ...

If this is indicative of China’s finances in general, they are in a very precarious place. That said, this makes China an even bigger threat, as their political ‘leadership’ will not just go quietly into the night.

Boy.

Working at even NYC’s minimum wage of $15 an hour, it would take 24,466,666,666,666.7 hours work to pay this off.

That’s gotta be at least a few double shifts.

The world economy will feel this, IMO.

Don’t have money in Chinese currency.

I am in no position to challenge the numbers shown here, but I’ve looked for about a half hour and see No financial site coming even close to these numbers.

hundreds of billions for Evergrande, yes.

But China’s whole economy is worth 40 trillion.

3/10 of a Quadrillion dollars?

Would love to find one other site to back those numbers up.

The entire world’s GDP is 80 trillion.

I looked and could not find another site coming even remotely close to these numbers.

Evergrande owes over 100 billion, seems to be the consensus.

If it says 367 trillion here, then I guess it is.

Would have liked to confirm that somewhere though

the numbers do not make sense

IT’S 2.5 TRILLION YUAN

THE 2,500 TRILLION YUAN NUMBER IN THE ARTICLE IS A MISTAKE.

I WENT TO THE CHINESE WEBSITE.

Because they’re wrong.

2.5 trillion yuan

not 2,500 trillion yuan.

went to the original site

RE: I WENT TO THE CHINESE WEBSITE.

Can you share the website for us? Thanks.

RE: IT’S 2.5 TRILLION YUAN

Yes, that looks more like the real number. Converting it to USD amounts to about $357 Billion — Still, an astronomical number !!

Fourth paragraph down...where it says..

A second study, conducted...

Click on the STUDY link and convert that site to English.

Please double check me.

I don’t trust myself that much :)

Staggering number.

From what I read, some of these companies are in a lot of trouble and they experts said they cannot meet the debt cutting goals they have put forth.

Now that’s a bubble!

Yet MANY Chinese are chasing the real estate prices.

That’s scarier.

Thank you.

Right.

RE: Fourth paragraph down...where it says..

A second study, conducted... Click on the STUDY link and convert that site to English. Please double check me.

That website has only a few paragraphs and does not mention the total debt of these real estate companies. It only mentions 307 domestic and overseas bond financings, with a financing scale of approximately 324.7 billion yuan, an increase of 14% year-on-year.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.