Posted on 08/16/2020 6:01:25 AM PDT by blam

It has been an miserable five years for Turkish citizens who have seen their purchasing power slashed by more than half, and it’s only getting worse.

The Turkish lira has cratered against the dollar and most developed currencies, plunging from 3 TRY per dollar, to a record low 7.37 last week after a brief and valiant attempt at imposing shadow capital control by Erdogan (who is now de facto head of the Turkish central bank) failed miserably at the end of July, and not even a draconian hike in overnight funding rates above 1000% last week (to crush the shorts) was able to prevent a plunge in the Lira to new all time lows.

As their currency implodes (in a nation that is becoming increasingly more “banana” with each passing day as Erdogan solidifies his takeover of every government institution, in the process turning off any potential foreign investors) Turks are discouraged from material purchases of dollars to hedge the collapse in their native currency due to some of the strictest capital controls on the planet, which has left them with just one option.

As Reuters reports, Hasan Ayhan followed his wife’s instructions last week and took their savings to buy gold at Istanbul’s Grand Bazaar as Turks scooped up bullion worth $7 billion in a just a fortnight while their currency went up in flames.

The retired police officer, hit by vivid memories of the 2018 currency crisis which saw the Lira lose 30% of its value virtually overnight, was among those playing it safe as he queued in the city’s sprawling covered market, where a screen showed the gold price rise by one Turkish lira ($0.1366) in just 10 minutes.

(snip)

(Excerpt) Read more at tradeforprofit.net ...

Some people actually like their screeching, they think it's music...

Gold luvk getting any of that in physical form these days.

Yes.

Kentucky jelly should also be involved.

Toilet paper. Lots and lots of toilet paper.

= = =

Inflated currency will get cheaper than toilet paper.

See Zimbabwe.

Many years back, I tried to cash a check at BofA, the check was drawn on BofA, the account was at that branch.

The teller wouldn’t cash it.

= = =

Me too, but they would cash it for a $7.00 fee.

I just shut up, turned and walked out, cashed it my credit union, down the street.

You know they sell gold dust on every street corner in the war torn hell hole.

Transfer funds from a foreign owned bank in Wash DC,NY, or SF, e.g., To your expat/gf/ friend corresponding bank in Phils, Thailand etc.The banks can transfer $100k’s VIP protocol no problema

Then the expat etcs can wu back to u 19k$ each time

The wife and I had a great vacation in Indonesia right after Soros crashed its currency from 500/$ to 5000/$. Maybe a trip to Turkey is in the offing.

Not that $h@t, again.

Nanzi and Biden’s handlers will be sad.

Ping - ???

Oh no problem....c’mon man, they can borrow money from Isis, Iran, and the Muslim brotherhood bunch.....their blood brothers...

ROFLMAO! Thanks, bert. Laugh-o-the day BUMP!

We continue to be concerned............if Russia attacks Turkey fron the rear, will Greece help?

Never let a giblet go to waste.

Stocks. Index mutual funds. Exchange traded funds.

Try SPY & QQQ.

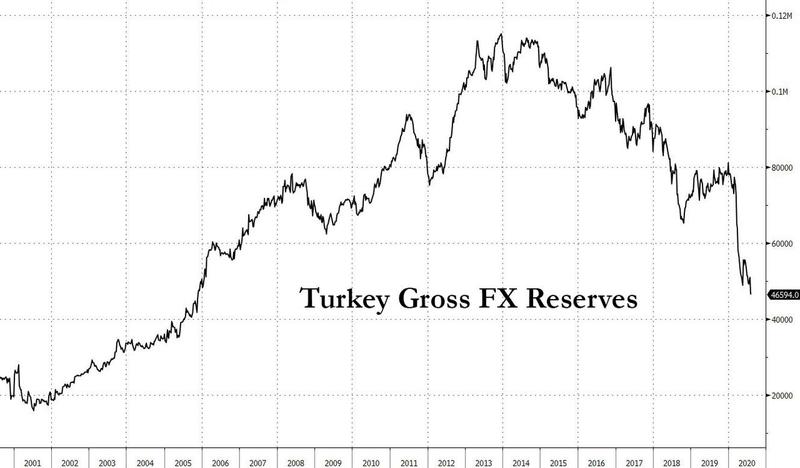

"Turkey’s (foreign currency) reserves have been depleted by market interventions (to pump up the value of the Turkish Lira), which are showing signs of fizzling out" (Reserves dropped from $80 Billion to $45 Billion so far this year. They are running out of ammo to continue manipulating the currency and economy, for their short term political benefit - a high price will have to be paid at some point.)

"rising current account deficits and a possible debt default could tarnish the country’s formerly solid reputation for meeting foreign obligations. And as Reuters notes, these debt repayments are set to rise in October"

"Meanwhile, Finance Minister Berat Albayrak – who just happens to be Erdogan’s son-in-law – said on Wednesday the lira’s competitiveness is more important than exchange rate volatility. The central bank has effectively borrowed on local dollar liquidity to fuel its foreign exchange market interventions, which are meant to stabilize the lira"

"if you get to that stage where locals are unwilling to keep their money in the bank then you’re heading to a balance of payments crisis. That’s when the alarm bells will start ringing.”

"Perhaps Erdoganomics, whereby the president mandated to “fight” high inflation with lower rates in contravention of all norms and rules of economics, will ultimately end up destroying Turkey just as so many expected."

"Meanwhile, Erdogan shows no sign of budging, and on Monday he said he hoped market rates would fall further “god willing.”"

Lebanon’s lira/pound is also cratering—and this was before the explosion. People there are now reduced to bartering for imported goods—even stuff like Pampers.

Whew—Thanks for the ping.

“God Willing”

Haa haa haa, Erdoo is going to blame his failure on God?

End the end God will deal with Erdoo.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.