Yes it does. We end up with guys like this prancing around.

Posted on 03/29/2020 6:33:55 AM PDT by Enlightened1

Once you throw money around like candy

don’t expect angelic behavior.

Wow. What is the law behind this?

Did it say a company can’t do that?

The money was supposed to be for people out of work and I’m not sure how that veered so far off course.

And even then it could have been taken from the next tax year where they get a return, because if they were getting a return, that would mean they are doing quite better.

Throwing around money has consequences.

Identify the company.

http://www.freerepublic.com/focus/f-chat/3829440/posts

This is Fake News® until documented proof is presented.

What will you do with your check?

We really don’t need the money. We are debating what to do with it.

Donate to church or charity?

Give it to our kids? (All still working)

Give it to a family we know in trouble?

Give it back to the treasury?

Give it to a local government?

Spend it?

Exactly! More anonymous stuff. Provide the company name so the story can be validated. One question not answered - are these employees actively working or are they furloughed with the company paying them anyway?

Probably NPR

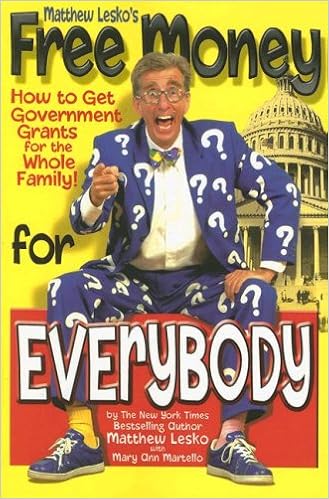

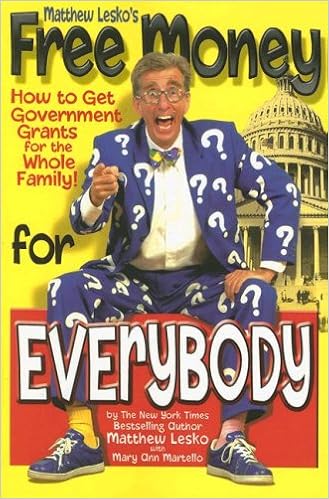

Yes it does. We end up with guys like this prancing around.

Many companies have continued to pay employees without layoffs to retain the employee. Meanwhile the business is not sufficient to support the payroll. The company is attempting to recoup some of their losses as the employees are getting money while still being paid. I personally believe that is a bad move both for morale, potential legal action, and word will spread to their customers of their actions.

The next FR fundraiser is starting in a couple of days...

If I had a surefire plan to make easy money, I sure wouldn’t tell anybody else about it, much less write a book.

The people who are making easy money are the people writing books on how to make easy money.

That’s good thought.

Un-named company. Un-named source. Un-embarrassed media.

Lay them off then.

There is free money and there is free money.

It is stated that all having taxable income < $75,000 will get $1,200 paid by the irs based on tax returns. The money will be payed into checking accounts by direct deposit. i qualify but so far as I know the IRS doesn’t have the bank account particulars required for direct deposit unless it is acquired from Social Security.

Then there is an additional $600 of unemployment benefits payed on top of the regular unemployment benefit. That is, unemployment checks will increase by $600.

My view is this article is fake news propagated by disgruntled anti business union types.

The law says employees must be payed a minimum wage and stipulates hours and such . Docking the wage is thus illegal

If the company needs cash to meet payroll, there are provisions to obtain that cash

The article is made up

This has all the appearances of a fake news story.

I always HATE when someone on here has the answer I couldn’t figure out

But then I guess that’ why I ask. :)

Of course that makes sense. You can’t dock pay because of a government stimulus. I should have realized that.

Thanks

Whatever you do don’t give it back to the treasury. They’ll just waste it in a worse way.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.